Summarizing the preliminary results of the ending week, we see that it has been favorable for the dollar. As of writing, DXY index was near 100.75, recovering from a sharp decline last week following the publication of U.S. CPI indices, which indicated another slowdown in inflation in June.

After the release of mixed data from the U.S. labor market earlier this month, inflation data became another argument in favor of massive dollar sales.

However, as we can see, its decline has stopped, and at the beginning of this week, the direction of the dollar's dynamics has reversed.

Next week (July 25–26), the Federal Reserve will hold its regular meeting, and market participants expect a rate hike despite the earlier published U.S. macro statistics.

Previously, in Congress and then at the ECB Forum, Fed Chairman Jerome Powell confirmed the central bank's inclination to continue fighting the still-high inflation, stating that it would be "appropriate to raise rates again this year and possibly twice more."

At the same time, the minutes of the June meeting published last week indicated that the Fed officials expressed support for further tightening of monetary policy, although this would depend on incoming macro data.

Inflation in the U.S. is slowing down—that's a fact. But it is slowing down not only in the U.S. but also in all economically developed countries worldwide, whose central banks, like the Fed, are currently implementing a rather tight monetary policy.

However, if both the Fed and the largest central banks worldwide simultaneously, or at least synchronously, start transitioning to a reverse process, gradually slowing the pace of tightening, then in this situation, the U.S. dollar may regain an advantage, considering the relatively greater stability and strength of the American economy.

Moreover, let us not forget about the tense geopolitical situation in the world. As a defensive asset, the dollar may receive support during the next surge of geopolitical tension or the start of a new wave of so-called "risk-off" sentiment and sell-offs in global stock markets, primarily the American one.

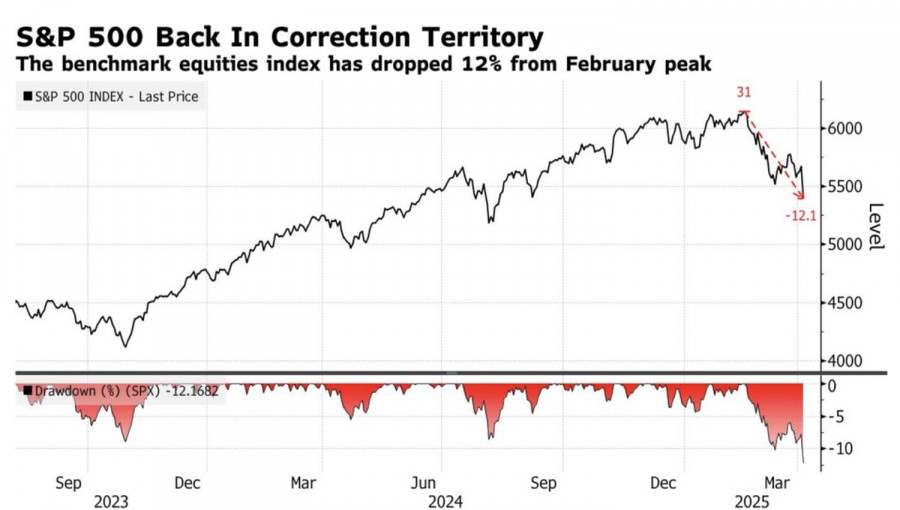

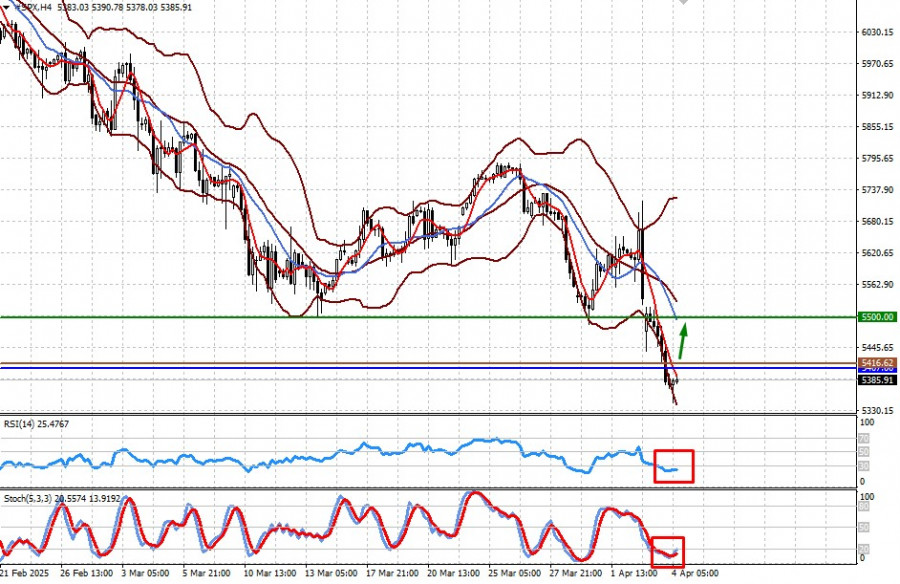

Main U.S. stock indices maintain a positive trend despite numerous risks, including geopolitical ones.

Next week, after the Federal Reserve meeting, the preliminary estimate of the U.S. GDP for the 2nd quarter will be published.

Currently, there is no data with specific indicators in the economic calendar on this matter.

If we turn our attention to the previous report, the U.S. GDP grew by +2.0% in the 1st quarter, which turned out to be better than the preliminary forecast of +1.3% growth. The GDP data confirmed a decrease in the risks of the national economy falling into a recession.

At the same time, reports from the Conference Board, based on a survey of about 3,000 American households, continue to indicate a high level of confidence among American consumers (109.7 in June compared to previous indicator values of 102.3, 101.3, and 104.2).

Another consumer confidence index in the U.S., from the University of Michigan, also speaks to this. Its preliminary estimate showed a sharp increase in the indicator to 72.6 in July (compared to previous values of 64.4, 59.2, 63.5, and 62.0).

These indicators are leading indicators of consumer spending, which accounts for a significant portion of overall economic activity, and the high level of consumer confidence indicates economic growth (these indicators will also be published next week, on Tuesday and Friday at 14:00 GMT, respectively).

Moreover, economists believe that the high degree of resilience of the American economy to the risk of recession (active job creation, high corporate profitability, a decrease in the household savings rate in the U.S., government programs supporting investments and energy transition) creates conditions for maintaining foreign investors' interest in American assets.

If the Federal Reserve leaders surprise the market and do not raise the interest rate at the July meeting or announce a pause in the rate hike cycle until the end of the year, then we should expect an acceleration in the growth of U.S. stock indices, primarily the major ones such as NASDAQ100, DJIA, and S&P 500.

This can also be fully attributed to the precious metals market, particularly the dynamics of gold.

Its quotes are extremely sensitive to changes in the monetary policies of the world's major central banks. A looser monetary policy by global central banks, especially the Federal Reserve, contributes to the rise in metal prices: as U.S. bond yields decrease with the lowering of interest rates, real interest rates also decline.

Moreover, the Federal Reserve may not only abandon its tightening policy, it also injected nearly $500 billion into the financial system to cover banks' unrealized losses during the banking crisis in March this year, which is a form of quantitative easing.

Recall that on March 20, 2023, the price of gold reached a one-year high, surpassing $2010.00 per troy ounce, and at the end of April, the price was again approaching the record high of $2070.00, reached in March 2022.

Economists believe that the persisting high geopolitical uncertainty, still relatively high inflation, and potential economic growth issues will support demand for safe-haven assets, including gold. Another break above the psychological level of $2,000 per ounce may trigger another wave of panic gold buying.

An alternative scenario, which is currently less likely, would be associated with breaking the support around the $1,900 level and a decline into the previously observed range near $1,800 per ounce.

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Dapatkan manfaat daripada cadangan penganalisis sekarang

Menambah semula akaun dagangan

Buka akaun dagangan

Kajian analisis InstaSpot akan membuat anda mengetahui sepenuhnya aliran pasaran! Sebagai pelanggan InstaSpot, anda disediakan sejumlah besar perkhidmatan percuma untuk dagangan yang cekap.