- Euro and Pound Retain All Prerequisites for Further Growth The single European currency showed virtually no reaction to yesterday's meeting of European Central Bank officials, during which another interest rate

Auteur: Miroslaw Bawulski

06:52 2025-04-18 UTC+2

0

Fundamental analysisWhat to Pay Attention to on April 18? A Breakdown of Fundamental Events for Beginners

There are no macroeconomic events scheduled for Friday—not in the US, the Eurozone, Germany, or the UK. Therefore, even if the market were paying any attention to the macroeconomic backdropAuteur: Paolo Greco

06:51 2025-04-18 UTC+2

3

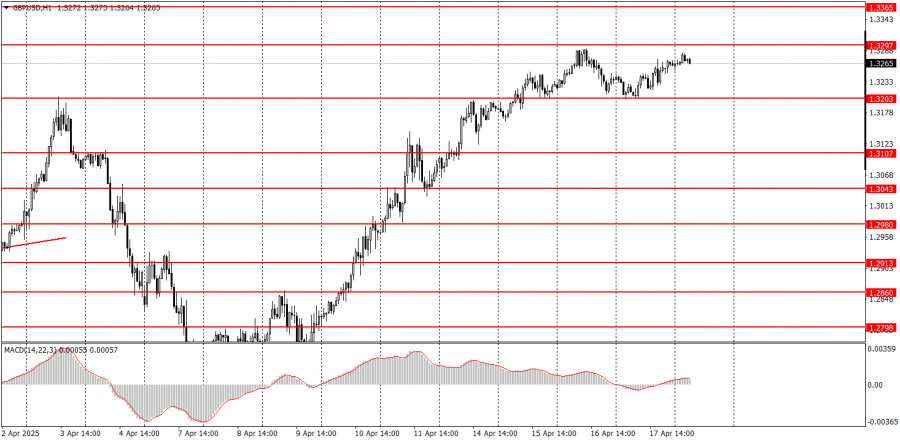

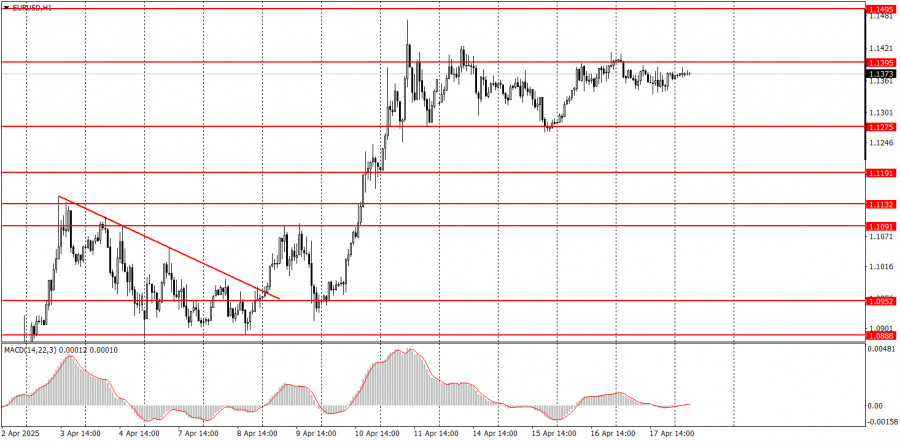

Trading planHow to Trade the GBP/USD Pair on April 18? Simple Tips and Trade Analysis for Beginners

Analysis of Thursday's Trades 1H Chart of GBP/USD The GBP/USD pair continued to trade higher throughout Thursday. Even at its peak levels, the British pound shows no intention of correctingAuteur: Paolo Greco

06:51 2025-04-18 UTC+2

4

- Trading plan

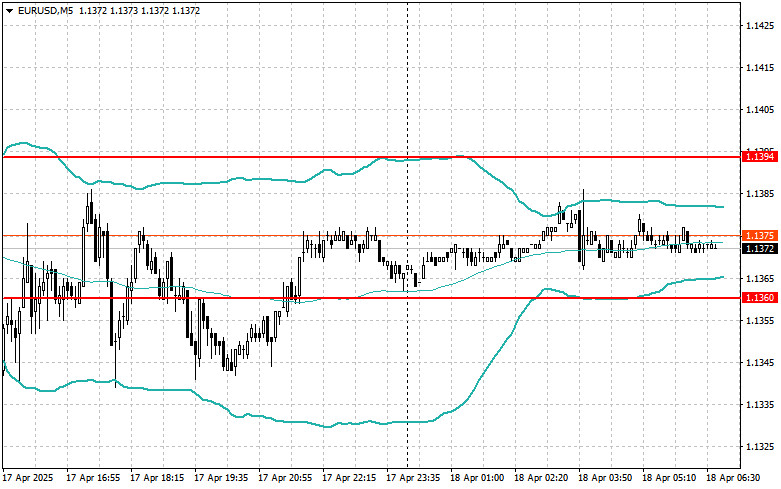

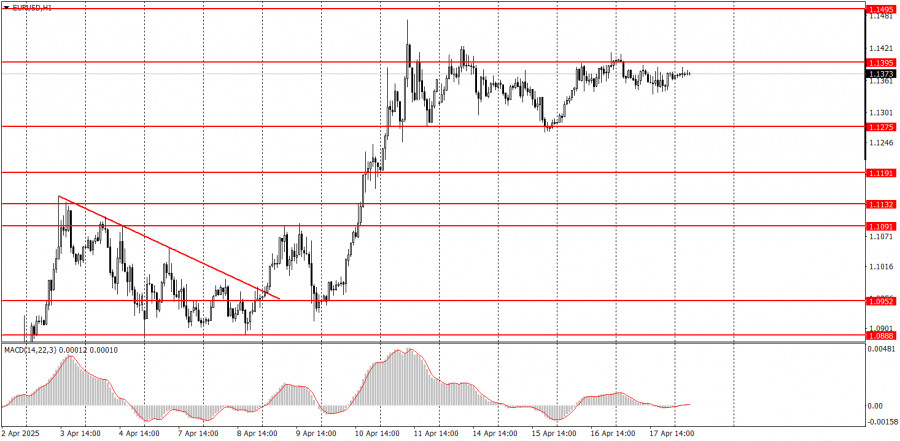

How to Trade the EUR/USD Pair on April 18? Simple Tips and Trade Analysis for Beginners

Analysis of Thursday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued trading within a sideways channel on Thursday, as shown on the hourly timeframe chart above. The currentAuteur: Paolo Greco

06:51 2025-04-18 UTC+2

3

The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward bias. We still can't classify the current movement as a "pullback" or "correction."Auteur: Paolo Greco

03:48 2025-04-18 UTC+2

16

Fundamental analysisEUR/USD Overview – April 18: The ECB Predictably Cut Rates, and the Market Predictably Ignored It

The EUR/USD currency pair spent most of the day moving sideways. When the European Central Bank meeting results were released, the market saw a small emotional reaction, but nothing fundamentallyAuteur: Paolo Greco

03:48 2025-04-18 UTC+2

22

- Trading plan

Trading Recommendations and Analysis for GBP/USD on April 18: The British Pound Is Losing Steam

The GBP/USD currency pair continued its upward movement on Thursday, trading near multi-year highs. Despite the lack of significant events in the U.S. or the U.K. (unlike Wednesday), the marketAuteur: Paolo Greco

03:48 2025-04-18 UTC+2

21

Trading planTrading Recommendations and Analysis for EUR/USD on April 18: The ECB Failed to Move the Market

The EUR/USD currency pair continued to trade sideways on Thursday. While previously it had been moving within a range between 1.1274 and 1.1391, on Thursday, it was stuckAuteur: Paolo Greco

03:48 2025-04-18 UTC+2

19

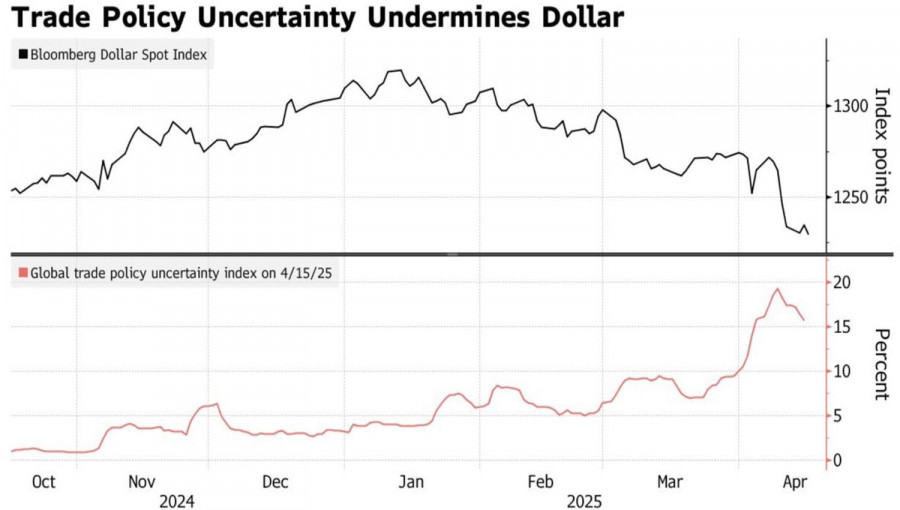

He meant well, but it turned out the usual way. Donald Trump firmly believes that tariffs can replace income tax, generate massive revenue for the budget, and bring aboutAuteur: Marek Petkovich

03:39 2025-04-18 UTC+2

17