The euro-dollar pair ended the trading week at the base of the 8th figure, reflecting the strength of the downward trend. In general, the past five days of trading turned out to be productive for EUR/USD bears: for the first time since May 2020, the pair tested the seventh figure, reaching 1.0758. This is almost a two-year price low. However, Thursday's downward breakthrough was more of a "reconnaissance fight" - the bears could settle in this price area. Apparently, most traders did not take risks and took profits, thereby reducing the pressure on the pair. But this circumstance does not negate the fact that bearish sentiment still prevails among market participants.

The European Central Bank, which, in fact, crossed out the ambitions of EUR/USD bulls. At its April meeting, the ECB did not implement the most hawkish scenario among all possible ones. While the euro needed the very "hawkish high" that would help the bulls of the pair, if not to reverse the trend, then at least to organize a large-scale correction. However, the ECB did not demonstrate an aggressive attitude: the results of the April meeting turned out to be too "vague".

If ahead of the meeting, experts discussed the likelihood of one or two rate hikes already in the third or fourth quarter of this year, then ECB President Christine Lagarde, by and large, questioned the question of at least one increase before the end of 2022. So, according to the text of the accompanying statement, the APP program will be completed in the third quarter of this year. The issue of raising the rate will be considered by the central bank only after the completion of QE. When journalists asked Lagarde – what time range can be laid in the period between the completion of the APP and the rate increase, she replied: "from a few weeks to several months." In other words, the ECB, even in the face of record inflation growth in the eurozone, lays a very wide time gap, leaving in limbo the issue of tightening monetary policy.

Such weak results of the April meeting put pressure on the euro, which was already under considerable pressure. The "specter of stagflation", which is increasingly reminiscent of itself against the background of the energy crisis, was reflected in the failed reports from the ZEW and IFO institutes. Pessimism in the business environment of Germany and the EU as a whole has been growing for the second month in a row. In particular, the ZEW indices fell into negative territory for the first time since the first wave of the coronavirus crisis. And if then the "ray of light at the end of the tunnel" was the pharmacological development of an anti-Covid vaccine, now all attention is focused on the Russian-Ukrainian negotiations. Which finally stalled. According to Russian President Vladimir Putin, the Ukrainian side has departed from its agreements in Istanbul, and now the negotiating parties "have again returned to a deadlock for themselves and for everyone." Similar signals have already been received earlier – both from Russian Foreign Minister Sergei Lavrov and from the representative of the Turkish president. They said in one form or another that the negotiating groups are still very far from final agreements.

This factor exerts significant pressure on the EUR/USD pair – both due to the strengthening of the safe dollar and due to the "independent" weakening of the euro. Moreover, anti-risk sentiment in the market is fueled by the so-called "Taiwan issue". Tensions are also rising here, especially in light of recent events. So, last week, China announced its decision to conduct comprehensive military exercises near Taiwan in response to a visit to the island by American congressmen. According to representatives of the Chinese Ministry of Defense, Beijing considers the visit of state officials to the island "a deliberate provocation that undermines relations between China and the United States and creates tension in the Taiwan Strait." Let me remind you that earlier Chinese officials have repeatedly stated that the country is ready to use force to prevent movement towards the official independence of Taiwan, which is considered a breakaway province of China. The growth of tension in this region provides indirect support to the greenback, which is strengthened by strengthening anti-risk sentiment.

The Federal Reserve is also an ally of the dollar, which is preparing to raise the interest rate at the May meeting by 50 basis points at once. Last week, the hawkish theses were voiced by one of the most influential members of the Fed (who has a permanent right to vote in the Committee) – the head of the Fed of New York, John Williams. In particular, he said that the central bank needs to move to a neutral level of rates as soon as possible. In turn, Williams' colleague, Lael Brainard, reported on Tuesday that the reduction of the Fed's balance sheet could occur as early as June – after the relevant decision was made in May. It should be noted here that last weekend the Reuters news agency interviewed more than a hundred leading economists over the weekend about the prospects for tightening the Fed's monetary policy. Eighty five of them said that the US central bank will raise the interest rate by 50 basis points at the May meeting. Moreover, 56 respondents also added that the Fed will raise the rate by the same amount following the results of the June meeting. Such prospects also provide significant support to the greenback.

![Exchange Rates 17.04.2022 analysis]()

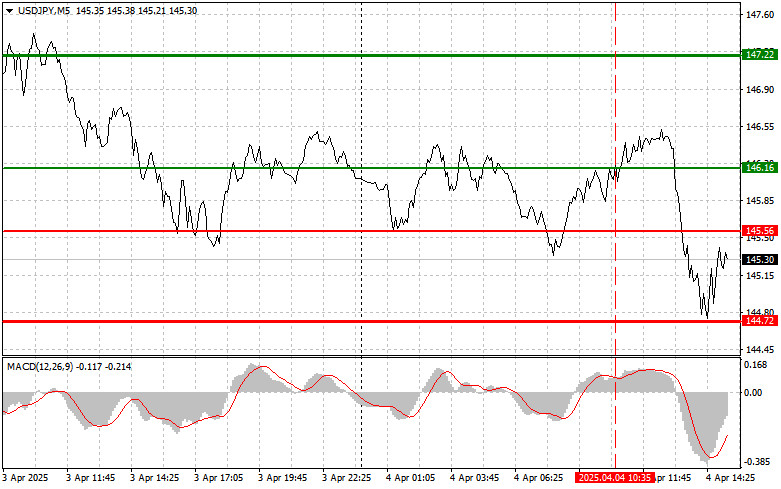

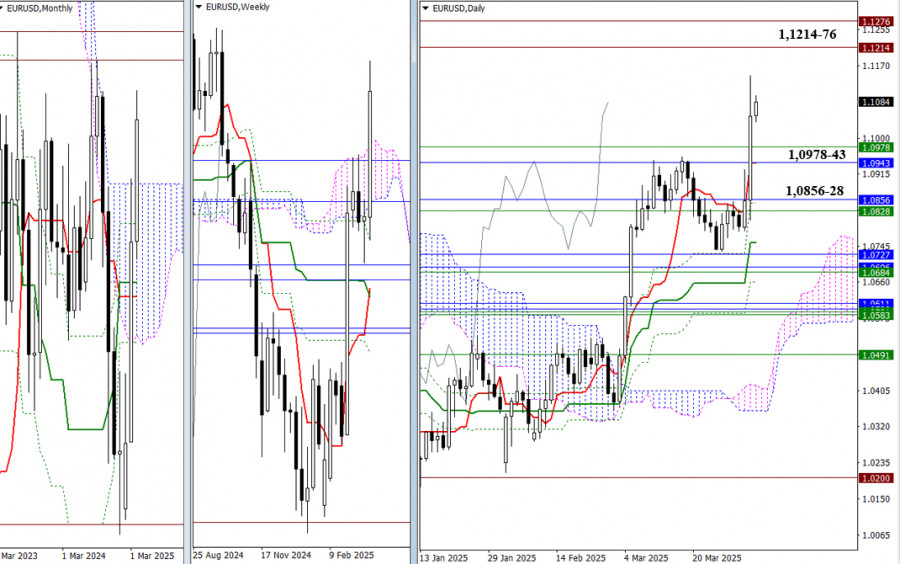

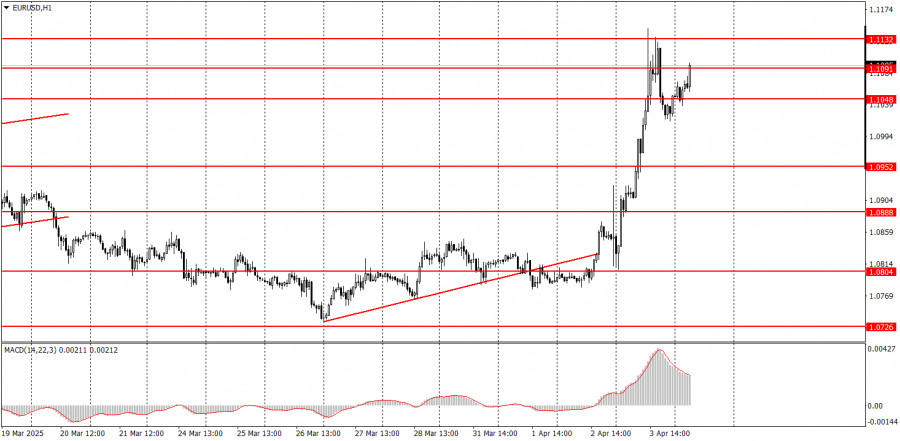

Thus, the EUR/USD pair is declining not only due to the strengthening of the greenback (although the dollar is the main locomotive here), but also due to the weakening of the European currency. Given the prevailing fundamental background, it can be assumed that next week the bears of the pair will again test the support level of 1.0760, which corresponds to the lower line of the Bollinger Bands indicator on the D1 timeframe. The technical picture also contributes to this: the price on the daily chart is located between the middle and lower lines of the Bollinger Bands indicator, as well as under all the lines of the Ichimoku indicator, which formed a strong bearish Parade of Lines signal. All these signals speak in favor of further development of the downward trend in the medium term.

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.