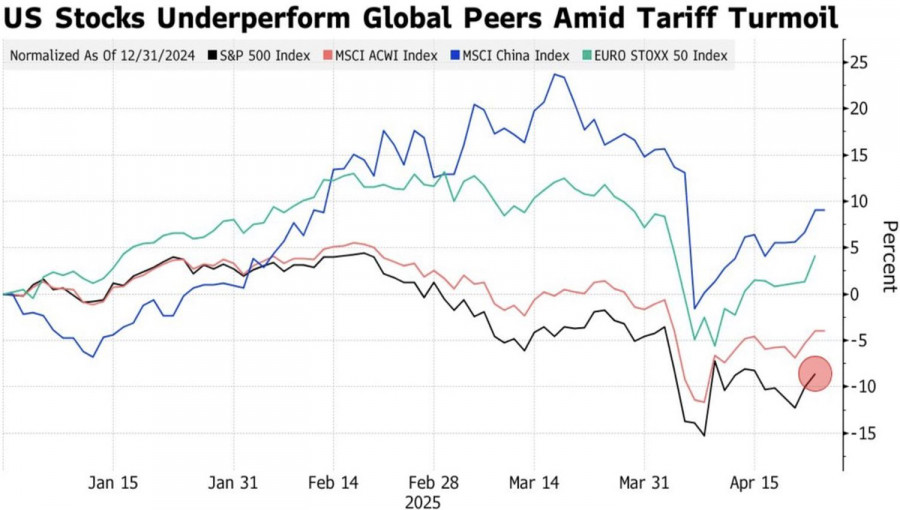

- The market is showing heightened sensitivity to any good news, but its best days are behind it. The value of US equities as a percentage of the MSCI All Country

Auteur: Marek Petkovich

11:42 2025-04-24 UTC+2

3

The Japanese yen maintains a bullish tone despite certain headwinds and remains in focus as renewed global risk aversion fuels demand for safe-haven assets. Diminishing hopes for a swift resolutionAuteur: Irina Yanina

11:35 2025-04-24 UTC+2

12

Gold is showing positive momentum as it attempts to hold above the $3300 level, indicating growing investor interest in this traditional safe-haven asset. The uncertainty surrounding U.S.-China trade relations—highlightedAuteur: Irina Yanina

11:33 2025-04-24 UTC+2

18

- According to a senior official at the European Central Bank, President Donald Trump has drawn the entire world into a game where everyone ends up losing — referring

Auteur: Jakub Novak

11:21 2025-04-24 UTC+2

31

The U.S. dollar surged sharply against most major currencies after President Donald Trump stated that he plans to be very "courteous" with China in any trade talks and that tariffsAuteur: Jakub Novak

11:16 2025-04-24 UTC+2

28

US stock indices, including the S&P 500 and Nasdaq 100, posted solid gains on optimism about progress in trade negotiations. Despite the lack of a clear position from the WhiteAuteur: Ekaterina Kiseleva

11:05 2025-04-24 UTC+2

0

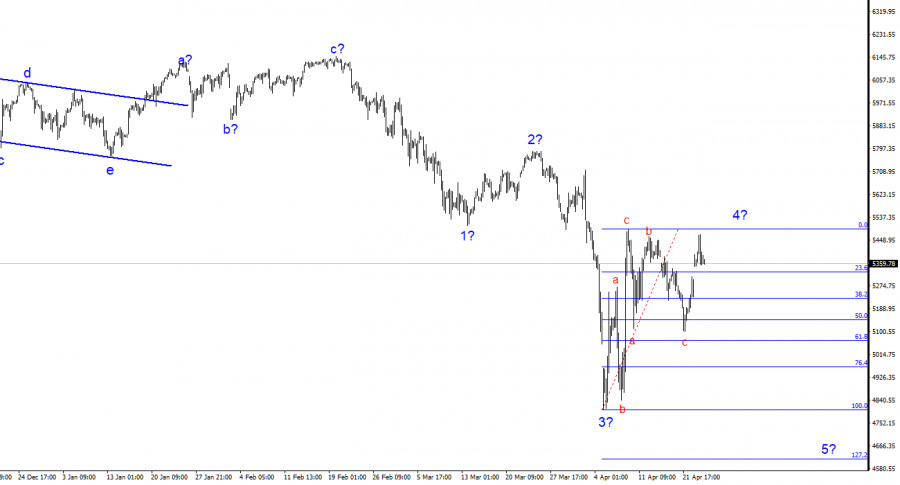

- The wave pattern on the 24-hour chart for #SPX is generally clear. The global five-wave structure doesn't even fit on the terminal screen at the smallest scale. In simple terms

Auteur: Chin Zhao

10:34 2025-04-24 UTC+2

12

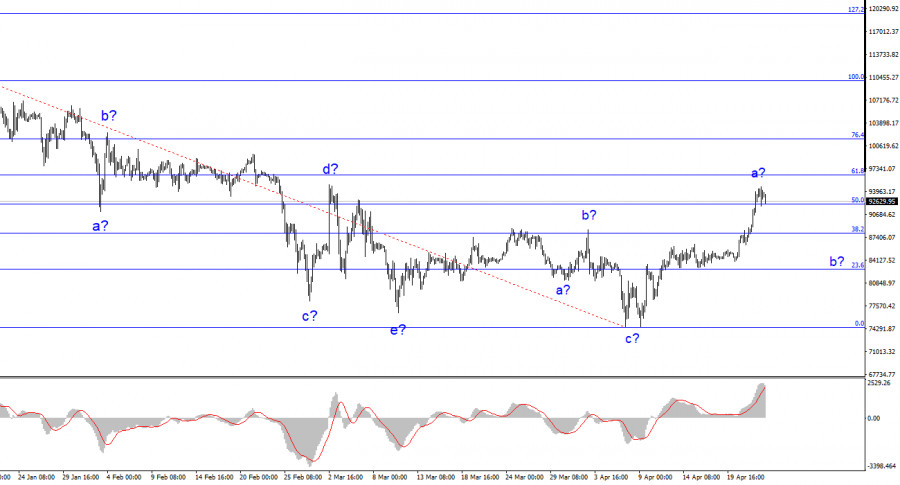

The wave pattern on the 4-hour chart for BTC/USD has become somewhat more complex. We observed a corrective downward structure that completed its formation around the $75,000 mark. Following thisAuteur: Chin Zhao

10:15 2025-04-24 UTC+2

14

While Donald Trump is attempting to reach an understanding with China, Federal Reserve Governor Adriana Kugler stated that the current tariff policy is likely to exert upward pressure on pricesAuteur: Jakub Novak

10:05 2025-04-24 UTC+2

13