- The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward bias. We still can't classify the current movement as a "pullback" or "correction."

Auteur: Paolo Greco

03:48 2025-04-18 UTC+2

12

Fundamental analysisEUR/USD Overview – April 18: The ECB Predictably Cut Rates, and the Market Predictably Ignored It

The EUR/USD currency pair spent most of the day moving sideways. When the European Central Bank meeting results were released, the market saw a small emotional reaction, but nothing fundamentallyAuteur: Paolo Greco

03:48 2025-04-18 UTC+2

19

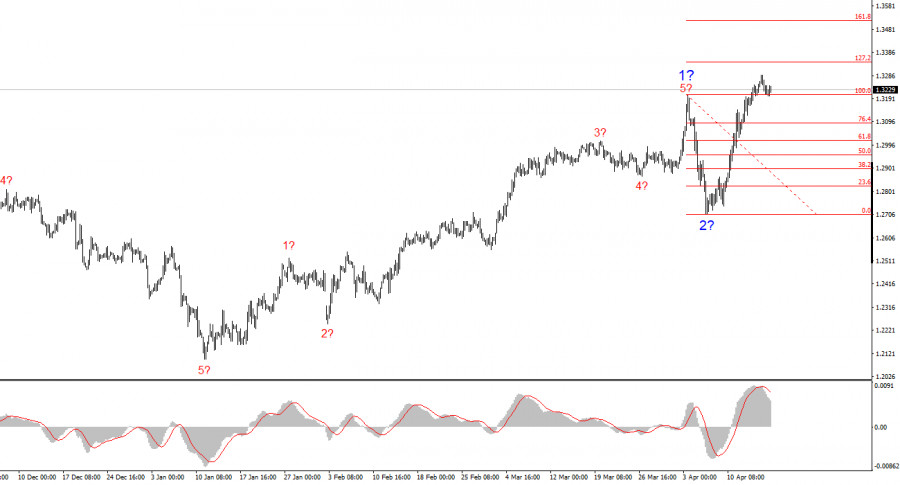

Trading planTrading Recommendations and Analysis for GBP/USD on April 18: The British Pound Is Losing Steam

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the marketAuteur: Paolo Greco

03:48 2025-04-18 UTC+2

17

- Trading plan

Trading Recommendations and Analysis for EUR/USD on April 18: The ECB Failed to Move the Market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuckAuteur: Paolo Greco

03:48 2025-04-18 UTC+2

18

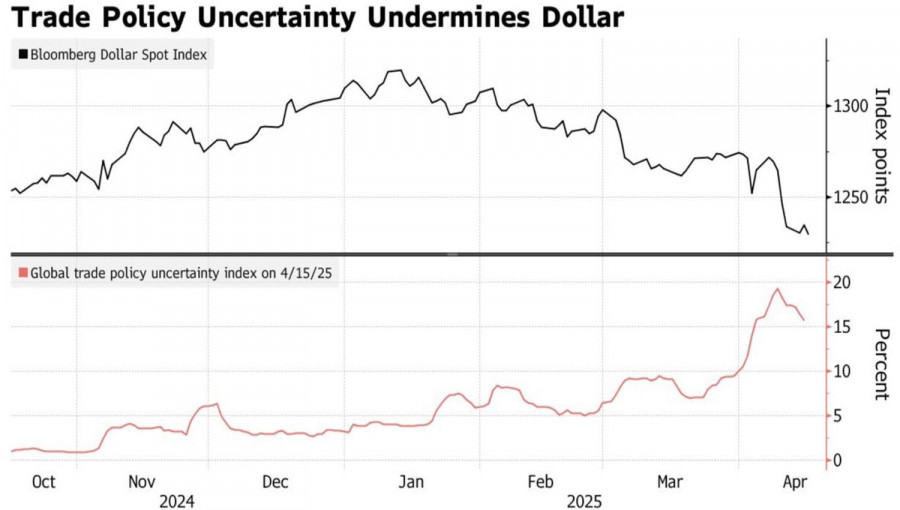

He meant well, but it turned out the usual way. Donald Trump firmly believes that tariffs can replace income tax, generate massive revenue for the budget, and bring aboutAuteur: Marek Petkovich

03:39 2025-04-18 UTC+2

15

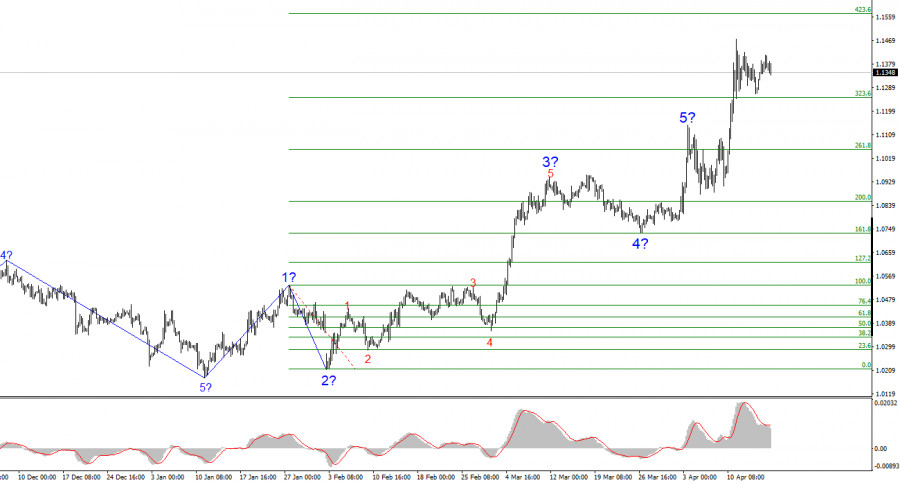

The wave structure on the 4-hour EUR/USD chart has shifted into a bullish impulse formation. I believe there's no doubt this transformation occurred solely due to the new U.S. tradeAuteur: Chin Zhao

19:12 2025-04-17 UTC+2

29

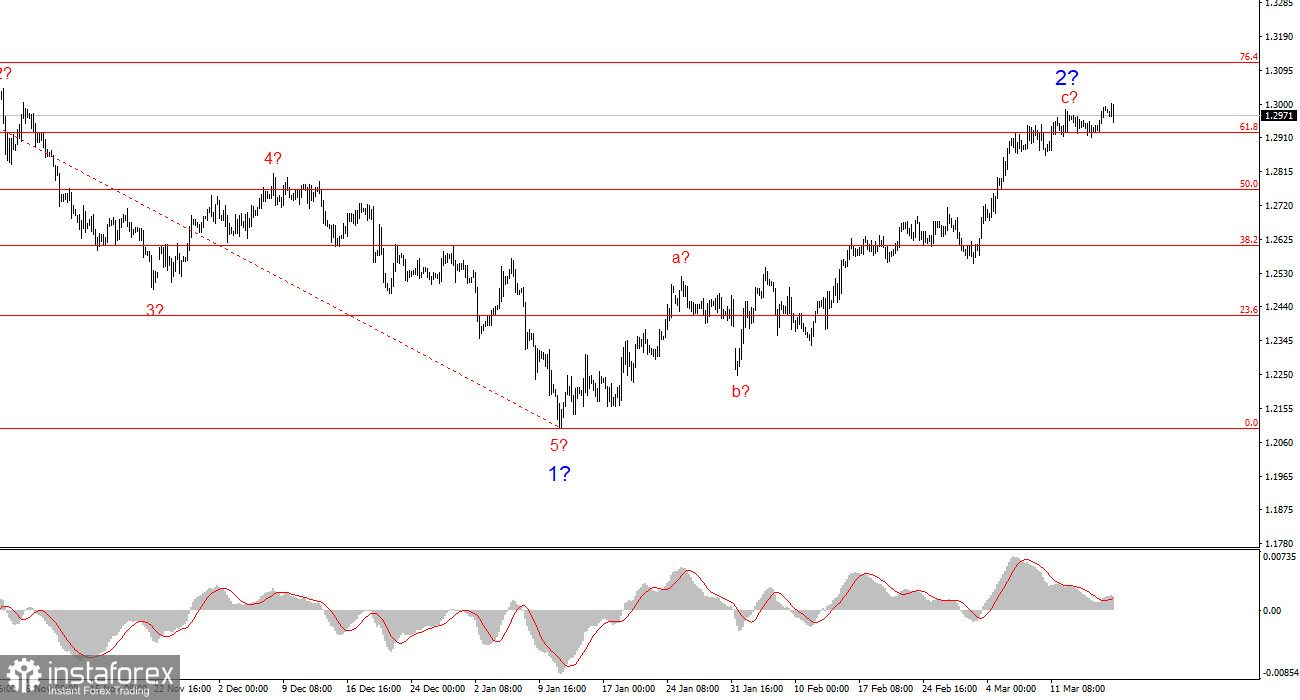

- The GBP/USD pair remained unchanged on Thursday. While such market behavior might have been expected for Thursday, it was surprising not to see a decline on Wednesday, given the number

Auteur: Chin Zhao

19:09 2025-04-17 UTC+2

25

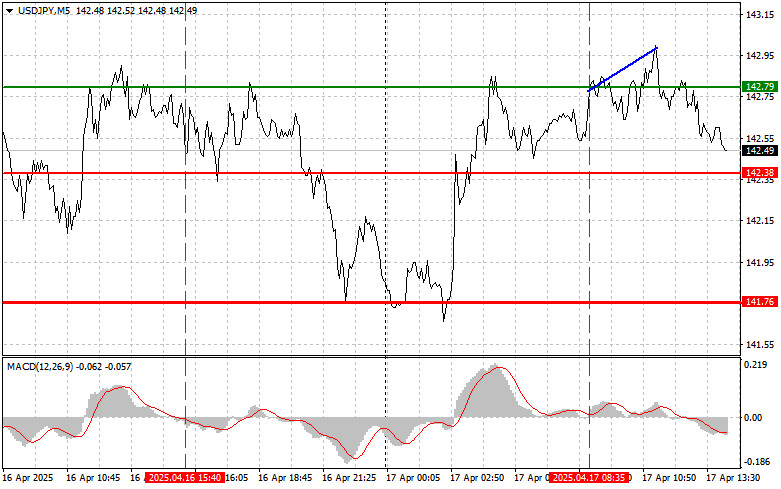

The test of the 142.79 level occurred when the MACD indicator had just started moving upward from the zero mark, which confirmed a valid entry point for buying the dollarAuteur: Jakub Novak

19:05 2025-04-17 UTC+2

19

The test of the 1.3230 level occurred when the MACD indicator had already moved well above the zero line, which limited the pound's upward potential. For this reason, I didn'tAuteur: Jakub Novak

19:02 2025-04-17 UTC+2

17