- Mercoledì 19 marzo, la Banca del Giappone concluderà la sua riunione mensile di marzo. In vista di questo evento, lo yen ha mostrato una forte debolezza contro il dollaro

Autore: Irina Manzenko

12:19 2025-03-18 UTC+2

0

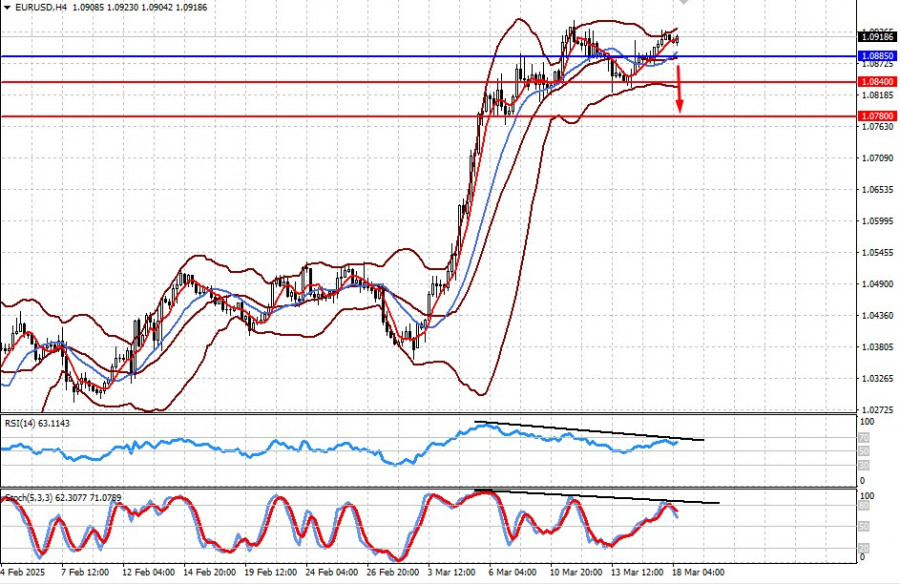

Fundamental analysisNon ci si deve aspettare nulla di importante e significativo dalla riunione della Fed (prevediamo un forte calo della coppia EUR/USD e la continuazione di una cauta crescita del prezzo dell'oro)

I mercati sono in fermento a causa del rischio di una possibile recessione dell'economia statunitense. E sebbene il Segretario al Tesoro Bessent stia cercando di rassicurare gli investitori affermandoAutore: Pati Gani

10:08 2025-03-18 UTC+2

0

Analytical NewsLa coppia EUR/USD si stabilizza, mentre le previsioni per lo S&P 500 peggiorano. Come trovare un equilibrio?

Attualmente, il mercato globale sta cercando di trovare un equilibrio tra le principali coppie di valute e gli strumenti azionari. Questo compito è piuttosto difficile, considerando il recente calo dell'euroAutore: Larisa Kolesnikova

09:38 2025-03-18 UTC+2

0

- La struttura a onde sul grafico a 24 ore per lo strumento #SPX appare abbastanza chiara. La prima cosa da notare è la struttura a cinque onde globale

Autore: Chin Zhao

09:03 2025-03-18 UTC+2

0

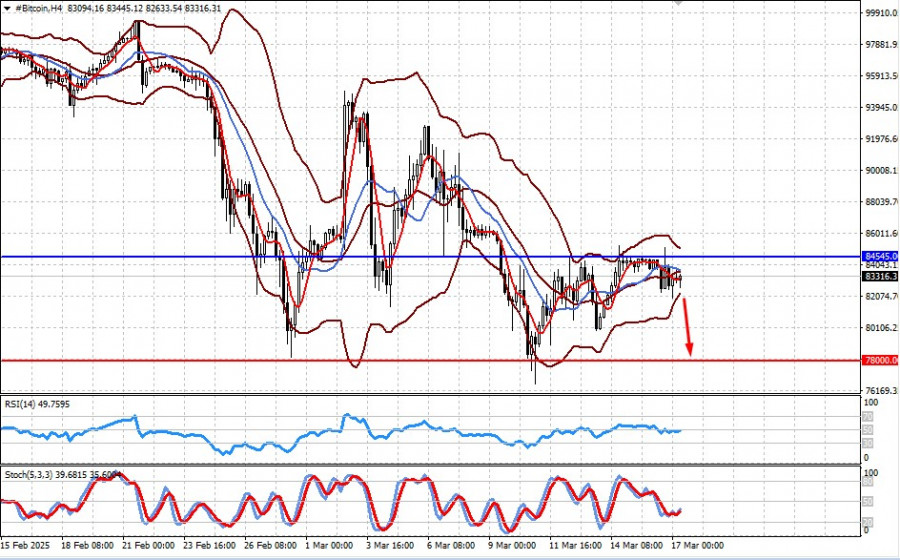

I compratori di Bitcoin ed Ethereum hanno tentato di ottenere una crescita più significativa, e per un momento sembrava che il mercato rialzista potesse ritrovare la speranza di una ripresaAutore: Miroslaw Bawulski

08:45 2025-03-18 UTC+2

0

Attualmente, operatori di mercato e analisti discutono se il prezzo di Bitcoin abbia raggiunto il suo massimo. Tuttavia, la maggior parte dei dati tecnici indica che il meglioAutore: Larisa Kolesnikova

11:10 2025-03-17 UTC+2

0

- Fundamental analysis

I mercati rimarranno in uno stato depresso per un po' di tempo (ci aspettiamo una ripresa del calo di #Bitcoin e #Litecoin).

I mercati finanziari globali restano fortemente influenzati dalla politica del presidente americano, che sta smantellando il modello economico e geopolitico costruito prima del suo mandato, il che, naturalmente, incideAutore: Pati Gani

10:32 2025-03-17 UTC+2

0

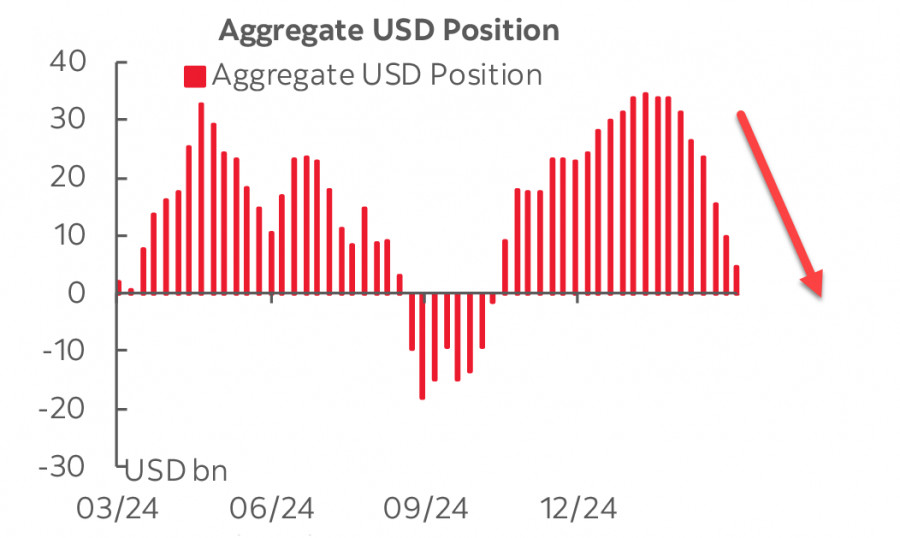

Fundamental analysisIl dollaro viene venduto, la minaccia di recessione cresce e l'indice S&P500 è a rischio di un crollo massiccio

La vendita del dollaro non si arresta e il ritmo delle vendite non rallenta. Secondo il rapporto CFTC, la posizione netta lunga sul dollaro si è ridotta di ulteriori 4,6Autore: Kuvat Raharjo

09:53 2025-03-17 UTC+2

0

Bitcoin ed Ethereum continuano a consolidarsi all'interno dei loro canali, permettendo di sperare nella continuazione dello sviluppo del mercato rialzista. Tuttavia, affinché ciò avvenga, è necessario soddisfare una serieAutore: Miroslaw Bawulski

09:11 2025-03-17 UTC+2

1