Melding van nieuwe economische publicaties

Praktijkhandelaren moeten veel tijd besteden aan het zoeken naar nuttige informatie over financiële markten, bijvoorbeeld hoogwaardige analyses, nieuwe strategieën en ideeën. Wij hebben je gedekt. Voor onze klanten selecteren we de belangrijkste en interessante gebeurtenissen uit de wereld van Forex. Wij leveren nieuws aan onze lezers.

InstaSpot Company brengt actief een systeem in actie om bestaande en potentiële cliënten te informeren over het economische nieuws.

U kunt gratis e-mails ontvangen over releases die gepland staan in de economische kalender.

Bovendien kunt u een tijd instellen tussen het e-mailen en de publicatie van dit nieuws op de website van InstaSpot Company.

Meldingen zullen u zeker helpen bij het maken van trading beslissingen.

De procedure voor het abonneren op @instaforex is heel eenvoudig en kost een paar minuten van uw tijd.

Zorg ervoor dat u onze aanwijzingen volgt:

- voer de Telegram-toepassing uit die u al hebt geïnstalleerd;

- voer @instaforex in het zoekveld in;

- klik op de optie "join" in het menu onderaan in het scherm.

Nu bent u geabonneerd op het InstaSpot-kanaal, dat u dagelijkse analyses en forex-updates bezorgt.

Zie ook

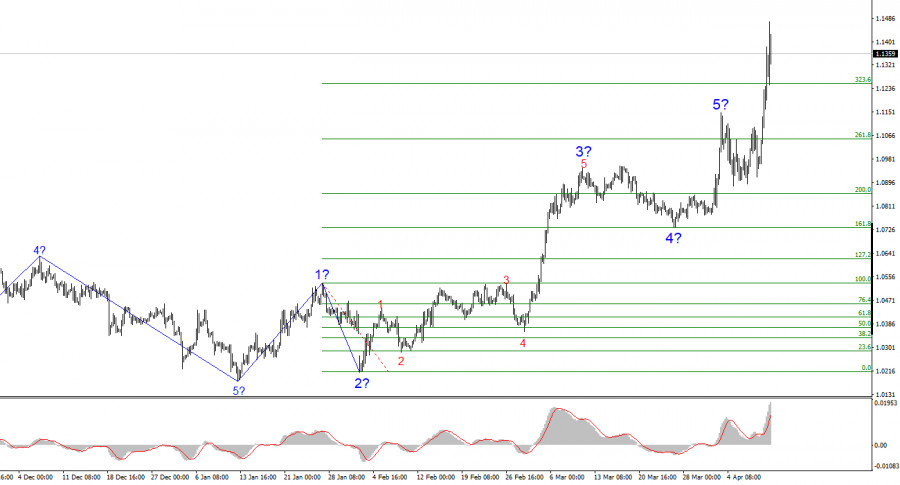

- The wave structure on the 4-hour EUR/USD chart has transformed into a bullish one. I believe there's no doubt that this transformation occurred solely due to the United States'

Auteur: Chin Zhao

18:33 2025-04-11 UTC+2

80

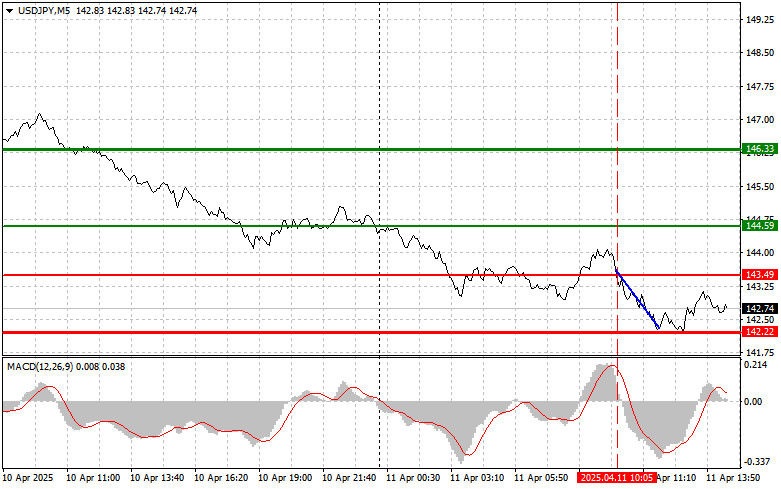

Trade Analysis and Advice for Trading the Japanese Yen The test of the 143.49 price level coincided with the moment the MACD indicator had just started moving downward fromAuteur: Jakub Novak

18:26 2025-04-11 UTC+2

55

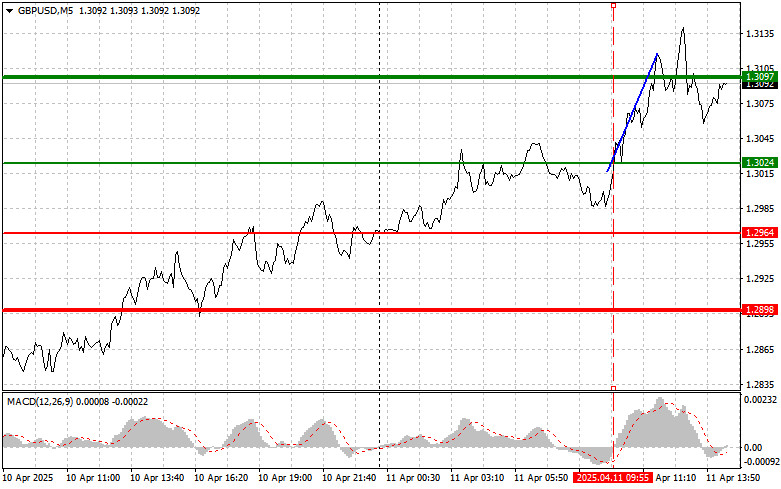

Trade Breakdown and Tips for Trading the British Pound The test of the 1.3024 price level occurred just as the MACD indicator was beginning to move upward from the zeroAuteur: Jakub Novak

18:22 2025-04-11 UTC+2

53

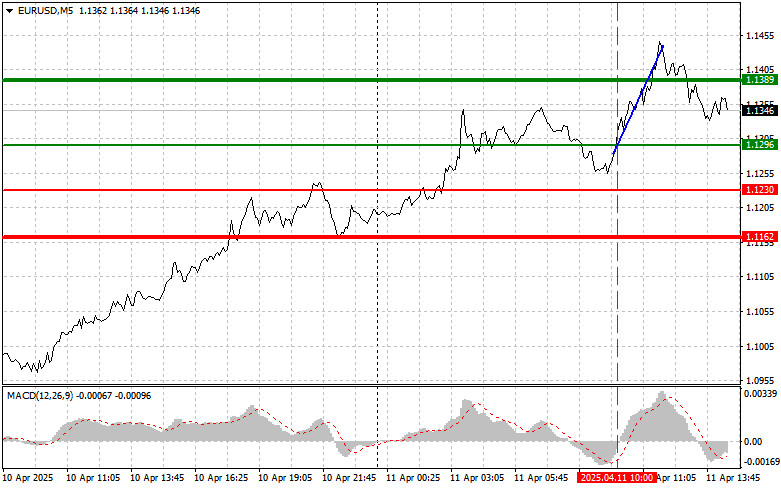

- Trade Analysis and Tips for the Euro The test of the 1.1296 price level occurred when the MACD indicator was just starting to move upward from the zero mark, which

Auteur: Jakub Novak

18:20 2025-04-11 UTC+2

54

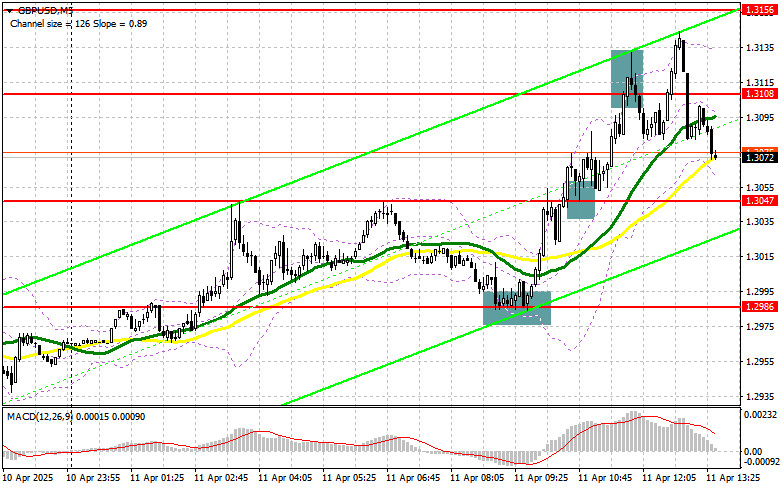

Trading planGBP/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)

In my morning forecast, I highlighted the level of 1.2986 and planned to make market entry decisions from that point. Let's take a look at the 5-minute chart and breakAuteur: Miroslaw Bawulski

18:18 2025-04-11 UTC+2

49

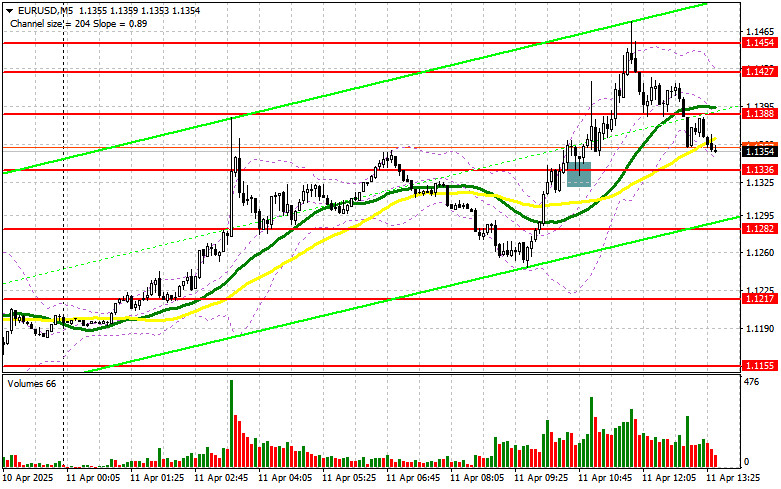

Trading planEUR/USD: Trading Plan for the U.S. Session on April 11th (Review of the Morning Trades)

In my morning forecast, I focused on the 1.1336 level and planned to make market entry decisions based on it. Let's take a look at the 5-minute chart and analyzeAuteur: Miroslaw Bawulski

18:15 2025-04-11 UTC+2

43

- Technical analysis

Trading Signals for EUR/USD for April 11-15, 2025: sell below 1.1470 (+2/8 Murray - overbought)

During the European session, the euro reached a new high around +2/8 Murray, located at 1.1473. This movement in EUR/USD occurred after the announcement by China's Ministry of Finance thatAuteur: Dimitrios Zappas

16:44 2025-04-11 UTC+2

88

Bitcoin and Ethereum plunged late yesterday but then managed to recover their positions. For now, the bears still have more strength than the buyers, but this may only be temporaryAuteur: Jakub Novak

16:38 2025-04-11 UTC+2

37

Technical analysisTrading Signals for GOLD (XAU/USD) for April 11-13, 2025: sell below $3,235 (+1/8 Murray - overbought)

Early in the American session, gold is undergoing a strong technical correction after reaching a new high around 3,237.69 for now. Economic data from the United States will be releasedAuteur: Dimitrios Zappas

16:04 2025-04-11 UTC+2

137

-

Three female policymakers to change political landscape in EU

Three female policymakers to change political landscape in EU -

Seven most vibrant places on earth

Seven most vibrant places on earth -

Top 5 most valuable assets of Donald Trump

Top 5 most valuable assets of Donald Trump -

Five inspiring forecasts for 2025

Five inspiring forecasts for 2025 -

Five billionaires who gained most wealth in 2024

Five billionaires who gained most wealth in 2024 -

Top five countries for wine tourism

Top five countries for wine tourism -

Wall Street legends: top 10 investors of all time

Wall Street legends: top 10 investors of all time

- 2025-04-13 20:21:04UK Shares Rise for 2nd SessionToon snel2025-04-13 20:21:04Week Ahead - Apr 14thToon snel2025-04-13 20:21:04Brazil’s Industrial Confidence Falls to Lowest Level Since 2020Toon snel2025-04-13 20:21:04Baltic Dry Index Rises, Still Posts Weekly DropToon snel2025-04-13 20:21:04Canadian Dollar Strengthens to 5-Month HighToon snel2025-04-13 20:21:04Poland Trade Balance Swings to Deficit in FebruaryToon snel2025-04-13 20:21:04US 10-Year Treasury Yield Tops 4.5%Toon snel2025-04-13 20:21:04US Stocks Remain VolatileToon snel2025-04-13 20:21:04TSX Poised Slight Weekly GainsToon snel2025-04-13 20:21:04US Consumer Sentiment Falls SharplyToon snel

- 2025-04-13 20:21:04China's March Loan Growth Shows Modest Uptick, Reaches 7.4%Toon snel2025-04-13 20:21:04China's March New Loan Surge Reveals Economic ThrustToon snel2025-04-13 20:21:04China's M2 Money Stock Growth Stagnates at 7.0% in March 2025Toon snel2025-04-13 20:21:04S&P Cuts Hungary's Outlook to NegativeToon snel2025-04-13 20:21:04S&P Upgrades Italy’s Credit Rating to BBB+Toon snel2025-04-13 20:21:04Ibovespa Posts Weekly GainsToon snel2025-04-13 20:21:04TSX Secures Weekly GainsToon snel2025-04-13 20:21:04Wall Street Rallies to End Volatile Week Amid Trade HopesToon snel2025-04-13 20:21:04New Zealand Dollar Sees Narrowing Bearish Positions as Speculative Net Positions ImproveToon snel2025-04-13 20:21:04Yen Speculative Net Positions Surge, Reflecting Increased Demand for Japan's CurrencyToon snel

- 2025-04-13 20:21:04Brazilian Real Speculative Positions Surge as CFTC Data Shows IncreaseToon snel2025-04-13 20:21:04Australian Dollar Speculative Net Positions Show Signs of StrengtheningToon snel2025-04-13 20:21:04Swiss Franc Speculative Positions Narrow, Signaling Market Sentiment ShiftToon snel2025-04-13 20:21:04CFTC Reports Decrease in Speculative Net Positions for Mexican PesoToon snel2025-04-13 20:21:04Canadian Dollar Sentiment Turns Slightly Less Bearish as CFTC Positions DeclineToon snel2025-04-13 20:21:04Speculative Net Positions in U.S. Wheat Market Show Significant ShiftToon snel2025-04-13 20:21:04Soybeans Speculative Net Positions Deepen in Downtrend, Reaching -16.8KToon snel2025-04-13 20:21:04Silver Sails: Speculative Net Positions See Significant Decline to 46.5K ContractsToon snel2025-04-13 20:21:04Speculative Net Positions in S&P 500: Speculators Increase Bearish Bets as Positions Dip to -28.7KToon snel2025-04-13 20:21:04Natural Gas Speculative Net Positions Improve as Negative Sentiment EasesToon snel

- 2025-04-13 20:21:04Speculative Surge: Nasdaq 100 Net Positions Jump by Nearly 60%Toon snel2025-04-13 20:21:04Sharp Decline in CFTC Gold Speculative Net Positions Amid Market ShiftsToon snel2025-04-13 20:21:04CFTC Crude Oil Speculative Positions Decline to 139.6K in Latest ReportToon snel2025-04-13 20:21:04Corn Futures Fluctuate as Speculative Positions Climb to 172.9K ContractsToon snel2025-04-13 20:21:04Copper Speculative Net Positions Drop to 24.2K, Lowest Since April’s StartToon snel2025-04-13 20:21:04Aluminum CFTC Speculative Positions Rise from 1.3K to 1.5K, Signaling Renewed Investor InterestToon snel2025-04-13 20:21:04Euro Bulls Charge Ahead as CFTC Net Positions Rise to 60.0KToon snel2025-04-13 20:21:04Speculative Net Positions for the British Pound Decline Significantly, Latest CFTC Data RevealsToon snel2025-04-13 20:21:04Oil Rebounds Amid Geopolitical Tensions, But Weekly Losses PersistToon snel2025-04-13 20:21:04Argentina Inflation Rises Above Estimates to 3.7% MoMToon snel

- 2025-04-13 20:21:04Uruguay Manufacturing Output at 4-month lowToon snel2025-04-13 20:21:04Argentina's Inflation Cools to 55.9% in March, Signaling Economic AdjustmentToon snel2025-04-13 20:21:04Argentina's CPI Surges in March: Inflation Concerns Rise with 3.7% Month-Over-Month IncreaseToon snel2025-04-13 20:21:04Argentina's Inflation Surge: National CPI Leaps to 3.70% in MarchToon snel2025-04-13 20:21:04Ecuador Achieves 14th Consecutive Trade SurplusToon snel2025-04-13 20:21:04U.S. Baker Hughes Total Rig Count Sees Slight Decline in Latest UpdateToon snel2025-04-13 20:21:04U.S. Baker Hughes Oil Rig Count Declines to 480Toon snel2025-04-13 20:21:04Russia Inflation Rises to 2-Year HighToon snel2025-04-13 20:21:04US Stocks Rise Amid Trade Tensions as Earnings Roll InToon snel2025-04-13 20:21:04European Stocks Close LowerToon snel

- 2025-04-13 20:21:04UK Shares Rise for 2nd SessionToon snel2025-04-13 20:21:04Week Ahead - Apr 14thToon snel2025-04-13 20:21:04Brazil’s Industrial Confidence Falls to Lowest Level Since 2020Toon snel2025-04-13 20:21:04Baltic Dry Index Rises, Still Posts Weekly DropToon snel2025-04-13 20:21:04Canadian Dollar Strengthens to 5-Month HighToon snel2025-04-13 20:21:04Poland Trade Balance Swings to Deficit in FebruaryToon snel2025-04-13 20:21:04US 10-Year Treasury Yield Tops 4.5%Toon snel2025-04-13 20:21:04US Stocks Remain VolatileToon snel2025-04-13 20:21:04TSX Poised Slight Weekly GainsToon snel2025-04-13 20:21:04US Consumer Sentiment Falls SharplyToon snel

- 2025-04-13 20:21:04China's March Loan Growth Shows Modest Uptick, Reaches 7.4%Toon snel2025-04-13 20:21:04China's March New Loan Surge Reveals Economic ThrustToon snel2025-04-13 20:21:04China's M2 Money Stock Growth Stagnates at 7.0% in March 2025Toon snel2025-04-13 20:21:04S&P Cuts Hungary's Outlook to NegativeToon snel2025-04-13 20:21:04S&P Upgrades Italy’s Credit Rating to BBB+Toon snel2025-04-13 20:21:04Ibovespa Posts Weekly GainsToon snel2025-04-13 20:21:04TSX Secures Weekly GainsToon snel2025-04-13 20:21:04Wall Street Rallies to End Volatile Week Amid Trade HopesToon snel2025-04-13 20:21:04New Zealand Dollar Sees Narrowing Bearish Positions as Speculative Net Positions ImproveToon snel2025-04-13 20:21:04Yen Speculative Net Positions Surge, Reflecting Increased Demand for Japan's CurrencyToon snel

InstaForex – Prime Sponsor of Traders Fair Lagos 2025!

InstaForex is proud to announce its participation in Traders Fair Lagos 2025 – one of the biggest financial events in Africa. As the Prime Sponsor, we warmly invite all traders, investors, and partners to visit our booth for unique opportunities, exclusive bonuses, and expert consultations. Why you can’t miss this event Traders Fair Lagos 2025 is not just an exhibition. It is a global platform to connect with leading financial experts. This event brings together traders, brokers, analysts, and investors from all over the world to explore trends, strategies, and technologies shaping the future of financial markets.

De berichtenservice van Telegram is populair en tegenwoordig een van de belangrijkste bronnen voor financiële informatie. InstaSpot heeft ook een eigen kanaal gelanceerd voor Telegram-gebruikers. Handelaren hebben dus al de nieuwe koerier gezien die onmiddellijk analytische artikelen, economisch en politiek nieuws levert. Je kunt je ook abonneren op het InstaSpot-kanaal dat je op de hoogte houdt van recente ontwikkelingen in Forex. Zorg er dus voor dat je regelmatig je mobiele telefoon nakijkt voor updates.

De nieuwe messenger is vooral handig voor mensen die hun tijd op prijs stellen. Waar wacht je op? Abonneer je op het InstaSpot-kanaal @instaforex.