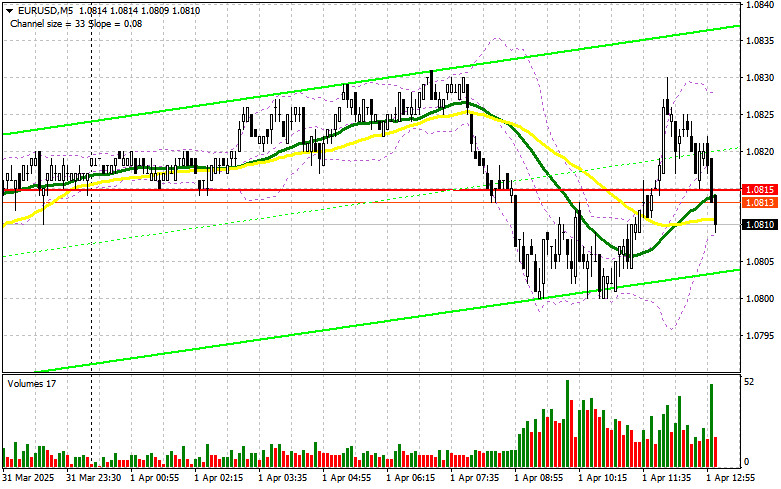

- The wave structure on the 4-hour EUR/USD chart risks evolving into a more complex formation. On September 25 of last year, a new bearish structure began to take shape, forming

Auteur: Chin Zhao

20:05 2025-04-01 UTC+2

1

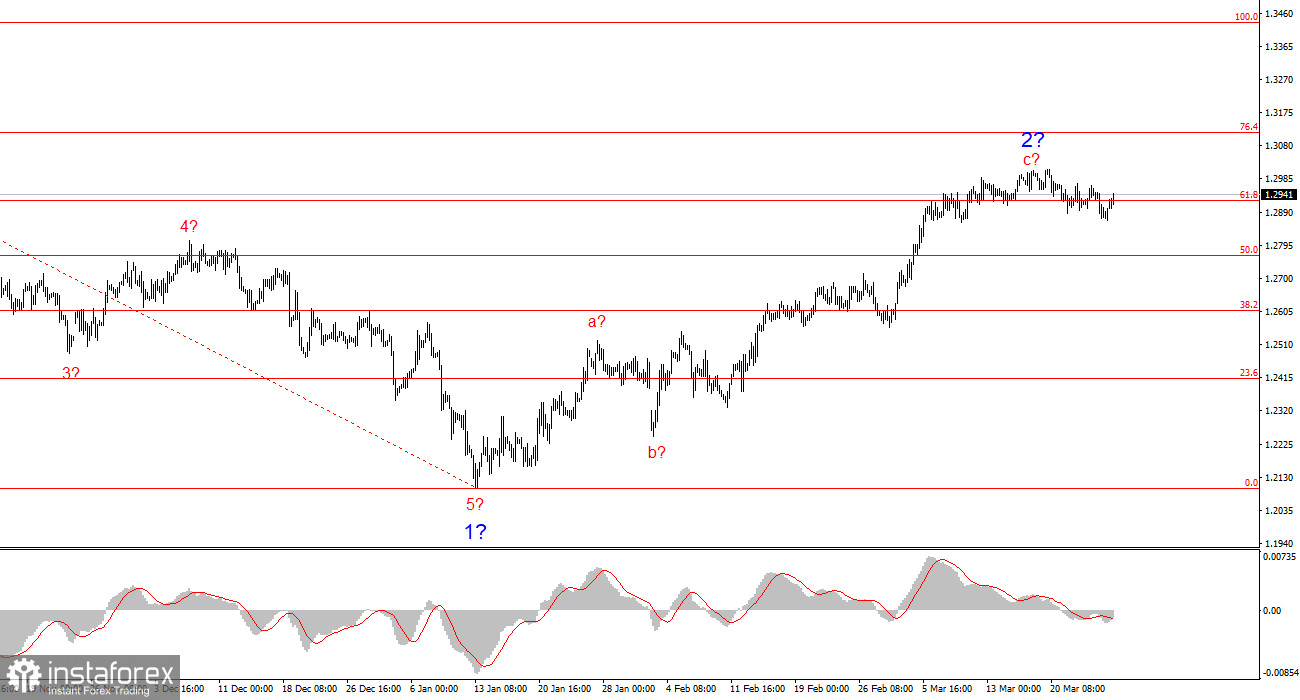

The wave structure for GBP/USD remains somewhat ambiguous but generally manageable. Currently, there is a high probability of a long-term bearish trend formation. Wave 5 has taken on a convincingAuteur: Chin Zhao

20:00 2025-04-01 UTC+2

2

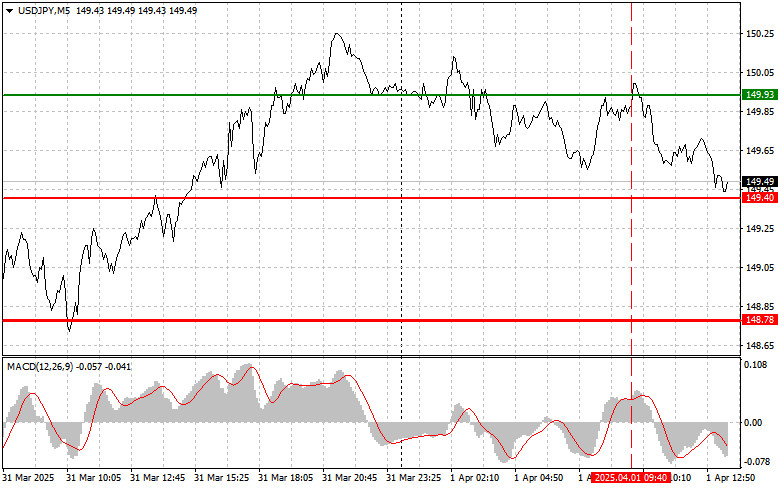

Trade Review and Japanese Yen Trading Recommendations The test of the 149.93 level occurred at a time when the MACD indicator had already moved significantly above the zero line, limitingAuteur: Jakub Novak

19:58 2025-04-01 UTC+2

2

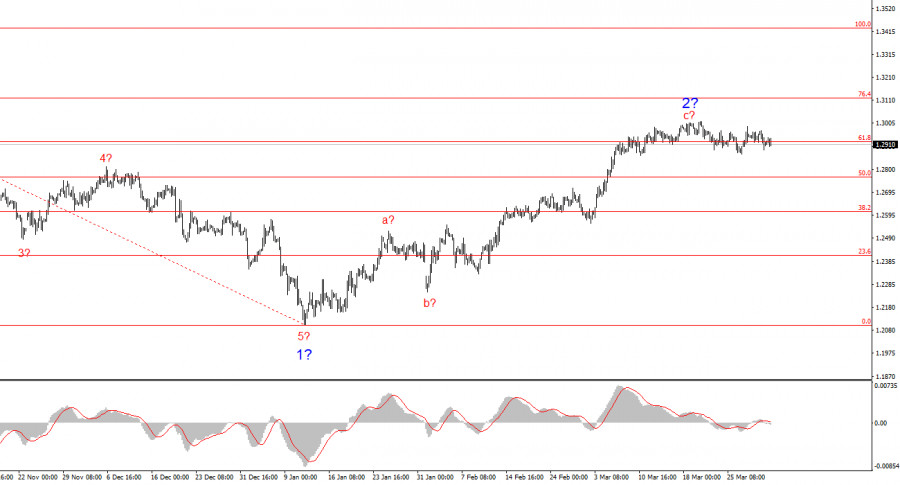

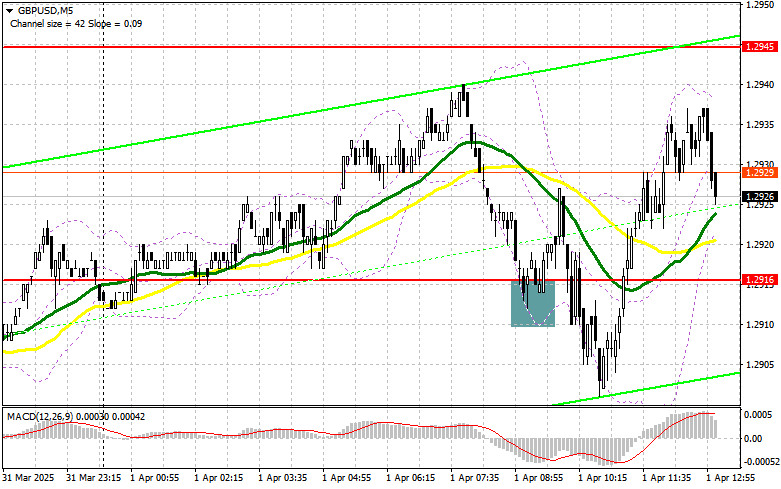

- Trade Review and British Pound Trading Recommendations The test of the 1.2925 level occurred just as the MACD indicator was beginning to move down from the zero line, confirming

Auteur: Jakub Novak

19:55 2025-04-01 UTC+2

1

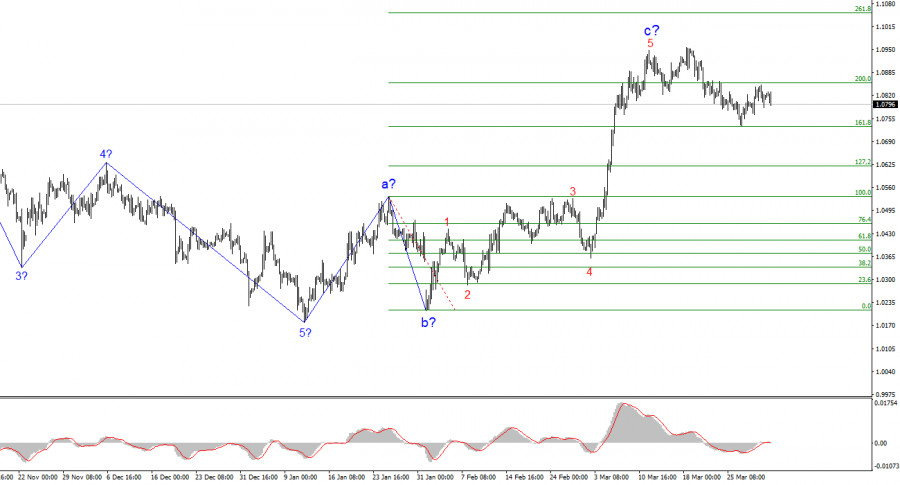

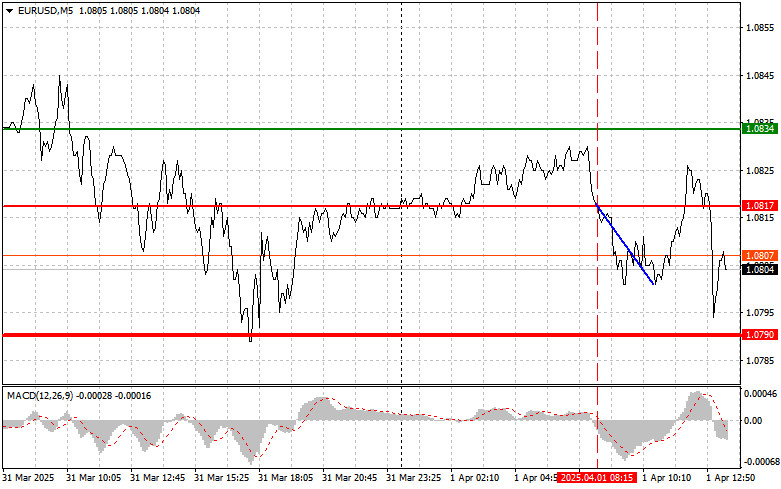

Trade Review and Euro Trading Recommendations The test of the 1.0817 price level coincided with the MACD indicator just beginning to move downward from the zero line, which confirmedAuteur: Jakub Novak

19:52 2025-04-01 UTC+2

1

In my morning forecast, I highlighted the level of 1.2916 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happenedAuteur: Miroslaw Bawulski

19:49 2025-04-01 UTC+2

3

- In my morning forecast, I highlighted the level of 1.0815 and planned to make market entry decisions based on it. Let's look at the 5-minute chart and analyze what happened

Auteur: Miroslaw Bawulski

19:31 2025-04-01 UTC+2

1

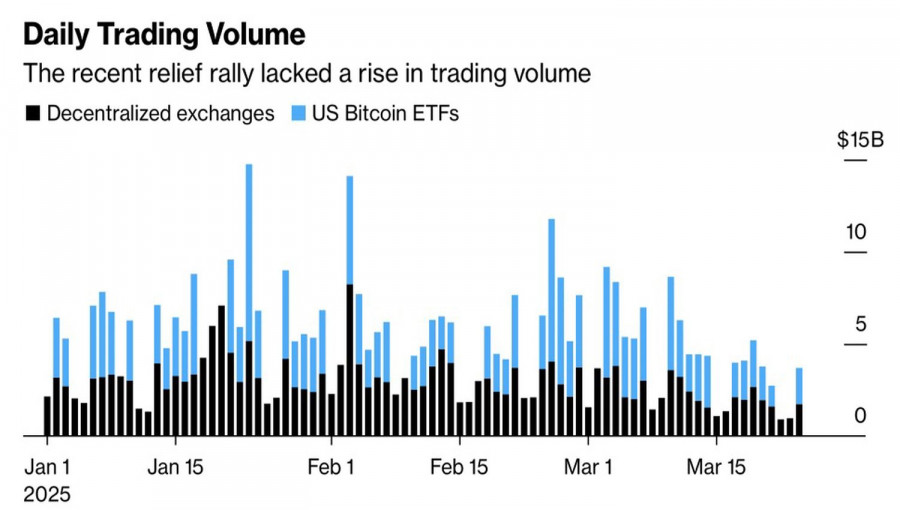

The bottom shows no strength, the top has no desire. Even the so-called "smart money" is not rushing to buy Bitcoin, citing a confluence of negative factors. Tepid trading activityAuteur: Marek Petkovich

15:58 2025-04-01 UTC+2

12

Technical analysisTrading Signals for EUR/USD for April 1-3, 2025: sell below 1.0804 (21 SMA - 8/8 Murray)

Early in the American session, the euro is trading around 1.0791, undergoing a technical correction after reaching the top of the downtrend channel formed on March 14 and showing signsAuteur: Dimitrios Zappas

15:06 2025-04-01 UTC+2

9