- Intel rises after a report that the new CEO plans to reorganize manufacturing and artificial intelligence operations. February retail sales rise 0.2%. New York manufacturing activity fell in March. Hong

Auteur:

06:16 2025-03-18 UTC+2

3

Intel Gains After New CEO Plans AI Manufacturing and Operations Overhaul February Retail Sales Up 0.2% New York Manufacturing Activity Falls in March Hong Kong Stocks, Kiwis Gain on ChinaAuteur: Thomas Frank

05:59 2025-03-18 UTC+2

4

On Monday, the GBP/USD currency pair continued to lean toward growth. There were no significant events in the UK throughout the day, while in the U.S., only one reportAuteur: Paolo Greco

05:04 2025-03-18 UTC+2

6

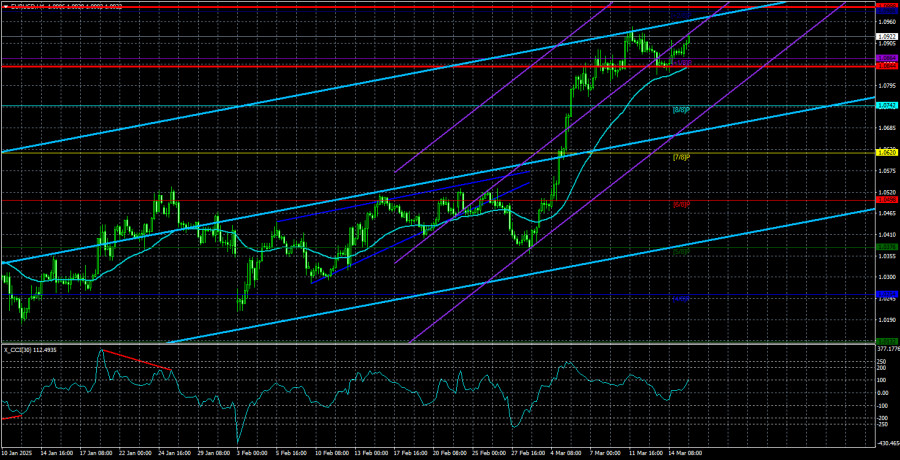

- The EUR/USD currency pair has resumed its upward movement. Since there was very little news on this day, and none of it was significant, volatility remained quite low, preventing

Auteur: Paolo Greco

05:04 2025-03-18 UTC+2

7

The extended Federal Reserve meeting on monetary policy is approaching, so we cannot yet conclude that yesterday's 0.64% rise in the S&P 500, the 0.32% drop in the dollar indexAuteur: Laurie Bailey

04:37 2025-03-18 UTC+2

11

On Monday, the pound rose by 53 pips and is now testing the resistance level at 1.3001. A breakout above this level would propel the pound's growth toward 1.3101. HoweverAuteur: Laurie Bailey

04:37 2025-03-18 UTC+2

10

- This morning, the yen reached the 149.38 level, which coincides with the 23.6% Fibonacci retracement. This level is significant as it suggests a potential reversal into a new wave

Auteur: Laurie Bailey

04:37 2025-03-18 UTC+2

11

Trading planTrading Recommendations and Analysis for GBP/USD on March 18: The British Pound is Flying North Again

On Monday, the GBP/USD currency pair again showed an upward movement despite having no reason. The market continues to buy the British pound purely out of inertia, much like BitcoinAuteur: Paolo Greco

03:35 2025-03-18 UTC+2

6

Trading planTrading Recommendations and Analysis for EUR/USD on March 18: A New Increase, But Within Reasonable Limits

The EUR/USD currency pair continued to trade higher on Monday but within a confined range that can be considered a sideways channel. Traders again ignored all news supporting the U.SAuteur: Paolo Greco

03:35 2025-03-18 UTC+2

9