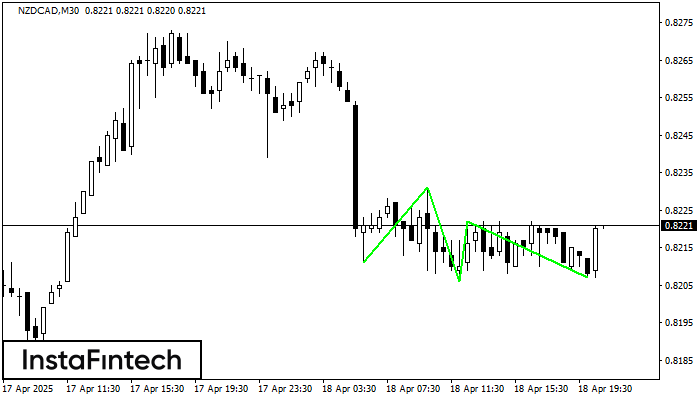

Technical analysis

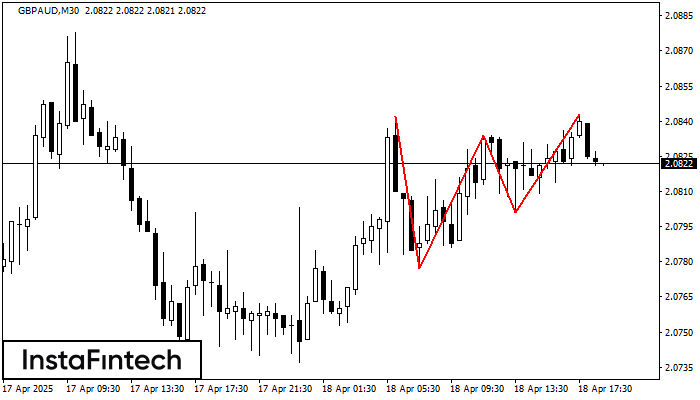

Technical analysis

The figures of technical analysis that periodically appear on the charts of trading instruments and having a certain system of emergence and development are usually called price figures.