A lenda da equipe InstaSpot!

Lenda! Você acha que isso é retórica bombástica? Mas como devemos chamar um homem que se tornou o primeiro asiático a vencer o campeonato mundial de xadrez aos 18 anos e que se tornou o primeiro grande mestre indiano aos 19? Esse foi o começo de um caminho difícil para o título de campeão do mundo para Viswanathan Anand, o homem que se tornou parte da história do xadrez para sempre. Agora mais uma lenda na equipe InstaSpot!

O Borussia é um dos clubes de futebol com mais títulos da Alemanha, que provou repetidamente aos fãs: o espírito de competição e liderança certamente levará ao sucesso. Negocie da mesma maneira que os profissionais do esporte jogam: com confiança e ativamente. Mantenha o "ritmo" do Borussia FC e esteja na liderança com a InstaSpot!

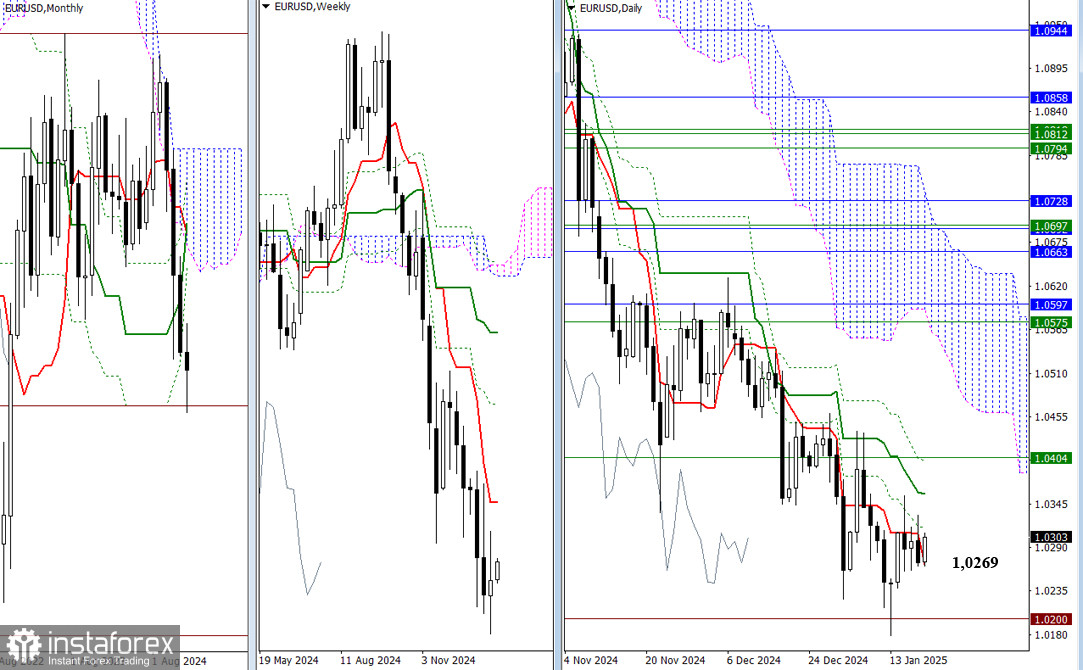

The daily short-term trend continues to hold the market close. Today, it has shifted to the lower part of the consolidation zone (1.0269) as if encouraging bullish players to take action. If the bulls capitalize on the lack of resistance from the daily short-term trend, they will need to overcome additional resistance from the daily Ichimoku "dead cross" (1.0315 – 1.0357 – 1.0399), reinforced by the weekly short-term trend (1.0404), to initiate a rise and achieve a broader shift in the situation. Breaking through the Ichimoku "dead cross" will allow bullish players to consider new opportunities.

For bearish players, the nearest target remains the historical support at 1.0200. Their primary objective is to update the corrective low at 1.0179 and restore the downward trend.

Bullish players maintain a primary advantage on lower timeframes despite prolonged sideways movement. The weekly long-term trend at 1.0278 acts as the lower boundary of the sideways range, supporting this advantage. Breaking and reversing this trend could shift the current balance of power. For directional movement, additional intraday targets include classical Pivot level supports at 1.0248, 1.0224, and 1.0183 and resistances at 1.0313, 1.0354, and 1.0378.

***

Consolidation within the monthly cloud persists, with uncertainty dominating. The boundaries of the monthly cloud serve as key levels for further movement. Market participants who manage to break through the boundaries of the cloud and firmly establish themselves outside it can unlock new opportunities. For bearish players, moving into the bearish zone relative to the monthly cloud at 1.2099 opens the path toward the weekly downward targets of 1.1894 and 1.1723. For bullish players, breaking into the bullish zone relative to the monthly cloud at 1.2301 shifts the focus to the resistance cluster across various timeframes at 1.2425–1.2456.

The consolidation seen on higher timeframes has caused the pair to coil around the weekly long-term trend at 1.2200 on lower timeframes, reinforcing the prevailing uncertainty. The situation can only shift if the pair escapes the gravitational pull and influence of the trend to develop a directional movement. If bearish players act first, additional intraday targets will be the classical Pivot level supports at 1.2135, 1.2106, and 1.2052. Should the bulls aim to initiate an upward movement today, their objectives will include surpassing the classic Pivot level resistances at 1.2218, 1.2272, and 1.2301.

***

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.

Our new app for your convenient and fast verification

Our new app for your convenient and fast verification

Vídeo de treinamento

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.