GBP/USD 5-Minute Analysis

The GBP/USD currency pair managed to move both upward and downward on Monday. We can't say that these movements were triggered by macroeconomic data, because they weren't. The UK's business activity indices were just as contradictory as the European, German, and U.S. figures. In any case, the pound began rising in the first half of the day well before those reports were released, and began falling in the second half of the day long before the U.S. data came out. Therefore, there's no correlation.

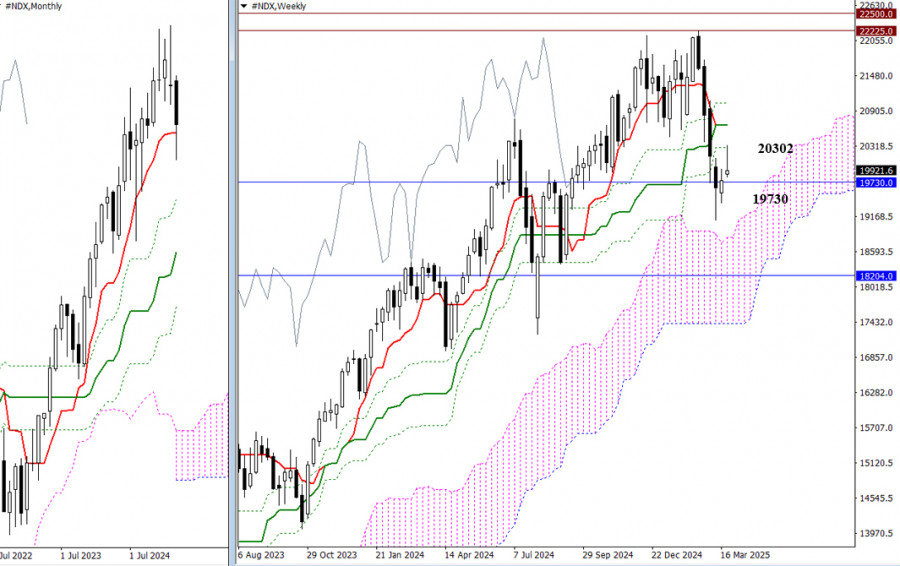

Like the euro, the British pound continues a sluggish, weak, and reluctant correction. The price barely managed to consolidate below the ascending channel, and just slightly broke below the Ichimoku indicator lines. From a technical standpoint, further decline is completely justified. Looking at the entire recent rise of the British currency, this correction seems even more logical. On the daily timeframe, there are simply no other scenarios. And on the monthly chart, the 16-year downtrend continues to form. The only problem is that the market doesn't want to buy the U.S. dollar—and that's solely due to Donald Trump's policy actions.

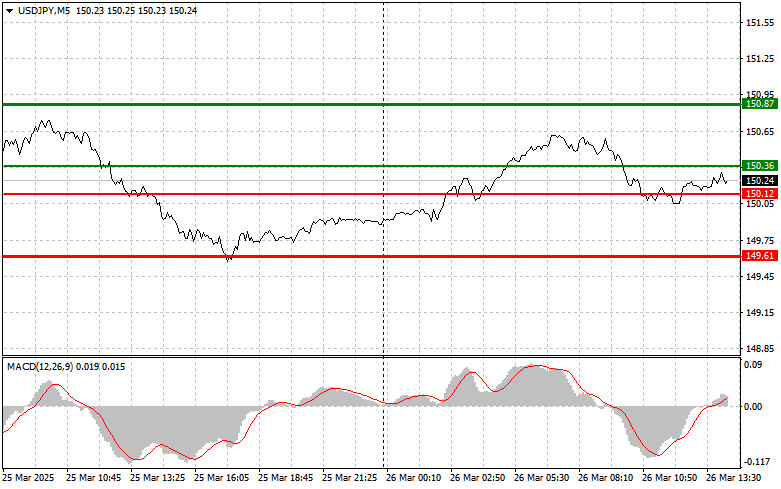

On the 5-minute timeframe, two trading signals were formed on Monday. First, the price broke through the Kijun-sen and Senkou Span B lines from bottom to top, and then from top to bottom. In the first case, the move in the right direction didn't even reach 20 pips. In the second case, it reached about 20. Thus, the second short trade could at best offset the loss from the first long trade. Volatility was again low, so it would have been difficult to profit from Monday's session regardless.

COT Report

COT reports on the British pound show that commercial traders' sentiment has constantly changed in recent years. The red and blue lines, representing the net positions of commercial and non-commercial traders, intersect frequently and are mainly close to the zero level. They are also near each other, indicating that the number of long and short positions is roughly equal.

On the weekly chart, the price first broke the 1.3154 level and then dropped to the trendline, which it successfully breached. Breaking the trendline suggests that the pound is likely to continue falling. However, we should note a rebound from the second-to-last local low on the weekly chart. We may be dealing with a flat market.

According to the latest COT report on the British pound, the "Non-commercial" group opened 1,100 buy contracts and 900 sell contracts. As a result, the net position of non-commercial traders saw little change over the week.

The current fundamental backdrop does not support long-term buying of the pound, and the currency has a real possibility of continuing its global downward trend. The recent sharp increase in the pound's value can be attributed solely to Donald Trump's policies.

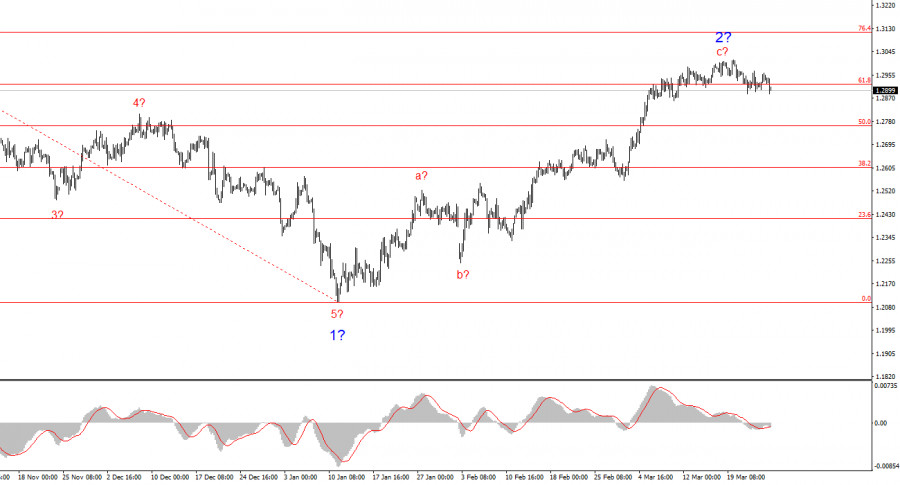

GBP/USD 1-Hour Analysis

GBP/USD has started a downward trend on the hourly timeframe, though the decline has been weak. The upward correction on the daily timeframe is long overdue to end. We still don't see any reason for the pound to rise from a long-term perspective. Donald Trump's actions are currently the only factor supporting the pound—specifically, his imposed sanctions and tariffs left and right. The market is ignoring all other aspects.

For March 25, we highlight the following important levels: 1.2331–1.2349, 1.2429–1.2445, 1.2511, 1.2605–1.2620, 1.2691–1.2701, 1.2796–1.2816, 1.2863, 1.2981–1.2987, 1.3050, 1.3119. The Senkou Span B line (1.2933) and Kijun-sen line (1.2948) may also serve as signal sources. It is recommended to place a Stop Loss at breakeven when the price moves 20 pips in the right direction. Note that the Ichimoku indicator lines may shift throughout the day, which should be considered when identifying trading signals.

On Tuesday, no important or noteworthy events are scheduled in the UK, and only the New Home Sales report in the U.S. can be considered somewhat relevant. Thus, the macroeconomic background will be nearly absent. Therefore, high volatility is unlikely. A trending intraday move is also unlikely. The British pound will likely continue to drift downward in a sluggish correction.

Illustration Explanations:

- Support and Resistance Levels (thick red lines): Thick red lines indicate where movement may come to an end. Please note that these lines are not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the 4-hour timeframe to the hourly timeframe. These are strong lines.

- Extreme Levels (thin red lines): Thin red lines where the price has previously bounced. These serve as sources of trading signals.

- Yellow Lines: Trendlines, trend channels, or any other technical patterns.

- Indicator 1 on COT Charts: Represents the net position size for each category of traders.