- برطانوی پاؤنڈ کے لیے تجارتی جائزہ اور سفارشات یہ کہ 1.3077 کی قیمت کا امتحان ایسے وقت میں ہوا جب ایم اے سی ڈی اشارے پہلے ہی صفر کی لکیر

مصنف: Jakub Novak

21:02 2025-04-04 UTC+2

0

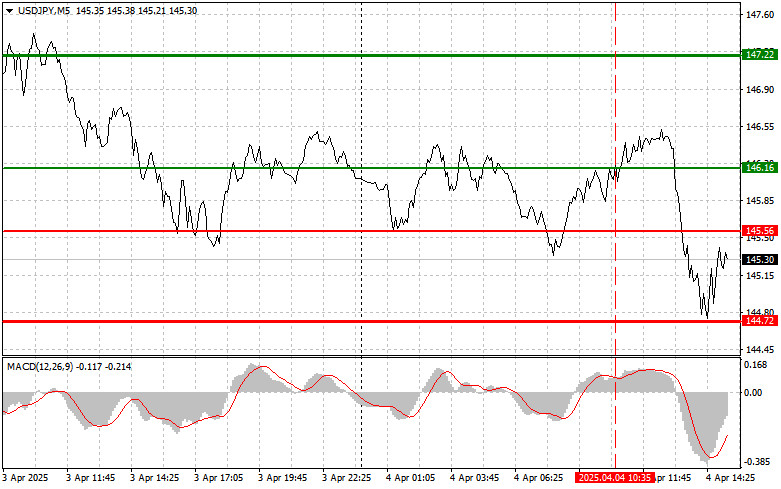

جاپانی ین کے لیے تجارتی جائزہ اور سفارشات یہ کہ 146.16 کی قیمت کا ٹیسٹ ایک ایسے لمحے میں ہوا جب ایم اے سی ڈی انڈیکیٹر پہلےمصنف: Jakub Novak

20:47 2025-04-04 UTC+2

0

تکنیکی تجزیہاپریل- 4-7 2025 کے لیے سونے (ایکس اے یو / یو ایس ڈی) کے لیے تجارتی سگنل: $3,120 سے نیچے فروخت کریں یا $3,025 سے اوپر خریدیں (21 ایس ایم اے - ریباؤنڈ)

دوسری طرف، 3,120 سے اوپر کا استحکام تیزی کے چکر کے دوبارہ شروع ہونے کا اشارہ دے سکتا ہے، اور سونا 3,167 کی بلند ترین سطح تک پہنچ سکتامصنف: Dimitrios Zappas

20:32 2025-04-04 UTC+2

0

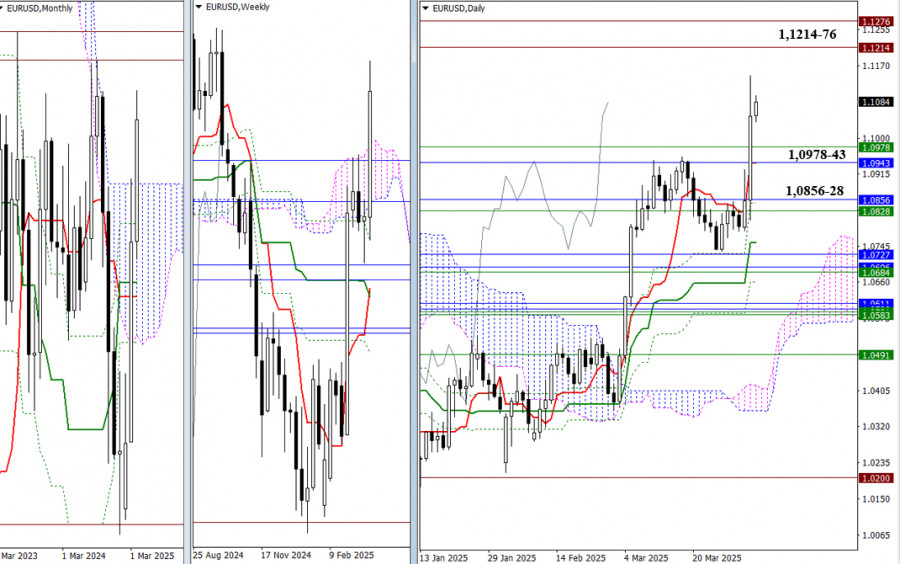

- کئی کوششوں اور تین ہفتوں کے استحکام کے بعد، بیلوں نے آخرکار ایک بریک آؤٹ شروع کیا، جس سے وہ کل ماہانہ (1.0943) اور ہفتہ وار (1.0978) ٹائم فریم

مصنف: Evangelos Poulakis

17:02 2025-04-04 UTC+2

1

ٹرمپ کے بڑے پیمانے پر محصولات نے وسیع مارکیٹ میں فروخت کو جنم دیا۔ ڈونلڈ ٹرمپ کی جانب سے نئے درآمدی محصولات کے اعلان کے بعد مارکیٹیں گر گئیں،مصنف: Ekaterina Kiseleva

16:38 2025-04-04 UTC+2

0

گراوٹ کے لیے کسی واضح بنیادی اتپریرک کی عدم موجودگی کے باوجود، سونا لگاتار دوسرے دن کچھ فروخت کنندگان کو اپنی طرف متوجہ کر رہا ہے۔ غالباً،مصنف: Irina Yanina

16:33 2025-04-04 UTC+2

0

- میکرو اکنامک رپورٹس کا تجزیہ: جمعے کے لیے صرف چند میکرو اکنامک ایونٹس شیڈول ہیں، لیکن وہ ایک نئے طوفان کو متحرک کر سکتے ہیں۔ بدھ کی شام کے واقعات

مصنف: Paolo Greco

14:05 2025-04-04 UTC+2

0

تجارتی منصوبہ4 اپریل کو برطانوی پاؤنڈ/امریکی ڈالر کے پیئر کی تجارت کیسے کی جائے؟ نئے تاجروں کے لیے آسان تجاویز اور تجارتی تجزیہ

جمعرات کی تجارت کا تجزیہ برطانوی پاؤنڈ/امریکی ڈالر کا 1 گھنٹے چارٹ جمعرات کو برطانوی پاؤنڈ/امریکی ڈالر جوڑی نے بھی اوپر کی طرف ایک مضبوط حرکت دکھائی۔ EUR سے متعلقہمصنف: Paolo Greco

13:56 2025-04-04 UTC+2

0

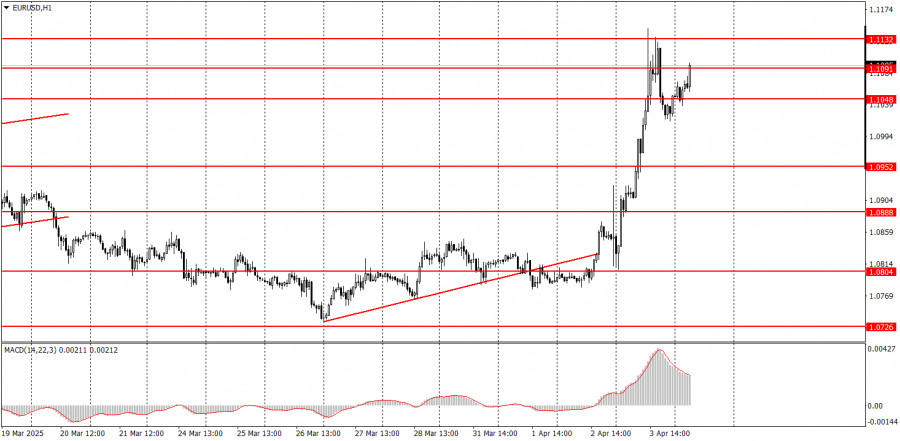

تجارتی منصوبہ4 اپریل کو یورو/امریکی ڈالر کے جوڑے کی تجارت کیسے کی جائے؟ نئے تاجروں کے لیے آسان تجاویز اور تجارتی تجزیہ

جمعرات کی تجارت کا تجزیہ یورو/امریکی ڈالر کا 1 گھنٹے چارٹ یورو/امریکی ڈالر کرنسی کے جوڑے نے جمعرات کو ایک مضبوط اوپر کی حرکت پوسٹ کی۔ اس صورتحالمصنف: Paolo Greco

13:52 2025-04-04 UTC+2

0