- Technical analysis

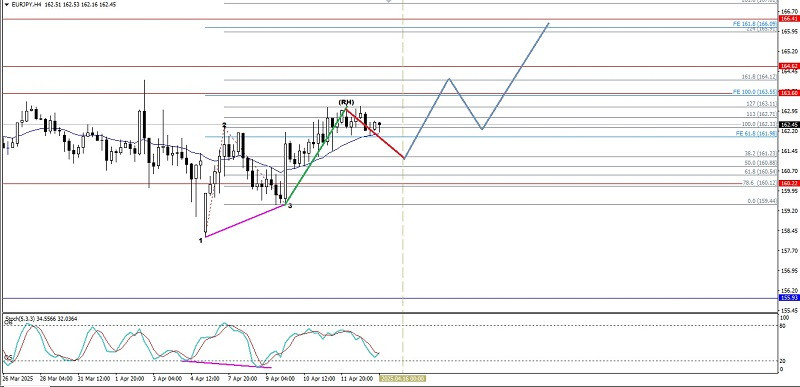

Technical Analysis of Intraday Price Movement of EUR/JPY Cross Currency Pairs, Tuesday April 15, 2025.

With the appearance of Divergence between the price movement of the EUR/JPY cross currency pair with the Stochastic Oscillator indicator also followed by the presence of the Bullish 123 patternAuteur: Arief Makmur

07:13 2025-04-15 UTC+2

5

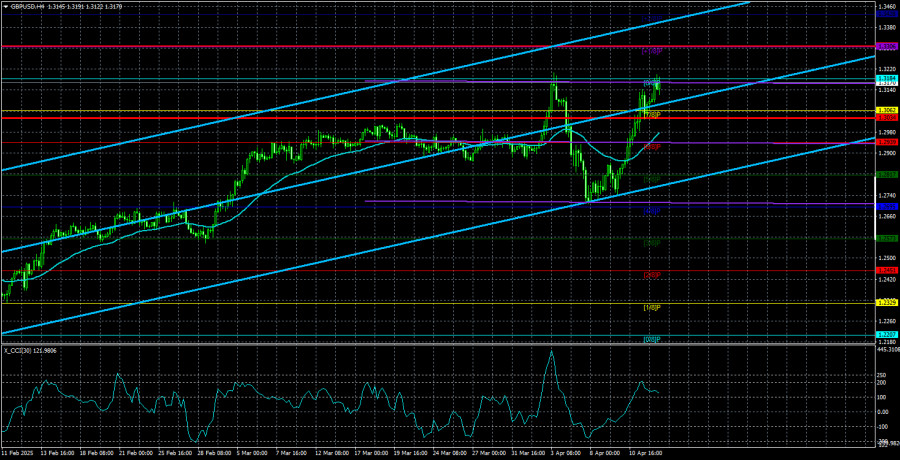

Technical analysisTechnical Analysis of Intraday Price Movement of GBP/AUD Cross Currency Pairs, Tuesday April 15, 2025.

On the 4-hour chart, the GBP/AUD cross currency pair appears to be moving below its EMA (21) and the Stochastic Oscillator indicator is in a Crossing SELL conditionAuteur: Arief Makmur

07:13 2025-04-15 UTC+2

4

Fundamental analysisWhat to Pay Attention to on April 15? A Breakdown of Fundamental Events for Beginners

Quite a few macroeconomic events are scheduled for Tuesday, but under the current circumstances, macroeconomic data mean little to the market. They might have a short-term local impactAuteur: Paolo Greco

06:29 2025-04-15 UTC+2

2

- Trading plan

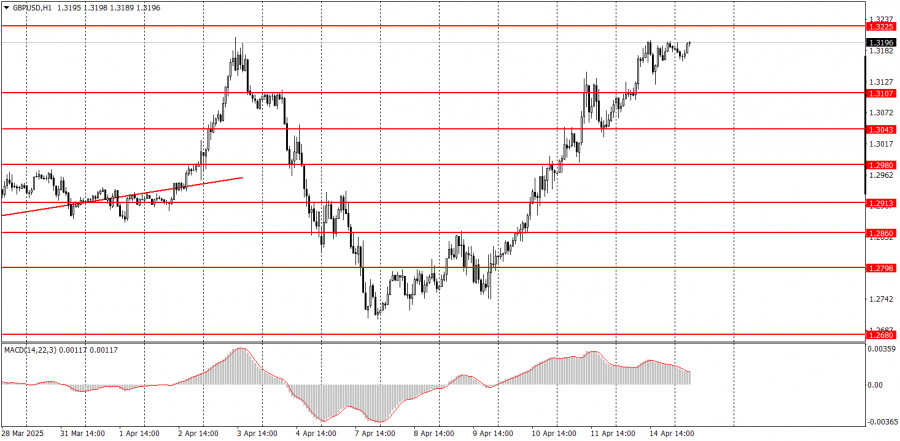

How to Trade the GBP/USD Pair on April 15? Simple Tips and Trade Analysis for Beginners

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair continued its upward movement without any trouble. There were no macroeconomic reasons for this, and evenAuteur: Paolo Greco

06:29 2025-04-15 UTC+2

5

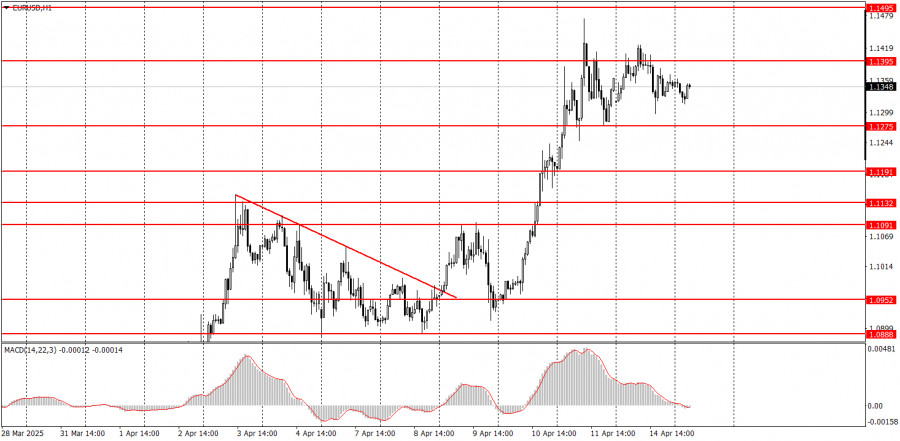

Trading planHow to Trade the EUR/USD Pair on April 15? Simple Tips and Trade Analysis for Beginners

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair traded more sideways than upward, although it still gained valueAuteur: Paolo Greco

06:29 2025-04-15 UTC+2

3

The GBP/USD currency pair continued its upward movement on Monday. As with the euro, there was no specific reason for the pair to decline. Of course, the current rally looksAuteur: Paolo Greco

03:57 2025-04-15 UTC+2

13

- The EUR/USD currency pair continued its upward movement on Monday. Despite the slower growth this time, the pair continues to rise. Yesterday saw a 50-pip increase; today, it's 250. What

Auteur: Paolo Greco

03:57 2025-04-15 UTC+2

18

Trading planTrading Recommendations and Analysis for GBP/USD on April 15: The Pound Sees No Reason to Stand Still

The GBP/USD currency pair traded higher on Monday without any "buts." While the euro showed some gains by the end of the day, they weren't significant — in contrastAuteur: Paolo Greco

03:57 2025-04-15 UTC+2

26

The EUR/USD currency pair attempted to extend its growth during Monday's session but eventually pulled back in the second half of the day. In essence, we didn't see any substantialAuteur: Paolo Greco

03:57 2025-04-15 UTC+2

20