- Na rynku surowców trudno już o prawdziwe zaskoczenia, ale odmowa przyjęcia tankowca z rosyjską ropą przez Indie była jednym z najbardziej nieoczekiwanych wydarzeń tygodnia. Oficjalnym powodem był brak wymaganych dokumentów

Autor: Anna Zotova

16:59 2025-03-28 UTC+2

0

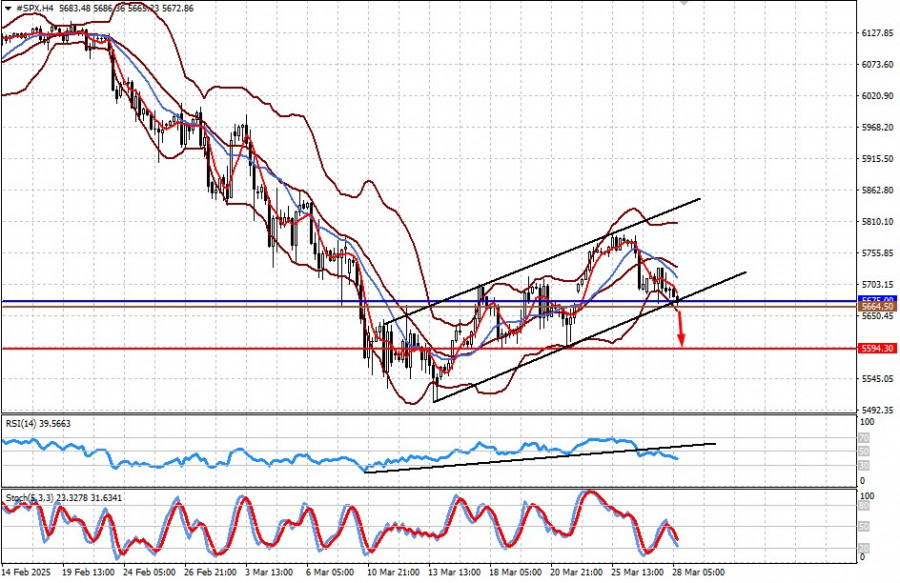

Analiza fundamentalnaRynki na rozdrożu w oczekiwaniu na wprowadzenie ceł przez Donalda Trumpa (istnieje ryzyko spadku kontraktów CFD na kontrakty terminowe na #SPX i #NDX).

Inwestorzy są już w pełni przekonani, że prezydent USA zrealizuje swoje plany wprowadzenia surowych ceł mających na celu zamknięcie rynku wewnętrznego i tym samym pobudzenie krajowej produkcji. Zdając sobieAutor: Pati Gani

15:29 2025-03-28 UTC+2

0

Jeśli rynek nie zareaguje za pierwszym razem, zrobi to za drugim. Wyprzedaż na S&P 500, napędzana przez akcje amerykańskich i zagranicznych producentów samochodów, była kontynuowana drugi dzień po nałożeniu 25%Autor: Marek Petkovich

12:03 2025-03-28 UTC+2

0

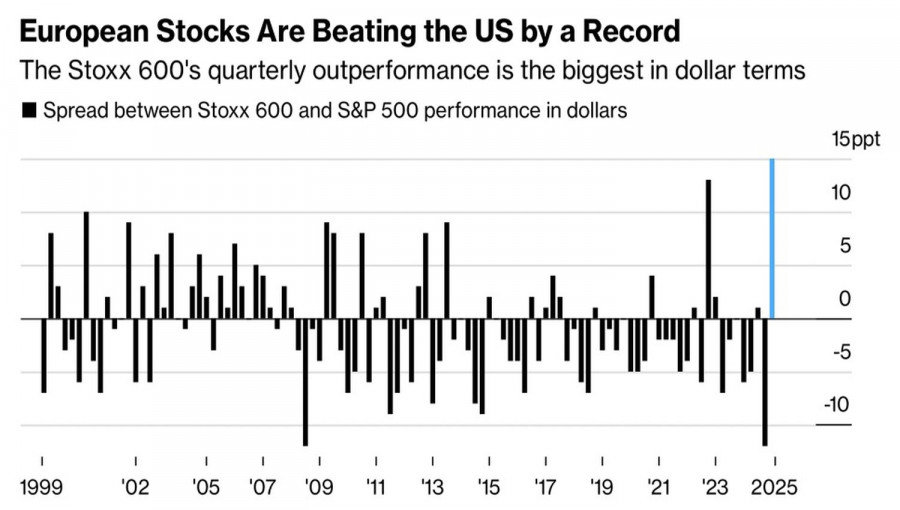

- Wczorajszą sesję amerykańskie indeksy giełdowe zakończyły na minusie: S&P 500 spadł o 0,33%, Nasdaq 100 stracił 0,53%, a Dow Jones Industrial Average zniżkował o 0,05%. Akcje wielu firm spadły

Autor: Jakub Novak

11:30 2025-03-28 UTC+2

0

Pomimo pomyślnego wdrożenia testowej aktualizacji Pectra na nowej sieci testowej Hoodi – która może być ostatnim krokiem przed wprowadzeniem zmian na głównej sieci Ethereum mających na celu poprawę skalowalności, stakinguAutor: Jakub Novak

10:54 2025-03-28 UTC+2

0

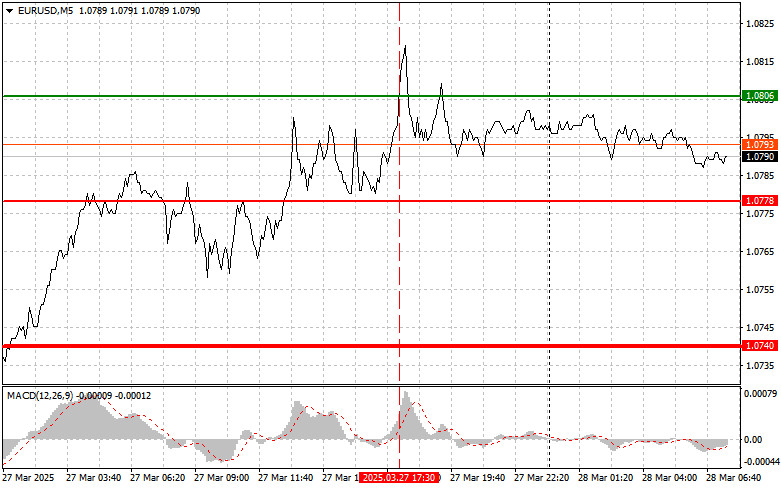

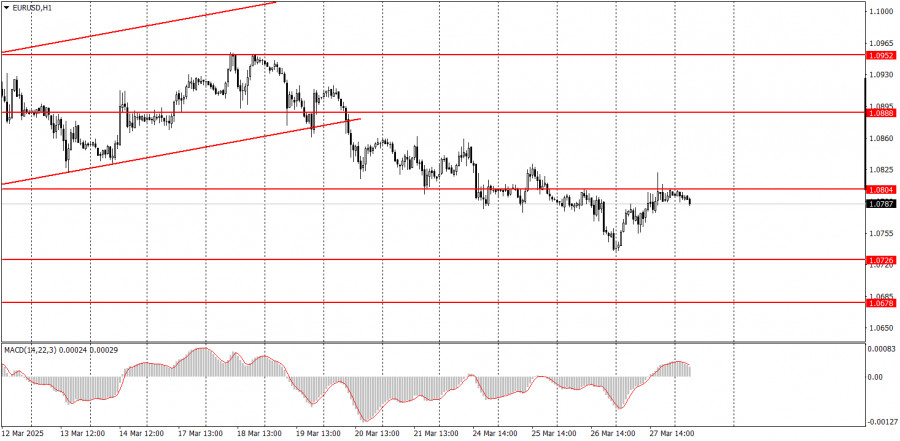

Analiza transakcji i wskazówki dotyczące handlu EUR/USD Test 1,0806 zbiegł się ze znacznym wzrostem wskaźnika MACD powyżej poziomu zera, co ograniczyło potencjał wzrostowy pary. Z tego powodu postanowiłem nie kupowaćAutor: Jakub Novak

09:45 2025-03-28 UTC+2

0

- Analiza fundamentalna

Na co zwrócić uwagę 28 marca? Analiza fundamentalnych wydarzeń dla początkujących

Na piątek zaplanowano sporo wydarzeń makroekonomicznych, ale naszym zdaniem wywołają one jedynie lokalną reakcję rynku. Wielka Brytania opublikuje dziś trzeci szacunek PKB za IV kwartał oraz dane o sprzedaży detalicznejAutor: Paolo Greco

08:54 2025-03-28 UTC+2

0

Bitcoin i Ethereum nadal zmagają się z trudnościami. Kolejna nieudana próba utrzymania się powyżej poziomu 88 000 USD zakończyła się wyprzedażą BTC podczas dzisiejszej sesji azjatyckiej. W przypadku ETH sytuacjaAutor: Miroslaw Bawulski

08:47 2025-03-28 UTC+2

0

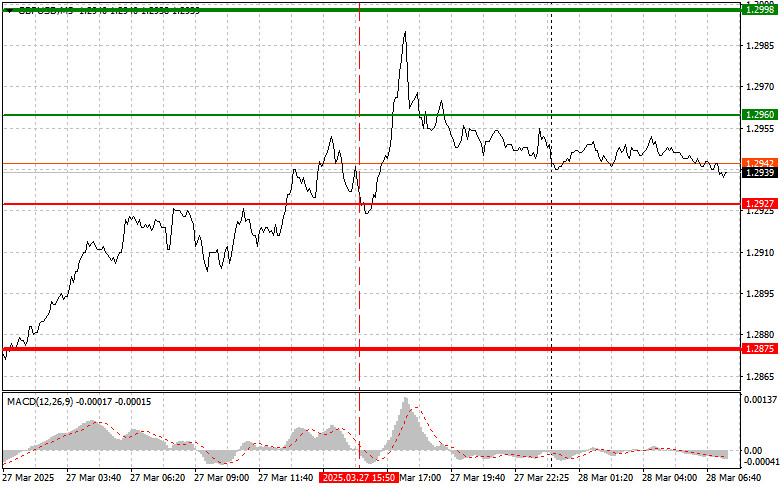

Analiza transakcji i wskazówki dotyczące handlu GBP/USD Test 1,2927 zbiegł się ze spadkiem wskaźnika MACD poniżej poziomu zera, co wywołało sygnał sprzedaży. Jednak, jak widać na wykresie, do dalszego spadkuAutor: Jakub Novak

08:47 2025-03-28 UTC+2

1