- Analisis gelombang

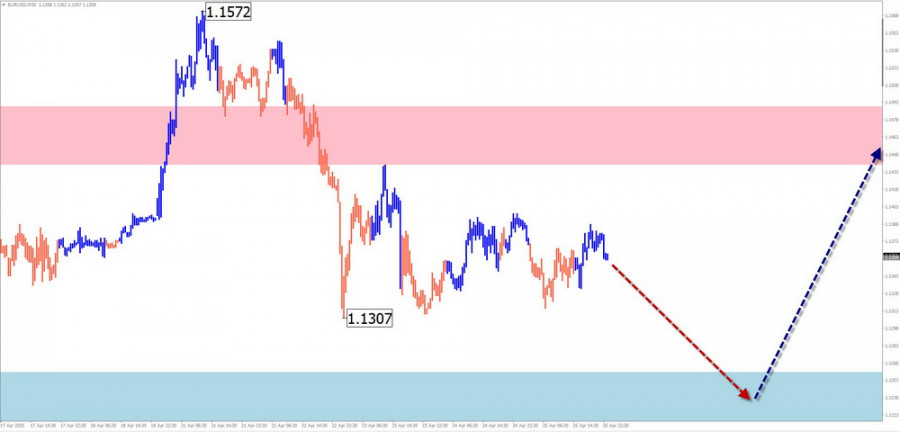

Ramalan Mingguan Berdasarkan Analisis Gelombang Ringkas untuk EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD dan EMAS — 28 April

Pada permulaan minggu akan datang, mata wang Eropah dijangka terus bergerak mendatar di sepanjang zon balas arah yang telah dikira. Pergerakan ke bawah lebih berkemungkinan pada awal minggu. Menjelang hujungPengarang: Isabel Clark

09:28 2025-04-28 UTC+2

23

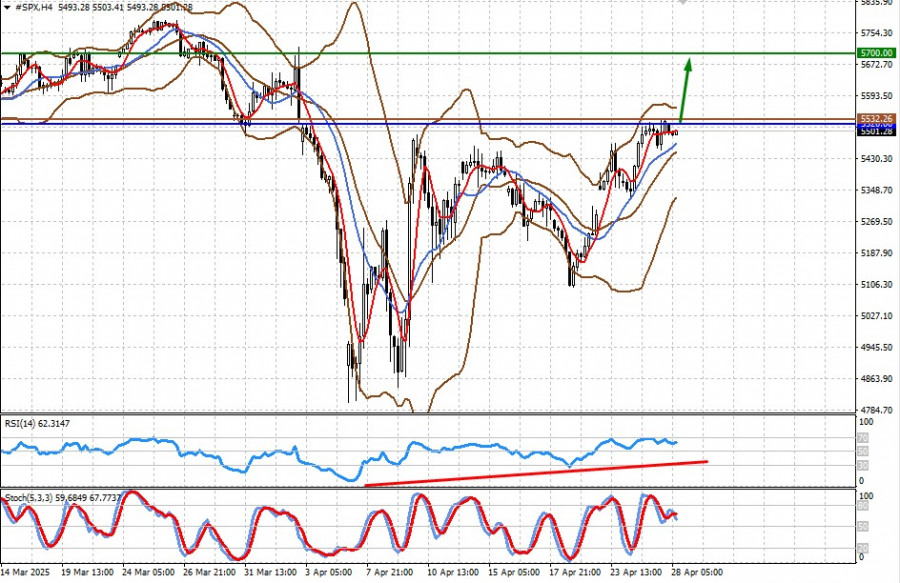

Analisis fundamentalMinggu Hadapan Mungkin Positif untuk Pasaran namun Negatif bagi Dolar dan Emas (kami menjangkakan pertumbuhan selanjutnya dalam kontrak CFD untuk niaga hadapan S&P 500 dan Bitcoin)

Minggu hadapan bakal menyaksikan pelbagai penerbitan data ekonomi penting yang berpotensi memberi kesan ketara terhadap dinamik pasaran — namun, sejauh mana data ini mampu mengubah keadaan? Dalam suasana geopolitik yangPengarang: Pati Gani

09:12 2025-04-28 UTC+2

11

Dalam sesi biasa sebelumnya, indeks saham AS ditutup lebih tinggi. S&P 500 meningkat sebanyak 0.74%, Nasdaq 100 naik 1.26%, dan Dow Jones Industrial Average meningkat sedikit sebanyak 0.05%. Indeks-indeks AsiaPengarang: Jakub Novak

09:06 2025-04-28 UTC+2

17

- Bitcoin terus menerima tekanan, namun ia masih bertahan dengan agak yakin. Selepas melonjak semula dari paras $92,000, mata wang kripto utama ini kembali ke kawasan $94,000, sekali gus mengekalkan prospek

Pengarang: Miroslaw Bawulski

08:19 2025-04-28 UTC+2

11

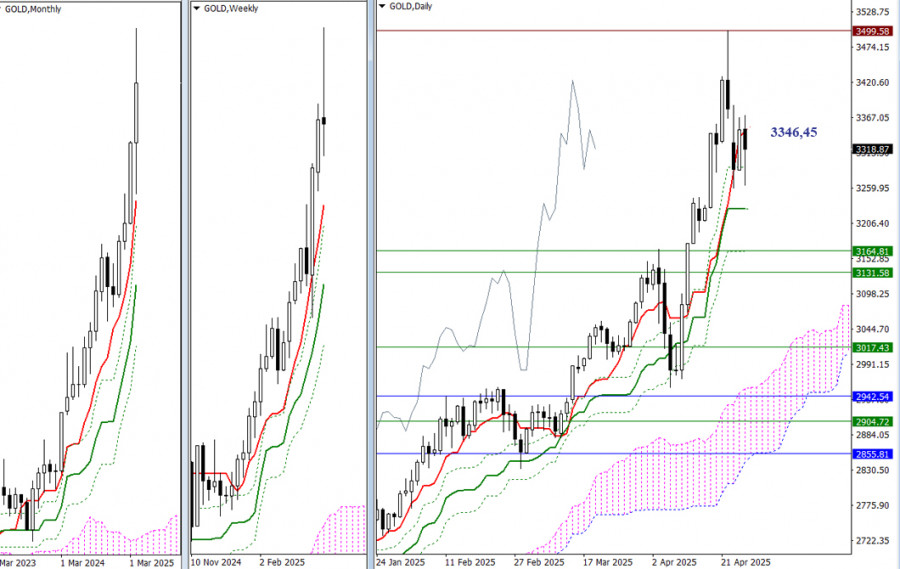

Minggu lepas, 'kenaikan harga' telah mengemaskini rekod tertinggi dan membentuk maksimum ekstrem yang baru pada 3499.58. Selepas itu, emas memasuki pembetulan ke bawah menuju sokongan aliran jangka pendek harian padaPengarang: Evangelos Poulakis

06:49 2025-04-28 UTC+2

12

Analisis fundamentalApa yang Perlu Diberi Perhatian pada 28 April? Ulasan Analisis Fundamental untuk Pedagang Baharu

Tiada peristiwa makroekonomi dijadualkan pada hari Isnin. Jika pasaran hampir tidak memberi reaksi kepada data makroekonomi minggu lalu, tiada apa yang diharapkan pada hari Isnin. Sudah tentu, Donald Trump bolehPengarang: Paolo Greco

05:51 2025-04-28 UTC+2

9

- Pelan Dagangan

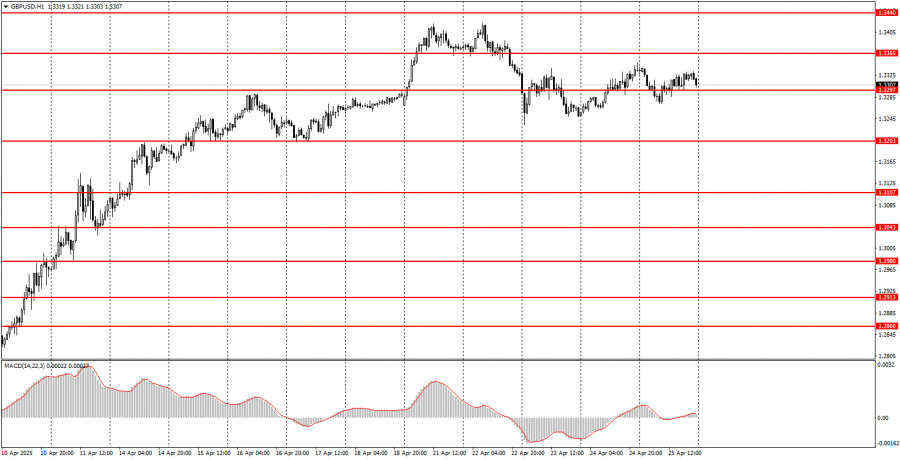

Bagaimana Berdagang Pasangan GBP/USD pada 28 April? Tip Ringkas dan Analisis Perdagangan untuk Pedagang Baharu

Pada hari Jumaat, pasangan mata wang GBP/USD juga tidak menunjukkan pergerakan yang menarik. Seperti euro, pound British kekal sangat hampir dengan julat mendatar. Walau bagaimanapun, mata wang British masih mengekalkanPengarang: Paolo Greco

05:51 2025-04-28 UTC+2

7

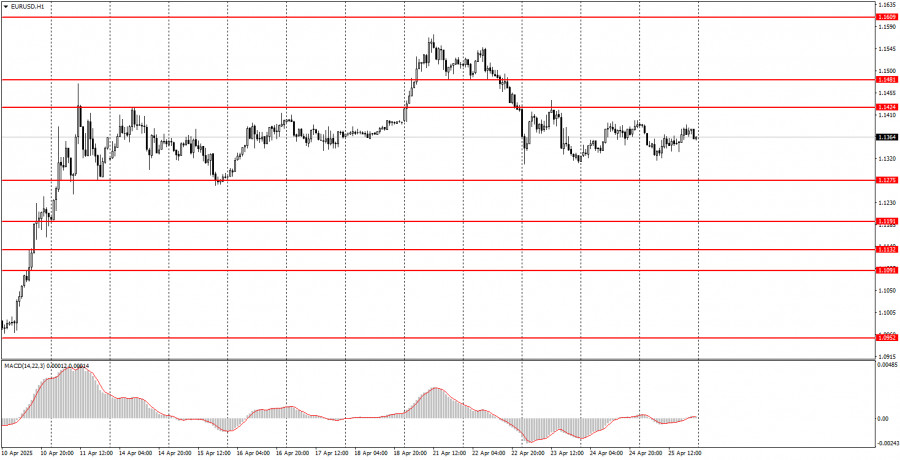

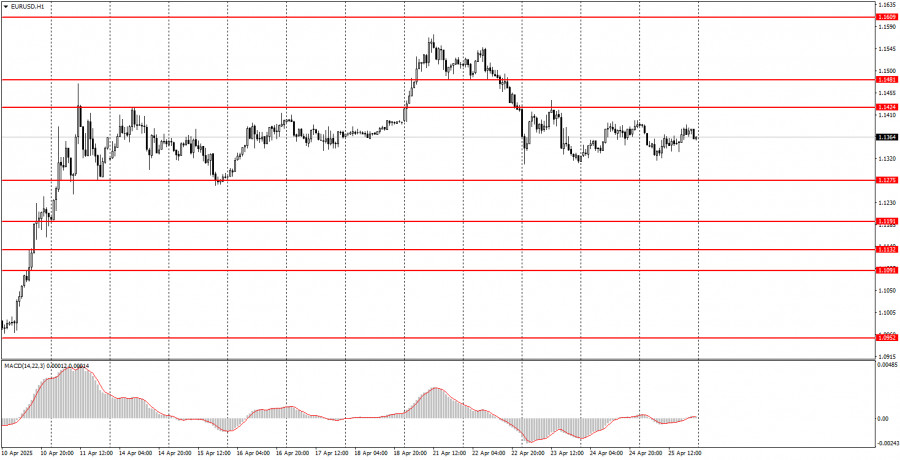

Pelan DaganganBagaimana untuk Berdagang Pasangan EUR/USD pada 28 April? Petua Ringkas dan Analisis Dagangan kepada Pedagang Baharu

Analisis Dagangan Hari Jumaat Carta 1-Jam pasangan EUR/USD Pasangan mata wang EUR/USD meneruskan dagangan secara mendatar pada hari Jumaat. Pasaran terus mengabaikan semua data makroekonomi, dan minggu lalu sekali lagiPengarang: Paolo Greco

05:51 2025-04-28 UTC+2

13

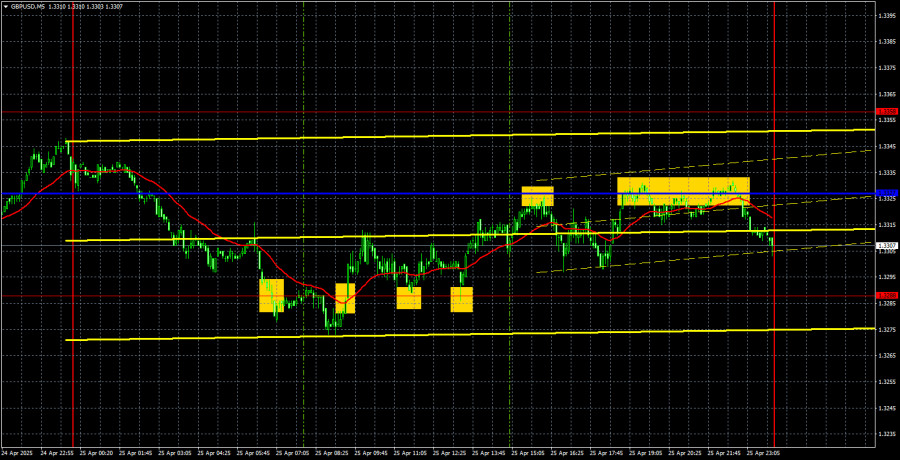

Pelan DaganganCadangan Dagangan dan Analisis untuk GBP/USD pada 28 April: Pound Tidak Percaya kepada Penyusutan Ketegangan

Analisis GBP/USD carta 5-Minit Pasangan mata wang GBP/USD meneruskan dagangan mendatar pada hari Jumaat, kekal berhampiran paras tertinggi tiga tahun. Hakikat bahawa pound British enggan melakukan pembetulan menurun walaupun sedikitPengarang: Paolo Greco

04:14 2025-04-28 UTC+2

11