- S&P 500 Overview for April 8 US market: real reason behind Trump's tariffs revealed. Part 1 Major US indices on Monday: Dow -0.9%, NASDAQ +0.1%, S&P 500 -0.2%, S&P

Auteur: Jozef Kovach

13:50 2025-04-08 UTC+2

1

S&P 500 Overview for April 8 US market sees sharp rebound. Part 2 Major US indices on Monday: Dow -0.9%, NASDAQ +0.1%, S&P 500 -0.2%, S&P 500: 5,062, trading rangeAuteur: Jozef Kovach

13:04 2025-04-08 UTC+2

3

In an interview yesterday, BlackRock CEO Larry Fink warned that equity markets may still have room to fall, possibly by as much as 20%. However, he also framed the declineAuteur: Jakub Novak

12:27 2025-04-08 UTC+2

9

- Analytical News

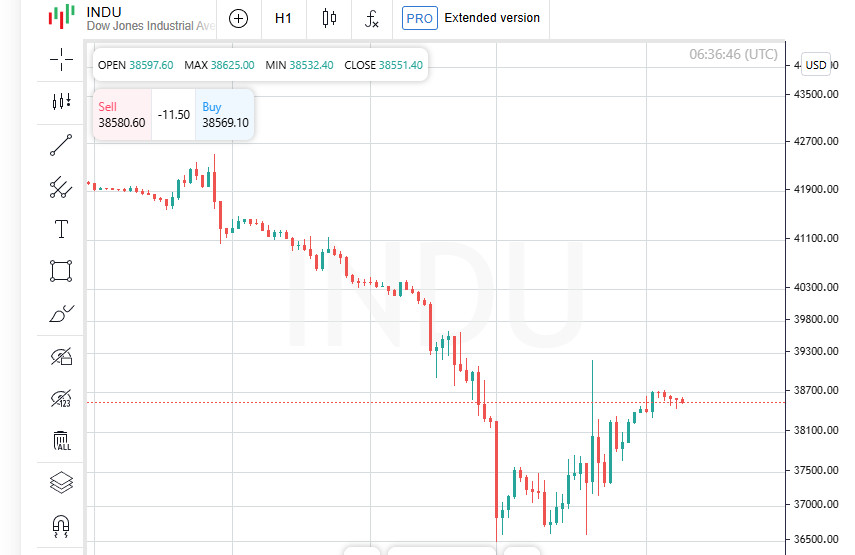

Markets on roller coaster: Dow plummets, gold rallying, Trump keeps investors on edge

The changes in Wall Street indices for the last 24 hours: the S&P 500 fell by 0.23%, the Nasdaq rose by 0.10%, and the Dow dropped by 0.91%. The S&PAuteur:

12:25 2025-04-08 UTC+2

3

The Trump administration's latest wave of tariffs is reshaping economic expectations. Goldman Sachs is now forecasting a recession within the next 12 months, while JPMorgan analysts are pricingAuteur: Ekaterina Kiseleva

12:14 2025-04-08 UTC+2

7

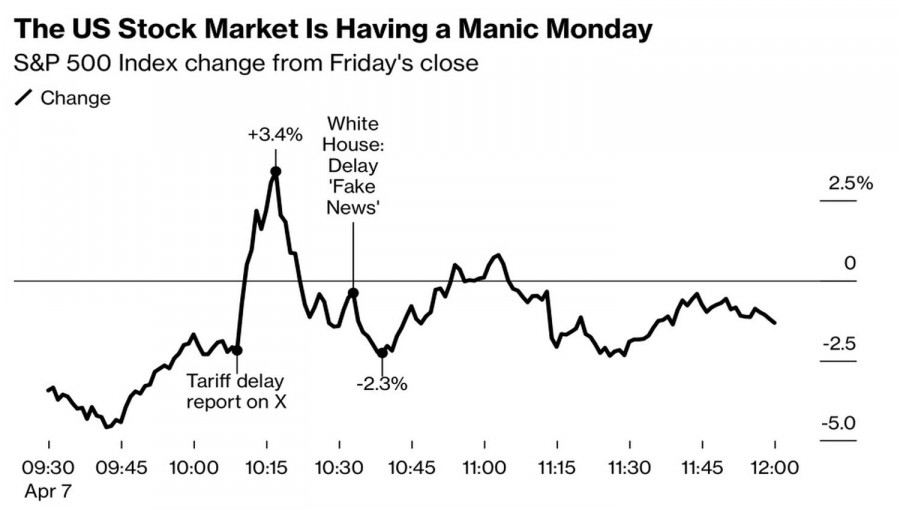

The world is a stage, and people are its actors. Tragicomedies happen every day in financial markets, but what happened at the start of the second week of AprilAuteur: Marek Petkovich

11:49 2025-04-08 UTC+2

11

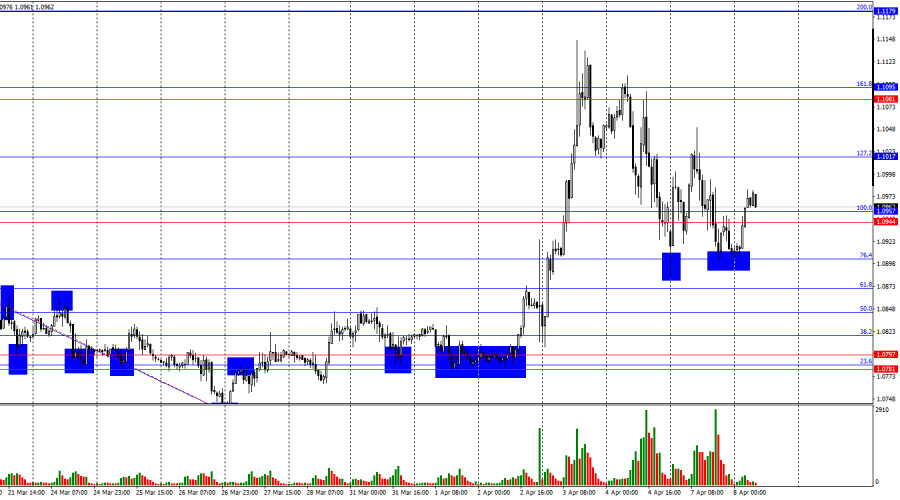

- On Monday, the EUR/USD pair made two rebounds from the 76.4% retracement level, turned in favor of the euro, and consolidated above the 1.0944–1.0957 zone. As a result, the upward

Auteur: Samir Klishi

10:57 2025-04-08 UTC+2

17

On the hourly chart, the GBP/USD pair continued its decline on Monday and ended the day near the 1.2709 level. Over just two trading days, the pound dropped by roughlyAuteur: Samir Klishi

10:53 2025-04-08 UTC+2

11

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAuteur: Sebastian Seliga

10:50 2025-04-08 UTC+2

13