- Ceny gazu ziemnego w Europie gwałtownie wzrosły po informacji o ataku na nieczynną stację tłoczną w obwodzie kurskim w Rosji. Według doniesień ukraińskie siły zbrojne przeprowadziły atak na gazową stację

Autor: Miroslaw Bawulski

12:49 2025-03-24 UTC+2

0

Amerykańskie indeksy giełdowe zakończyły piątkową sesję na plusie: S&P 500 wzrósł o 0,08%, a Nasdaq 100 zyskał 0,22%. Dziś kontrakty terminowe na indeksy giełdowe w USA i Europie wzrosłyAutor: Jakub Novak

11:22 2025-03-24 UTC+2

0

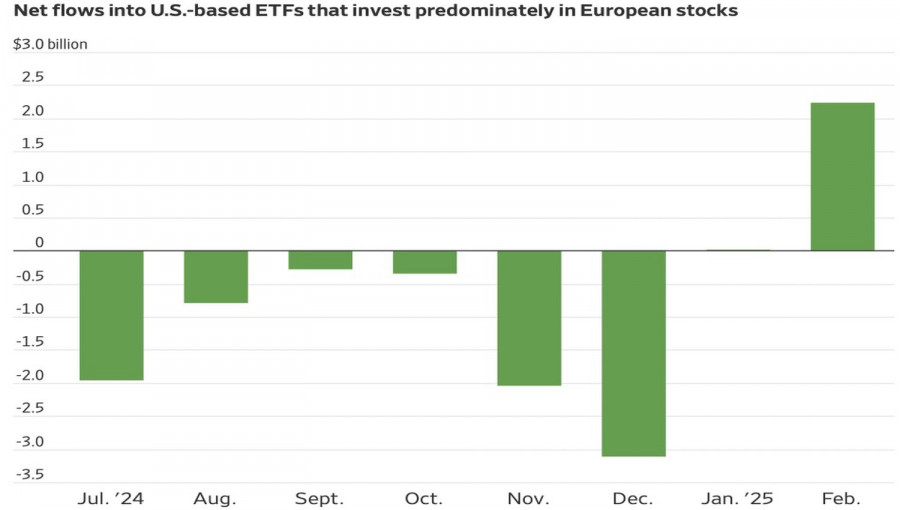

Co napędza rynki? Strach? Chciwość? Obecnie znacznie ważniejsze jest rozczarowanie. Inwestorzy zaczynają dostrzegać, że polityka celna Donalda Trumpa nie przyniesie niczego dobrego, a utrata amerykańskiej wyjątkowości prowadzi do odpływu kapitałuAutor: Marek Petkovich

10:51 2025-03-24 UTC+2

0

- Bitcoin i Ethereum odnotowały dziś zauważalny wzrost po stosunkowo słabym weekendzie, co wskazuje na rosnący apetyt inwestorów na ryzyko nawet w tych niepewnych czasach. Najnowsze dane dotyczące napływu środków

Autor: Miroslaw Bawulski

09:02 2025-03-24 UTC+2

0

Analiza fundamentalnaNa co zwrócić uwagę 24 marca? Analiza fundamentalnych wydarzeń dla początkujących

Na poniedziałek zaplanowano osiem wydarzeń makroekonomicznych. W Niemczech, strefie euro, USA i Wielkiej Brytanii zostaną opublikowane w stępne marcowe dane indeksów aktywności biznesowej w sektorach przemysłowym i usługowym. Pojedyncze publikacjeAutor: Paolo Greco

09:00 2025-03-24 UTC+2

0

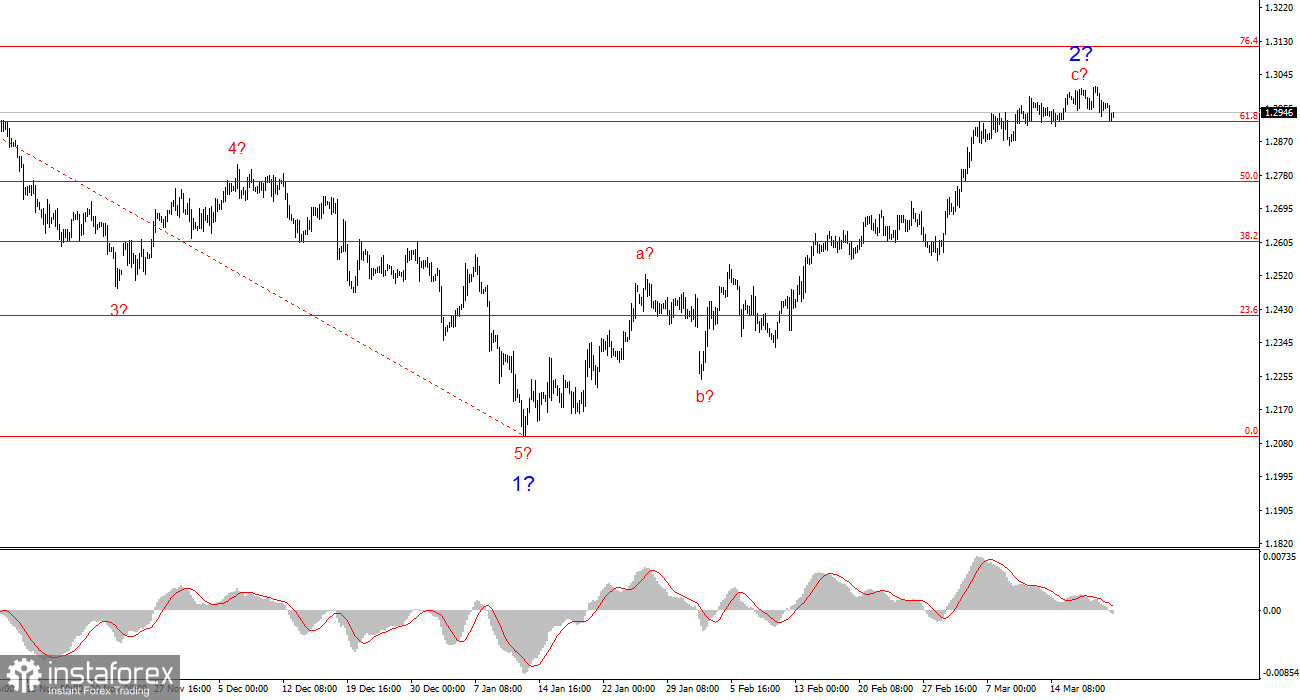

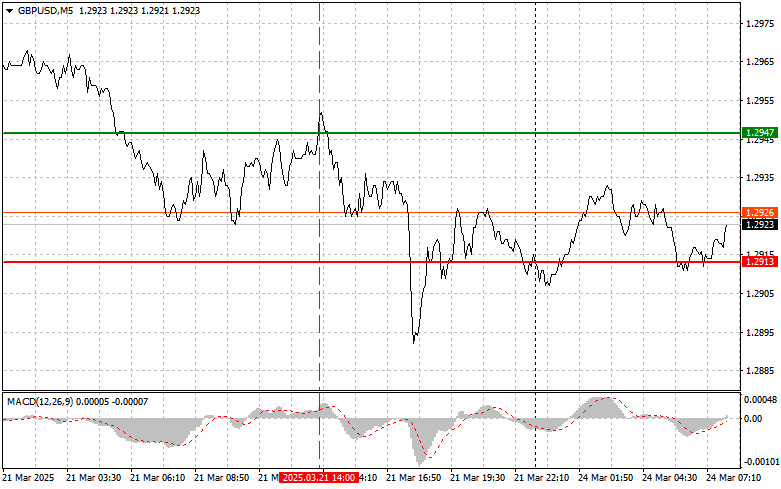

Analiza transakcji i wskazówki dotyczące handlu GBP/USD Test 1,2947 nastąpił, gdy wskaźnik MACD wzrósł znacznie powyżej poziomu zera, co ograniczało potencjał wzrostowy pary. Z tego powodu postanowiłem nie kupować funtaAutor: Jakub Novak

08:39 2025-03-24 UTC+2

0

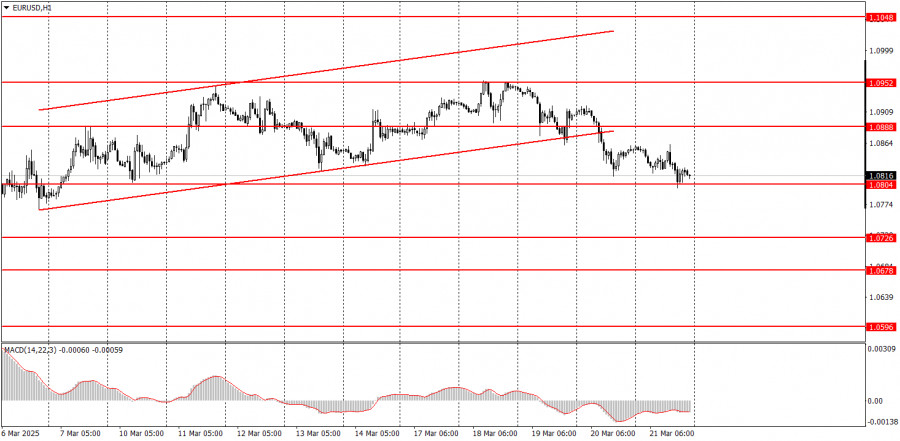

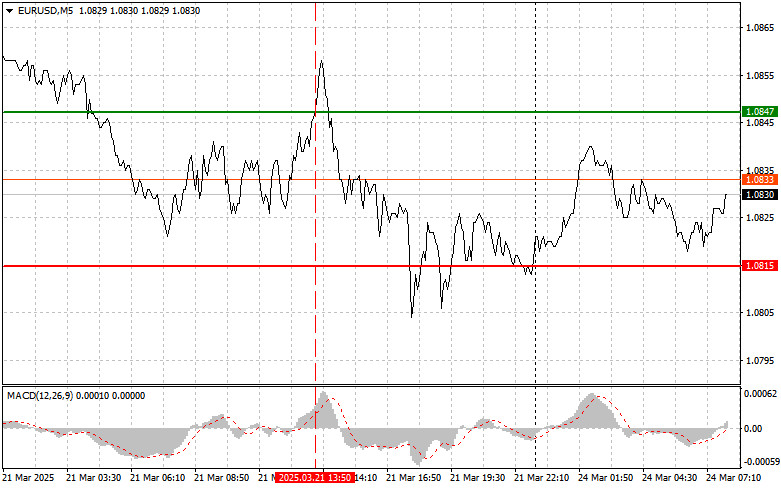

- Analiza transakcji i wskazówki dotyczące handlu EUR/USD Test 1,0847 zbiegł się ze znacznym wzrostem wskaźnika MACD powyżej poziomu zera, co ograniczyło potencjał wzrostowy pary. Z tego powodu postanowiłem nie kupować

Autor: Jakub Novak

08:39 2025-03-24 UTC+2

0

Jeśli pozytywne trendy się utrzymają, XRP może osiągnąć nowe maksima, a uznanie instytucjonalne przyspieszy jego integrację ze światowym systemem finansowym. Z technicznego punktu widzenia para XRP/USD pozostaje w strefie hossyAutor: Jurij Tolin

14:53 2025-03-21 UTC+2

4

GiełdyApple w obliczu wyzwań związanych z technologią AI, piąta korekta Nasdaq 100: co dalej z sektorem technologicznym?

Biorąc pod uwagę czynniki techniczne oraz utrzymującą się niepewność fundamentalną, amerykańskie indeksy mogą pozostać w fazie konsolidacji w przyszłym tygodniu. Kluczową rolę odegrają oczekiwania wobec obniżek stóp procentowych oraz nadchodząceAutor: Anna Zotova

12:57 2025-03-21 UTC+2

6