- On Tuesday, the euro declined by 42 pips. The downward movement paused at the 55-day moving average (MA55). Now, the test of the target support at 1.1495 —

Auteur: Laurie Bailey

05:13 2025-07-30 UTC+2

0

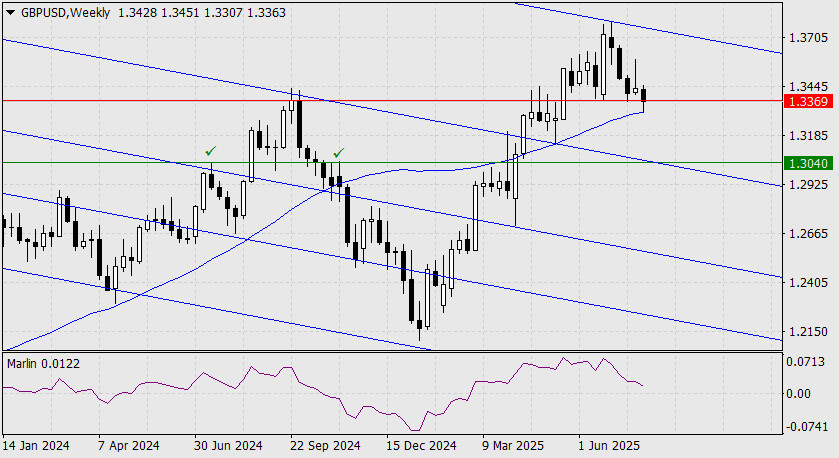

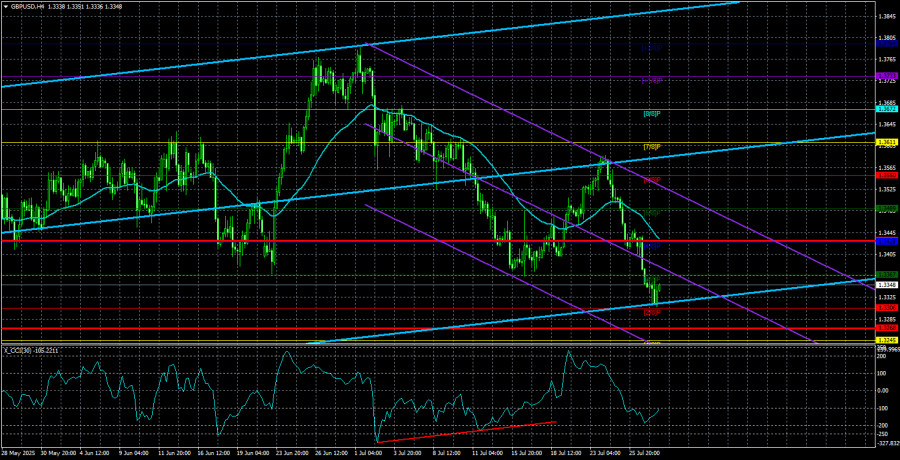

By the end of yesterday, the British pound had settled below the 1.3369 level. But let's take a look at the weekly chart — here, the price has tested supportAuteur: Laurie Bailey

05:13 2025-07-30 UTC+2

6

Oil (CL) By this morning, the price has reached the target level of 69.43 and the MACD line on the weekly scale. Two weeks ago, a pullback lasting two weeksAuteur: Laurie Bailey

05:13 2025-07-30 UTC+2

3

- The GBP/USD currency pair continued its decline on Monday and extended the move into Tuesday. It's worth noting that the British pound began falling earlier than the euro, already last

Auteur: Paolo Greco

03:48 2025-07-30 UTC+2

13

The EUR/USD currency pair continued its downward movement on Tuesday, driven by the same factors as on Monday—as we warned in advance. On Monday, it was revealed that the EuropeanAuteur: Paolo Greco

03:48 2025-07-30 UTC+2

16

Trading planTrading Recommendations and Trade Breakdown for GBP/USD on July 30: The Pound Temporarily Loses Its Advantage

The GBP/USD currency pair also continued its downward movement on Tuesday, though much more moderately compared to Monday or last week. The reasons for the pound's decline this weekAuteur: Paolo Greco

03:47 2025-07-30 UTC+2

17

- Trading plan

Trading Recommendations and Trade Breakdown for EUR/USD on July 30: The Euro Crisis Continues

The EUR/USD currency pair continued its downward movement on Tuesday, although during the day, it made the first attempts to halt the decline and recover. Overall, we fully supportedAuteur: Paolo Greco

03:47 2025-07-30 UTC+2

16

There will likely be some dovish hints, but they will probably not differ from previous statements and rhetoric by Federal Reserve officials. This is the general expectation one day beforeAuteur: Chin Zhao

01:14 2025-07-30 UTC+2

17

Donald Trump continues to reshape the world order. The U.S. President keeps dictating terms to nearly half the world's countries—and his strategy is working so far. The trade agreement withAuteur: Chin Zhao

01:14 2025-07-30 UTC+2

23