- Euro sedang menunjukkan kenaikan yang mendadak berbanding dolar AS. Pasangan EUR/USD telah mencapai paras tertinggi dalam tiga tahun dan tidak menunjukkan tanda-tanda akan memperlahan. Sementara itu, menurut kaji selidik pakar

Pengarang: Jakub Novak

12:42 2025-04-11 UTC+2

52

Pasangan AUD/USD sedang berusaha untuk menarik pembeli dalam pemulihan dari tahap psikologi 0.5900, menandakan tahap terendah sejak Mac 2020. Momentum menaik ini berjaya mengatasi tahap sekitar 0.6200, didorong oleh keyakinanPengarang: Irina Yanina

12:39 2025-04-11 UTC+2

22

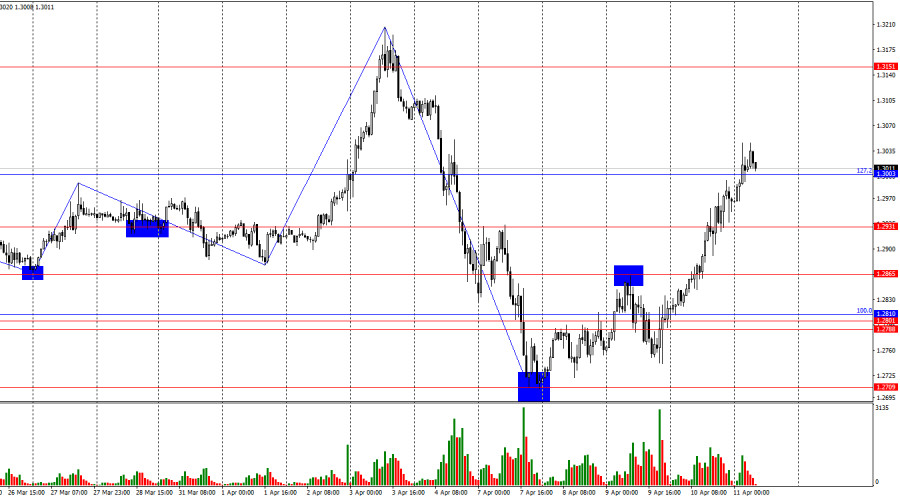

Pada carta setiap jam, pasangan GBP/USD meneruskan pergerakan menaiknya pada hari Khamis dan berjaya berada di atas tahap pembetulan 127.2% pada 1.3003 – menjelang pagi Jumaat. Ini menunjukkan bahawa pergerakanPengarang: Samir Klishi

12:32 2025-04-11 UTC+2

12

- Bitcoin dan Ethereum mengalami penurunan nilai menjelang penutupan sesi Amerika Syarikat pada hari Khamis tetapi pulih semula semasa waktu dagangan Asia hari ini. Adalah menjadi kebiasaan bahawa pasaran kripto menurun

Pengarang: Miroslaw Bawulski

09:28 2025-04-11 UTC+2

18

Analisis fundamentalPasaran Menghadapi Tempoh Ketidakstabilan yang Berpanjangan (USD/JPY dan USD/CHF Dijangka Terus Menurun)

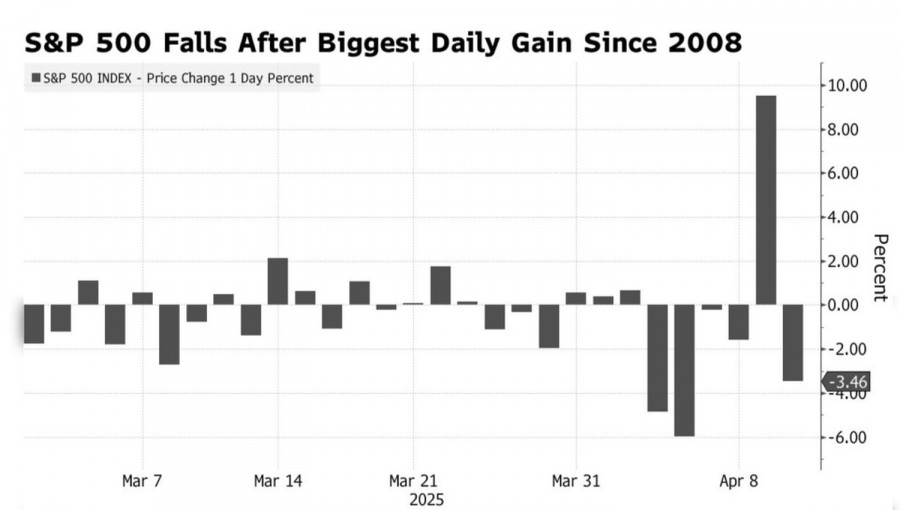

Pada hari Khamis, pelabur menyedari bahawa kestabilan tidak wujud pada masa ini. Volatiliti pasaran yang tinggi kekal dan akan terus mendominasi untuk suatu tempoh masa. Penyebab utama keadaan ini adalahPengarang: Pati Gani

09:11 2025-04-11 UTC+2

8

Mata wang KryptoAnalisis Teknikal Pergerakan Harga Harian Cryptocurrency Polkadot, Jumaat 11 April 2025

Apabila berlaku perbezaan antara pergerakan harga mata wang kripto Polkadot dan penunjuk Stochastic Oscillator pada carta 4 jamnya, selagi tiada pembetulan kelemahan yang menembusi dan ditutup di bawah tahap 3.2460Pengarang: Arief Makmur

08:52 2025-04-11 UTC+2

13

- Mata wang Krypto

Analisis Teknikal Pergerakan Harga Intraday Matawang Kripto Uniswap, Jumaat 11 April 2025.

Berdasarkan apa yang diperhatikan pada carta 4 jam bagi mata wang kripto Uniswap, terdapat perbezaan (divergence) antara pergerakan harga Uniswap dan penunjuk Pengayun Stochastic. Maka, berdasarkan isyarat ini, dalam masaPengarang: Arief Makmur

08:52 2025-04-11 UTC+2

7

Apakah ertinya hidup jika bukan sekadar satu permainan? Dalam tahun-tahun sebelumnya, tumpuan para pelabur adalah terhadap pertembungan antara Rizab Persekutuan dan pasaran kewangan. Namun pada tahun 2025, peraturan permainan telahPengarang: Marek Petkovich

08:42 2025-04-11 UTC+2

3

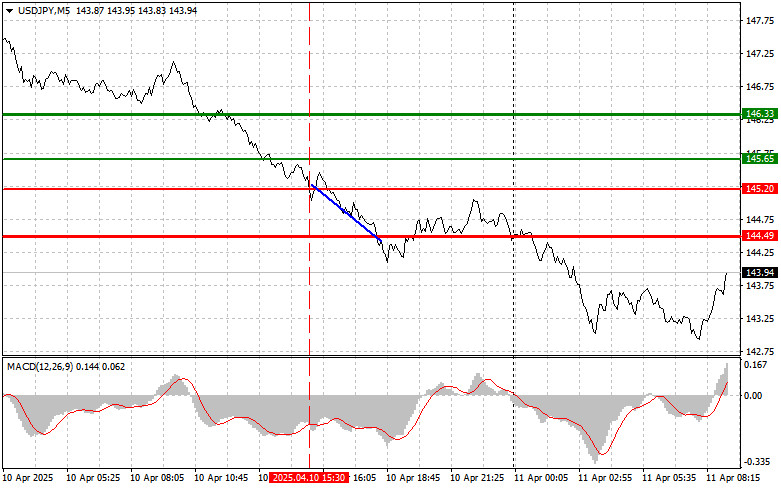

RamalanUSD/JPY: Tip Dagangan Ringkas untuk Pedagang Baharu pada 11 April. Kajian Dagangan Forex Semalam

Ujian harga pada 145.20 berlaku apabila penunjuk MACD bergerak jauh di bawah garisan sifar, mengehadkan potensi penurunan pasangan itu. Namun, ini tidak menghalang penjualan dolar A.S., kerana ujian ini berlakuPengarang: Jakub Novak

08:42 2025-04-11 UTC+2

9