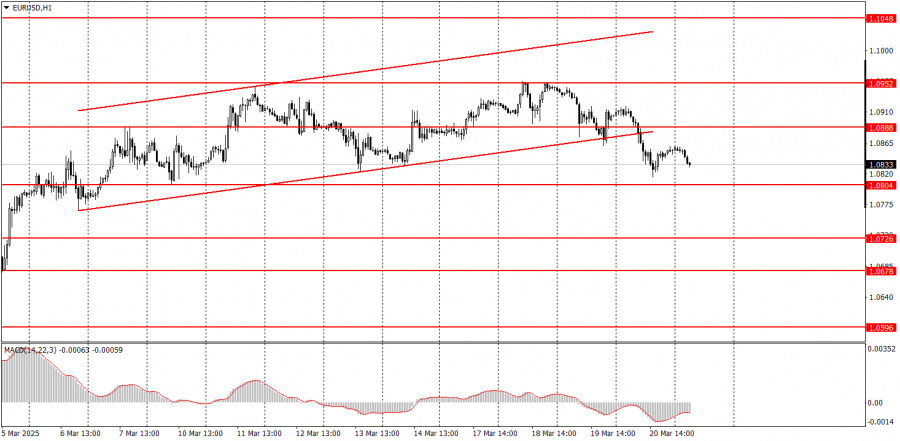

EUR/USD

Brief Analysis:

Analysis on the 4-hour chart for the euro shows that the trend is driven by the upward wave from April 16 of this year. The movement demonstrates high potential and is transitioning to a larger timeframe. Since the end of August, a counter-correction, resembling a shifting flat, has been forming on the chart. The price is moving along the upper boundary of a strong potential reversal zone.

Weekly Forecast:

In the coming days, a continued flat movement of the euro with an overall downward direction is highly likely. In the resistance zone, a pause, reversal, and subsequent rise are expected. The resistance level marks the upper boundary of the expected weekly movement of the pair.

Potential Reversal Zones

- Resistance: 1.1230/1.1280

- Support: 1.1030/1.0980

Recommendations:

- Buying: Possible after confirmed reversal signals near the support zone.

- Selling: Can be used with small volume sizes within intraday trading.

USD/JPY

Brief Analysis:

The upward section of the Japanese yen chart from August 5 is completing a prolonged correction from May and is resuming the previously dominant bullish trend. The price is moving within a strong potential reversal zone, which is acting as support in this case. Before the price rise continues, the correction must be completed.

Weekly Forecast:

In the coming days, a continuation of the sideways movement along the support levels is expected. A breakout of the lower boundary is unlikely. The second half of the week is anticipated to be more volatile. A price rise from the support zone towards the calculated resistance levels is expected.

Potential Reversal Zones

- Resistance: 146.40/146.90

- Support: 141.50/142.00

Recommendations:

- Selling: No conditions for trades.

- Buying: Can be profitable after confirmed signals near the support zone.

GBP/JPY

Brief Analysis:

On a larger scale of the pound/yen pair, an uptrend continues. After the corrective decline from August 5, an upward wave with reversal potential is developing from the lower boundary of strong resistance. The middle section (B) of this wave is nearing completion. No signals of an imminent reversal are yet visible on the chart.

Weekly Forecast:

At the beginning of the week, the sideways movement along the support zone is likely to continue. Closer to the weekend, volatility may increase, with a possible change in direction. A brief breakout of the lower boundary of support is not ruled out. The timing of the reversal may coincide with the release of important economic data.

Potential Reversal Zones

- Resistance: 191.50/192.00

- Support: 186.40/185.90

Recommendations:

- Selling: High-risk and potentially unprofitable.

- Buying: Can be used after reversal signals near the calculated support zone.

USD/CAD

Brief Analysis:

The price of the Canadian dollar relative to the U.S. dollar has been moving sideways for the past six months. On the weekly chart, this movement appears as a correction. The price is within a potential reversal zone. The upward movement from August 28 has reversal potential and may mark the start of a new segment of the main trend.

Weekly Forecast:

At the beginning of the upcoming week, expect the upward movement to continue, with the price rising to the resistance zone. Towards the weekend, a reversal and price decline are likely. The highest volatility is expected closer to the weekend.

Potential Reversal Zones

- Resistance: 1.3610/1.3660

- Support: 1.3430/1.3380

Recommendations:

- Buying: Has limited potential; can be profitable within intraday trades with small volume sizes.

- Selling: No conditions until confirmed reversal signals appear near the resistance zone.

NZD/USD

Brief Analysis:

The "kiwi" has been moving in a sideways pattern since December last year. The latest upward movement started on July 29, with an intermediate correction forming over the past few weeks. The price is trapped in a narrow range between opposing zones.

Weekly Forecast:

In the first few days, a continuation of the downward movement with a flat trend is likely. A reversal is expected within the support zone, and the resumption of the bullish trend is more probable in the second half of the week. The resistance zone marks the upper boundary of the expected weekly range.

Potential Reversal Zones

- Resistance: 0.6270/0.6320

- Support: 0.6100/0.6050

Recommendations:

- Buying: No conditions for buying.

- Selling: Recommended after confirmed reversal signals near the resistance zone.

Gold

Brief Analysis:

The gold trend over the past six months has shown a weak upward vector, mostly moving sideways. This entire movement forms a correction to the previous upward trend. The wave structure resembles a shifting flat with no final section. Over the past three weeks, the price has been moving along the lower boundary of a strong potential reversal zone on the weekly chart.

Weekly Forecast:

At the beginning of the week, the price is likely to continue moving sideways along the support zone. Later, conditions for a reversal are expected to form. A rise in gold prices is more likely towards the end of the week. The resistance zone marks the upper boundary of the expected weekly movement.

Potential Reversal Zones

- Resistance: 2560.0/2580.0

- Support: 2480.0/2460.0

Recommendations:

- Selling: Carries high risk; safer to use small volume sizes.

- Buying: Will become relevant after confirmed signals appear near the resistance zone according to your trading systems.

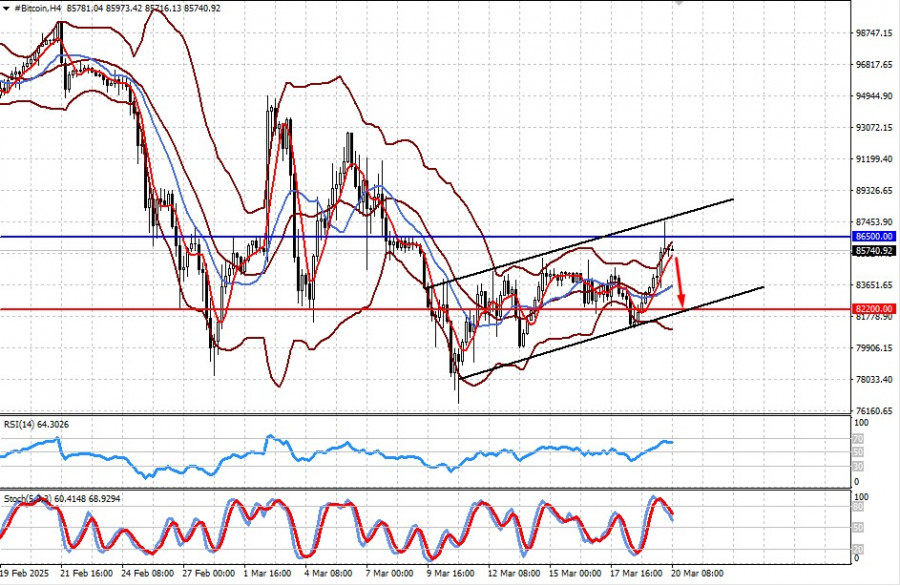

Bitcoin

Brief Analysis:

The short-term bitcoin trend since the beginning of August is driven by an upward wave. Over the past two weeks, an unfinished downward section of this wave has been forming. The price is approaching the upper boundary of the potential reversal zone on the daily chart.

Weekly Forecast:

In the coming days, the downward movement is likely to continue until it reaches the support zone. A reversal is expected with high probability. A rise in bitcoin prices is anticipated by the end of the current week or early next week.

Potential Reversal Zones

- Resistance: 56900.0/57400.0

- Support: 52300.0/51800.0

Recommendations:

- Selling: Possible with small volumes within individual sessions; potential limited by the support zone.

- Buying: Will become relevant after confirmed signals appear near the support zone according to your trading systems.

Explanation: In simplified wave analysis (SWA), all waves consist of three parts (A-B-C). The last, unfinished wave is analyzed at each timeframe. Dotted lines indicate expected movements.

Note: The wave algorithm does not account for the duration of movements in time!