- Emas mengekalkan nada menurun hari ini, walaupun ia telah pulih sedikit dari tahap rendah harian, dengan meningkat kembali melebihi paras $3300. Pelabur terus berharap untuk kemungkinan pengurangan ketegangan dalam perang

Pengarang: Irina Yanina

12:23 2025-04-25 UTC+2

62

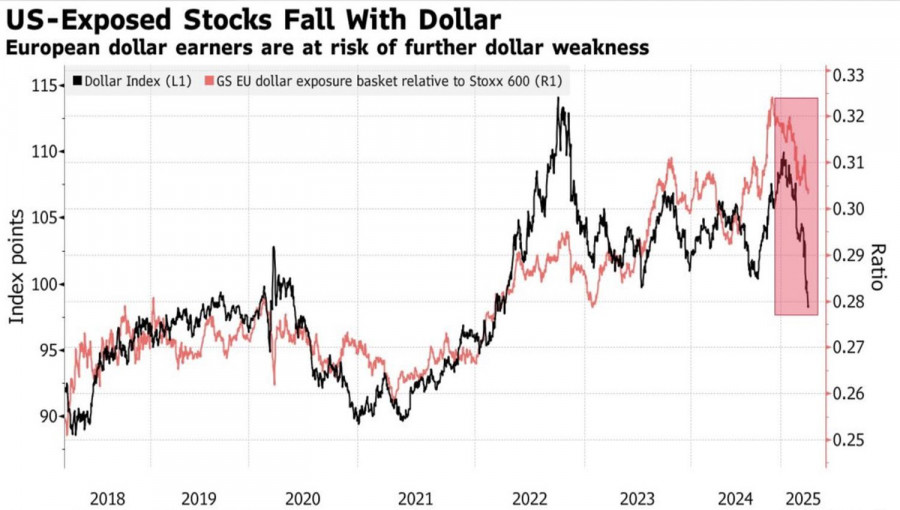

Sementara Donald Trump dan Beijing masih berusaha untuk menentukan sama ada rundingan perdagangan antara A.S. dan China benar-benar berlaku, S&P 500 terus meningkat untuk hari ketiga berturut-turut — kaliPengarang: Marek Petkovich

11:57 2025-04-25 UTC+2

43

Dolar A.S. mengukuh berbanding sejumlah mata wang global, begitu juga pasaran saham A.S., selepas laporan bahawa kerajaan China sedang mempertimbangkan untuk menggantung tarif 125% terhadap beberapa jenis import A.S. LangkahPengarang: Jakub Novak

11:31 2025-04-25 UTC+2

32

- Di penutupan sesi biasa yang lepas, indeks saham AS berakhir lebih tinggi. S&P 500 meningkat sebanyak 2.03%, manakala Nasdaq 100 naik 2.74%. Dow Jones Industrial Average bertambah sebanyak 1.23%. Saham

Pengarang: Jakub Novak

11:27 2025-04-25 UTC+2

27

Analisis fundamentalMengapa Harga Emas Boleh Menurun Secara Signifikan? (Terdapat kemungkinan emas akan terus merosot manakala CFD pada kontrak niaga hadapan NASDAQ 100 mungkin meningkat)

Permulaan rundingan sebenar boleh menyebabkan penurunan ketara dalam harga emas dalam masa terdekat. Dalam artikel-artikel terdahulu, saya mencadangkan bahawa harga emas yang sebelum ini meningkat dengan ketara boleh mengalami pembetulanPengarang: Pati Gani

10:14 2025-04-25 UTC+2

47

Cubaan yang tidak berjaya semalam untuk kekal melebihi $94,000 menunjukkan bahawa masih terdapat minat membeli yang ketara. Ethereum juga tetap kukuh, walaupun pembetulan semalam semasa sesi Eropah mungkin menggusarkan sesetengahPengarang: Miroslaw Bawulski

08:56 2025-04-25 UTC+2

31

- Ramalan

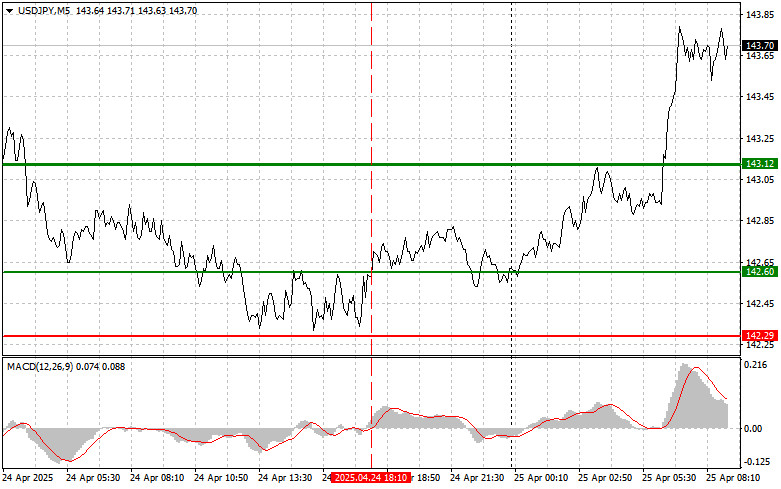

USD/JPY: Petua Dagangan Ringkas kepada Pedagang Baharu pada 25 April. Semakan Dagangan Forex Semalam

Analisis Dagangan dan Petua Dagangan untuk Yen Jepun Ujian harga pada paras 142.60 berlaku ketika penunjuk MACD telah bergerak jauh di atas paras sifar, yang pada pandangan saya telah mengehadkanPengarang: Jakub Novak

08:31 2025-04-25 UTC+2

31

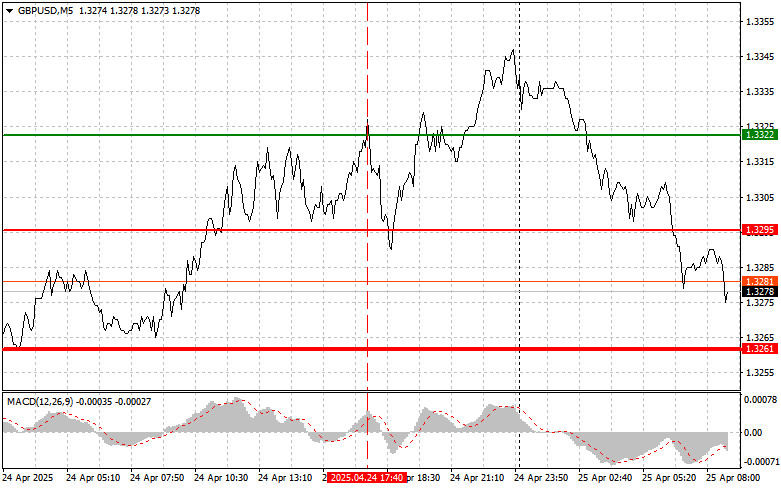

RamalanGBP/USD: Petua Dagangan Ringkas kepada Pedagang Baharu pada 25 April. Semakan Dagangan Forex Semalam

Analisis Dagangan dan Petua Dagangan untuk Pound British Ujian harga pada paras 1.3322 berlaku apabila penunjuk MACD telah bergerak jauh di atas garisan sifar, sekali gus mengehadkan potensi kenaikan pasanganPengarang: Jakub Novak

08:31 2025-04-25 UTC+2

29

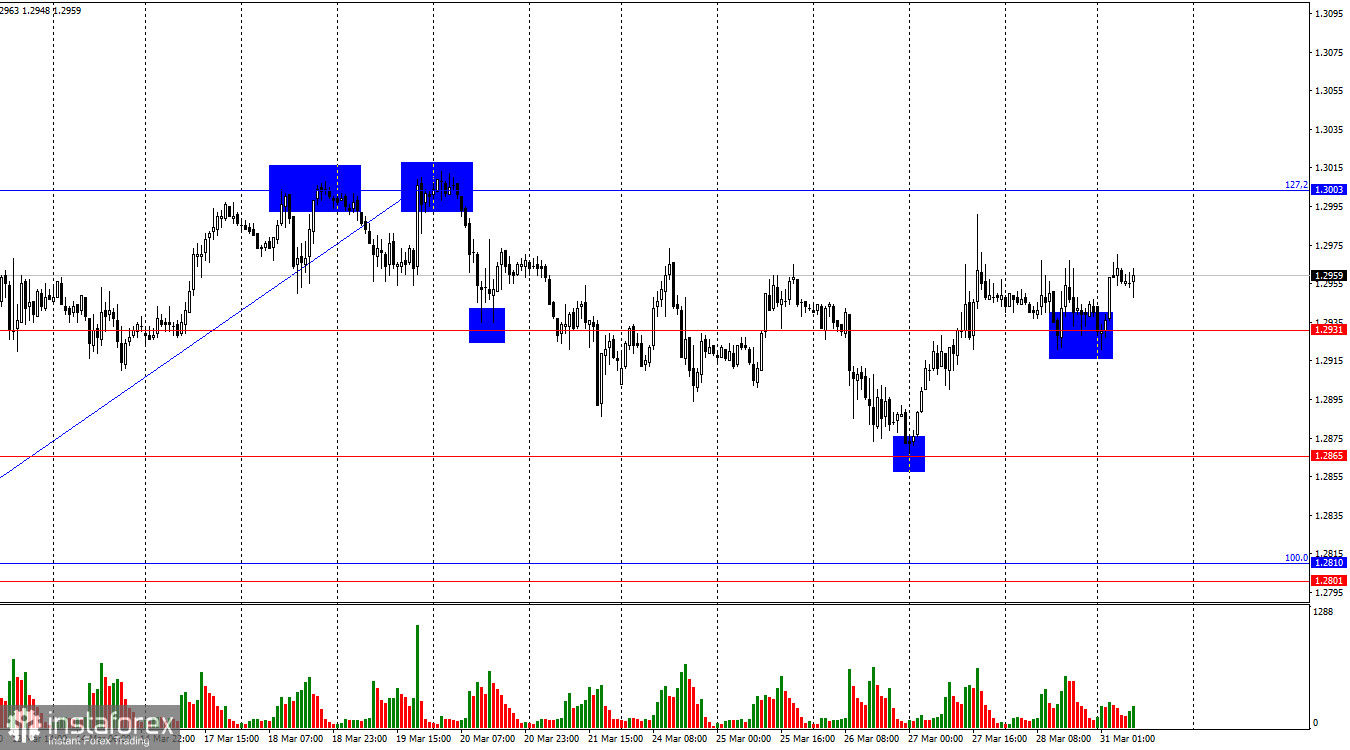

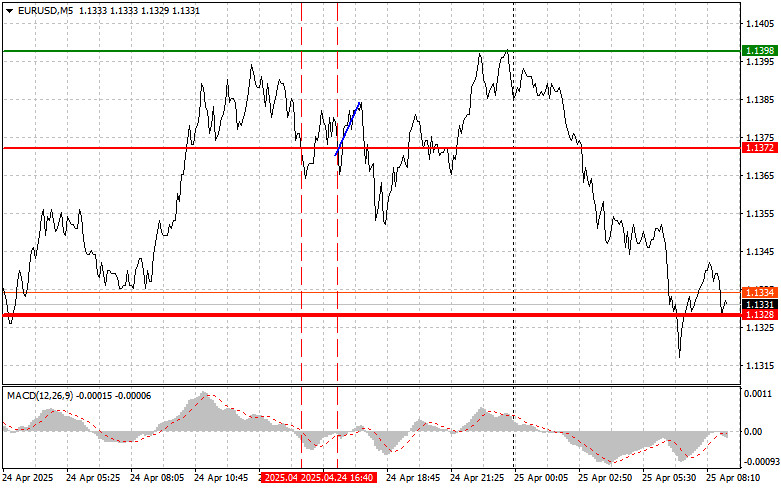

RamalanEUR/USD: Petua Dagangan Ringkas kepada Pedagang Baharu pada 25 April. Semakan Dagangan Forex Semalam

Analisis Dagangan dan Petua Dagangan untuk Euro Ujian pertama pada aras harga 1.1372 pada separuh kedua hari berlaku apabila penunjuk MACD sudah pun bergerak jauh di bawah paras sifar, yangPengarang: Jakub Novak

08:31 2025-04-25 UTC+2

33