- Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Auteur: Sebastian Seliga

10:18 2025-04-18 UTC+2

9

Will the White House cross the Rubicon by initiating the dismissal of Jerome Powell from his position as Chair of the Federal Reserve? That would deal another blow to financialAuteur: Marek Petkovich

09:16 2025-04-18 UTC+2

8

Fundamental analysisWhy Are Markets Frozen and What Are They Waiting For? (There is a possibility of continued Bitcoin and Ethereum consolidation in sideways ranges)

Today is Good Friday, a day Christians observe worldwide across all denominations. Market activity has noticeably decreased ahead of the Easter holiday, but this isn't the main reason for marketAuteur: Pati Gani

09:00 2025-04-18 UTC+2

6

- Bitcoin and Ethereum remain within their sideways channels, and the inability to break out of these ranges could jeopardize the prospects for a broader recovery in the cryptocurrency market. However

Auteur: Miroslaw Bawulski

09:00 2025-04-18 UTC+2

8

Donald Trump has once again set his sights on the Federal Reserve, accusing its chairman Jerome Powell of failing in monetary policy and threatening to fire him. But what liesAuteur: Аlena Ivannitskaya

08:43 2025-04-18 UTC+2

6

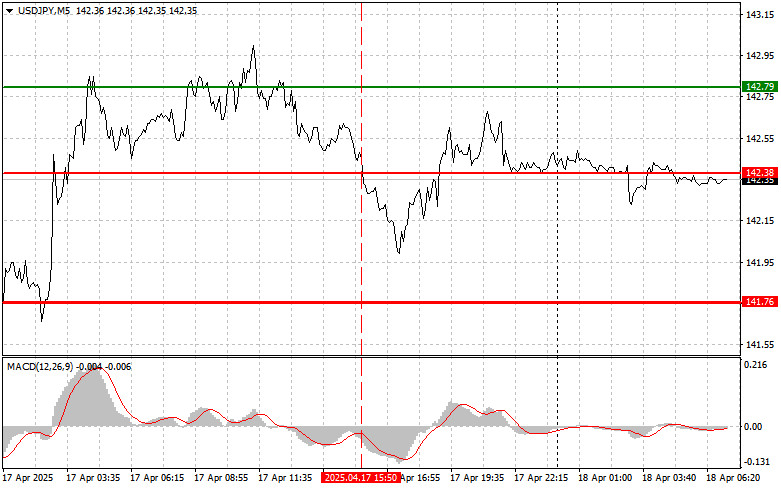

ForecastUSD/JPY: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex Trades

The test of the 142.38 level coincided with a moment when the MACD indicator had already significantly moved below the zero mark, which limited the pair's downside potential. For thisAuteur: Jakub Novak

08:33 2025-04-18 UTC+2

12

- Forecast

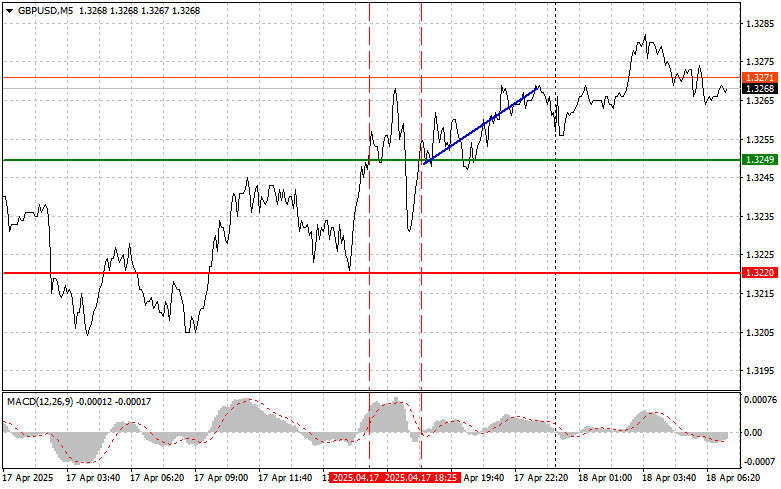

GBP/USD: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex Trades

The test of the 1.3249 price level occurred when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. For this reasonAuteur: Jakub Novak

08:31 2025-04-18 UTC+2

9

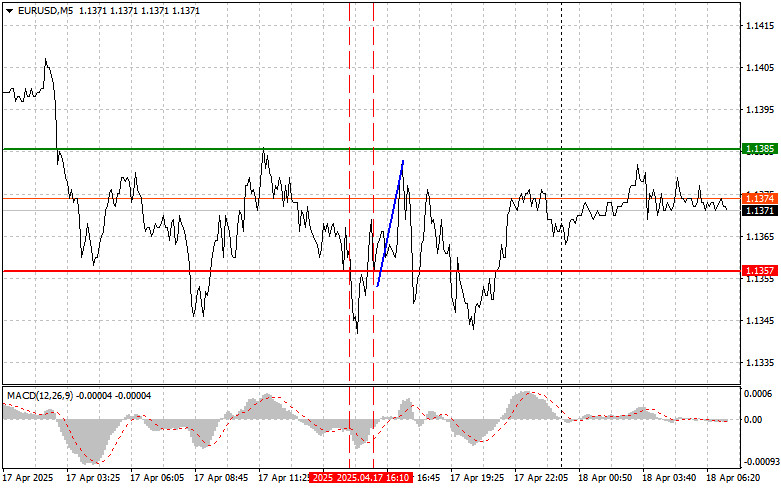

ForecastEUR/USD: Simple Trading Tips for Beginner Traders on April 18. Review of Yesterday's Forex Trades

The test of the 1.1357 price level occurred when the MACD indicator had already dropped significantly below the zero line, which limited the pair's downside potential. For this reasonAuteur: Jakub Novak

08:30 2025-04-18 UTC+2

16

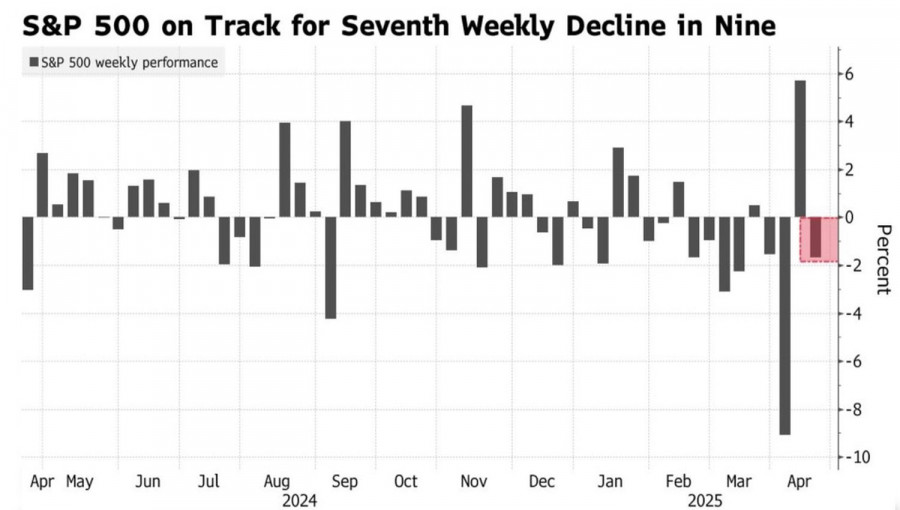

At the close of the previous regular trading session, U.S. stock indices ended mixed. The S&P 500 rose by 0.13%, while the Nasdaq 100 fell by 0.13%. The industrialAuteur: Jakub Novak

08:00 2025-04-18 UTC+2

12