On Friday, the euro fell against the US dollar by almost 0.6% to $1.0840.

The single European currency failed to outperform its US counterpart, although overall risk sentiment on the markets looked stable.

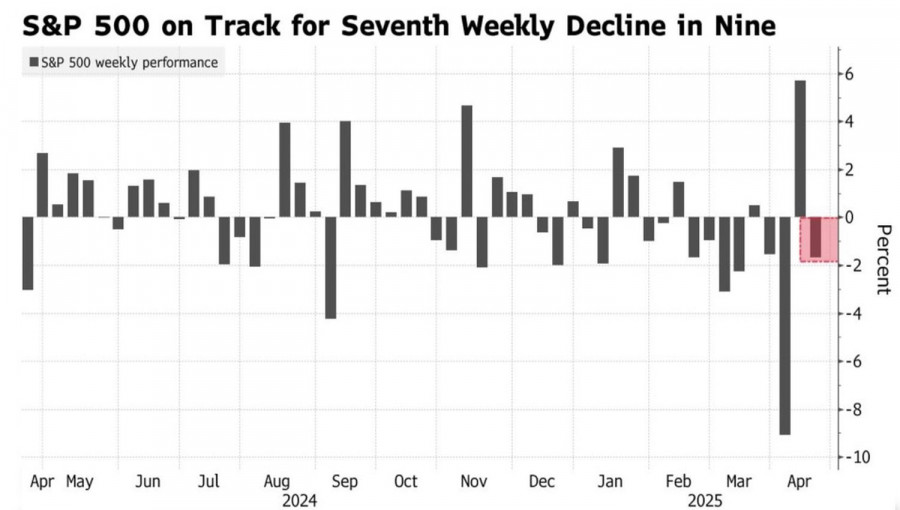

Wall Street's key indices closed the session on Friday in positive territory. In particular, the S&P 500 index rose by 1.4% to 4109.31.

At the end of the previous week, the index gained more than 3% and recorded the largest weekly increase since November 2022.

The main topic that was in focus in the past week was devoted to the easing of the banking crisis.

On Monday, the US Federal Deposit Insurance Corporation (FDIC) said that deposits and loans from bankrupt Silicon Valley Bank are being transferred to First-Citizens Bank.

Increased confidence that the Fed may ease the fight against inflation and suspend rate hikes due to concerns about an impending recession also added to the positive sentiment.

On Friday, the index of US consumer confidence for March fell to 62 compared to 67 in the previous month. The indicator dropped for the first time in 4 months and tested the low of December last year.

Meanwhile, the Core PCE index rose by 0.3% month-on-month in February against a 0.5% rise in January. In annual terms, growth in the indicator, which the Fed closely monitors when assessing inflation risks, slowed to 4.6% compared to 4.7% in January.

Signs of cooling inflation, along with signals that the economy is losing momentum, raised hopes that the Fed will no longer raise interest rates so aggressively.

On Friday, investors estimated there was a 50% chance that the regulator would raise the key rate by 25 basis points in May or leave it unchanged. At the same time, traders suggested that even if the central bank increases the cost of borrowing, this could be the last step in the current cycle of monetary tightening, and then the Fed will quickly change its course and end the year with lower rates.

Notably, the prospects for an early easing of the Fed's monetary policy loomed on the horizon back in September last year. Because of this, the greenback was forced to retreat from multi-year highs of 114.80. In the fourth quarter, USD sank by about 8% and ended December at 103.20.

In January, the US dollar continued to lose ground as market participants began to price in a scenario according to which the Fed could cut rates before the end of the year.

As a result, the greenback lost about 1.3% and ended the first month of the year near 101.90.

In February, the greenback reversed sharply and jumped by almost 3%, recovering to 104.90.

High inflation in January brought back the issue of raising Fed rates by 50 basis points. In addition, FOMC officials defied expectations that monetary policy easing will begin this year.

USD regained its ground thanks to the hawkish rhetoric of the American regulator.

However, already in March, the dollar lost all the gains received in the previous month due to the fact that the turmoil in the US banking sector forced the Fed to take a cautious stance.

As a result of the March meeting, the US central bank raised interest rates by 25 basis points. But at a press conference, Fed Chairman Jerome Powell said the recent banking turmoil had tightened financial conditions in the country.

Investors took this as a hint that further rate hikes are not guaranteed.

As market participants regained confidence that monetary easing is just around the corner, the greenback fell by more than 2.4% in March.

Despite Friday's bounce by about 0.4%, USD ended the last five days with a decrease of almost 0.5%, around 102.20.

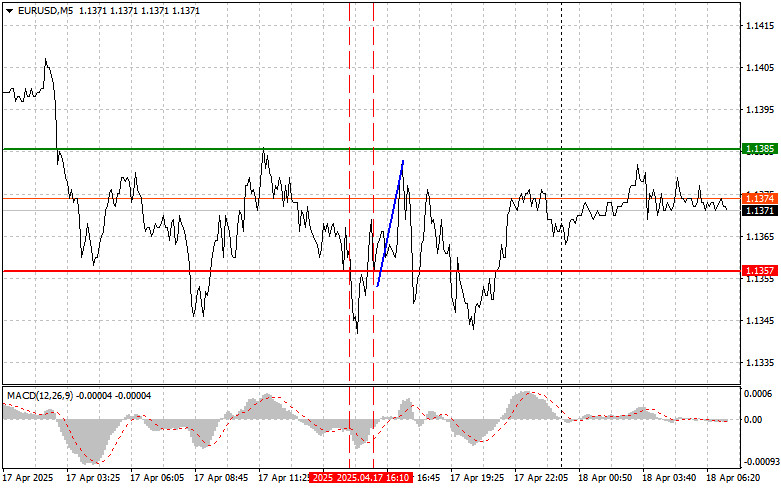

The euro has been rising against its American counterpart for the fifth week in a row, marking the longest winning streak since August 2020.

In March, the EURUSD pair added about 2.5%. This was largely due to expectations that the ECB will tighten policy more than the Fed in the coming months.

For the most part of the week, the euro was gaining ground against its American counterpart but pulled back on Friday, losing more than 0.5% and falling to $1.0840. So, the euro retreated from the previous weekly high of $1.0920.

Such a dynamic was caused by the fact that cash flows typical for the end of the month spurred demand for the dollar.

In addition, the US currency looked oversold. Prior to this, the greenback had been declining for four days in a row, losing about 0.9%.

Many experts see high chances for a further decline in the US dollar, believing that the best times for the dollar when the Fed was among the first to tighten its policy are already behind.

Now the US regulator is widely believed to be nearing the end of its rate hike cycle.

However, most market participants believe that the ECB will continue to raise rates, given that core inflation in the euro area accelerated to new record highs in March.

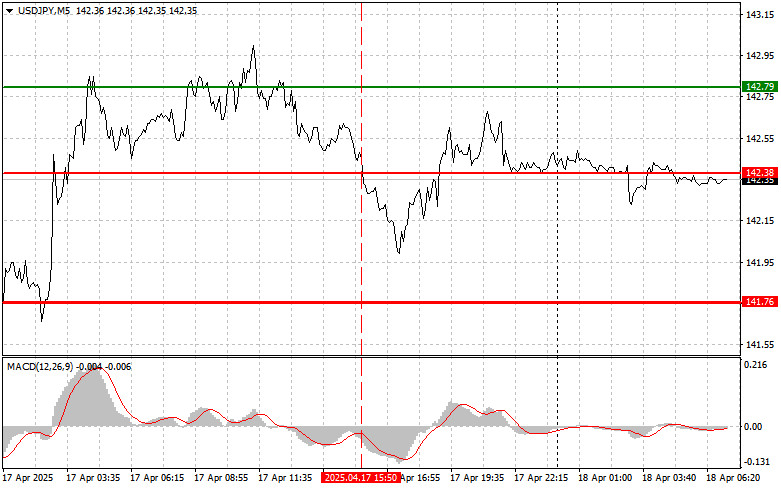

In the early trading hours on Monday, the US dollar held its ground against its major counterparts and even managed to gain more than 0.4% to rise above 102.70.

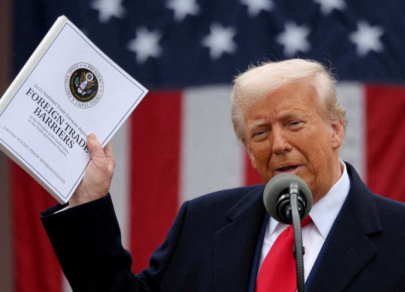

Investors were digesting the statement made over the weekend by the Organization of the Petroleum Exporting Countries (OPEC) and its allies.

OPEC+ was expected to stick to the 2 million bpd oil production cut that was already in place until the end of 2023, but instead, it announced a further production cut of around 1.16 million bpd.

The surprise from OPEC+ led to an increase in oil prices and pushed USD higher.

"Higher oil prices will put pressure on global inflation, and if we assume that the banking turmoil continues, then markets will increasingly focus on inflation forecasts," strategists at Danske Bank said.

"Given the rise in oil prices, this could be a push to reverse the Fed's future rate path," they added.

Markets now estimate the probability of a quarter-point Fed rate hike in May at 60%, while on Friday the chances of such an outcome were about 50%. At the same time, by the end of the year, traders still expect a reduction in interest rates in the US by 40 basis points.

After the initial rebound, the US began to decline and lost its positive momentum.

"The OPEC+ decision may have given the dollar a temporary reprieve, but we still think markets will want to hear more assurance from Fed Chairman Jerome Powell that the regulator will indeed continue tightening despite the recent financial turmoil to allow the greenback to stabilize a little," ING specialists noted.

It is believed that central banks are likely to remain focused on inflation measures that reflect energy prices with a large lag. Therefore, the potential difference in the rates of the Fed and the ECB turns against the dollar in favor of the single European currency.

While investors are expecting another 25 basis point rate hike in May, they hope to see a pause in June and a rate cut in December.

At the same time, traders estimate further tightening of the ECB's policy by about 60 basis points by the end of the year.

"The expected spread in interest rates on both sides of the Atlantic is the main factor determining the exchange rate of the euro against the US dollar," analysts at Nordea said.

Taking advantage of the weakening US dollar, the EUR/USD pair managed to recover. It rebounded by almost 120 points from the weekly lows recorded earlier in the 1.0790 area.

"EUR/USD is vulnerable to any risk aversion sentiment, but barring surprises, a near-term test of the 1.1000 level with rate differential support is likely," HSBC economists said.

In the near future, Europe may face problems in the banking sector which may turn out to be more vulnerable than is currently expected.

In addition, if eurozone interest rates rise even higher, the budgets of countries such as Greece, Italy, and Portugal may not be able to cope with it. Refinancing debts at such rates seems too expensive.

These factors may put significant pressure on the EUR/USD pair in the future.

So far, it is growing on the risk appetite of investors. The S&P 500 is up by about 0.3% on Monday and hovering around 4120.

The ongoing weakness of the US dollar is also a tailwind for EUR/USD.

Currently, the US dollar index is trading down by almost 0.5%, around 101.70.

"The broad decline of the US dollar from local highs leaves a negative view on the short-term chart and suggests that after a modest bounce seen on Friday, the dollar will continue to decline," strategists at Scotiabank said.

"A strong rise of EUR/USD from the level of 1.0800 suggests that the sentiment on the pair remains bullish but it needs to reach new highs above 1.0930. This will give EUR/USD more momentum in the short term and drive it up in the 1.1000+ direction," they added.

The EUR/USD breakout of 1.1000 is still possible, but the unexpected OPEC+ cut in oil production throws a lifeline for the dollar, ING experts say.

"We expected EUR/USD to break 1.1000 sometime this week, but the unexpected cut in OPEC+ oil production means that such a scenario is now likely to require disappointing US data. This is not necessarily our main scenario, and the EUR/USD bulls are likely to be ok if the pair ends the week in the 1.0850-1.0900 area," they said.

"Strong US data and hawkish comments from FOMC officials will fuel expectations for a Fed rate hike in May. This will help strengthen the dollar and cause the EUR/USD pair to test the support levels of 1.0700 and 1.0600," ING believes.