- Technical analysis

Technical Analysis of Price Movement of Silver Commodity Instrument, Thursday April 24, 2025.

On the 4-hour chart, the Silver commodity instrument is visible even though its condition is strengthening where this is confirmed by the movement of the Silver price which is movingAuteur: Arief Makmur

06:18 2025-04-24 UTC+2

1

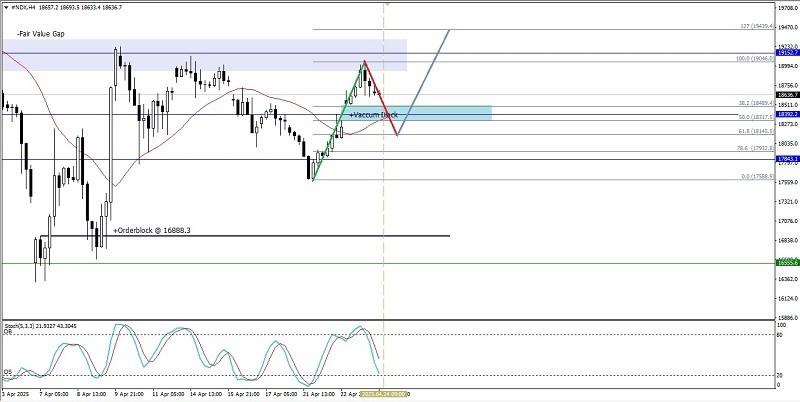

Technical analysisTechnical Analysis of Price Movement of Nasdaq 100 Index, Thursday April 24, 2025.

Although on the 4-hour chart the Nasdaq 100 index is Sideways, the range is quite large so that there is still a fairly promising opportunity in the index. CurrentlyAuteur: Arief Makmur

06:18 2025-04-24 UTC+2

1

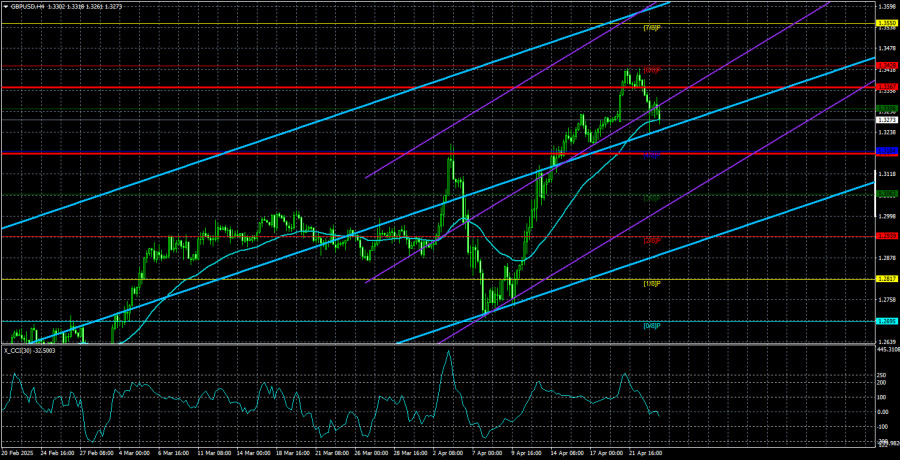

On Wednesday, the GBP/USD currency pair managed to avoid a substantial decline, although the day before, it seemed that a downtrend was finally beginning. However, the market quickly bounced backAuteur: Paolo Greco

03:16 2025-04-24 UTC+2

4

- The EUR/USD currency pair refrained from continuing its decline on Wednesday. As the saying goes, "Everything in moderation." The dollar gained around 200 pips on Tuesday, which shouldn't scare anyone

Auteur: Paolo Greco

03:16 2025-04-24 UTC+2

5

Trading planTrading Recommendations and Analysis for GBP/USD on April 24: De-escalation or False Alarm?

On Wednesday, the GBP/USD currency pair followed the same trend as the EUR/USD pair. The British pound also plummeted sharply overnight following two statements from Donald Trump, then quickly recoveredAuteur: Paolo Greco

03:16 2025-04-24 UTC+2

8

Trading planTrading Recommendations and Analysis for EUR/USD on April 24: Chaos in the Market Persists

The EUR/USD currency pair traded in both directions throughout Wednesday, constantly changing its trajectory. The trading day began with a price collapse following Donald Trump's announcement that he wouldAuteur: Paolo Greco

03:16 2025-04-24 UTC+2

12

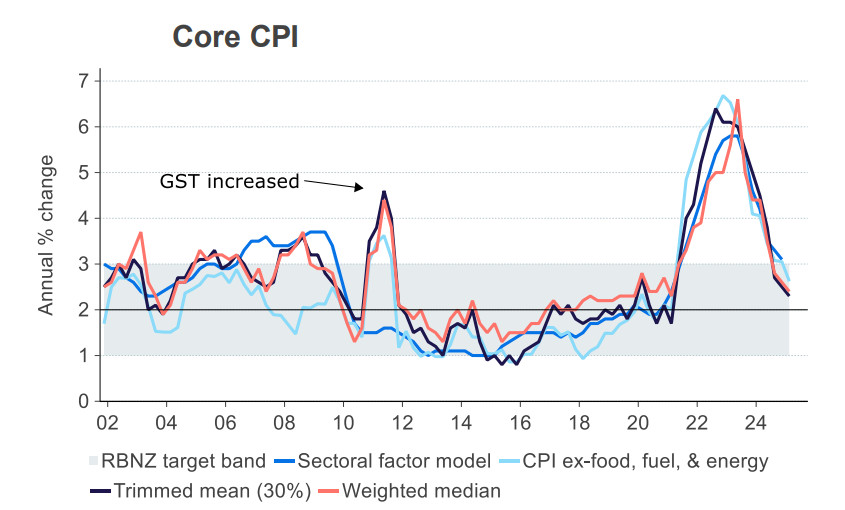

- Inflation in New Zealand in Q1 came in slightly above expectations, rising from 2.2% to 2.5% year-over-year. This was mainly due to the goods sector, while core inflation is slowing

Auteur: Kuvat Raharjo

00:59 2025-04-24 UTC+2

9

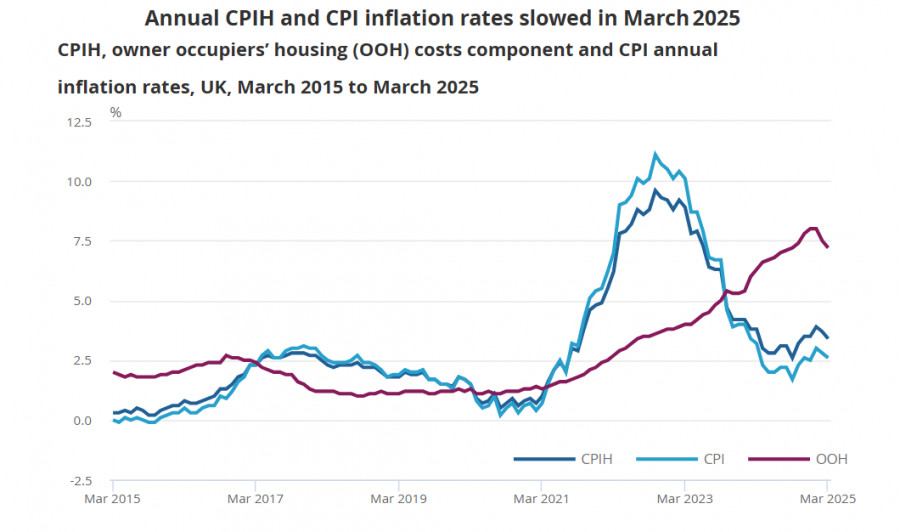

Inflationary pressure in the UK is gradually easing but remains elevated. In March, the core index fell from 3.5% to 3.4% year-over-year, while the headline CPI dropped from 2.8%Auteur: Kuvat Raharjo

00:59 2025-04-24 UTC+2

12

There will be no winners in trade wars. The U.S. will suffer due to a loss of trust in the dollar and other American assets, while Europe will suffer fromAuteur: Marek Petkovich

00:59 2025-04-24 UTC+2

14