Relevance up to 21:00 2025-03-17 UTC--4

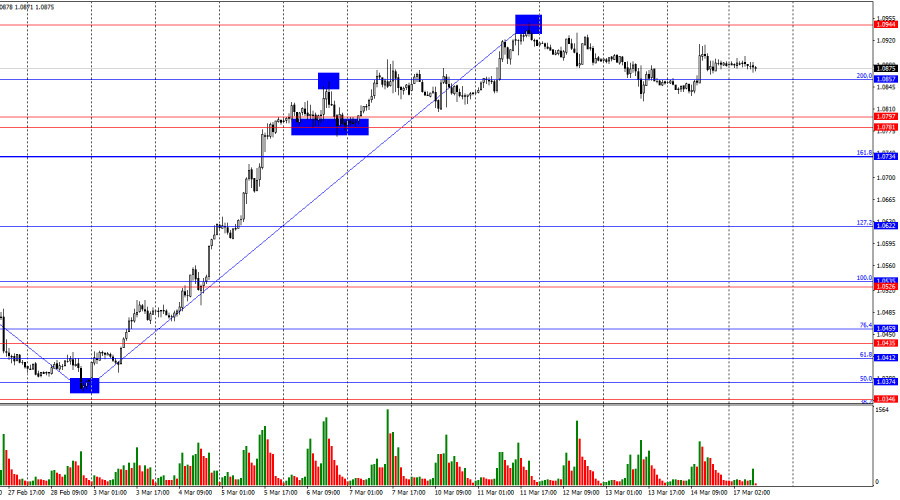

EUR/USD 5-Minute Analysis

The EUR/USD currency pair traded upward again on Friday, although no clear reasons emerged for this movement. The increase occurred during the European trading session, followed by a period of mostly sideways trading until the end of the day. Did the market react to the neutral consumer price index reports from Germany or the consumer sentiment index from the USA? Not necessarily. Firstly, the rise of the euro began much later than the release of inflation data in the European Union. Secondly, neither of the reports carried enough significance to provoke a strong market response. Thirdly, the pair is trading within a limited price range, which is arguably the most crucial point.

Overall, we cannot say the market is in a flat state right now. While the European currency initially experienced rapid growth, it is now increasing at a much slower pace. We can highlight the range of 1.0843 – 1.0935, which the currency pair has yet to break out of. Since the pair has tested the lower limit of this range the last two times, the recent growth may have been triggered by technical factors. Notably, the market has currently been ignoring macroeconomic and fundamental events. Additionally, Donald Trump has paused the frequent implementation of new import tariffs in recent days, leading to a calm market environment where "ordinary" news fails to capture interest.

On Friday, several trading signals appeared on the 5-minute time frame, but the movements were inconsistent, making them unlikely to be actionable. In reality, we only saw significant movement during the European session for a few hours. For the remainder of the time, the market experienced a flat period, disregarding all technical indicators. Traders may have opened one or two positions at the beginning of the European session, but these were unlikely to yield profits.

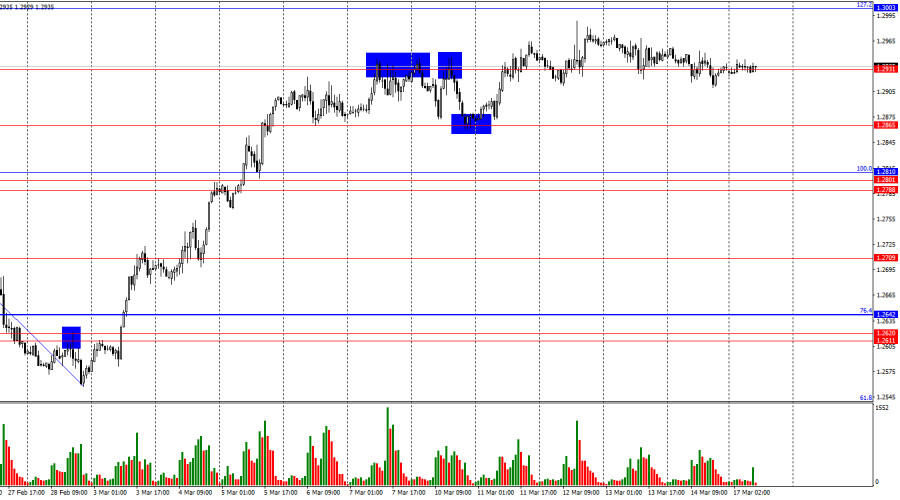

COT Report

The latest COT report, dated March 11, shows that the net position of non-commercial traders has been consistently bullish for a considerable time. Bears have struggled to gain a foothold, while bulls have regained control. The advantage of the bears is diminishing, especially since Trump took office as President, leading to a significant decline in the dollar's value.

While we cannot definitively predict that the American currency's decline will continue, the COT reports reflect the sentiments of major market players, which can change rapidly under current conditions.

Currently, we do not see any fundamental factors that would strengthen the European currency. However, a significant factor contributing to the decline of the American currency has emerged. It is possible that the pair may correct for a few more weeks or months, but the long-term downward trend that has persisted for 16 years is unlikely to shift quickly.

At present, the red and blue lines have crossed again, indicating a bullish trend in the market. During the last reporting week, the number of long positions in the non-commercial group increased by 3,400, while the number of short positions decreased by 19,800. As a result, the net position rose by an additional 23,200 contracts.

EUR/USD 1-Hour Analysis

On the hourly timeframe, the price continues to move upward, although not at the same pace as before. We expect that the decline will resume in the medium term due to the differing monetary policies of the ECB and the Fed. However, it is uncertain how much longer the market will react to the influence of Donald Trump. The current upward movement seems to be driven by panic in the market, and its ultimate direction is unknown. Traders are primarily focused on Trump's statements, selling the dollar at any opportunity, rather than responding to the macroeconomic background when it calls for it.

On March 17, we identify the following trading levels: 1.0340-1.0366, 1.0461, 1.0524, 1.0585, 1.0658-1.0669, 1.0757, 1.0797, 1.0843, 1.0886, 1.0935, 1.1006, and 1.1092, along with the Senkou Span B (1.0626) and Kijun-sen (1.0879) lines. Please note that the Ichimoku indicator lines may shift during the day, which should be factored into your trading decisions. Remember to place a Stop Loss order at breakeven if the price moves 15 pips in your favor; this will help protect against potential losses if the signal turns out to be false.

On Monday, Christine Lagarde will deliver a speech in the European Union, and the US will publish a report on retail sales. However, neither of these events is likely to trigger significant movement at this time. The euro is currently in a local flat, and the market seems more influenced by Trump's decisions than by monetary policy or macroeconomic data.

Illustration Explanations:

- Support and Resistance Levels (thick red lines): Thick red lines indicate where movement may come to an end. Please note that these lines are not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the 4-hour timeframe to the hourly timeframe. These are strong lines.

- Extreme Levels (thin red lines): Thin red lines where the price has previously bounced. These serve as sources of trading signals.

- Yellow Lines: Trendlines, trend channels, or any other technical patterns.

- Indicator 1 on COT Charts: Represents the net position size for each category of traders.