انسٹا فاریکس ٹیم میں لیجنڈ!

لیجنڈ!آپ کو لگتا ہے کہ یہ حیرت انگیز بیانات ہے؟ لیکن ہمیں ایسے شخص کو کیا کہنا چاہئے ، جو 18 سال میں جونیئر ورلڈ شطرنج چیمپئن شپ جیتنے والا پہلا ایشین بن گیا تھا اور 19 میں پہلا ہندوستانی گرینڈ ماسٹر بنا؟ ورلڈ چیمپیئن ٹائٹل کے لئے یہ مشکل آغاز تھا جو وشونااتھ آنند کے لئے تھا ، وہ شخص جو ہمیشہ کے لئے شطرنج کی تاریخ کا حصہ بن گیا تھا۔ انسٹا فاریکس ٹیم میں اب ایک اور لیجنڈ!

Borussia is one of the most titled football clubs in Germany, which has repeatedly proved to fans: the spirit of competition and leadership will certainly lead to success. Trade in the same way that sports professionals play the game: confidently and actively. Keep a "pass" from Borussia FC and be in the lead with InstaSpot!

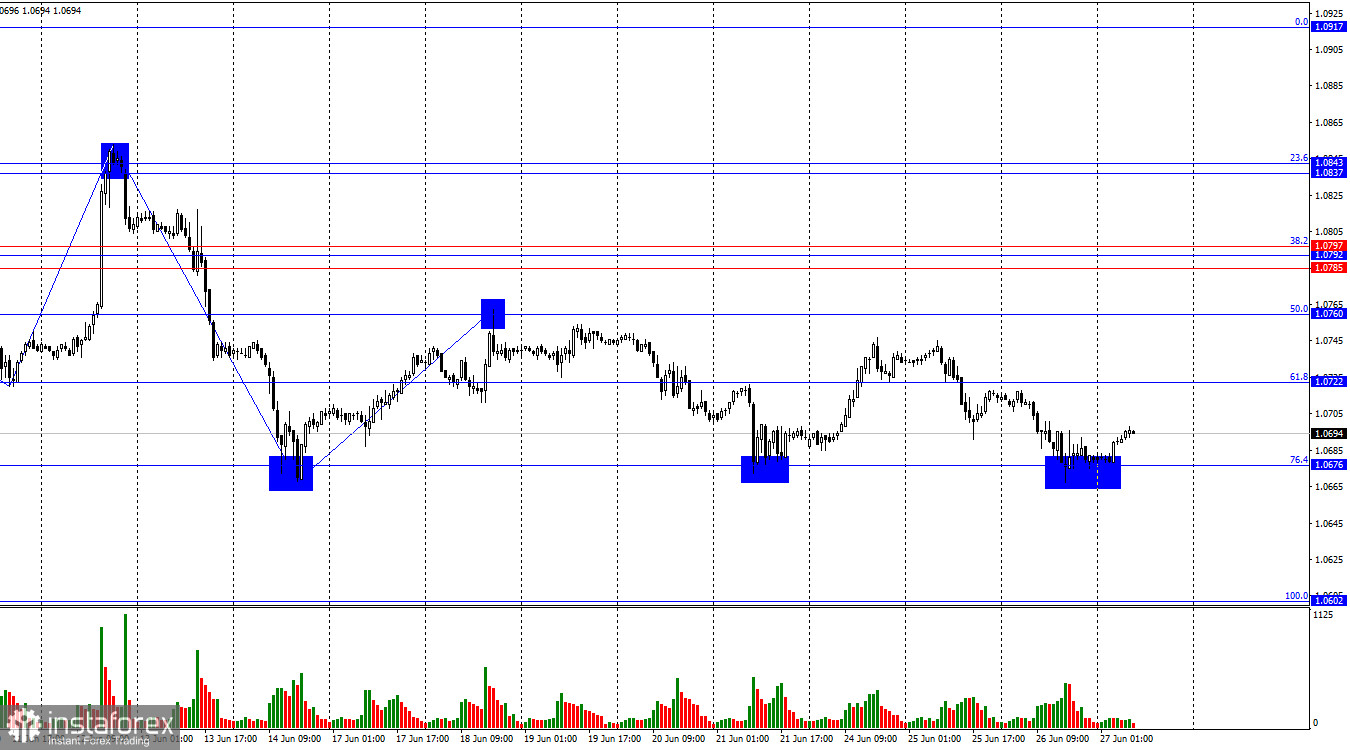

On Wednesday, the EUR/USD pair made a new decline to the corrective level of 76.4%-1.0676. The rebound from this level was the third one, leading to a new reversal in favor of the euro. A new growth process began towards the corrective level of 61.8% (1.0722). A rebound from this level will suggest a reversal in favor of the US dollar and a third return to the 1.0676 level. Further decline in the euro will be possible after consolidating below the 1.0676 level.6.

The wave situation remains clear. The last completed upward wave was very weak and failed to break the peak of the previous wave. The last downward wave (which may still be incomplete) failed to break the low of the previous wave. Thus, the "bearish" trend persists, but in the near future, the first sign of a trend change to "bullish" may appear. This sign would break the peak of the last upward wave from June 18. If this does not happen, I will expect a return to the 1.0676 level. At the same time, breaking the low from June 14 will maintain the "bearish" trend.

There was no news background on Wednesday. The trend remains "bearish," and the peak from June 18 has not been updated. Everything suggests that the decline will continue, and the consolidation of bears below the 1.0676 level is just a matter of time. Trader activity has been quite low this week, but the bears are in no hurry, and the bulls have no reason to counterattack. Today, reasons for more active trading may arise for both bulls and bears. In America, reports on US GDP and durable goods orders, which are of considerable interest to traders, will be released. US GDP has been slowing over the last two quarters, and the final estimate for the first quarter may be lower than the second preliminary estimate. This could create conditions for the bears to retreat from the market. The orders report should be addressed too, as it is quite important.

On the 4-hour chart, the pair made a new reversal in favor of the euro after forming a "bullish" divergence in the CCI indicator, followed by another upward reversal after forming another "bullish" divergence. A week ago, the 4-hour chart showed a close below the trendline, which shifted traders' sentiment to "bearish." Thus, any "bullish" divergences are signals of a correction. Without consolidating below the 1.0676 level, corrections may recur.

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 16,233 long positions and opened 19,460 short positions. The sentiment of the "Non-commercial" group shifted to "bearish" a few weeks ago and is only strengthening. The total number of long positions speculators hold is now 171,000, while short positions total 163,000. The gap continues to narrow.

The situation will continue to shift in favor of the bears. I see no long-term reasons to buy euros, as the ECB has begun easing monetary policy, which will reduce the yields on bank deposits and government bonds. In America, they will remain at high levels for at least a few more months, making the dollar more attractive to investors. The potential for a decline in the euro is significant even according to the COT reports. If there is still a "bullish" sentiment among major players while the euro is falling, where will the euro be when the sentiment turns "bearish"?

The economic calendar includes three entries for the US on June 27. The impact of the news background on trader sentiment today may be moderate, but it will occur in the second half of the day.

The pair's sales were possible upon consolidation below the 1.0722 level on the hourly chart, with a target of 1.0676. This target was achieved. Consolidation below the 1.0676 level will allow staying in sales with a target of 1.0602. Buying euros was possible on the hourly chart rebound from the 1.0676 level with a target of 1.0722.

The Fibonacci level grids are constructed based on 1.0602–1.0917 on the hourly chart and 1.0450–1.1139 on the 4-hour chart.

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.