- Analytical News

Record dell'oro: quasi 3000 dollari l'oncia. Perché gli investitori stanno abbandonando in massa le azioni?

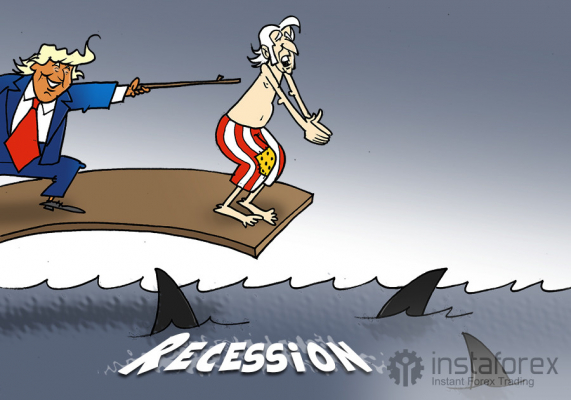

Tutti gli indici di Wall Street hanno perso l'1%, l'indice S&P 500 conferma la fase correttiva. Le modifiche tariffarie di Trump influenzano il sentiment del mercato. L'oro ha raggiuntoAutore:

11:43 2025-03-14 UTC+2

0

La struttura a onde sul grafico a 24 ore per lo strumento #SPX appare nel complesso chiara. La prima cosa da sottolineare è la struttura globale a cinque ondeAutore: Chin Zhao

10:01 2025-03-14 UTC+2

3

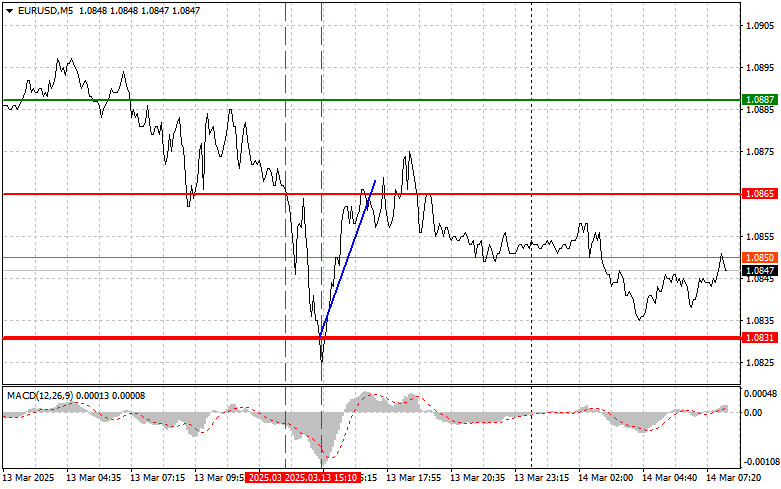

ForecastEURUSD: semplici consigli di trading per i trader principianti il 14 marzo. Analisi delle operazioni Forex di ieri

Analisi delle operazioni e consigli per il trading della valuta europea Il test del prezzo a 1,0865 si è verificato nel momento in cui l'indicatore MACD era sceso significativamenteAutore: Jakub Novak

09:21 2025-03-14 UTC+2

3

- Bitcoin ed Ethereum si consolidano nei canali, creando presupposti concreti per ulteriori ribassi, sebbene molti esperti sostengano all'unanimità che i minimi siano già stati raggiunti e che ci attenda

Autore: Miroslaw Bawulski

08:39 2025-03-14 UTC+2

0

Il mercato azionario statunitense continua a mostrare un'elevata volatilità, ma gli investitori iniziano a cercare punti d'ingresso dopo il recente calo. Al centro dell'attenzione ci sono l'andamento degli indici S&PAutore: Anna Zotova

11:36 2025-03-13 UTC+2

1

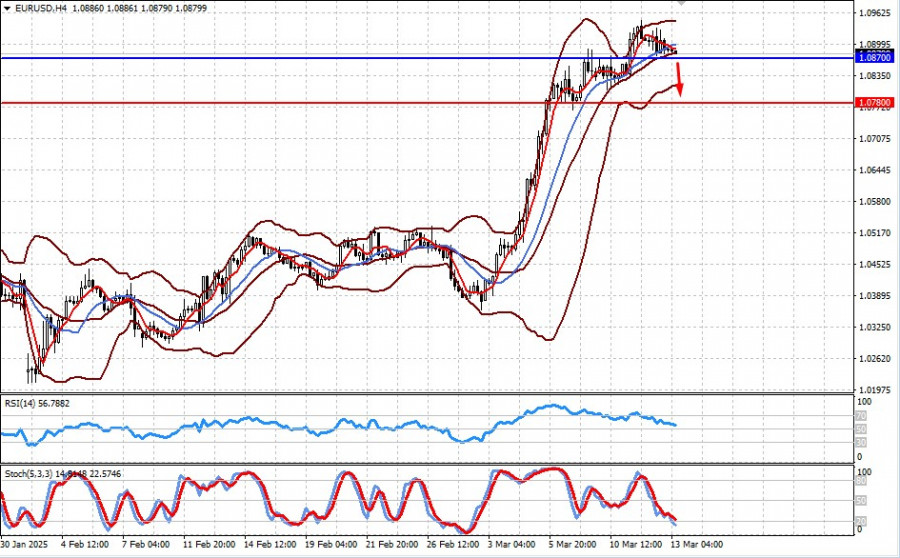

Fundamental analysisTrump e la sua politica restano al centro dell'attenzione dei mercati (esiste la possibilità di una correzione al ribasso delle coppie EUR/USD e GBP/USD)

Sembra che gli investitori abbiano ormai compreso che D. Trump, nell'attuazione dei suoi piani economici e geopolitici, agisce secondo il metodo: due passi avanti, uno indietro. Questo si manifesta chiaramenteAutore: Pati Gani

11:01 2025-03-13 UTC+2

2

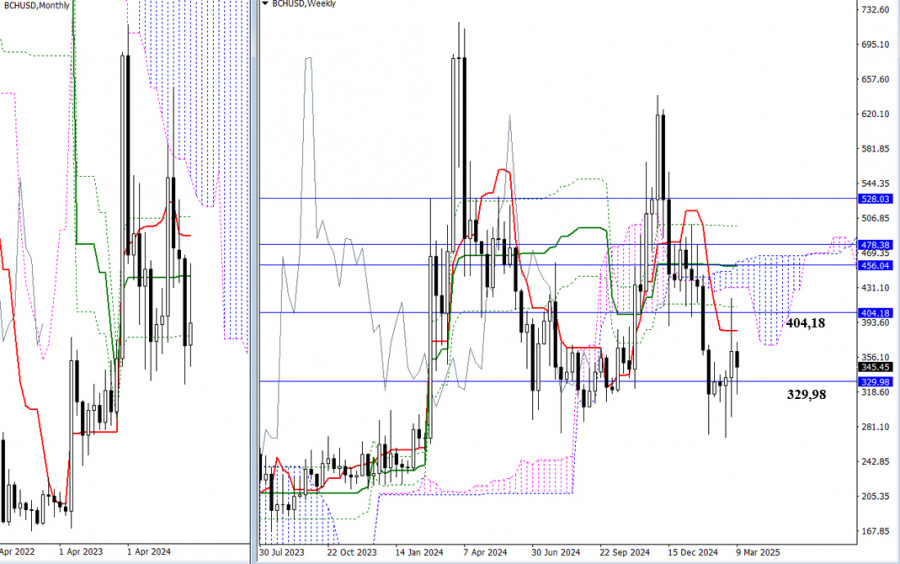

- Il consolidamento al livello finale del Golden Cross mensile di Ichimoku (329,98) si è prolungato. Nonostante il rimbalzo e i test delle resistenze nell'area 384,78 – 404,18 – 410,99

Autore: Evangelos Poulakis

10:16 2025-03-13 UTC+2

0

Stock MarketsMercato azionario del 13 marzo: la ripresa degli indici SP500 e NASDAQ non è durata a lungo

I futures sull'indice azionario S&P 500 e NASDAQ sono tornati a scendere dopo la pubblicazione dei dati sull'inflazione negli Stati Uniti di ieri, che sorprendentemente hanno indicato un rallentamento dellaAutore: Jakub Novak

09:43 2025-03-13 UTC+2

2

Bitcoin ed Ethereum sono bloccati in nuovi canali. Da un lato, questa situazione è positiva, poiché la pressione osservata all'inizio della settimana è ormai svanita. Dall'altro, la mancanza di acquistiAutore: Miroslaw Bawulski

08:54 2025-03-13 UTC+2

0