- Stock Markets

Crisi dell'IA in Apple e quinta correzione del Nasdaq 100. Cosa attende il settore tecnologico?

Considerando i fattori tecnici e l'incertezza fondamentale, gli indici americani potrebbero rimanere in una fase di trading laterale la prossima settimana. Le aspettative di un taglio dei tassi e l'attenzioneAutore: Anna Zotova

12:21 2025-03-21 UTC+2

18

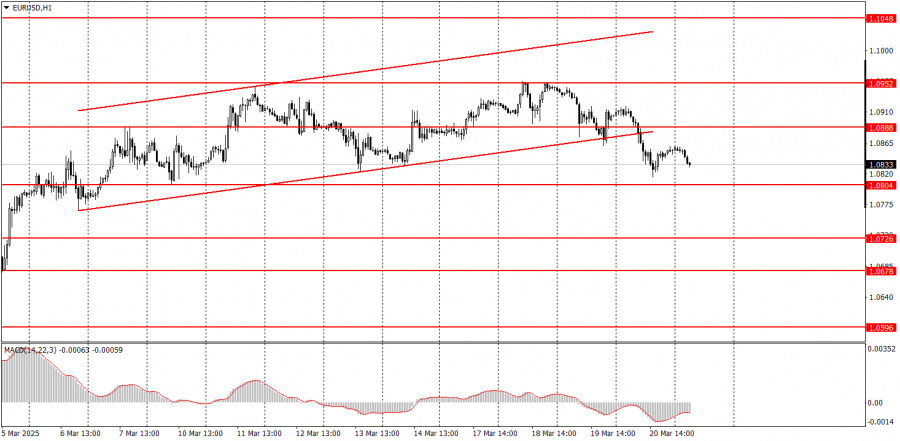

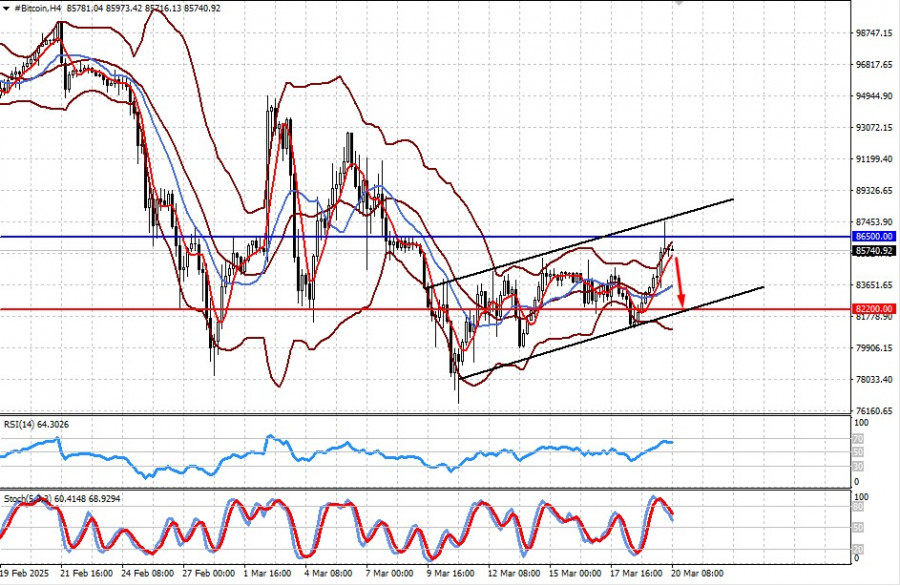

Bitcoin ed Ethereum hanno nuovamente incontrato difficoltà nel superare resistenze piuttosto importanti, il che non ha permesso lo sviluppo di una tendenza rialzista a breve termine per questi strumentiAutore: Miroslaw Bawulski

11:09 2025-03-21 UTC+2

18

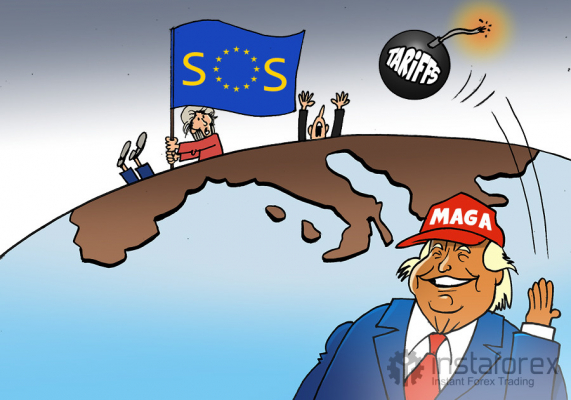

Fundamental analysisA cosa prestare attenzione il 21 marzo? Analisi degli eventi fondamentali per principianti

Non sono previsti eventi macroeconomici per venerdì. L'euro e la sterlina hanno finalmente iniziato a scendere rispetto al dollaro USA. La Fed ha rassicurato i mercati, affermando che al momentoAutore: Paolo Greco

08:11 2025-03-21 UTC+2

14

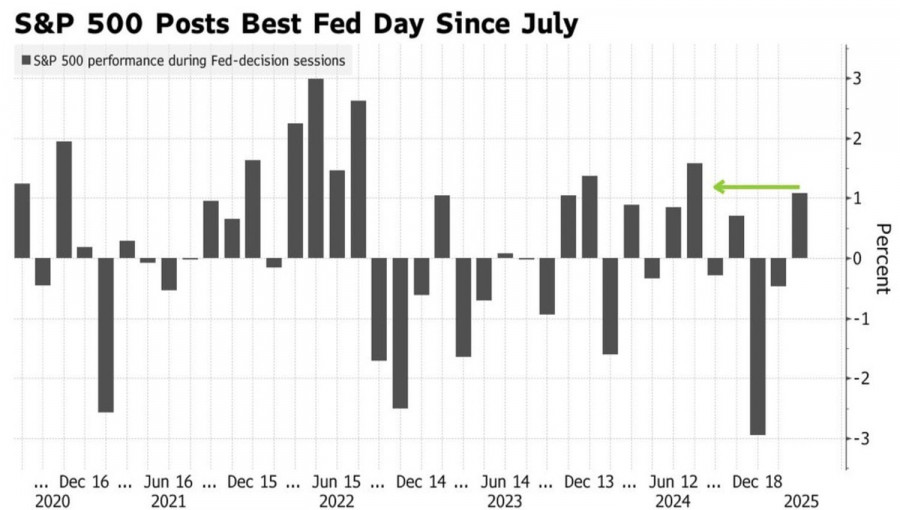

- Sebbene l'indice S&P 500 mostri ottimismo, dal 14 marzo il suo aumento è considerato più un movimento correttivo. Il raggiungimento dell'intervallo target di 5881-5910 diventa più probabile se il prezzo

Autore: Ekaterina Kiseleva

12:10 2025-03-20 UTC+2

17

La Fed non ha intenzione di lanciare un salvagente allo S&P 500, ma forse non è nemmeno necessario? Si tende la mano a chi sta affondando. Il mercato, inveceAutore: Marek Petkovich

10:02 2025-03-20 UTC+2

12

Fundamental analysisI mercati intrappolati in un circolo vizioso, senza via d'uscita per ora (possibile calo di Bitcoin e del prezzo dell'oro)

I mercati rimangono in uno stato di smarrimento a causa dell'enorme ondata di negatività che li sovrasta come una grande minaccia, senza che si intraveda una fine. In questo contestoAutore: Pati Gani

09:43 2025-03-20 UTC+2

12

- Il metallo giallo ha accelerato il passo, superando il livello chiave di 3.000 dollari per oncia, e non sembra intenzionato a fermarsi. In questo contesto, la valuta statunitense ha ceduto

Autore: Larisa Kolesnikova

09:28 2025-03-20 UTC+2

18

Bitcoin ed Ethereum sono tornati a crescere dopo la riunione di ieri della Federal Reserve, dalla quale è emerso chiaramente che sarà necessario abbassare i tassi. Per quanto tempoAutore: Miroslaw Bawulski

08:38 2025-03-20 UTC+2

17

La sessione di trading americana di martedì ha portato notizie interessanti per gli operatori del mercato: le quotazioni dei futures sul gas naturale sono improvvisamente balzate in alto, mentreAutore: Natalia Andreeva

11:08 2025-03-19 UTC+2

14