The expected non-farm payrolls data may show that the US economy created 243k new jobs last month. This number is significantly lower than the 303k jobs added in March, which could indicate a slowdown in job gains.

The unemployment rate is projected to remain steady at 3.8%. Particular attention will be paid to changes in average hourly earnings, an important indicator of wage inflation, which is expected to show an annualized growth rate of 4.0% through April, down from 4.1% in March.

This key employment data, along with wage information, will be closely scrutinized to better understand the possible timing of the Fed's interest rate cut.

Jerome Powell's recent remarks have added to the uncertainty surrounding the Fed's future actions, making the upcoming report particularly significant for markets and policy decisions.

GBP keeps its finger on the pulse

The pound/dollar pair may continue to rise through the weekend as further strengthening of the greenback requires crossing a high threshold.

The first significant test for the dollar in May comes from US non-farm payroll data. Markets have already priced in expectations of strong growth after the economy's successful start to the year.

Commerzbank argues that the results above forecasts could support the dollar. However, analysts also point to increased difficulty for the dollar in capitalizing on positive economic data, given that markets have already priced in a later key interest rate cut.

Furthermore, the current forecast is the highest since September 2022 and marks the fourth consecutive month of rising job expectations. This underscores the strengthening US economic outlook.

The US dollar has shown itself to be the best-performing currency among G10 countries in 2024, which is associated with revised expectations for a US interest rate cut. At the beginning of the year, markets were expecting a 150-basis-point cut in Fed rates.

However, the forecasts have been adjusted to only one cut in December.

Other central banks in the G10 group are also planning rate cuts, which could widen the interest rate gap if the dollar seeks to reach new highs.

It is worth noting that long positions on the dollar have expanded significantly, making it potentially vulnerable to a correction.

Any disappointment in NFP or ISM data could be more important to the current overbought dollar than any unexpected growth data. Data shows that most long positions are opened on the US compared to other G10 FX currencies. In this light, it could be vulnerable to a sell-off in the near term.

NatWest writes that the market has already factored in and expects the US economy to continue to dominate, which raises the likelihood of economic data exceeding expectations.

The dollar may need strong data in April to continue rising. However, it is not certain that upcoming US data will be able to meet these expectations.

Researchers point out that while strong employment reports are less influential in revising Fed expectations compared to inflation data, they do send clear signals of US economic success, which has been a key driver of the greenback's strength.

According to Barclays analysis, despite a possible pause in the dollar's rally, the reasons for its rise remain solid. A change in the current trend would require a series of disappointing economic reports that could indicate the end of US economic dominance.

Thus, any short-term rise in the pound against the dollar is likely to be seen as a temporary phenomenon. Risks to the dollar continue to remain low in the near term.

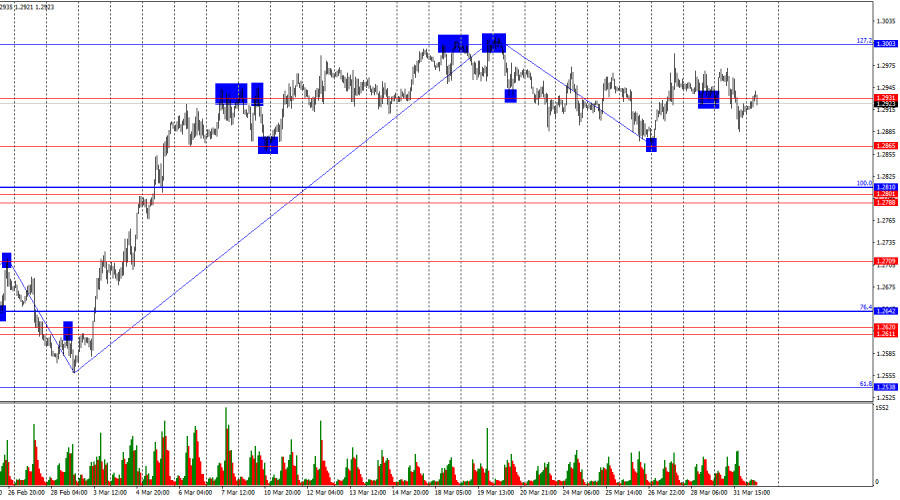

The technical picture for the USD index

The dollar index bulls continue to hold their ground despite some technical headwinds. Technical analysis reflects buying activity largely based on the index's position relative to its simple moving averages (SMAs).

Although the near-term outlook remains skeptical due to the battle between bears and bulls, the DXY continues to trade above its 20-, 100-, and 200-day SMAs, indicating potential bullish strength.

However, the moving average convergence divergence indicator (MACD) is showing an increase in red bars, which could signal bears' onslaught. Also, the Relative Strength Index (RSI) is stable within the positive zone, indicating a possible weakening of buying strength, while bears are exerting downward pressure.

Such signals suggest that, despite the current bullish stability, the market may be starting to change. In this situation, traders should keep a close eye on the further movements of the indicators to assess whether the selling pressure will continue or bulls will strengthen their positions again.