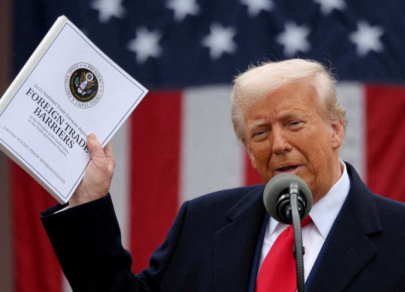

US markets slip as investors await Fed decision

US stock markets closed lower on Tuesday, ending a two-day rally. Investors opted to take a wait-and-see approach ahead of the Federal Reserve's upcoming monetary policy decision and the possible impact of the Trump administration's trade strategy.

Expectations before the Fed meeting

On Wednesday, the Fed will release its latest statement, in which, according to analysts, interest rates will remain unchanged. The regulator will also present an updated economic forecast (SEP), which may shed light on further steps in monetary policy.

At the moment, markets are pricing in a 60 basis point rate cut over the course of the year. However, the Fed itself is in no hurry to make radical decisions. A number of agency officials warn that the regulator will assess the impact of tariff measures on the economy before taking any steps.

Key indices went into the red zone

The leading US stock indices felt significant pressure:

- The Dow Jones Industrial Average fell by 260.32 points (0.62%), closing at 41,581.31;

- The S&P 500 lost 60.46 points (1.07%) and fell to 5,614.66;

- The Nasdaq Composite showed the biggest decline, falling by 304.55 points (1.71%) to 17,504.12.

Inflation risks: unexpected growth in import prices

Additional pressure on the market was exerted by unexpected inflation statistics. In February, prices for imported goods in the United States showed growth, which is associated with the rise in the cost of consumer goods. This factor may increase investor concerns about inflation pressure and further steps of the Fed.

Markets continue to balance between expectations of rate cuts and fears about price growth, which makes further trading dynamics unstable.

The market is trying to stabilize, but pressure remains

After a prolonged decline, which led to a fall of more than 10% in the S&P 500 and Nasdaq from recent highs, US stock indices are showing attempts to stabilize. However, uncertainty in the market remains, and investors are still cautious.

Dow Jones close to correction zone

The Dow Jones Industrial Average remains just 2% below correction level, indicating continued pressure on shares of the largest US companies.

Tech and growth stocks took the biggest hit. The S&P 500 (.IGX) lost 2.2% during the trading session, while the communications services sector (.SPLRCL) was among the outsiders, falling 2.14%.

Alphabet makes its largest deal in history; investors react with a drop in shares

Big deals do not always inspire investors. Alphabet (GOOGL.O) shares fell 2.2% after announcing the acquisition of cybersecurity company Wiz for $32 billion. The deal was the largest in the company's history, but market participants perceived it ambiguously, fearing excessive costs and possible integration risks.

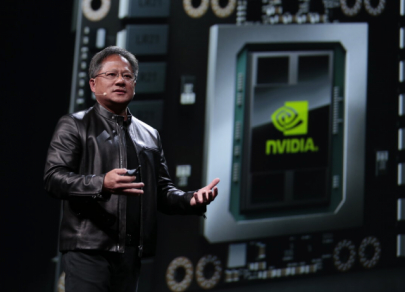

Nvidia Slips as Market Evaluates CEO's Words

Shares in leading AI chipmaker Nvidia (NVDA.O) fell 3.35%. CEO Jensen Huang tried to reassure investors by saying that Nvidia is prepared for the changing dynamics of the industry, in particular the transition of companies from training AI models to their practical use. However, the market took these statements with caution.

Tesla Plunges as Forecasts Worse

The situation is worst for Tesla (TSLA.O), whose shares fell 5.34% after RBC analysts revised their forecast for the company downwards. The broker cut the target price for the automaker's shares from $320 to $120, explaining this by decreasing expectations regarding self-driving technologies and the robotaxi market share.

Tesla's market capitalization has fallen by almost 45% over the current year, which is increasing investors' fears about a further decline in the company's share price.

The market remains under pressure

Despite attempts at stabilization, pressure on US stock indices remains. Investors are closely monitoring economic data, corporate news and Fed decisions, which may determine further market dynamics.

Gold hits record highs amid global instability

Gold prices hit all-time highs on Wednesday as rising geopolitical tensions in the Middle East and trade uncertainty made the precious metal particularly attractive to investors. Expectations of the US Federal Reserve's monetary policy decision added to the support.

Gold hits new highs

At 04:15 GMT, spot gold settled at $3,035.12 an ounce, after hitting a record high of $3,038.90 during the session. US gold futures also rose 0.1% to $3,042.20 an ounce.

Gold has reaffirmed its status as a safe haven amid economic uncertainty caused by tariff and international uncertainty, according to Tim Waterer, chief market strategist at KCM Trade.

Fed May Give Gold a New Boost

Investors expect that if the Federal Open Market Committee (FOMC) takes a dovish tone in its statement, it will provide additional support for gold prices.

"If the Fed expresses concern about the impact of trade barriers on economic growth, this could be a green light for gold to rise further, perhaps above $3,050 an ounce," Waterer said.

Market participants are also focused on the upcoming speech by Fed Chairman Jerome Powell, which is scheduled for 18:30 GMT. His comments may shed light on the regulator's future policy and, accordingly, affect gold's dynamics.

Other precious metals under pressure

Despite gold's confident rise, other precious metals showed a decline:

- Silver fell by 0.2% to $33.97 an ounce;

- Platinum lost 0.4%, falling to $992.85;

- Palladium fell 0.1%, reaching $966.24 an ounce.

Markets remain tensely awaiting the Fed's decisions and further developments in the global economy, which could determine the movement of metal prices in the near term.