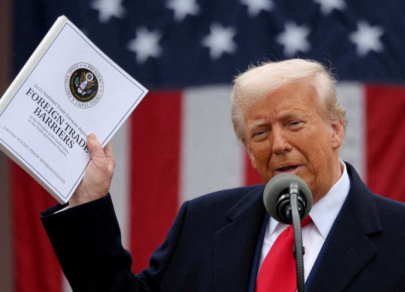

America's consumer inflation data turned out to be weaker. The general price index increased by 0.3% in August, which is below the consensus forecast of 0.4%. Meanwhile, the benchmark rose by 0.1%, well below the forecast of 0.3%.

Following a positive opening of the day, US stock indexes ended the day with a decline, primarily in the financial and energy sectors. The US dollar fell after the publication of the consumer price index, but it then reversed due to the fall in commodity prices, which hurt commodity currencies.

The inflation report did not actually provide any new information before the Fed meeting, and so, uncertainty in the markets will continue. . The decline in the index was largely due to falling prices for air tickets and a decrease in demand for hotel services, which is not unexpected amid the spread of the delta strain. In addition, the demand for used cars finally went down.

In fact, the signs of a slowdown in inflation are very unreliable, which means they can be interpreted in any direction, and the FOMC will clearly do so – it interprets the situation with the dynamics of prices in any direction convenient for itself.

As for the general market mood, there is a tendency towards risk aversion. The raw material prices are declining, with aluminum (-2.26%), iron ore (-1.37%), copper (-1.19%). In turn, oil is holding near highs as API reserves report declines more than expected.

It can be assumed that the range trading will continue. As September 22 approaches, the demand for defensive assets will slowly grow due to the rising probability of tightening the Fed's rhetoric, which will have to counterbalance the delay in winding down the QE program with verbal interventions.

USD/CAD

The results of the Bank of Canada meeting last week turned out to be close to forecasts. The overnight rate remained at the level of the effective lower limit of 0.25%, the pace of asset purchases in the amount of $ 2 billion per week was also maintained. The forecasts also remained unchanged. In any case, the overnight rate will be inviolable at least until the excess reserves are eliminated and according to BoC forecasts, this will happen no earlier than the second half of 2022.

The Bank of Canada ignored the GDP decrease in Q2, emphasizing that domestic demand continues to grow. The forecasts for the start of curtailing the buyback program assume the meeting on October 27 as a starting point, that is, the Bank of Canada will take its step only after the Fed's position becomes clear. This leaves the Canadian dollar vulnerable to bearish pressure.

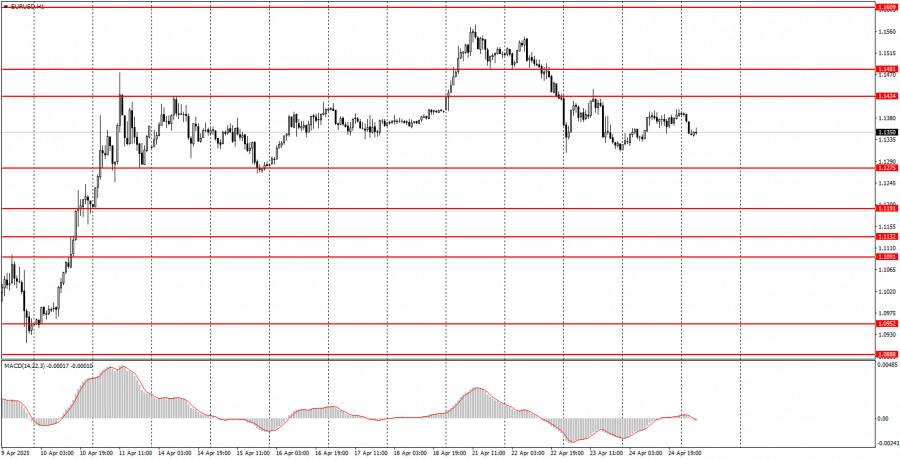

Over the reporting week, the net short position in CAD rose by 249 million to -475 million. The bearish advantage is small, and the market position should be regarded as quite neutral. The estimated price is above the long-term average, which gives reason to expect the continued growth of USD/CAD pair.

The pair was able to consolidate above the resistance level of 1.2665 as assumed a week earlier. We are waiting for the resistance zone 1.2710/20, then 1.2760/70 to be tested in the near future since leaving above this zone before the FOMC meeting is unlikely.

USD/JPY

The Japanese yen continues to trade in a narrow range. The industrial production and orders for mechanical engineering products reports came out generally slightly worse than expected, but not so much as to form a reason for leaving the range. Possible political changes related to the completion of the abenomics policy have not yet been filled with specifics, and possible changes to the budget have already been considered by the market.

The net short position of JPY remained unchanged during the reporting week. The bearish advantage remains significant (-7.064 billion), which is confirmation that the markets do not expect the US Fed to curtail QE soon and bet that the global economy will continue to recover amid strong stimulus. The estimated price declines.

It can be assumed that the chances of leaving the range in a downward direction remain higher. The nearest support is 109.00/10, while the next one is 108.74. However, it is clearly too early to talk about it before the result of the FOMC meeting appears.

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.