- O ouro continua atraindo a atenção dos investidores, especialmente em momentos de elevada incerteza nos mercados financeiros. Incerteza comercial: As persistentes tensões nas relações entre EUA e China reforçam

Autor: Irina Yanina

14:13 2025-04-16 UTC+2

1

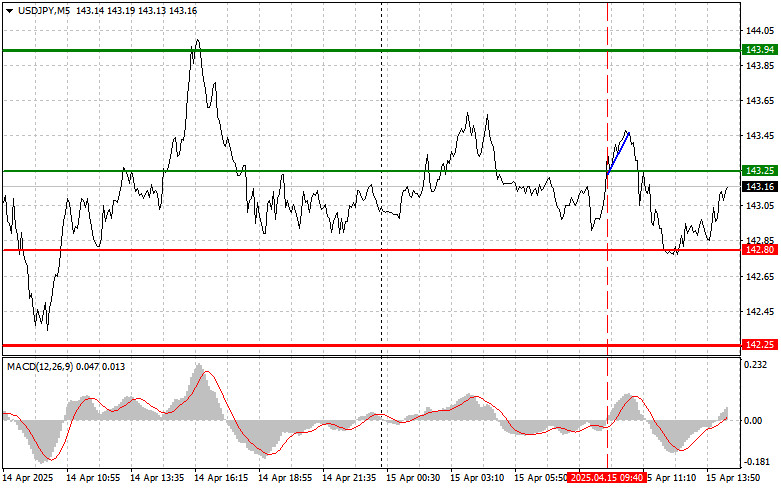

ForecastUSD/JPY: Dicas simples de negociação para traders iniciantes em 15 de abril (sessão dos E.U.A.)

Análise das operações e dicas para negociar o Iene japonês O teste do nível 143,25 ocorreu justamente quando o indicador MACD havia começado a se mover para cima a partirAutor: Jakub Novak

22:37 2025-04-15 UTC+2

13

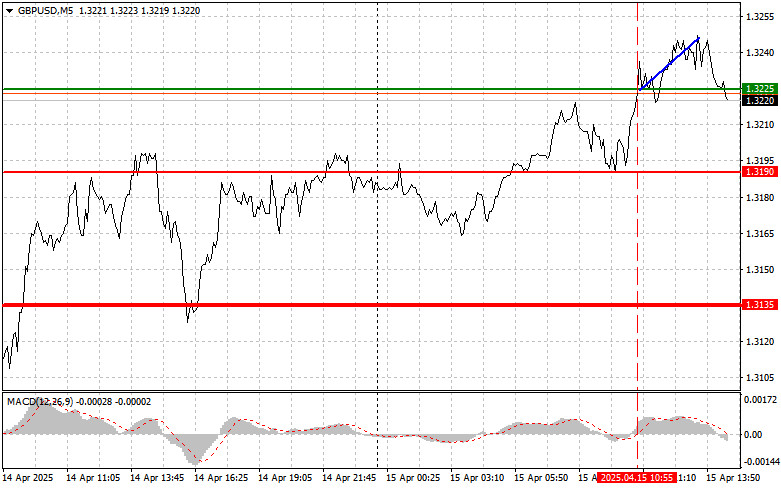

ForecastGBP/USD: Dicas simples de negociação para traders iniciantes em 15 de abril (sessão dos EUA)

Análise da operação e dicas para negociar a libra esterlina O teste do nível de 1,3225 ocorreu exatamente quando o indicador MACD começou a subir a partir da linha zeroAutor: Jakub Novak

22:13 2025-04-15 UTC+2

7

- Forecast

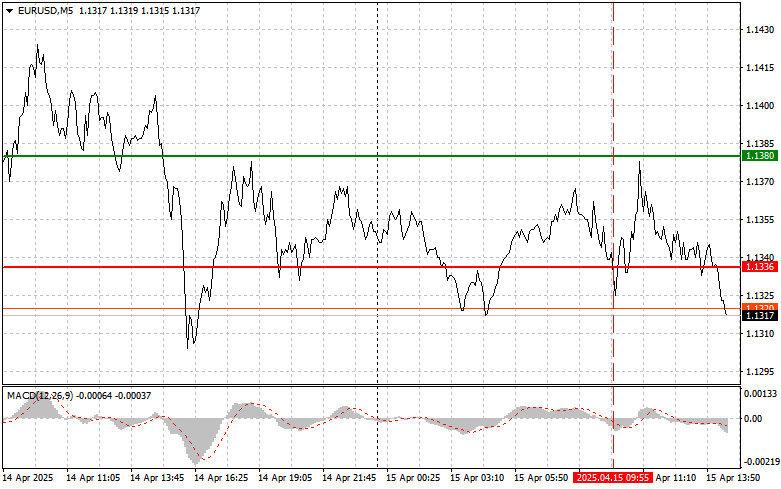

EUR/USD: Dicas simples de negociação para traders iniciantes em 15 de abril (sessão dos E.U.A.)

Análise da operação e dicas para negociar o euro O teste do nível de preço de 1,1336 ocorreu quando o indicador MACD já havia se deslocado significativamente abaixo da linhaAutor: Jakub Novak

22:02 2025-04-15 UTC+2

6

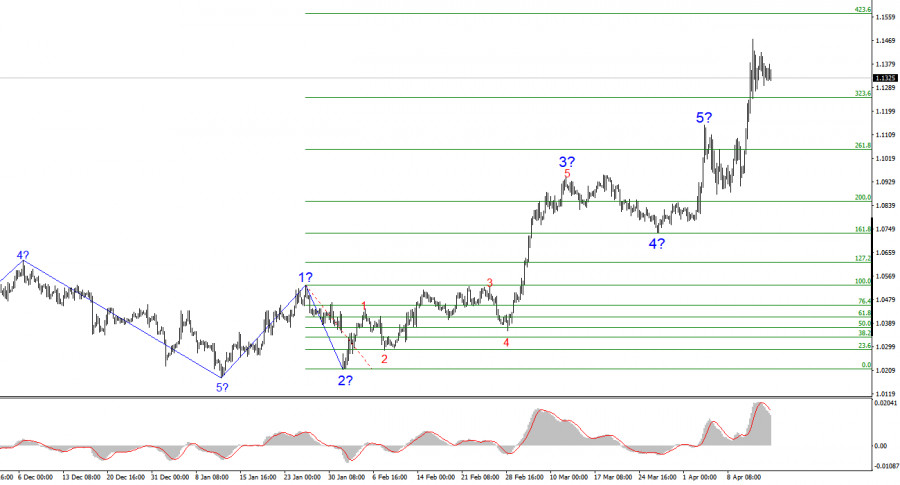

A estrutura da onda no gráfico de 4 horas do EUR/USD mudou para uma formação de alta. Não há muitas dúvidas de que essa transformação se deve inteiramente à novaAutor: Chin Zhao

21:37 2025-04-15 UTC+2

12

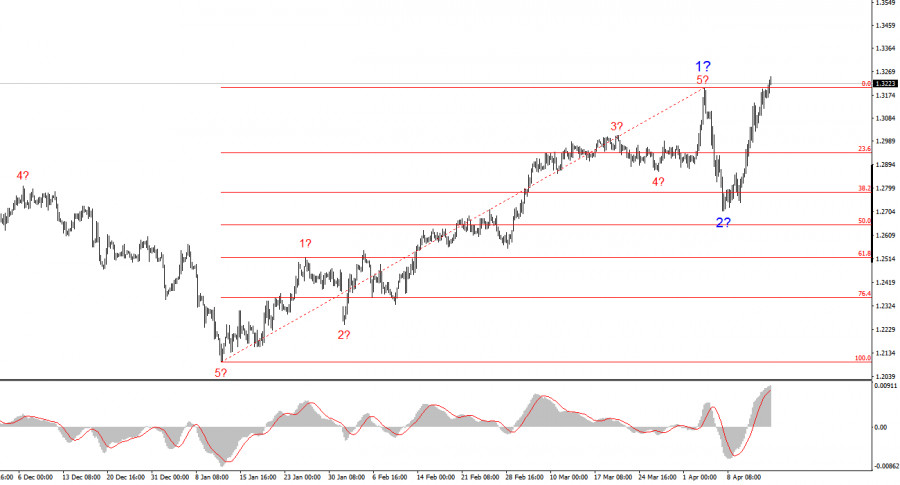

A estrutura de ondas do GBP/USD também se transformou em uma formação impulsiva e de alta, "graças" a Donald Trump. O padrão de ondas é quase idêntico ao do EUR/USDAutor: Chin Zhao

21:30 2025-04-15 UTC+2

10

- Nesta semana, ocorrerá a reunião do Banco Central Europeu (BCE) em abril, e o euro está em alta. O euro tem se saído excepcionalmente bem há pelo menos dois meses

Autor: Chin Zhao

18:31 2025-04-15 UTC+2

14

No fechamento da sessão regular anterior, os índices de ações dos EUA terminaram em território positivo. O S&P 500 subiu 0,79%, enquanto o Nasdaq 100 ganhou 0,64%. O Dow JonesAutor: Jakub Novak

18:27 2025-04-15 UTC+2

10

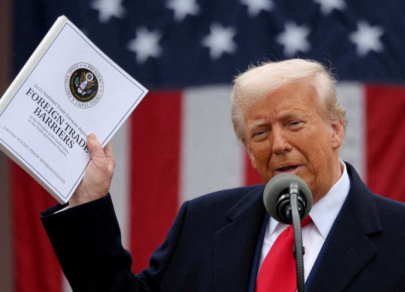

O governo Trump fez concessões: as tarifas sobre produtos eletrônicos foram temporariamente suspensas, e condições mais flexíveis para a indústria automobilística estão sendo consideradas. Esses movimentos desencadearam uma reação positivaAutor: Ekaterina Kiseleva

18:21 2025-04-15 UTC+2

10