The leading digital asset has slightly declined over the past few days but remains afloat. Bitcoin is striving to recover lost ground. Analysts say that BTC is succeeding.

On Monday, February 10, Bitcoin opened with a drop followed by a recovery. The asset traded at $96,752 in the morning before rising to $97,650.

Over the past 24 hours, the BTC market saw minor recovery after a bearish trading week. Following a sharp drop to $91,000 on Monday, February 3, analysts and market participants feared that Bitcoin had reached a local bottom. However, historically, a rebound follows such declines. There is no consensus on BTC's near-term trajectory, but many believe that the flagship asset is far from reaching a true bottom.

According to crypto expert Ali Martinez, now is an ideal time to buy Bitcoin. Using CryptoQuant data, Martinez analyzed optimal entry points for investors. The realized price of all BTC purchased in the last three months is $97,354, indicating that the market's total loss is less than 1%, given that Bitcoin is currently trading at $97,000.

However, Martinez notes that the most favorable buying conditions have historically occurred when traders were down 12%. With Bitcoin's average market loss under 1%, conditions may not yet be ideal for new buyers, as there is significant potential for further correction. Martinez's estimates suggests that Bitcoin is far from a local bottom despite the recent decline.

Preliminary forecasts indicate the next local bottom for BTC could be $85,600, which would create an optimal accumulation zone for investors looking for higher returns.

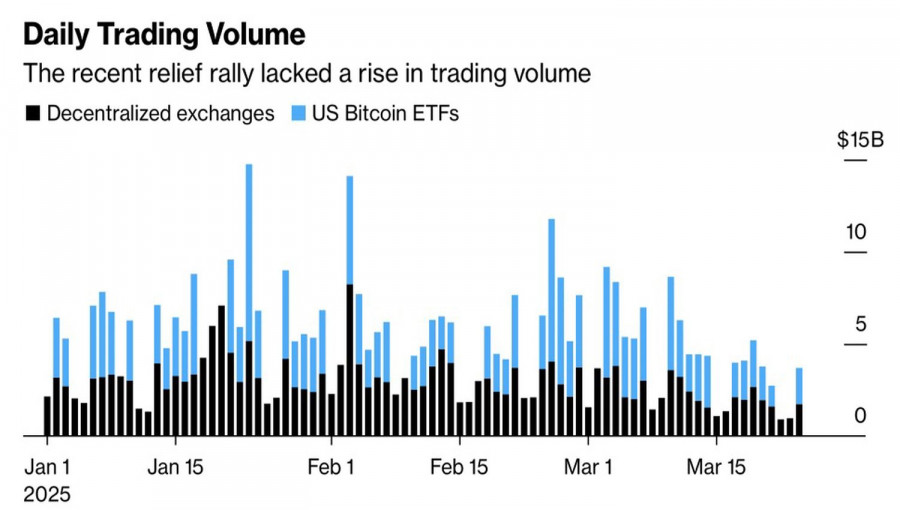

However, new variables—such as strong institutional interest and corporate accumulation via spot ETFs—could prevent Bitcoin from reaching these lows and instead spark the next bullish cycle.

Miners' actions could lead to Bitcoin weakness

For the past four days, Bitcoin has traded near $96,500, showing no significant movement. A potential concern is a sell-off from Bitcoin miners, which could exert downward pressure on BTC's price.

Charles Edwards, founder of Capriole Investments, believes that the current stagnation in Bitcoin's price could be driven by miners offloading their holdings.

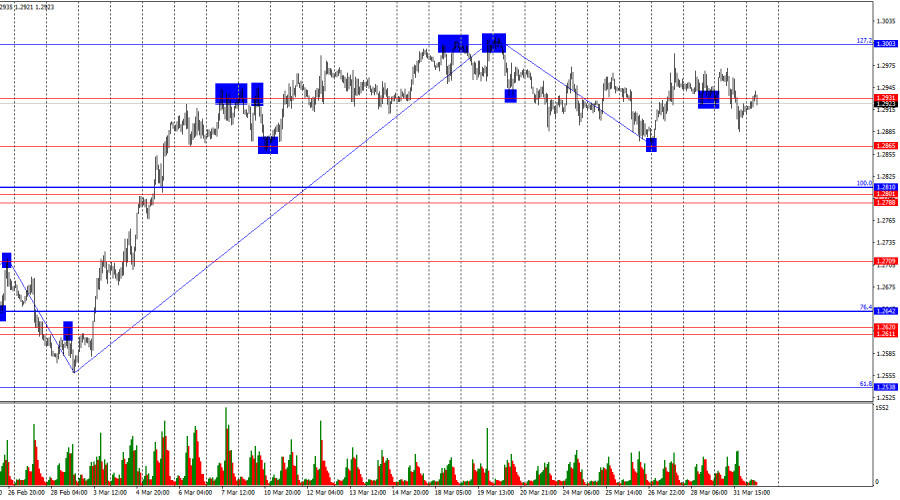

BTC dropped 2.70% over the past week, but monthly returns remain positive at 3.76%. Despite strong buyer support near $96,000, a breakout above $97,000 remains elusive—a sign that Bitcoin could reverse if bearish pressure intensifies.

Bitcoin faces challenges amid macro turbulence

Bitcoin's sluggish performance in February is partly due to unfavorable macroeconomic factors. Global market turbulence intensified due to US tariffs imposed by President Donald Trump and escalating trade tensions between Washington and Beijing. The initial sharp market reaction led to over $2 billion in liquidations across digital assets, but crypto markets have since stabilized.

Bitcoin is now holding steady around its $96,000 support level.

Market sentiment & Bitcoin forecast

According to CoinCodex analysts, investors remain uncertain, with the Fear and Greed Index currently at 44 ("Fear"). Despite current stagnation, CoinCodex experts believe Bitcoin will soon enter a bullish phase.

Short-term BTC projections: In five days, Bitcoin is expected to reach $106,613. In one month, BTC could trade at $129,434.

Long-term BTC forecasts (3 months): Bitcoin could rise to $158,992, according to some analysts.

With a market capitalization of $1.92 trillion, Bitcoin remains the largest digital asset, dominating 60.6% of the crypto market.

Bearish miner data signals potential downtrend

IntoTheBlock's miner reserves indicator presents a bearish outlook for Bitcoin. The reason? A sharp decline in BTC reserves among mining companies. This metric tracks daily BTC balance changes in wallets controlled by major miners and mining pools. Between February 4 and February 8, miner reserves dropped from 1.94 million BTC to 1.91 million BTC. This resulted in an outflow of approximately 30,000 BTC (~$3 billion), increasing short-term BTC supply and intensifying selling pressure. If miners continue offloading BTC reserves at this rate, Bitcoin may struggle to stay above its $96,000 support level. The current trend raises the risk of BTC falling to $94,500 or lower.

Bitcoin at crossroads: bullish rebound or further decline?

The short-term outlook for Bitcoin remains uncertain. If miners reduce selling pressure and Bitcoin breaks above $97,000, a new bullish trend could emerge.

However, if the opposite scenario unfolds, BTC could remain stagnant or enter a short-term bearish phase.

Bitcoin is currently at a pivotal moment, experts say. Traders and investors are closely monitoring miners' activity and macroeconomic developments to respond swiftly to any market shifts.