- Fundamental analysis

What to Pay Attention to on March 27? A Breakdown of Fundamental Events for Beginners

There are very few macroeconomic events scheduled for Thursday, and even fewer are deemed important. The only report that deserves attention is the third estimate of U.SAuteur: Paolo Greco

06:42 2025-03-27 UTC+2

0

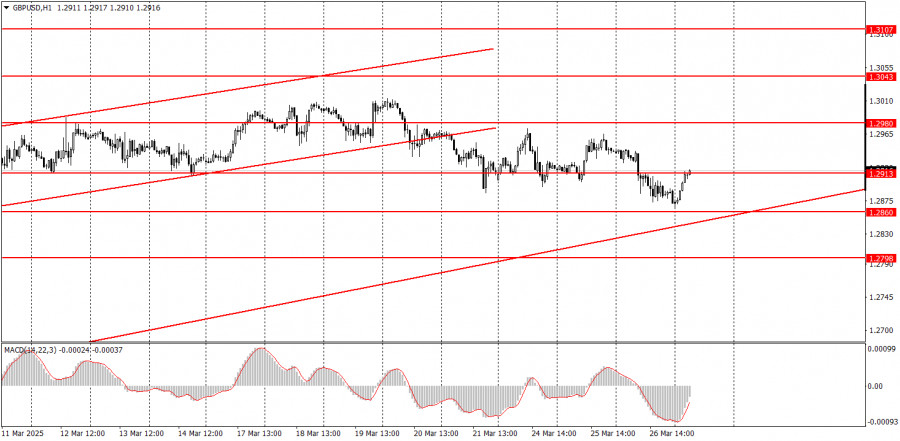

Trading planHow to Trade the GBP/USD Pair on March 27? Simple Tips and Trade Analysis for Beginners

Analysis of Wednesday's Trades 1H Chart of GBP/USD On Wednesday, the GBP/USD pair showed a downward movement that finally aligned with the macroeconomic backdrop. During the day, traders were interestedAuteur: Paolo Greco

06:42 2025-03-27 UTC+2

0

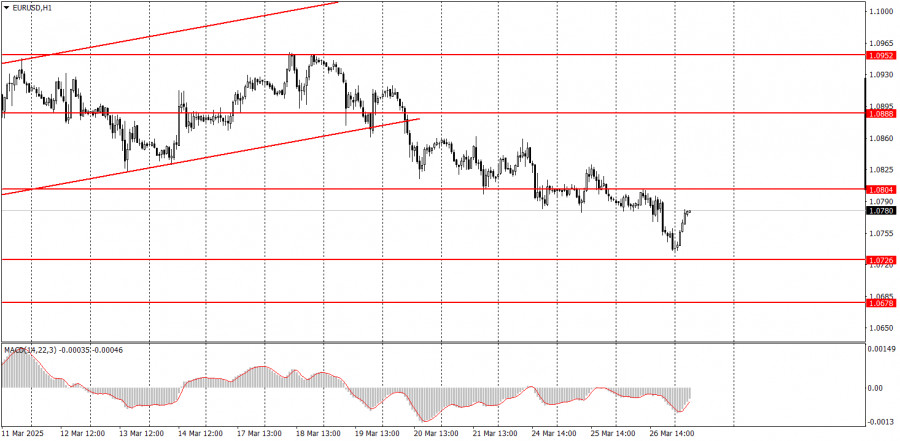

Trading planHow to Trade the EUR/USD Pair on March 27? Simple Tips and Trade Analysis for Beginners

Analysis of Wednesday's Trades 1H Chart of EUR/USD On Wednesday, the EUR/USD currency pair continued its sluggish decline. The euro's depreciation is quite logical, although traders continue to ignoreAuteur: Paolo Greco

06:42 2025-03-27 UTC+2

0

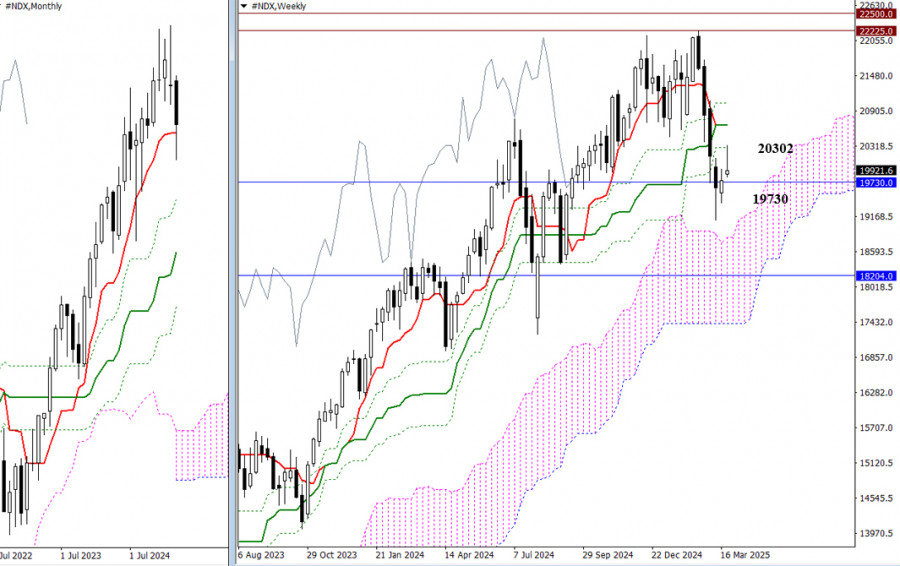

- A stall at the monthly short-term trend level (19730) prompted an effort by bulls to reclaim their positions. As a result, a bullish gap formed at the start

Auteur: Evangelos Poulakis

05:45 2025-03-27 UTC+2

8

On Wednesday, the GBP/USD currency pair openly traded in a flat range. Volatility remains low, with no trending movements even within the day. In other words, the market is simplyAuteur: Paolo Greco

04:06 2025-03-27 UTC+2

34

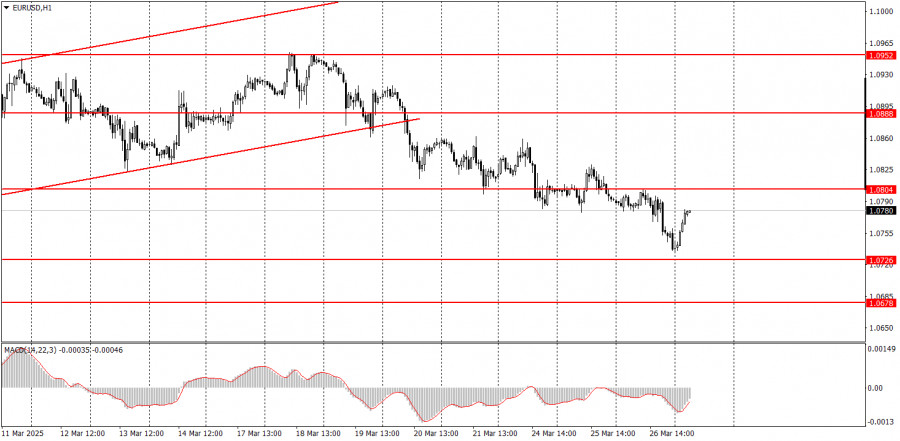

On Wednesday, the EUR/USD currency pair continued trading with minimal volatility and a slight downward bias. Trading volumes were absent, which is unsurprising—there has been very little news this weekAuteur: Paolo Greco

04:06 2025-03-27 UTC+2

24

- Trading plan

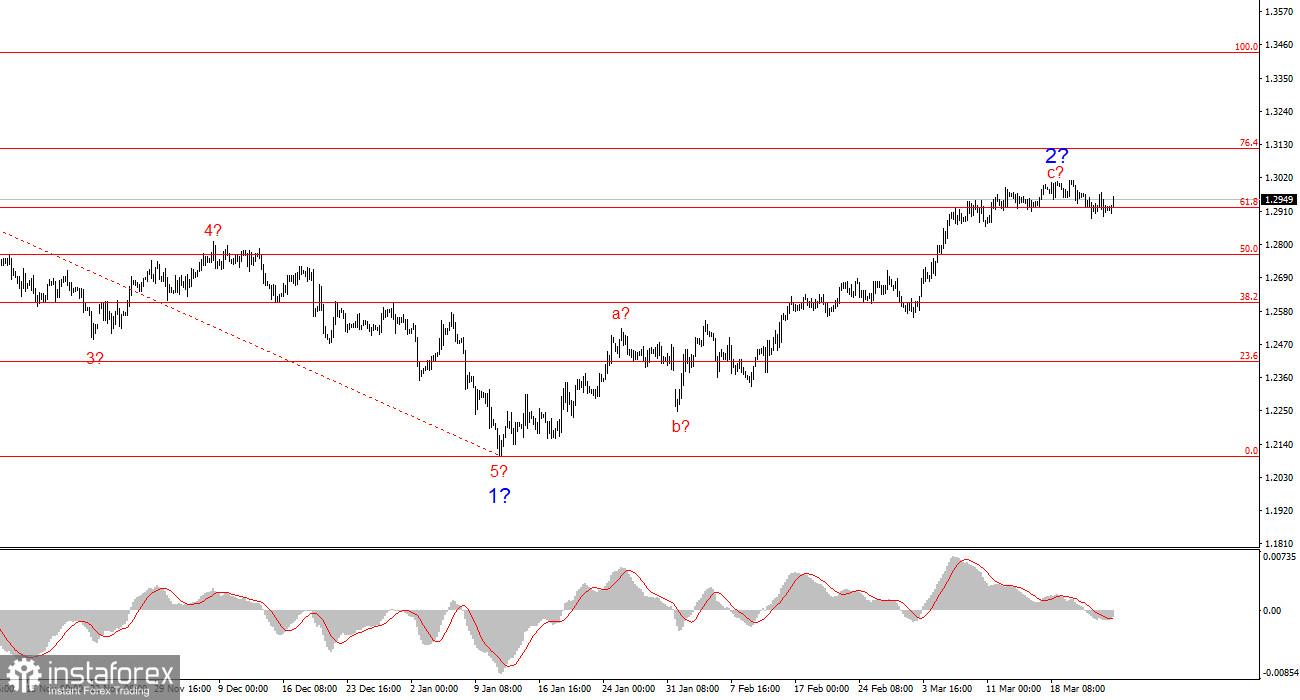

Trading Recommendations and Analysis for GBP/USD on March 27: Pound Dropped, but Nothing Has Changed

The GBP/USD currency pair traded lower on Wednesday. We had warned that the pair has recently been swinging like a pendulum. The pound was rising on Tuesday, so it couldAuteur: Paolo Greco

04:06 2025-03-27 UTC+2

47

Trading planTrading Recommendations and Analysis for EUR/USD on March 27: The Market Is in No Hurry

The EUR/USD currency pair traded with minimal losses throughout Wednesday, while the overall trend on the hourly time frame remains bearish following the price's exit from the ascending channelAuteur: Paolo Greco

04:06 2025-03-27 UTC+2

36

The UK inflation report failed to support the pound—all components of the release came in below expectations. On the one hand, this report is unlikely to influence the outcomeAuteur: Irina Manzenko

00:41 2025-03-27 UTC+2

38