- United States President Donald Trump once again stirred confusion on Tuesday by announcing plans to introduce a series of exemptions to his sweeping tariff proposal. The announcement served

Auteur: Jakub Novak

12:36 2025-03-26 UTC+2

14

Gold continues to show a positive tone today, but conviction behind the upward movement remains weak. Market uncertainty, driven by the tariffs announced by Donald Trump—set to take effectAuteur: Irina Yanina

11:54 2025-03-26 UTC+2

51

Top banks are split on the S&P 500 outlook: the market remains in a zone of uncertainty. The S&P 500 is holding above a key level, but the rally lacksAuteur: Irina Maksimova

11:47 2025-03-26 UTC+2

33

- The Japanese yen remains under pressure today due to weak domestic economic data. In February, Japan's leading inflation indicator in the services sector rose by 3.0% year-over-year, slightly below

Auteur: Irina Yanina

11:42 2025-03-26 UTC+2

44

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAuteur: Sebastian Seliga

11:35 2025-03-26 UTC+2

9

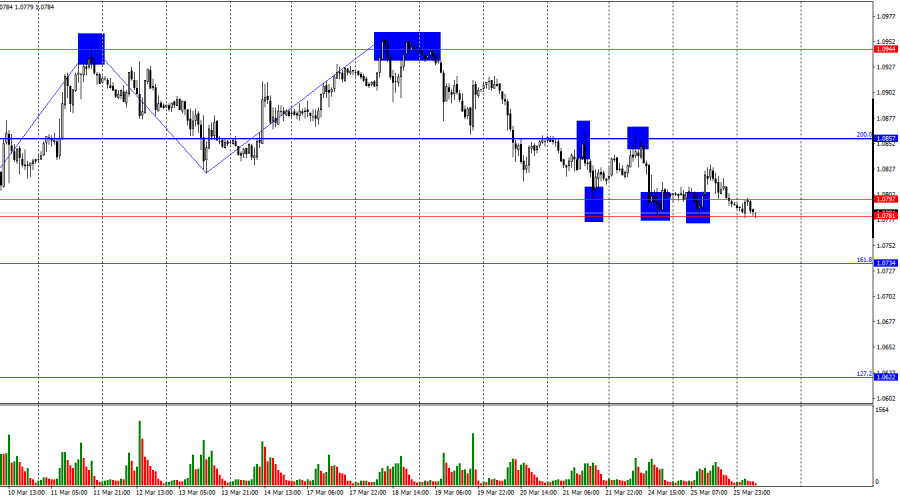

On Tuesday, the EUR/USD pair once again rebounded from the support zone of 1.0781–1.0797, but the bulls showed weakness due to the lack of a supportive news background. TodayAuteur: Samir Klishi

11:32 2025-03-26 UTC+2

42

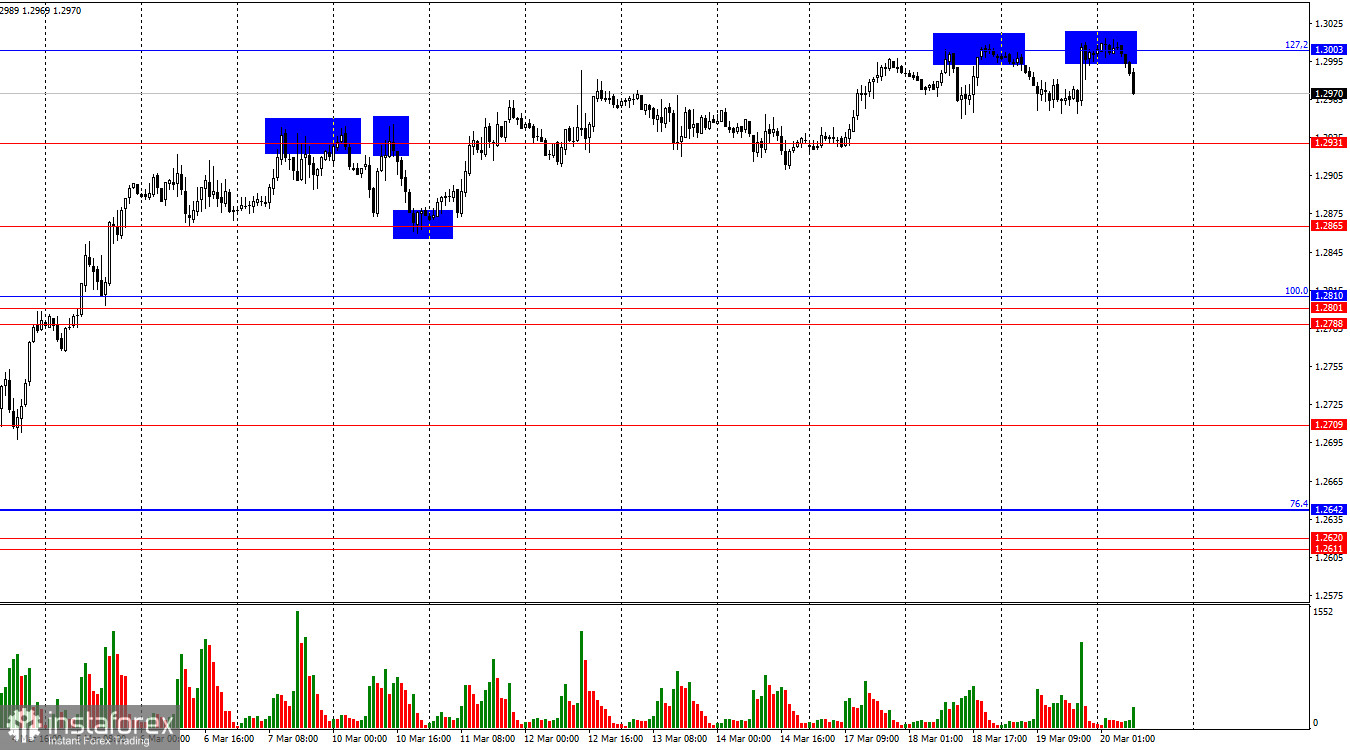

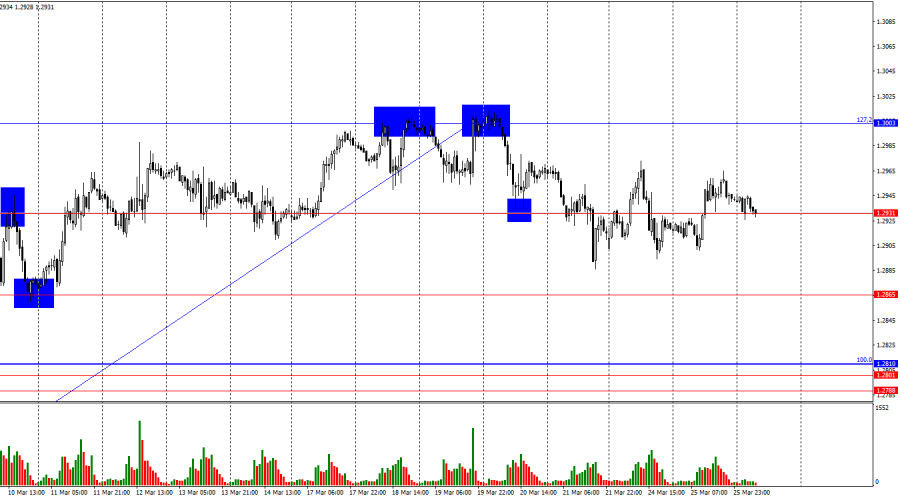

- On the hourly chart, the GBP/USD pair continued to trade sideways on Tuesday, showing no reaction to the 1.2931 level. Therefore, a new close above or below this level will

Auteur: Samir Klishi

11:29 2025-03-26 UTC+2

34

While you're mulling over whether to buy Bitcoin or not, the world's largest asset management leader, BlackRock, is actively increasing its ETH holdings for its tokenized fund, BUIDL. This moveAuteur: Jakub Novak

10:39 2025-03-26 UTC+2

25

Technical analysisTechnical Analysis of Intraday Price Movement of AUD/JPY Cross Currency Pairs, Wednesday March 26, 2025.

It can be seen on the 4-hour chart that the AUD/JPY cross currency pair is moving in a Bullish channel harmoniously and is above the EMA (21) which alsoAuteur: Arief Makmur

10:34 2025-03-26 UTC+2

28