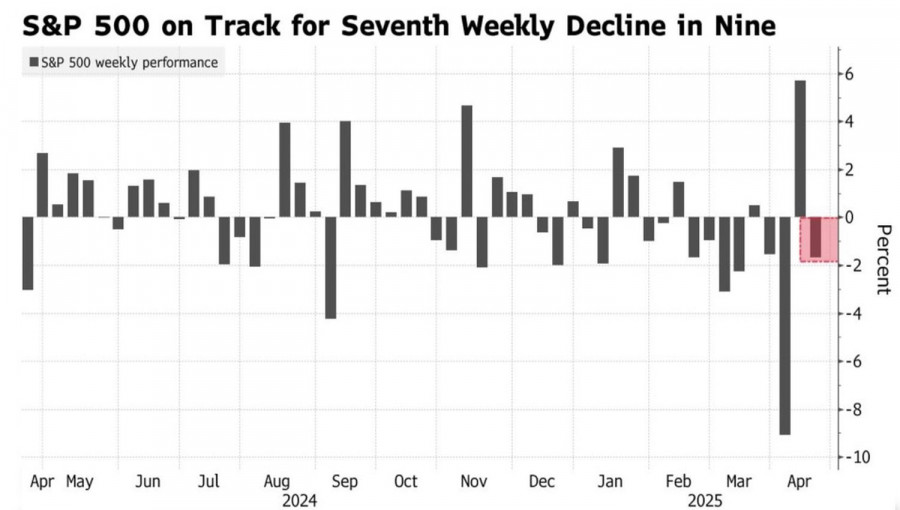

- Adakah Rumah Putih akan melangkah jauh dengan memecat Jerome Powell dari jawatannya sebagai Pengerusi Federal Reserve? Tindakan tersebut akan memberi impak lagi kepada pasaran kewangan, tetapi buat masa ini, S&P

Pengarang: Marek Petkovich

09:16 2025-04-18 UTC+2

13

Euro dan Pound Kekal Dengan Semua Prasyarat untuk Pertumbuhan Selanjutnya Mata wang tunggal Eropah hampir tidak menunjukkan reaksi terhadap mesyuarat pegawai Bank Pusat Eropah (ECB) semalam, di mana satu lagiPengarang: Miroslaw Bawulski

06:52 2025-04-18 UTC+2

11

Analisis fundamentalPerkara Yang Perlu Diperhatikan pada 18 April? Satu Ulasan Mengenai Peristiwa Fundamental untuk Pedagang Baharu

Tidak ada peristiwa makroekonomi yang dijadualkan pada hari Jumaat—baik di AS, Zon Euro, Jerman, atau UK. Oleh itu, walaupun pasaran memberi perhatian kepada latar belakang makroekonomi, ia sememangnya tidak wujudPengarang: Paolo Greco

06:51 2025-04-18 UTC+2

7

- Pelan Dagangan

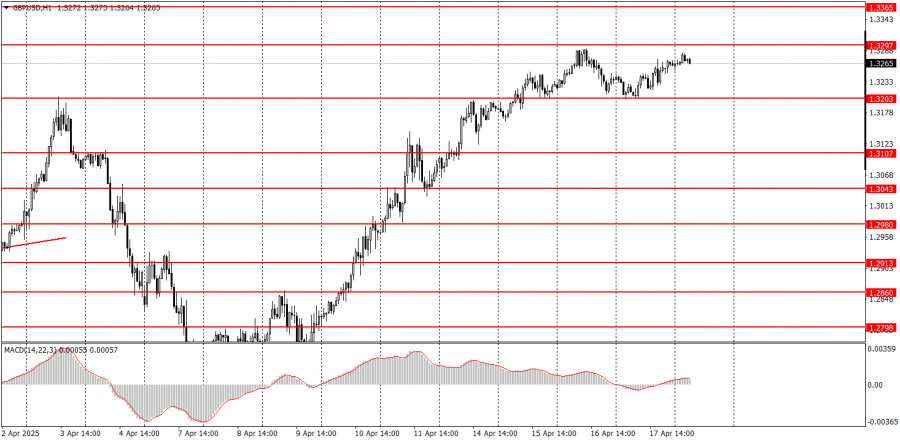

Bagaimana untuk Berdagang Pasangan GBP/USD pada 18 April? Tip Ringkas dan Analisis Perdagang Baharu

Pasangan GBP/USD meneruskan dagangan lebih tinggi sepanjang Khamis. Walaupun pada tahap puncaknya, pound British tidak menunjukkan kecenderungan untuk pembetulan. Tiada peristiwa penting di UK semalam, walaupun laporan menarik telah diterbitkanPengarang: Paolo Greco

06:51 2025-04-18 UTC+2

5

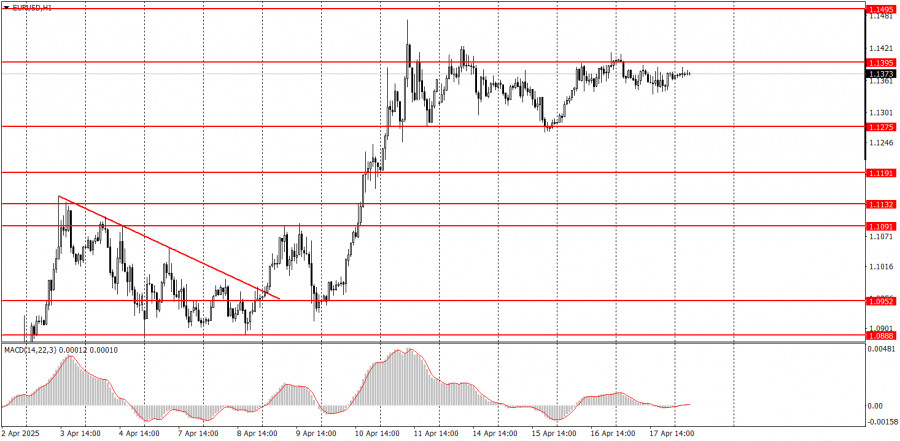

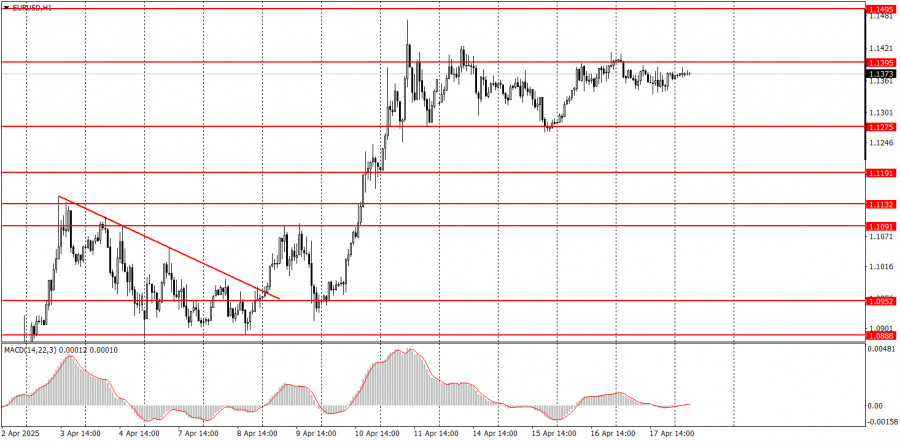

Pelan DaganganBagaimana untuk Berdagang Pasangan EUR/USD pada 18 April? Petua Ringkas dan Analisis Dagangan kepada Pedagang Baharu

Analisis Dagangan Hari Khamis Carta 1 Jam pasangan EUR/USD Pasangan mata wang EUR/USD terus didagangkan dalam saluran mendatar pada hari Khamis, seperti yang ditunjukkan pada graf carta masa (TF) setiapPengarang: Paolo Greco

06:51 2025-04-18 UTC+2

4

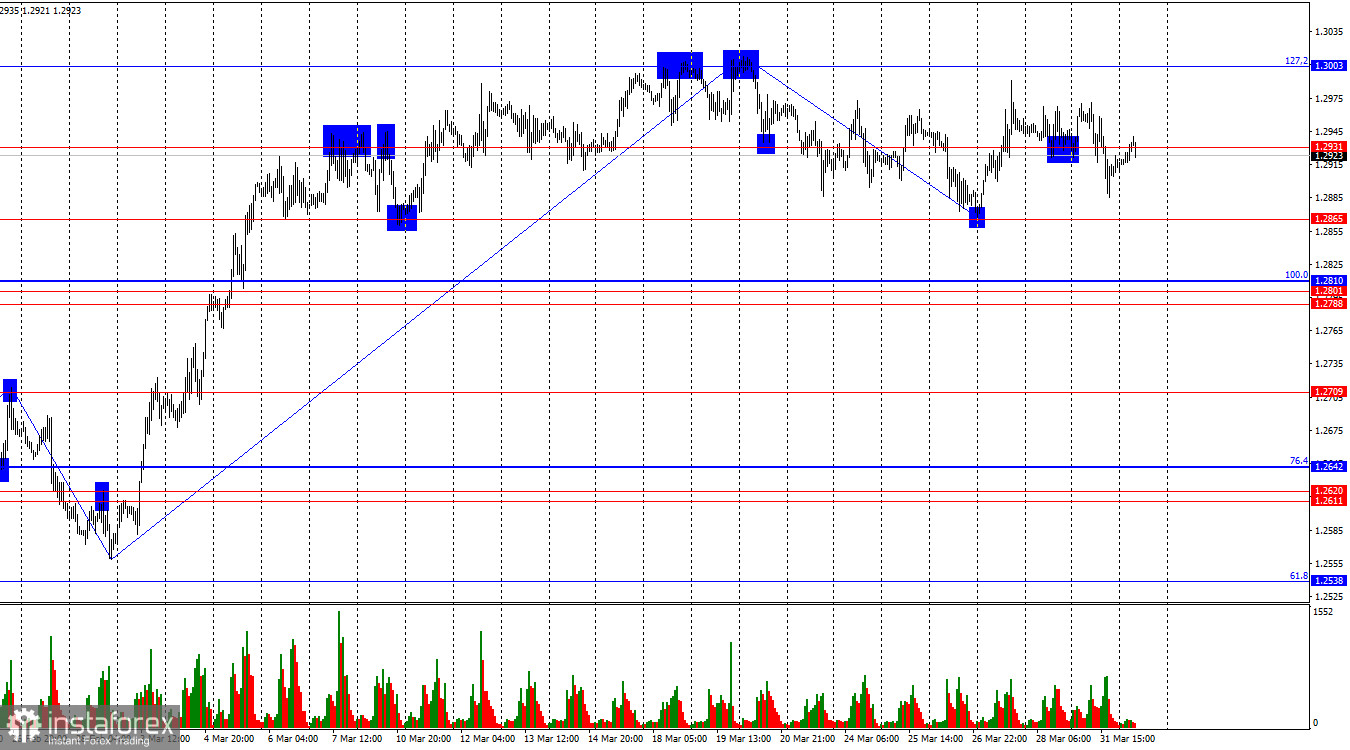

Analisis fundamentalGambaran Keseluruhan GBP/USD – 18 April. Ucapan Powell: Tiada Apa-apa yang Positif untuk Dolar

Pasangan mata wang GBP/USD terus berdagang secara relatif tenang pada hari Khamis, menunjukkan sedikit sahaja kecenderungan menurun. Kami masih tidak boleh mengklasifikasikan pergerakan semasa sebagai "penurunan semula" atau "pembetulan". CartaPengarang: Paolo Greco

03:48 2025-04-18 UTC+2

9

- Analisis fundamental

Gambaran Keseluruhan EUR/USD – 18 April: Pemotongan Kadar oleh ECB Seperti Dijangka, dan Pasaran Juga Mengabaikannya Seperti Dijangka

Pasangan mata wang EUR/USD menghabiskan sebahagian besar hari dalam pergerakan mendatar. Apabila keputusan mesyuarat Bank Pusat Eropah diumumkan, pasaran hanya menunjukkan sedikit reaksi emosional, namun tiada perubahan asas yang berlakuPengarang: Paolo Greco

03:48 2025-04-18 UTC+2

6

Pelan DaganganCadangan dan Analisis Dagangan untuk GBP/USD pada 18 April: Pound British Kehilangan Tenaga

Pada hari Khamis, pasangan mata wang GBP/USD meneruskan pergerakan menaiknya, berdagang hampir dengan paras tertinggi bertahun-tahun. Walaupun kekurangan peristiwa penting di A.S. atau U.K. (tidak seperti hari Rabu), pasaran terus-menerusPengarang: Paolo Greco

03:48 2025-04-18 UTC+2

7

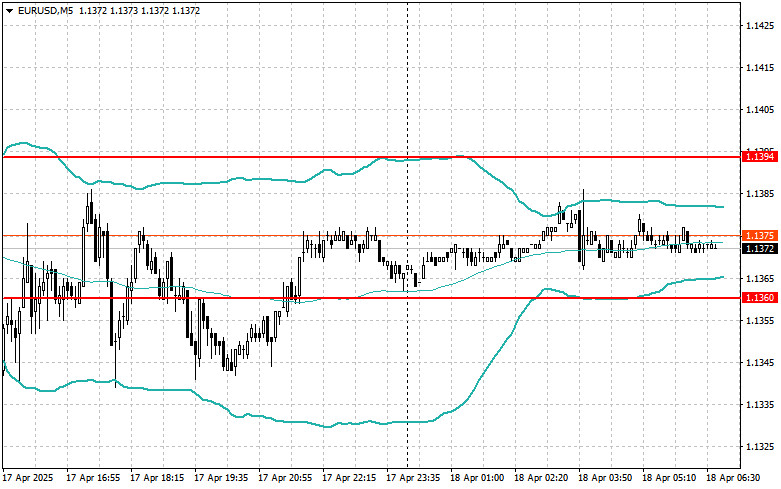

Pelan DaganganCadangan Dagangan dan Analisis untuk EUR/USD pada 18 April: ECB Gagal Menggerakkan Pasaran

Analisis 5-Minit pasangan EUR/USD Pasangan mata wang EUR/USD terus didagangkan secara mendatar pada hari Khamis. Jika sebelum ini ia bergerak dalam julat antara 1.1274 dan 1.1391, pada hari Khamis pasanganPengarang: Paolo Greco

03:48 2025-04-18 UTC+2

6