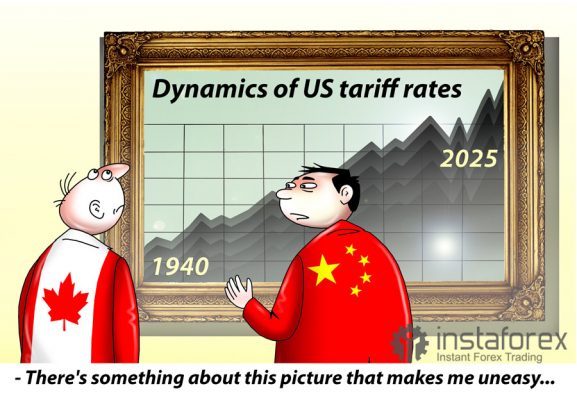

- آٹو ٹیرف نے مارکیٹ کو ہلا کر رکھ دیا ہے: اسٹاک دباؤ میں ہیں، جبکہ سونا بڑھ رہا ہے۔ کساد بازاری کے خدشات میں شدت آنے کے ساتھ ہی سرمایہ

مصنف: Irina Maksimova

18:43 2025-03-28 UTC+2

0

اگر آپ کو پہلی بار نہیں ملتا ہے، تو آپ دوسری بار حاصل کریں گے۔ ایس اینڈ پی 500 سیل آف، جس کی قیادت امریکی اور غیر ملکی آٹومیکرمصنف: Marek Petkovich

18:11 2025-03-28 UTC+2

0

بٹ کوائن اور ایتھریم تیرتے رہنے کے لیے جدوجہد کر رہے ہیں۔ بٹ کوائن کی جانب سے $88,000 پر جمے رہنے کی ایک اور ناکام کوشش آج کے ایشیائی تجارتیمصنف: Miroslaw Bawulski

17:56 2025-03-28 UTC+2

0

- نئے ہودی ٹیسٹ نیٹ پر پیکٹرا ٹیسٹ اپ گریڈ کے کامیاب رول آؤٹ کے باوجود- ممکنہ طور پر ایتھریم مین نیٹ پر اپ ڈیٹ کرنے سے پہلے آخری مرحلہ

مصنف: Jakub Novak

17:43 2025-03-28 UTC+2

0

آج، یورو / یو ایس ڈی پئیر 1.0800 کی کلیدی نفسیاتی سطح کے قریب مستحکم ہو رہا ہے، جو 1.0780 سے نیچے پیچھے ہٹنے کا کوئی ارادہ نہیں دکھامصنف: Irina Yanina

16:52 2025-03-28 UTC+2

0

اے یو ڈی / یو ایس ڈی پئیر 0.6300 کی کلیدی نفسیاتی سطح کے قریب ایک واقف رینج کے اندر رہتے ہوئے اپنی طرف سے مضبوطی کو جاری رکھے ہوئےمصنف: Irina Yanina

16:47 2025-03-28 UTC+2

0

- تکنیکی تجزیہ

28-31 مارچ 28-31 2025 کے لیے یورو / یو ایس ڈی کے لیے تجارتی اشارہ: 1.0775 سے نیچے فروخت کریں (21 ایس ایم اے - 6/8 مرے)

یورو کا آؤٹ لک اب بھی مندی کا شکار ہے۔ ہمیں یقین ہے کہ آنے والے دنوں میں یہ کمی 1.08 سے نیچے 1.0620 کی طرف جاری رہ سکتی ہے۔مصنف: Dimitrios Zappas

16:20 2025-03-28 UTC+2

0

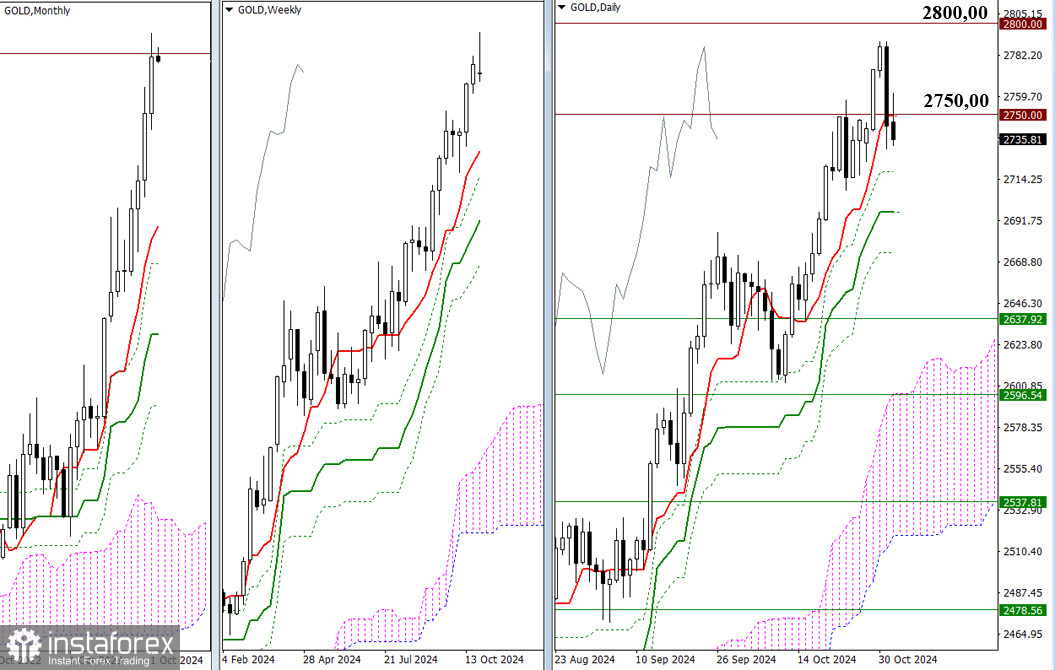

تکنیکی تجزیہمارچ 28-31 2025 کے لیے سونے (ایکس اے یو / یو ایس ڈی) کے لیے تجارتی سگنل: $3,078 سے نیچے فروخت (تکنیکی اصلاح - 21 ایس ایم اے)

اہم سپورٹ 21 ایس ایم اے کے آس پاس 3,035 پر واقع ہے۔ یہ سطح اپ ٹرینڈ چینل کے نچلے حصے کے ساتھ ملتی ہے، جو آنے والے دنوںمصنف: Dimitrios Zappas

16:18 2025-03-28 UTC+2

0

تکنیکی تجزیہمارچ 27-29 2025 کے لیے سونے (ایکس اے یو / یو ایس ڈی) کے لیے تجارتی سگنل: $3,057 سے نیچے فروخت (ڈبل ٹاپ - 7/8 مرے)

اگر سونا 3,057 سے اوپر ٹوٹنے میں ناکام رہتا ہے تو اسے 3,023 کے ہدف کے ساتھ فروخت کرنے کے سگنل کے طور پر دیکھا جائے گا۔ مزید برآں،مصنف: Dimitrios Zappas

21:10 2025-03-27 UTC+2

11