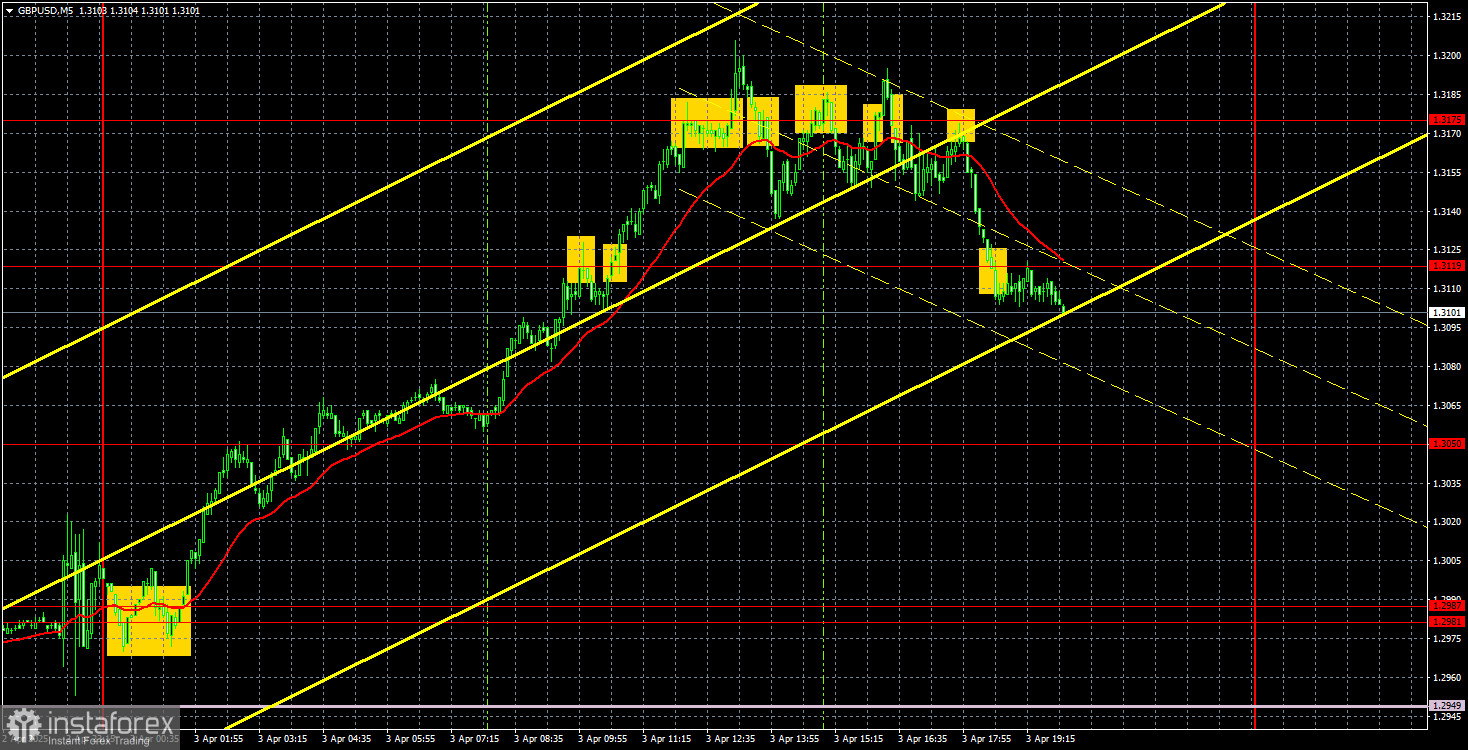

GBP/USD 5-Minute Analysis

The GBP/USD currency pair also showed a strong upward movement on Thursday. Naturally, this was driven by just one factor. Late Wednesday evening, Donald Trump announced introducing new tariffs on all countries that export goods to the U.S. The base rate will be 10%, but individual tariffs will apply to several countries. Trump has already implemented several tariff packages against China and the European Union. This shows that the U.S. president is not concerned with the fairness of these tariffs. He has a clear goal — to balance the trade deficit, bring manufacturing back to the U.S., and increase job creation. And he is pursuing this goal. Meanwhile, the dollar is falling sharply as the market has responded decisively to the question: "What does it think about Trump's tariffs?"

On Friday, Federal Reserve Chair Jerome Powell is scheduled to speak in the U.S. Powell will likely try to stabilize the situation in the currency market. Remembering that Trump's tariffs will almost certainly trigger inflation worldwide. Therefore, instead of one or two rate cuts in 2025, the Fed is more likely to forgo any easing. If Powell confirms this hypothesis, the dollar could recover slightly. However, if Powell talks about a recession, serious risks to the U.S. economy, and hints at deeper monetary easing, the dollar could again plummet.

All of Thursday's trading signals could have been traded using one simple strategy — buy anywhere, exit anywhere. All levels were ignored throughout the day, and the signals that formed were largely coincidental. The pair spent half the day rising and correcting with very high volatility. We treat such movements with extreme caution.

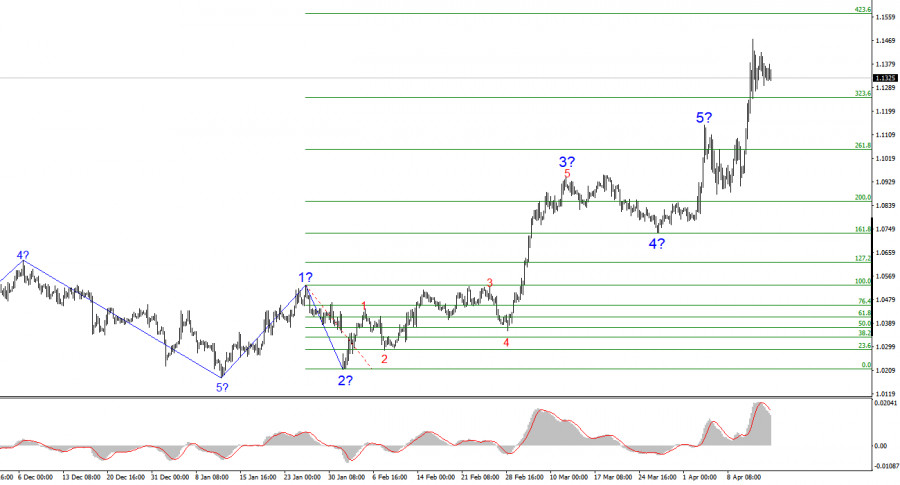

COT Report

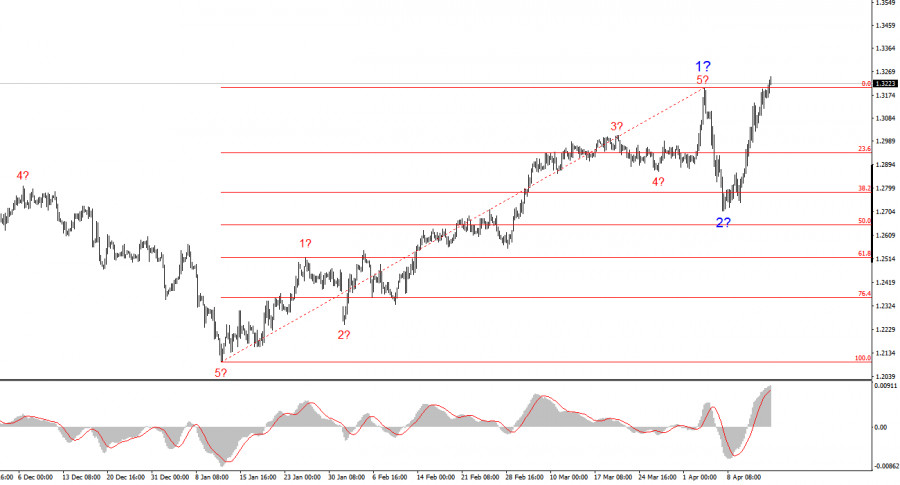

The COT reports for the British pound show that commercial traders' sentiment has constantly shifted in recent years. The red and blue lines, which reflect the net positions of commercial and non-commercial traders, frequently cross and usually stay close to the zero line. They are again near each other, indicating a roughly equal number of long and short positions.

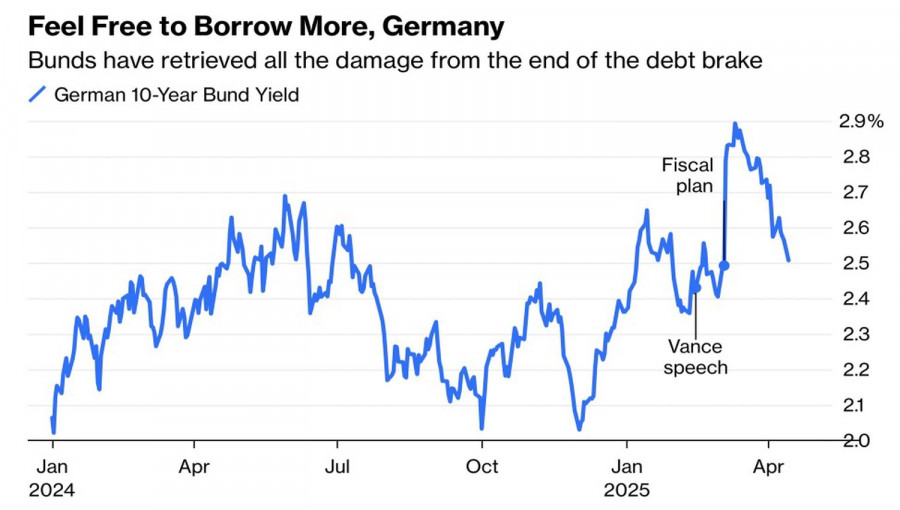

On the weekly timeframe, the price first broke through the 1.3154 level and then dropped to the trendline, which it successfully breached. Breaking the trendline suggests a high probability of further GBP decline. However, the bounce from the previous local low on the weekly timeframe is also worth noting. We may be looking at a broad flat.

According to the latest COT report for the British pound, the "Non-commercial" group opened 13,000 new long contracts and closed 1,800 short contracts. As a result, the net position of non-commercial traders rose again—by 14,800 contracts.

The fundamental background still provides no grounds for long-term GBP purchases, and the currency remains vulnerable to continuing the global downtrend. The pound has risen significantly recently, and the primary reason for this increase is Donald Trump's policy.

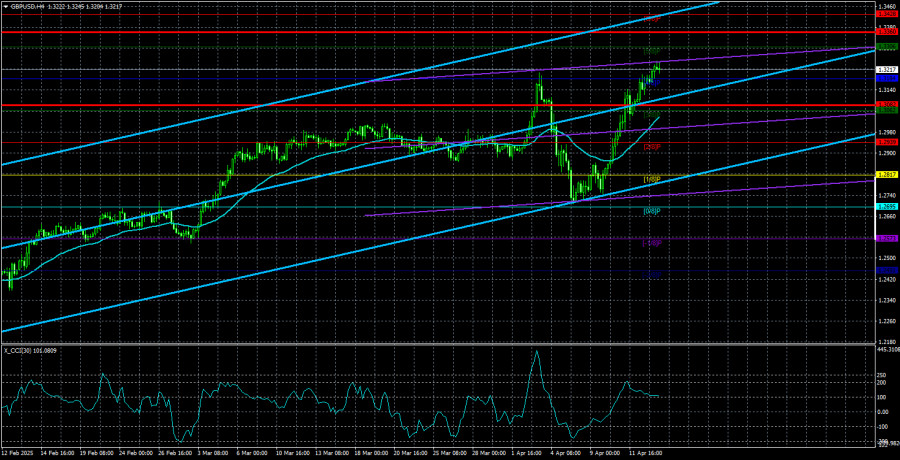

GBP/USD 1-Hour Analysis

GBP/USD showed a powerful surge in the hourly timeframe after nearly a month of flat trading. Despite the British pound rising for three months, it bears no credit for this upward movement. The entire uptrend is simply the result of the dollar's decline, driven by Donald Trump. What's most interesting is that this movement could end any moment, no matter how strong and stable it may seem. All of Trump's actions in recent months have only muddied the technical picture on higher timeframes.

For April 4, we highlight the following important levels: 1.2511, 1.2605–1.2620, 1.2691–1.2701, 1.2796–1.2816, 1.2863, 1.2981–1.2987, 1.3050, 1.3119, 1.3175, 1.3222, 1.3273, 1.3358. The Senkou Span B line (1.2939) and the Kijun-sen line (1.3042) may also serve as signal sources. A Stop Loss order is recommended to be set to breakeven once the price moves 20 pips in the correct direction. Remember that the Ichimoku indicator lines can shift throughout the day, which should be considered when interpreting signals.

No significant events are scheduled in the UK on Friday, while the U.S. will see events and reports that could spark another storm. Trying to predict where the pair will be by the weekend close is pointless. No one knows in advance what Powell will say or what the Nonfarm Payroll and unemployment figures will be. A correction would seem logical — but we already saw one Thursday evening. And logic is not exactly the main driving force in the market right now.

Illustration Explanations:

- Support and Resistance Levels (thick red lines): Thick red lines indicate where movement may come to an end. Please note that these lines are not sources of trading signals.

- Kijun-sen and Senkou Span B Lines: Ichimoku indicator lines transferred from the 4-hour timeframe to the hourly timeframe. These are strong lines.

- Extreme Levels (thin red lines): Thin red lines where the price has previously bounced. These serve as sources of trading signals.

- Yellow Lines: Trendlines, trend channels, or any other technical patterns.

- Indicator 1 on COT Charts: Represents the net position size for each category of traders.