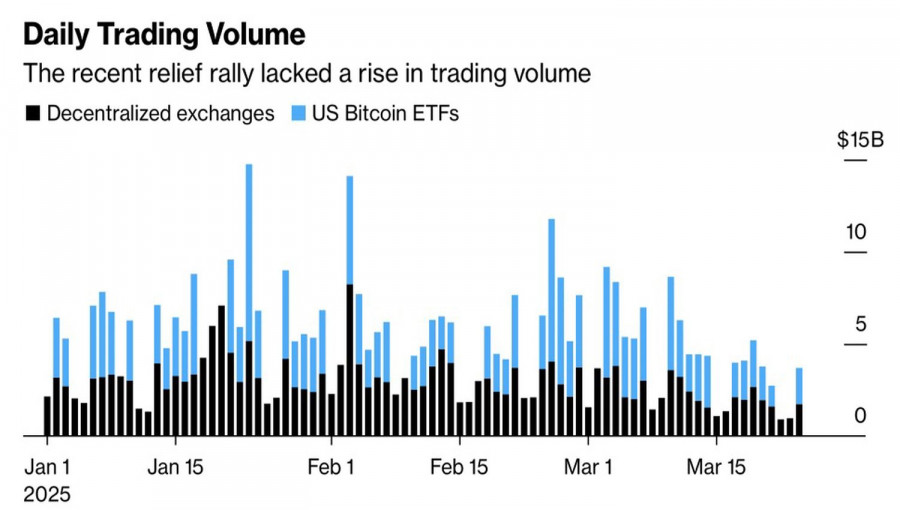

- The bottom shows no strength, the top has no desire. Even the so-called "smart money" is not rushing to buy Bitcoin, citing a confluence of negative factors. Tepid trading activity

Auteur: Marek Petkovich

15:58 2025-04-01 UTC+2

3

Technical analysisTrading Signals for EUR/USD for April 1-3, 2025: sell below 1.0804 (21 SMA - 8/8 Murray)

Early in the American session, the euro is trading around 1.0791, undergoing a technical correction after reaching the top of the downtrend channel formed on March 14 and showing signsAuteur: Dimitrios Zappas

15:06 2025-04-01 UTC+2

3

Technical analysisTrading Signals for GOLD (XAU/USD) for April 1-3, 2025: sell below $3,144 (21 SMA - 8/8 Murray)

On the other hand, if the price consolidates below the 8/8 Murray level at 3,125, the outlook will be negative. So, we believe the instrument could reach 3,091Auteur: Dimitrios Zappas

15:04 2025-04-01 UTC+2

5

- S&P, Nasdaq post worst month since December 2022 Biggest quarterly interest rate drop: S&P since Q3 2022, Nasdaq Q2 2022 Trump tariff uncertainty weighs on markets in Q1 Trump

Auteur: Thomas Frank

12:03 2025-04-01 UTC+2

8

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAuteur: Sebastian Seliga

11:43 2025-04-01 UTC+2

18

US stock indices closed the trading session with mixed results: the S&P 500 rose by 0.55%, while the Nasdaq 100 lost 0.14%. The reason for this uncertainty is the potentialAuteur: Ekaterina Kiseleva

11:37 2025-04-01 UTC+2

7

- Today, the USD/JPY pair is struggling to benefit from a slight intraday upward movement, especially amid expectations that the Bank of Japan may raise interest rates at a faster pace

Auteur: Irina Yanina

11:37 2025-04-01 UTC+2

9

On Monday, the EUR/USD pair continued its upward movement and even rebounded from the support zone at 1.0781–1.0797. However, believing in a further rise of the euro is becoming increasinglyAuteur: Samir Klishi

11:32 2025-04-01 UTC+2

13

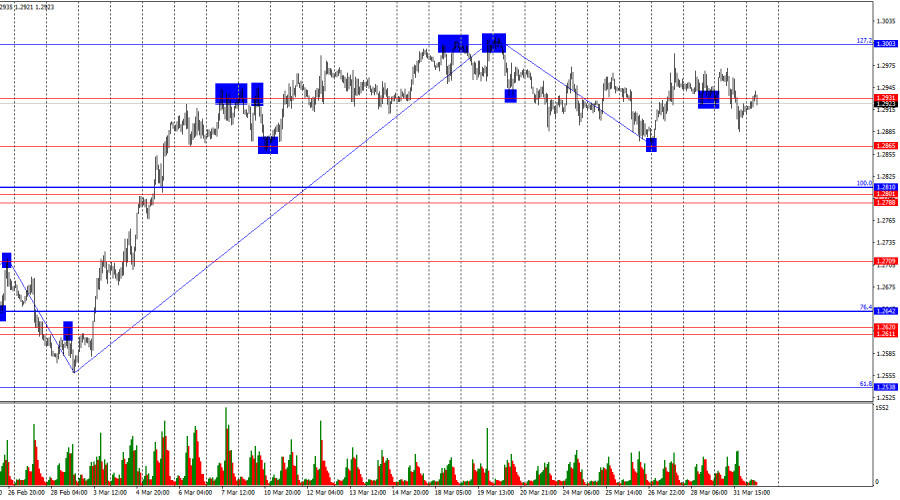

On the hourly chart, the GBP/USD pair continued to trade sideways on Monday. Currently, there is no dominance of either bulls or bears in the market. This has beenAuteur: Samir Klishi

11:29 2025-04-01 UTC+2

8