This is the final week of March. At the end of each month, the U.S. traditionally publishes one of its most important inflation indicators — the Core PCE Index — while Europe focuses on PMI and IFO indices. This is the "basic set," so to speak. However, this week also includes a bonus: the final estimate of U.S. GDP growth for Q4. In addition, the U.S. will release the University of Michigan Consumer Sentiment Index and the Conference Board Consumer Confidence Index.

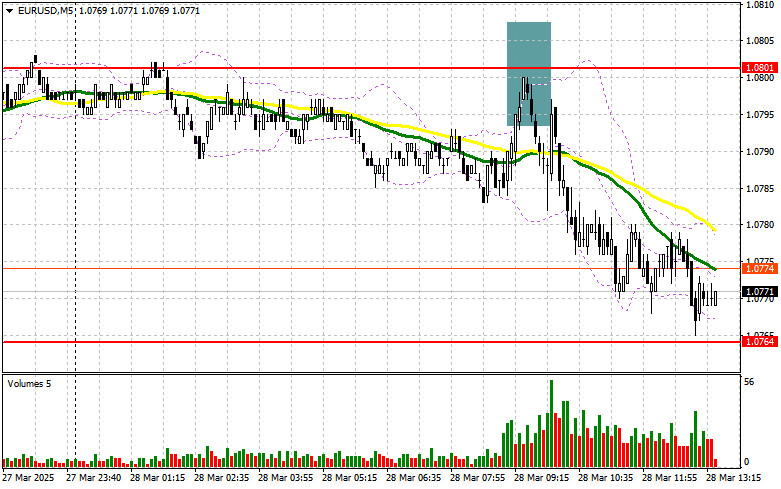

These releases will either support EUR/USD sellers consolidating in the 1.07 zone or help buyers defend the 1.0800 level.

Monday

Monday is PMI day. Germany's manufacturing PMI is expected to remain in contraction territory (below the 50-point mark) but show slight improvement — from 46.5 to 47.1. This would offer minor, mostly symbolic, support for the euro. Germany's services PMI has been in expansion territory for the past three months and is expected to remain above 50.0 in March, with a forecast of 52.3. For EUR/USD buyers, it is critical that this indicator does not fall below the 50 threshold into contraction. Eurozone-wide PMIs mirror the German trajectory — the manufacturing index remains below 50.0 (with a forecasted increase from 47.6 to 48.3), and the services index stays above 50.0 (expected to rise to 51.2).

During the U.S. session, the U.S. manufacturing PMI for March will be released, with a slight decline expected — from 52.7 to 51.9. The index has risen for two consecutive months (climbing out of contraction in January), so even a minor pullback could pressure the dollar. However, if the index unexpectedly continues to climb, the dollar may receive a boost — especially considering the recent jump in industrial production (+0.7% versus a 0.3% forecast).

Also on Monday, two Fed officials will speak: Atlanta Fed President Raphael Bostic (non-voting this year) and Fed Governor Michael Barr (a permanent voting member). They may comment on the Fed's March meeting, in which the central bank signaled it would not rush to cut rates. However, this applies only to the May meeting. The market still largely expects a rate cut in June. If Bostic and Barr cast doubt on the June outlook, the dollar may gain strong support.

Tuesday

During the European session, Germany's IFO indices will be published. The business climate index held steady at 85.2 in January and February, but a rise to 86.8 is expected for March — the highest since July 2024. The IFO expectations index is also projected to increase from 85.4 to 86.9. This optimism is linked to Germany's approval in March of a multibillion-euro investment package in infrastructure and defense, including loosening the "debt brake" and allocating €500 billion for a special infrastructure fund.

In the U.S. session, the Conference Board Consumer Confidence Index will be released. Last month, this report pressured the dollar after a sharp decline (from a forecast of 102.7 to an actual reading of 98.3). The indicator has shown a downward trend for three consecutive months, and March may extend that streak. Forecasts suggest a decline to 94.2 — the lowest reading since February 2021. The dollar will only find support if the index unexpectedly rises above the psychologically important 100.0 mark.

Key Fed speakers for Tuesday include Fed Governor Adriana Kugler (voting member) and New York Fed President John Williams (voting member).

Wednesday

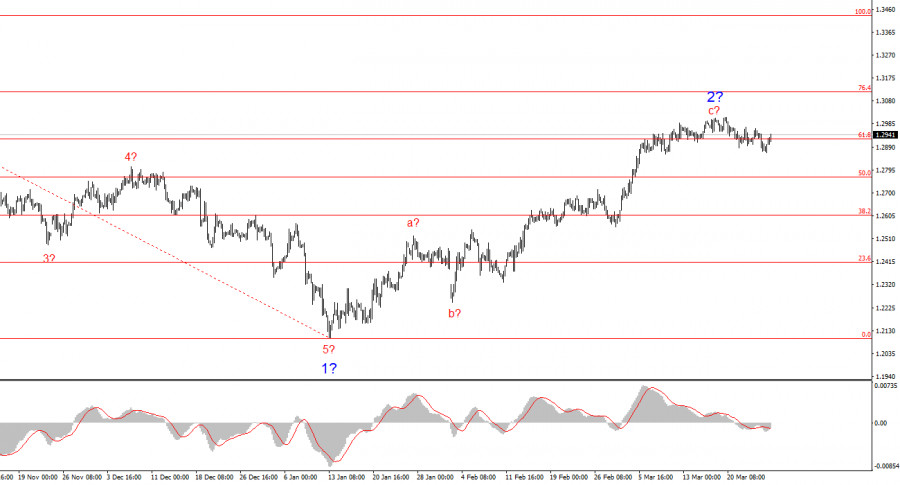

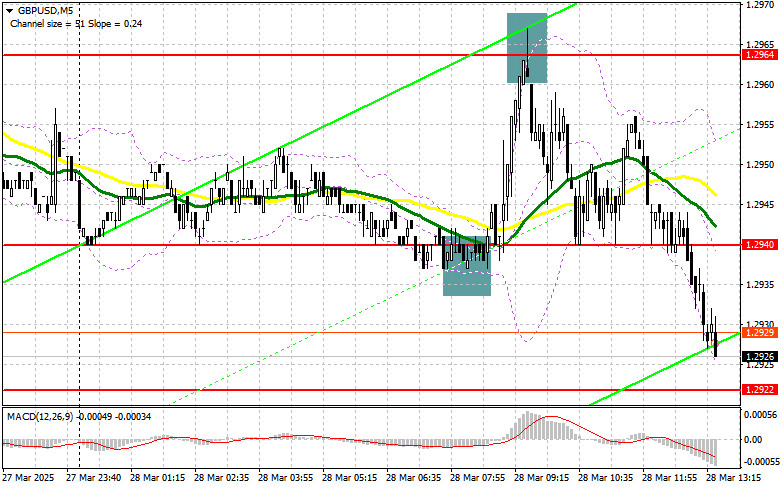

Wednesday's economic calendar is not rich in significant EUR/USD events. However, it is a crucial day for the British pound due to the release of the UK's annual budget and key inflation data.

For EUR/USD, the only notable developments are scheduled speeches by Minneapolis Fed President Neel Kashkari (non-voting this year) and St. Louis Fed President Alberto Musalem (voting member).

Thursday

On Thursday, all attention will be focused on the final Q4 2024 U.S. GDP estimate. The second estimate held at 2.3%. Forecasts suggest a slight upward revision to 2.4%. For reference, the Q3 result was revised from 2.8% (second estimate) to 3.1% (final). If the Q4 figure is revised significantly higher, the dollar will likely receive strong support amid rising recession risks.

Also on Thursday, weekly jobless claims will be published. Over the past three weeks, the figure has ranged from 221,000 to 223,000. This week's forecast is 225,000. The dollar could come under pressure if the number exceeds 230,000.

Friday

The final trading day of the week is expected to bring strong volatility for EUR/USD, as the U.S. releases its most closely watched inflation indicator: the Core PCE Index for February. In January, the Core PCE slowed to 2.6% y/y from 2.9% in December. A further decline to 2.5% is expected for February.

Also on Friday, the University of Michigan Consumer Sentiment Index will be published. In February, it fell sharply to 57.9 (against a forecast of 63). In March, it's expected to rebound to 61.5.

Conclusions

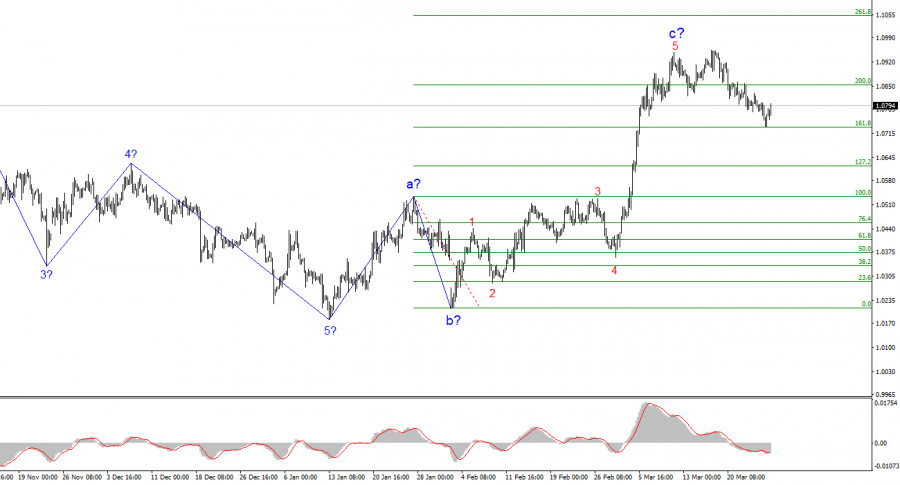

Over the past three days of the previous week, EUR/USD declined steadily, ending Friday's session at 1.0816, down from the weekly high of 1.0955. Key releases in the upcoming week may support EUR/USD sellers if the eurozone's PMI and IFO indices fall into negative territory and if the U.S. Core PCE and GDP growth data exceed forecasts. Additionally, comments from Fed officials — particularly voting members — questioning the likelihood of a June rate cut could also support the dollar.

Technically, on the H4 chart, EUR/USD is positioned between the middle and lower Bollinger Bands and within the Kumo cloud. The nearest support is at 1.0770 — the lower boundary of the Kumo cloud and the lower Bollinger Band on H4. The next support lies at 1.0720 — the middle Bollinger Band on the daily chart. Resistance is at 1.0870 — the middle Bollinger Band and upper boundary of the Kumo cloud on H4, coinciding with the Kijun-sen line. Long positions should only be considered if buyers break through this level and secure consolidation above it.