- The S&P 500 and Nasdaq ended the previous trading session higher, defying choppy performance across Asian and European exchanges. Investors are now focused on the upcoming economic data and earnings

Auteur: Ekaterina Kiseleva

11:31 2025-04-28 UTC+2

0

Trump policy summaries European stocks rose on Monday after a second straight weekly gain Investors are eyeing tariff changes, as well as a busy week of earnings and economic dataAuteur: Thomas Frank

11:22 2025-04-28 UTC+2

3

Wave analysisWeekly Forecast Based on Simplified Wave Analysis for GBP/USD, AUD/USD, USD/CHF, EUR/JPY, AUD/JPY, and US Dollar Index — April 28th

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatilityAuteur: Isabel Clark

09:32 2025-04-28 UTC+2

15

- Wave analysis

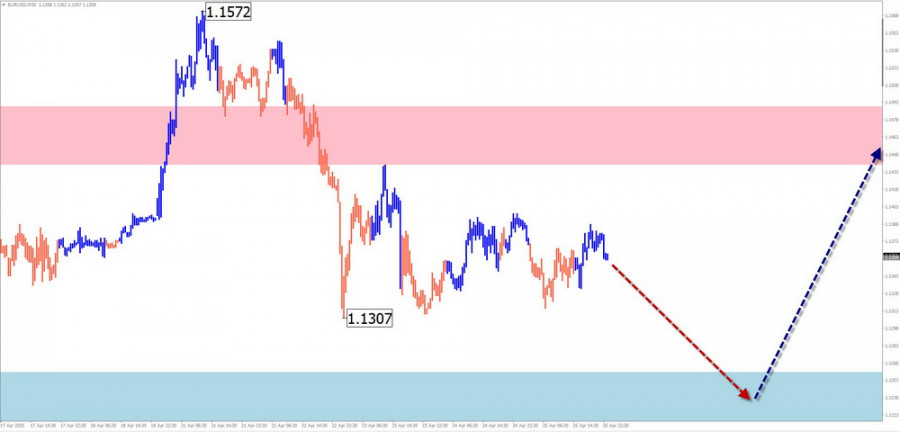

Weekly Forecast Based on Simplified Wave Analysis for EUR/USD, USD/JPY, GBP/JPY, USD/CAD, NZD/USD, and GOLD — April 28th

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the startAuteur: Isabel Clark

09:28 2025-04-28 UTC+2

26

Officials at the European Central Bank are preparing for further interest rate cuts, anticipating that U.S. tariff policies will inflict serious and prolonged damage on the economy, evenAuteur: Jakub Novak

09:24 2025-04-28 UTC+2

14

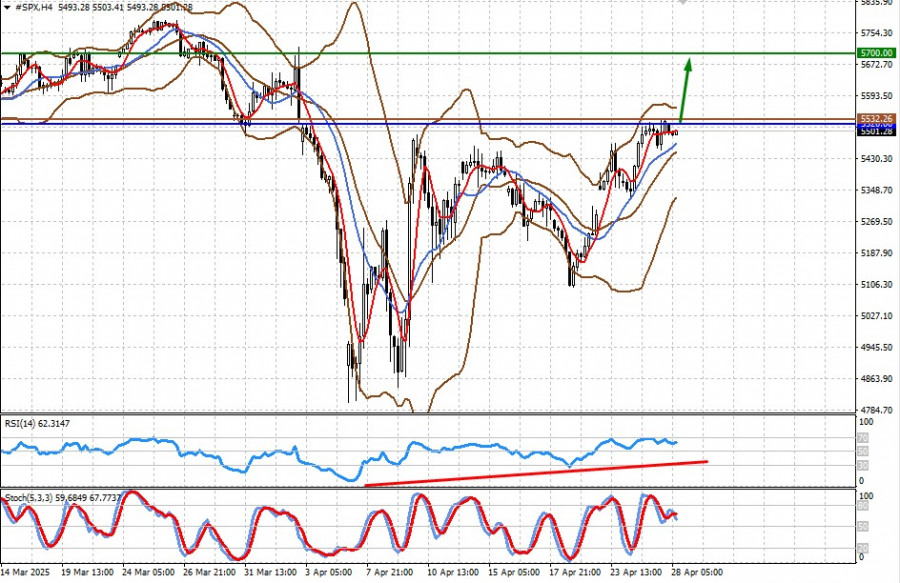

Fundamental analysisThe Upcoming Week May Be Positive for Markets but Negative for the Dollar and Gold (we expect further growth in CFD contracts for S&P 500 futures and Bitcoin)

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to? Amid the geopoliticalAuteur: Pati Gani

09:12 2025-04-28 UTC+2

9

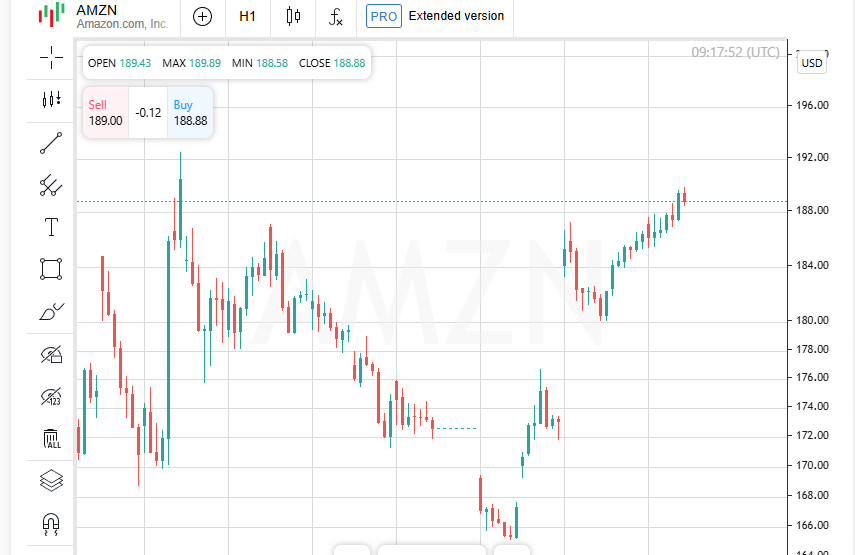

- In the previous regular session, U.S. stock indices closed higher. The S&P 500 gained 0.74%, the Nasdaq 100 rose 1.26%, and the Dow Jones Industrial Average edged up by 0.05%

Auteur: Jakub Novak

09:06 2025-04-28 UTC+2

13

Bitcoin is being pressured, but it still holds up quite confidently. After rebounding from the $92,000 mark, the first cryptocurrency returned to the $94,000 area, maintaining good growth prospectsAuteur: Miroslaw Bawulski

08:19 2025-04-28 UTC+2

8

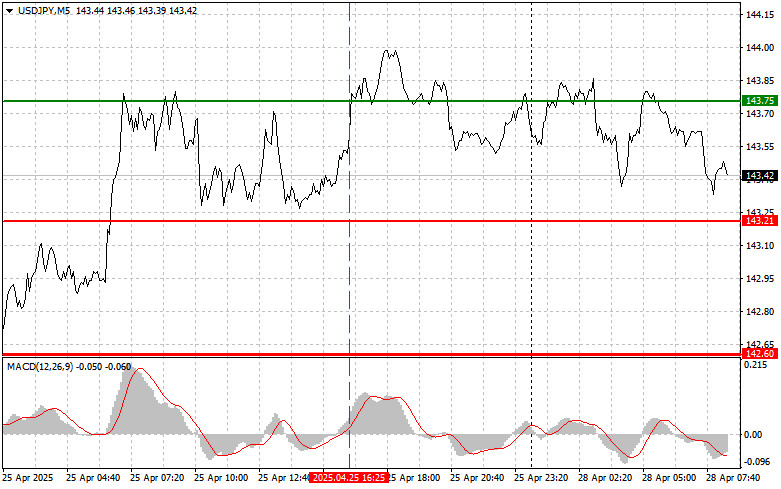

ForecastUSD/JPY: Simple Trading Tips for Beginner Traders on April 28. Review of Yesterday's Forex Trades

The price test at 143.75 occurred when the MACD indicator had already moved significantly above the zero line, which, in my view, limited the pair's upside potential. For this reasonAuteur: Jakub Novak

08:19 2025-04-28 UTC+2

20