Analysis of Monday's Trades

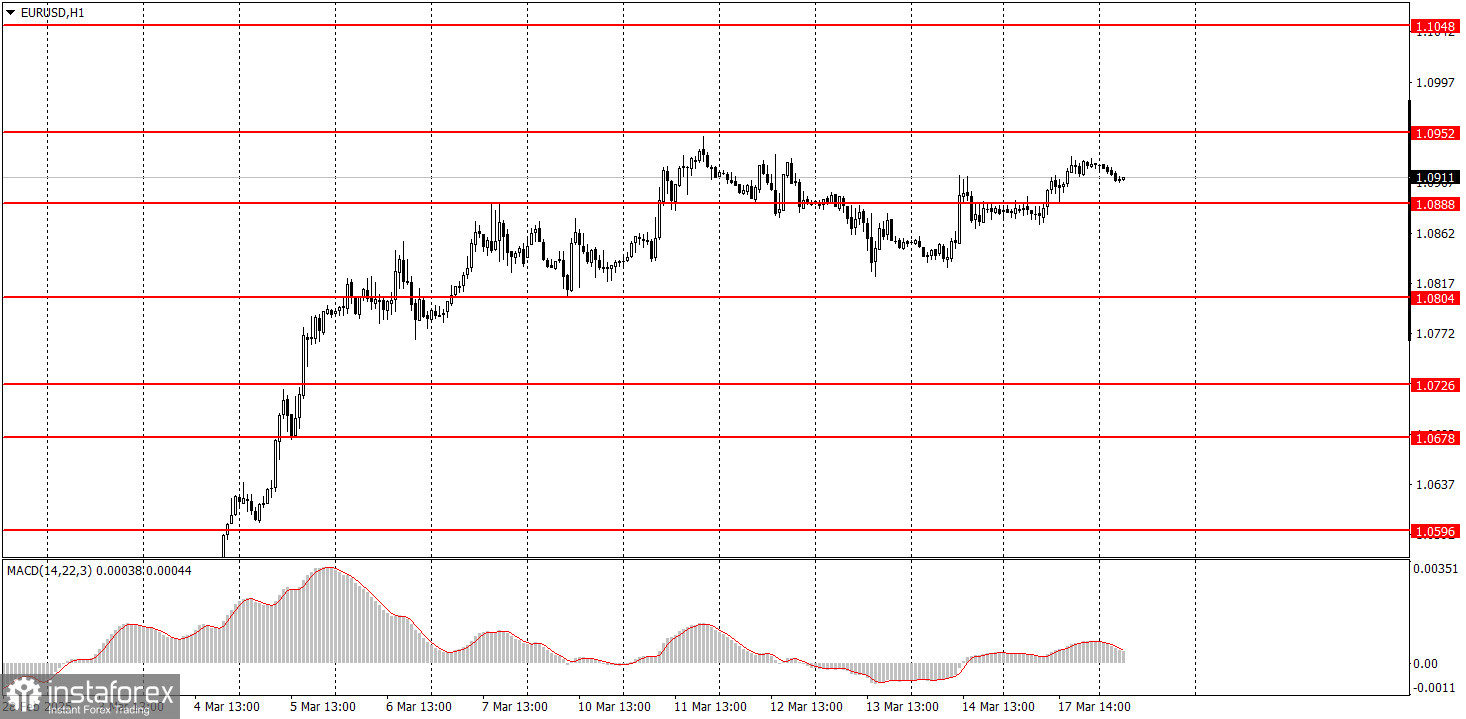

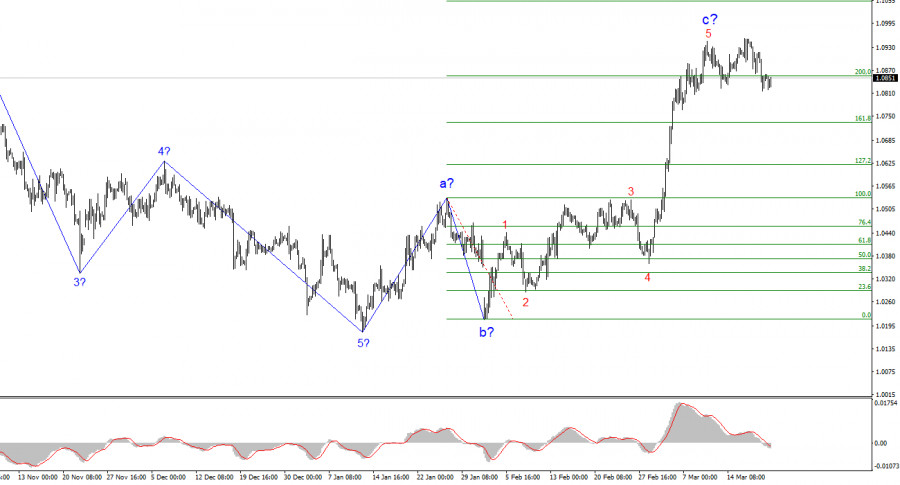

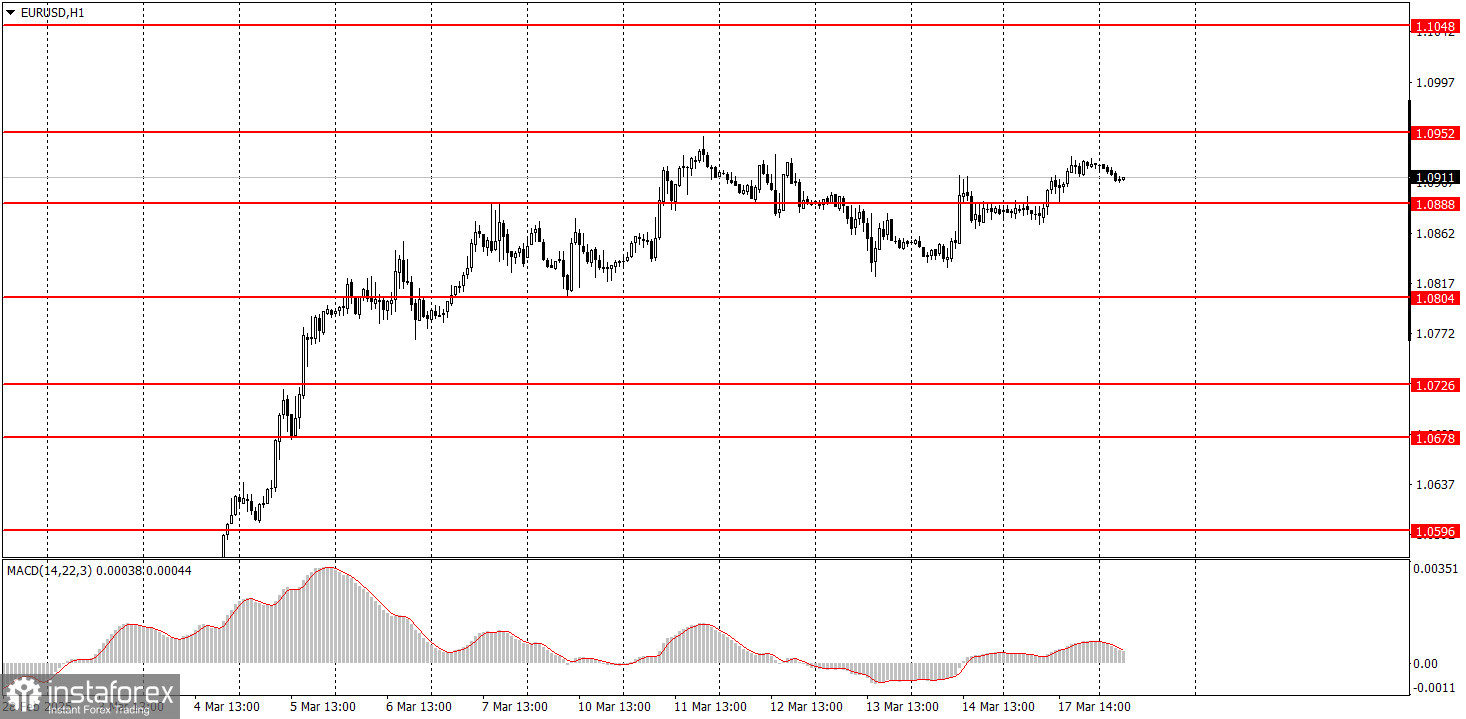

1H Chart of EUR/USD

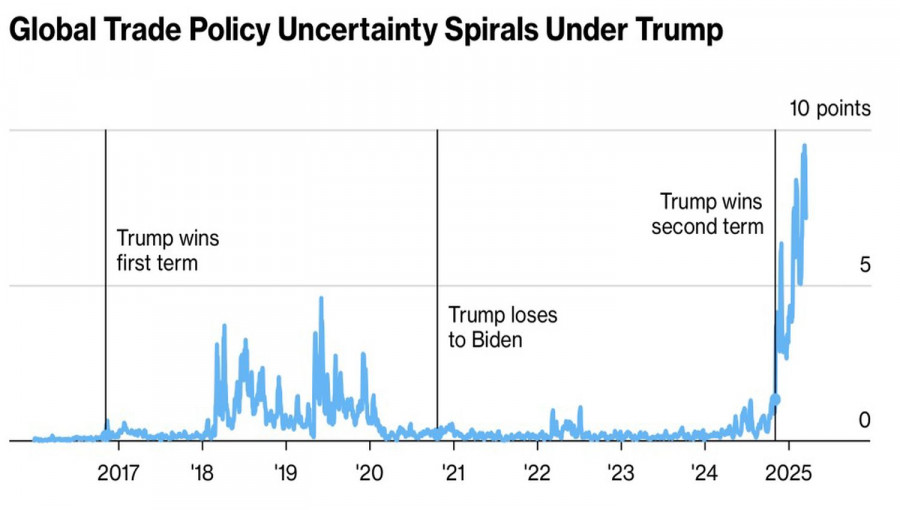

On Monday, the EUR/USD currency pair resumed its upward movement but remained within a sideways channel between the levels of 1.0804 and 1.0952. As we previously mentioned, this is not a classic sideways channel, but we have observed mostly sideways movement for the past one and a half weeks. The key takeaway is that the U.S. dollar refuses to grow, and the market is unwilling to buy it. The dollar declined during the European trading session on Monday despite no reports or significant events. At the start of the U.S. session, the retail sales report in the U.S. was released, which turned out to be slightly worse than expected in its main reading. However, by then, the dollar was already declining. It is difficult to imagine further depreciation of the American currency, as the market has been acting more logically recently than when the dollar was being massively sold off almost daily. However, Trump's new tariffs may once again trigger a wave of U.S. currency sell-offs.

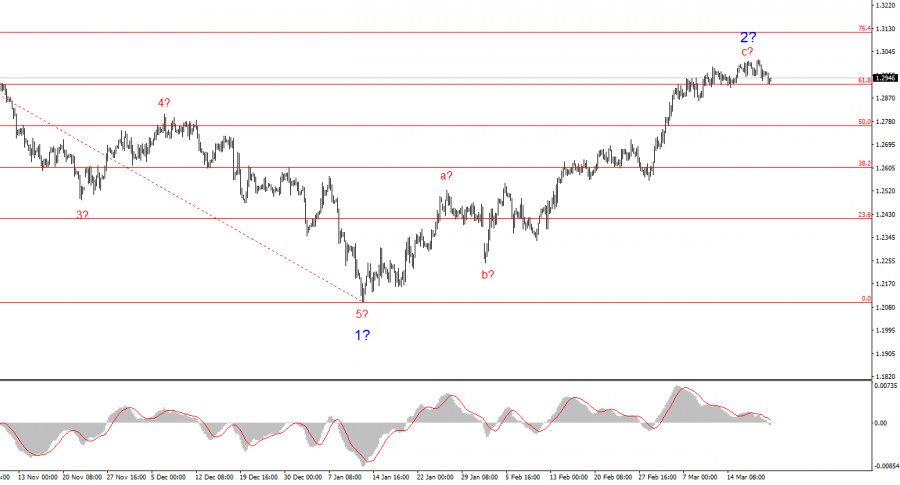

5M Chart of EUR/USD

Three trading signals were formed on Monday in the 5-minute timeframe. Initially, the price rebounded overnight from the 1.0888-1.0896 area, but this signal was false. Later, the pair consolidated above the marked area and rebounded from it again, allowing novice traders to open long positions. By the evening, these positions fully offset the loss from the first trade.

Trading Strategy for Tuesday:

On the hourly timeframe, the EUR/USD pair remains in a medium-term downtrend, but the chances of its continuation are decreasing. Since the fundamental and macroeconomic background continues to support the U.S. dollar much more than the euro, we still expect a decline. However, Donald Trump continues to push the dollar downward with his regular tariff decisions and statements about the necessary U.S. world order. Fundamentals and macroeconomics remain overshadowed by politics and geopolitics.

On Tuesday, the euro may trade in any direction, as the macroeconomic and fundamental background does not consistently influence the pair's movement. Additionally, there is a likelihood of a flat movement in the hourly timeframe, and the price is currently in its upper range.

On the 5-minute timeframe, the key levels to consider are 1.0433-1.0451, 1.0526, 1.0596, 1.0678, 1.0726-1.0733, 1.0797-1.0804, 1.0845-1.0851, 1.0888-1.0896, 1.0940-1.0952, 1.1011, and 1.1048. On Tuesday, the Eurozone will release ZEW economic sentiment indices, which are not particularly significant. In the U.S., the most interesting report will be on industrial production, but the pair's movement throughout the day will not depend on these reports.

Core Trading System Rules:

- Signal Strength: The shorter the time it takes for a signal to form (a rebound or breakout), the stronger the signal.

- False Signals: If two or more trades near a level result in false signals, subsequent signals from that level should be ignored.

- Flat Markets: In flat conditions, pairs may generate many false signals or none at all. It's better to stop trading at the first signs of a flat market.

- Trading Hours: Open trades between the start of the European session and the middle of the US session, then manually close all trades.

- MACD Signals: On the hourly timeframe, trade MACD signals only during periods of good volatility and a clear trend confirmed by trendlines or trend channels.

- Close Levels: If two levels are too close (5–20 pips apart), treat them as a support or resistance zone.

- Stop Loss: Set a Stop Loss to breakeven after the price moves 15 pips in the desired direction.

Key Chart Elements:

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.