Wall Street Reels, But S&P 500 and Nasdaq Survive

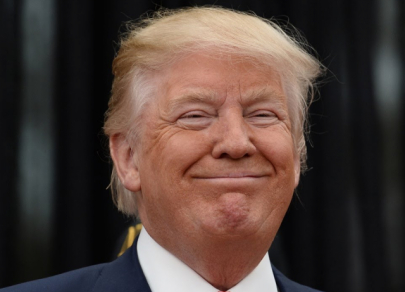

U.S. stocks ended Tuesday with gains in the key S&P 500 and Nasdaq Composite, despite palpable nervousness gripping investors ahead of Donald Trump's announcement of new trade tariffs.

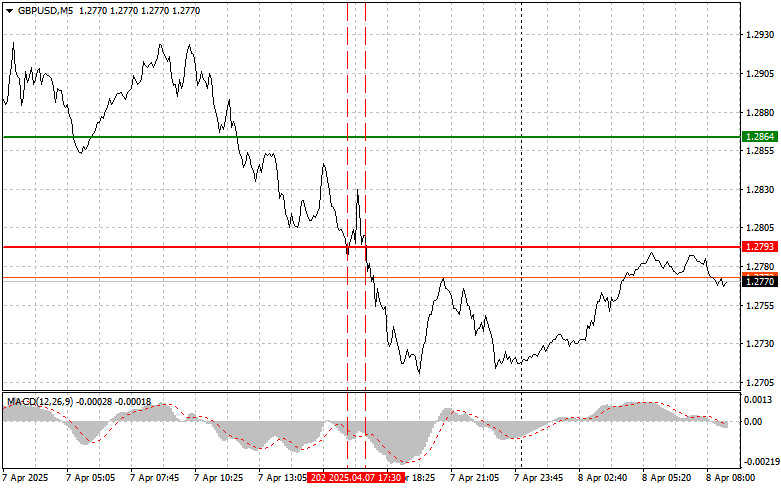

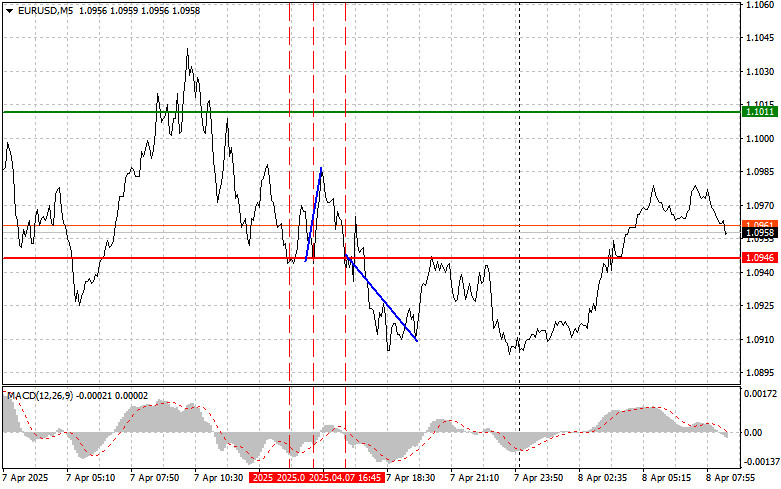

Investors on edge: markets in turmoil

The financial markets have been experiencing high volatility in recent weeks. The reason is fears that the US President's large-scale tariff initiatives could slow down the country's economic growth and spur inflation. While waiting for specifics from the White House, investors are maneuvering between caution and hope.

Markets are waiting for signals from the Rose Garden

All eyes are on Trump's speech tomorrow, scheduled for 4:00 PM ET in the White House Rose Garden. He is expected to announce the details of his tariff policy, and this may clarify at least part of the situation shrouded in guesswork and rumors.

However, even if clarity appears in terms of measures, investors will still face general uncertainty - both regarding the consequences of these steps and the possible reaction of US partners in the trade arena. All this makes the direction of further market movement vague and difficult to predict.

Swings of the day: from minus to confident point

Amid this tense uncertainty, all three major US indexes showed fluctuations throughout the trading session, jumping between growth and decline. Only in the second half of the day did positive dynamics prevail.

The bottom line for the day is as follows: the broad market S&P 500 index added 21.22 points, or 0.38%, to close at 5,633.07. The high-tech Nasdaq Composite strengthened by 150.60 points, which is an increase of 0.87%, ending the day at 17,449.89. But the Dow Jones industrial average slightly fell - by 11.80 points, or 0.03%, to 41,989.96.

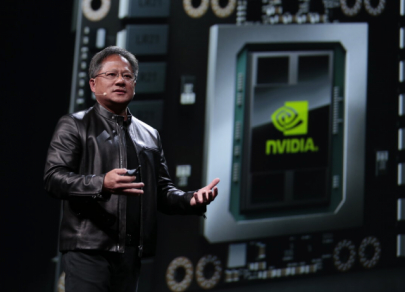

Technology Takes Revenge: Nasdaq Back on Top

On Tuesday, it was the technology sector that became the engine of growth on Wall Street. After a difficult start to the year, the previously damaged IT giants began to confidently regain their positions, pulling the Nasdaq and S&P 500 indices up with them.

Tesla Accelerates Ahead of the Report

Tesla stood out, its shares jumped by 3.6% amid expectations of fresh statistics on car deliveries for the first quarter, which will be released on Wednesday. Investors are betting on positive figures and waiting for a signal of demand recovery.

Other representatives of the so-called "magnificent seven" - Amazon, Microsoft and Meta Platforms (banned in Russia) - also showed confident growth, adding from 1% to 1.8%. This strengthened the position of Nasdaq and breathed technological optimism into the market.

Doctors and airlines drag the market down

But not everything was so rosy on the markets. The S&P 500 was under pressure from the healthcare and transportation sectors, which ended up in the red amid corporate and legal setbacks.

Johnson & Johnson was the real outsider of the day. The pharmaceutical giant's shares fell by 7.6%, showing the worst result among all the companies in the index. The reason was a blow in court: an American bankruptcy judge rejected J&J's offer to settle claims for $10 billion. We are talking about a long-standing dispute over talc-based products, which tens of thousands of plaintiffs associate with cancer.

The airline market is on the decline: anxiety over demand

Airlines also showed weakness. Shares of Delta, American Airlines and Southwest fell in the range of 2.4% to 5.9%. This was the result of analysts at Jefferies revising investment ratings downwards. Financial experts have expressed concern that macroeconomic uncertainty and fluctuations in consumer sentiment could negatively impact demand for both business and leisure travel.

IPO Newbies Are Rocking the Market: Newsmax and CoreWeave Are Riding High

Amid the general market turbulence, some newcomers to the exchange have become the real stars of the trading session. Among them is media player Newsmax, whose shares have demonstrated a dizzying rise for the second day in a row.

After a stunning start on the New York Stock Exchange on Monday, when the company's shares rose by more than 700%, they jumped another 208% on Tuesday. Given Newsmax's politically charged and Trump-friendly image, investor interest was literally explosive.

CoreWeave Startup Rising After a Shaky Debut

Another participant in the recent IPO, AI company CoreWeave, has also pleased investors. Despite an uncertain first step after going public on Friday, its shares added an impressive 41.8% on Tuesday, exceeding the announced offering price. This signals strong demand for AI stocks despite market risks.

Gold finds support, Asia wavers

While some investors are chasing the hype of new releases, others are turning their attention to more conservative assets. Gold prices have begun to show signs of recovery — the metal is traditionally seen as a "safe haven" amid geopolitical and economic uncertainty.

Asian markets, meanwhile, remained in a range of moderate volatility. Despite a shaky start, they managed to avoid sharp declines, following a more confident finish to trading on Wall Street. European futures are so far signaling a calm but cautious start.

Tariff time bomb

Investors are still keeping in mind the "hour X" — Donald Trump's planned statement on Wednesday, which he has dubbed "Liberation Day." In essence, we are talking about a large-scale initiative to introduce new import duties - both against strategic opponents and traditional US allies.

The announcement ceremony is scheduled for 20:00 GMT and will take place in a landmark location - the Rose Garden near the White House. And although market participants are waiting for specifics, no real relief from uncertainty is expected yet.

Quick measures, tough responses

Perhaps the most alarming detail is the lack of a negotiating phase. According to available data, tariff measures will be introduced immediately, which sharply reduces the room for diplomatic maneuvers and, on the contrary, increases the likelihood of a quick response from the affected countries.

This creates the basis for increased volatility in the markets in the coming days - from exchange rates to stock indices. Analysts do not rule out sharp jumps and new nervous sell-offs.

Tariff barrage: metal, cars and China under attack

The White House has already taken the first steps in implementing a tough trade strategy. Donald Trump has imposed tariffs on key import categories, from aluminum and steel to automobiles. He has also significantly increased tariffs on a whole range of Chinese products. These actions have resonated in global markets, increasing fears of a trade confrontation that could paralyze global economic growth.

Economists are sounding the alarm: the threat of a full-scale trade war is becoming increasingly real. Tensions between Washington and its main trading partners, including Beijing, threaten to go beyond diplomacy and enter the phase of a systemic conflict that could hit global supply chains and slow down the recovery of the world economy.

Gold shines amid anxiety

Amid growing risks, investors have flocked to safe haven assets, and, above all, to gold. The "yellow metal" is confidently storming new historical heights, having exceeded the psychological mark of $3,000 per ounce.

Gold has already gained 19% since the start of the year, continuing a strong upward trend after a remarkable 27% gain in 2024, the best year for the precious metal in a decade. The rise in prices reflects not only fears of geopolitical and economic shocks, but also growing demand from central banks and large institutional players seeking to preserve capital in an unstable environment.

Not gold, but a barometer of fear

With markets reeling from conflicting signals – from tariff threats to volatile inflation and unclear interest rate prospects – gold is once again becoming a universal indicator of anxiety. Its rise speaks not only of the demand for stability, but also of how deeply rooted the fears among investors are.