ہمارے ٹیم میں 7000000 سے ذائد تاجران شامل ہیں

ہم تجارت کی بہتری کے لئے ہر روز اکھٹے کام کرتے ہیں اور بہترین نتائج حاصل کرتے ہوئے آگے کی جانب بڑھتے ہیں

دُنیا بھر سے سے لاکھوں ہمارے بہترین کام کو سند عطاء کرتے ہیں آپ اپنا انتحاب کریں باقی ہم آپ کی توقعات پر پورا اترنے کے لئے اپنی بہترین کوشش کریں گے

ہم مل کر ایک بہترین ٹیم بناتے ہیں

انسٹا فاریکس آپ سے کام کرتے ہوئے فخر محسوس کرتا ہے

ایکٹر - یو سی ایف 6 ٹورنامنٹ چیمپین اور واقعی ہیرو

ایک فرد کے جس نے اپنا آپ منوایا ہے وہ فرد کہ جو ہماری راہ پر چلا ہے.

ٹکٹا روو کی کامیابی کا راز یہ ہے کہ وہ اپنے اہداف کی جانب مسلسل بڑھتا رہتا ہے

اپنے ہنر یا ٹیلنٹ کے تمام پہلو آشکار کررہے ہیں

پہچانیں ، کوشش کریں ، ناکام ہوں لیکن کبھی نہ رُکیں

انسٹا فاریکس آپ کی کامیابی کی کہاں یہاں سے شروع ہوتی ہے

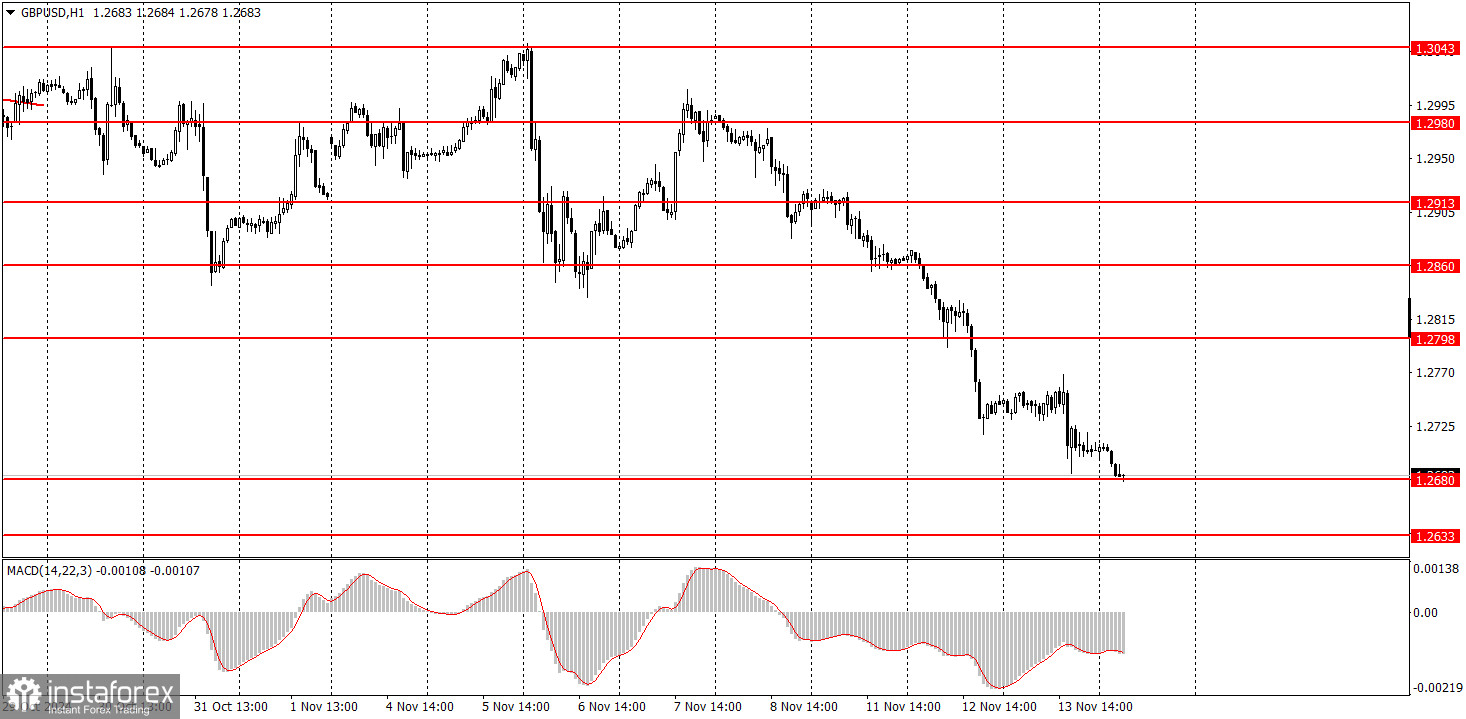

On Wednesday, the GBP/USD pair continued its downward movement, showing no signs of correction. Similar to the euro, only one report could have influenced buyers or sellers yesterday. In reality, it supported neither. The U.S. Consumer Price Index matched market expectations, leaving no significant reason for the market to react. However, the market once again demonstrated that the current situation is not driven by U.S. inflation or the Federal Reserve's upcoming decision in December. Instead, the market continues to rebalance the dollar's exchange rate—a trend we predicted throughout the year's first half. The British pound rose similarly for two years, often without justification, while the market ignored numerous factors favoring the U.S. dollar. We are witnessing a logical decline in the pound and the strengthening of the dollar. This has nothing to do with Trump.

Some levels were also revised on Wednesday in the 5-minute timeframe. The price bounced three times from the 1.2754 level, dropping to the 1.2680–1.2685. Although it failed to break below this zone on the first attempt, it may not hold today. Thus, we currently see no signs of even a minor upward correction. The pound can easily continue its decline.

In the hourly time frame, GBP/USD continues to trend downward. Over the past few weeks, we observed a flat movement between 1.2860 and 1.3043, but this range broke on Tuesday. We fully support the pound's decline in the medium term, as it appears to be the only logical direction. While the pound may attempt another correction soon, it will require strong support to materialize.

On Thursday, novice traders can anticipate the downward movement persisting if the price breaks below the 1.2680–1.2685 area. The price has already consolidated slightly below this zone.

On the 5-minute TF, you can now trade at 1.2547, 1.2633, 1.2680-1.2685, 1.2754, 1.2791-1.2798, 1.2848-1.2860, 1.2913, 1.2980-1.2993, 1.3043. On Thursday, the UK's economic calendar is empty, while the U.S. will release a few reports unlikely to impact market sentiment significantly. Powell's speech will carry more weight, but how could Powell possibly help the euro or the pound?

Support and Resistance Levels: Levels that serve as targets for opening buys or sells. Take Profit levels can be placed around these areas.

Red Lines: Channels or trend lines that indicate the current trend and the preferred trading direction.

MACD Indicator (14,22,3): Histogram and signal line—an auxiliary indicator that can also be used as a source of signals.

Major speeches and reports (always found in the news calendar) can significantly impact currency pair movements. Therefore, it's advised to trade cautiously or exit the market during their release to avoid sharp price reversals against prior movements.

Beginners trading on the forex market should remember that not every trade will be profitable. A clear strategy and money management are the keys to success in long-term trading.

*تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.