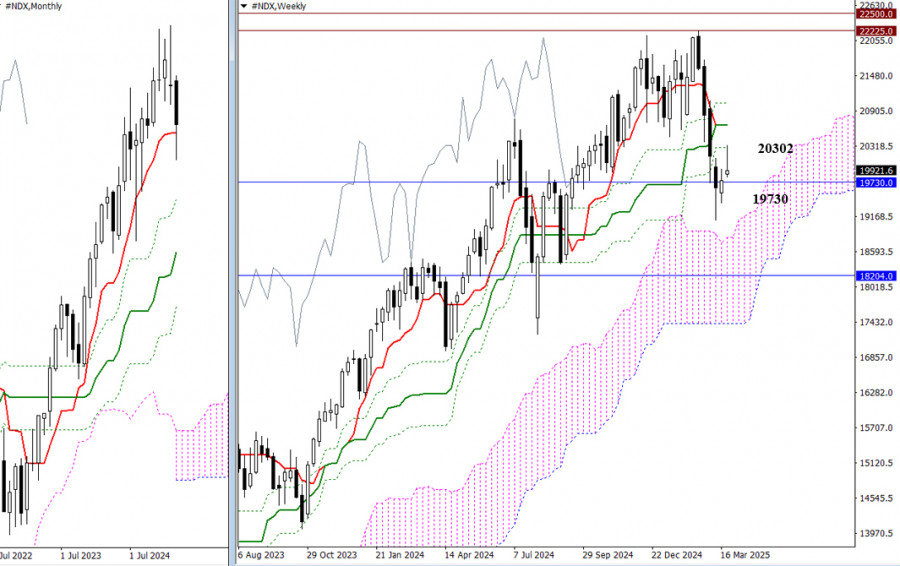

- A stall at the monthly short-term trend level (19730) prompted an effort by bulls to reclaim their positions. As a result, a bullish gap formed at the start

Auteur: Evangelos Poulakis

05:45 2025-03-27 UTC+2

7

On Wednesday, the GBP/USD currency pair openly traded in a flat range. Volatility remains low, with no trending movements even within the day. In other words, the market is simplyAuteur: Paolo Greco

04:06 2025-03-27 UTC+2

30

On Wednesday, the EUR/USD currency pair continued trading with minimal volatility and a slight downward bias. Trading volumes were absent, which is unsurprising—there has been very little news this weekAuteur: Paolo Greco

04:06 2025-03-27 UTC+2

24

- Trading plan

Trading Recommendations and Analysis for GBP/USD on March 27: Pound Dropped, but Nothing Has Changed

The GBP/USD currency pair traded lower on Wednesday. We had warned that the pair has recently been swinging like a pendulum. The pound was rising on Tuesday, so it couldAuteur: Paolo Greco

04:06 2025-03-27 UTC+2

46

Trading planTrading Recommendations and Analysis for EUR/USD on March 27: The Market Is in No Hurry

The EUR/USD currency pair traded with minimal losses throughout Wednesday, while the overall trend on the hourly time frame remains bearish following the price's exit from the ascending channelAuteur: Paolo Greco

04:06 2025-03-27 UTC+2

36

The UK inflation report failed to support the pound—all components of the release came in below expectations. On the one hand, this report is unlikely to influence the outcomeAuteur: Irina Manzenko

00:41 2025-03-27 UTC+2

38

- The euro is retreating cautiously, worried about a potential trade war between the European Union and the United States, while the dollar is on track for its worst month

Auteur: Marek Petkovich

00:41 2025-03-27 UTC+2

36

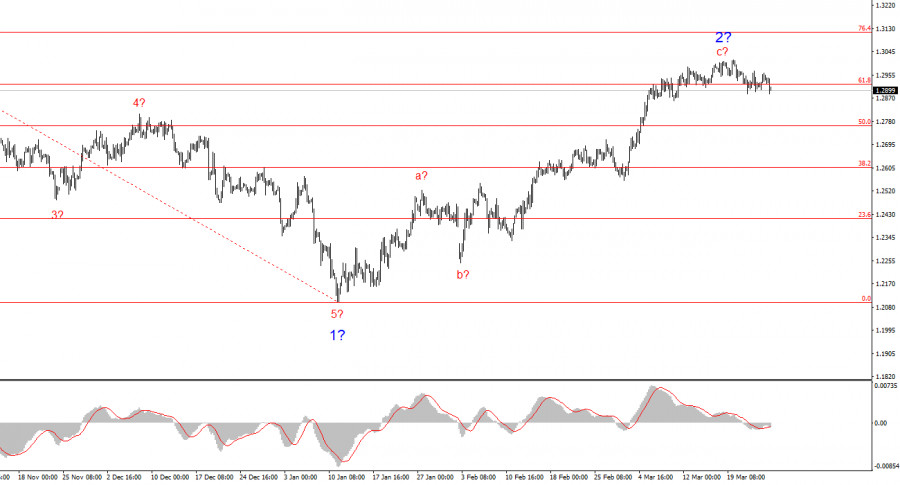

The wave pattern for GBP/USD remains somewhat ambiguous but overall workable. There is still a high probability of a long-term bearish trend forming. Wave 5 has taken a clear shapeAuteur: Chin Zhao

18:37 2025-03-26 UTC+2

58

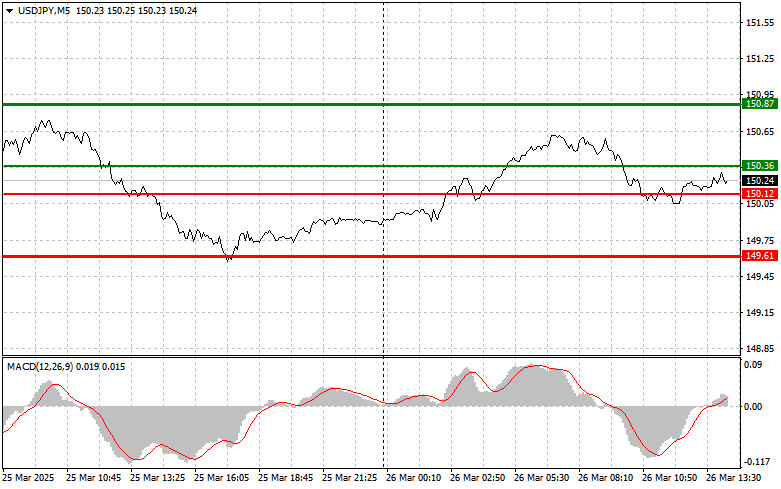

Trade Review and Trading Advice for the Japanese Yen There were no tests of the designated levels during the first half of the day. During the U.S. session, a seriesAuteur: Jakub Novak

18:35 2025-03-26 UTC+2

53