#N225 (Nikkei 225). Cursul de schimb și diagramele online.

Convertor valutar

24 Mar 2025 11:39

(-0.01%)

Pretul de inchidere, ziua precedenta.

Pretul de deschidere.

Pretul maxim al ultimei zile de tranzactionare.

Pretul minim al ultimei zile de tranzactionare.

Pretul maxim din ultimele 52 spatamani.

Pretul minim din ultimele 52 saptamani.

The Nikkei-225 Stock Average is one of the major Japanese stock indices. It is a price-weighted average of 225 top-rated Japanese companies listed in the First Section of the Tokyo Stock Exchange. The Nikkei 225 began to be calculated on September 7, 1950. Its first name was TSE Adjusted Average Price. Since 1970, the index has been calculated by the Japanese newspaper Nihon Keizai Shimbun.

The components of the Nikkei 225 are reviewed once a year. In case stocks of a company are no longer liquid, they may be replaced by other companies. Previously, the index had been subject to changes only in case of merger or liquidation of firms. The Nikkei’s all-time high of 38,915.87 points was recorded in late 1989, while its all-time low of 7,607.88 was reached on April 28, 2003. Currently, the index is gradually rising.

Futures on the Nikkei 225 provide investors from all over the world with a great opportunity to take advantage of the Japanese stock market fluctuations. In order to trade the Nikkei 225 in a right way, traders are recommended to do it precisely at the opening of the Japanese session. It is also interesting to note that the US economy has a strong impact on the Nikkei 225, but these effects are seen only within the first hour after trades on Tokyo Stock Exchange are opened.

Vedeți Și

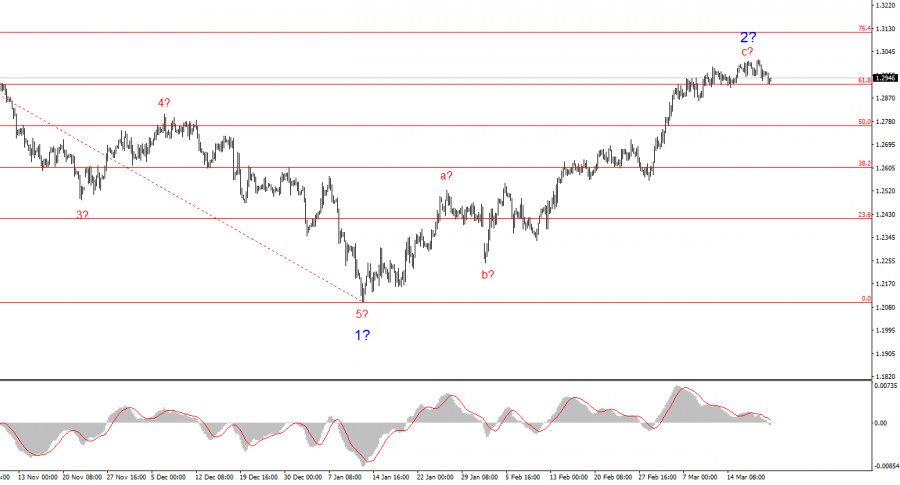

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Autor: Chin Zhao

19:42 2025-03-21 UTC+2

2773

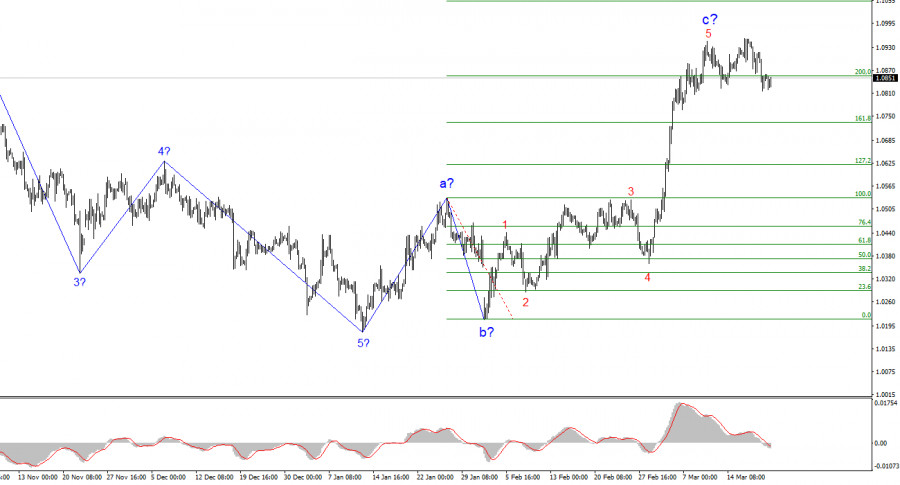

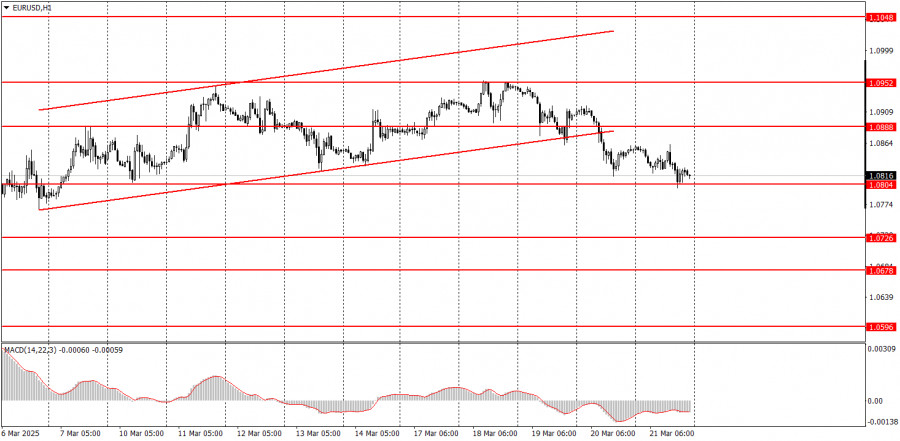

The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.Autor: Chin Zhao

19:39 2025-03-21 UTC+2

2398

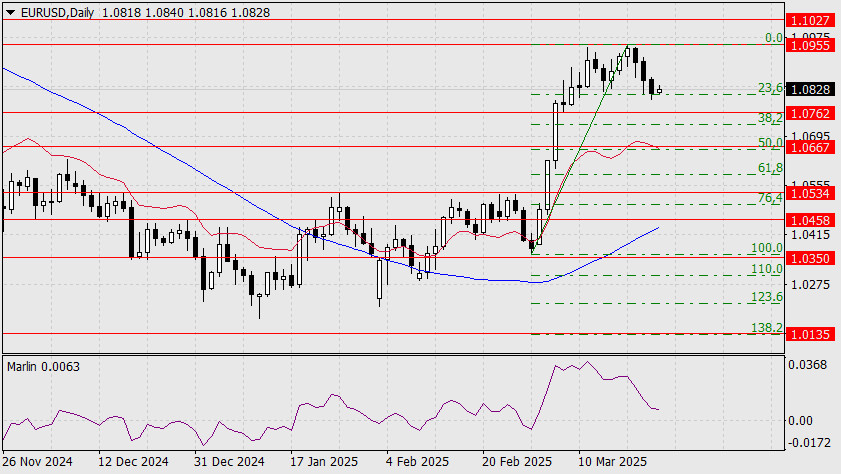

The euro is eyeing the 1.1027 level.Autor: Laurie Bailey

05:20 2025-03-24 UTC+2

1378

- The yen is significantly extending the correction � the target is 153.60�154.56

Autor: Laurie Bailey

05:20 2025-03-24 UTC+2

1243

The pound resumes its rise.Autor: Laurie Bailey

05:20 2025-03-24 UTC+2

1123

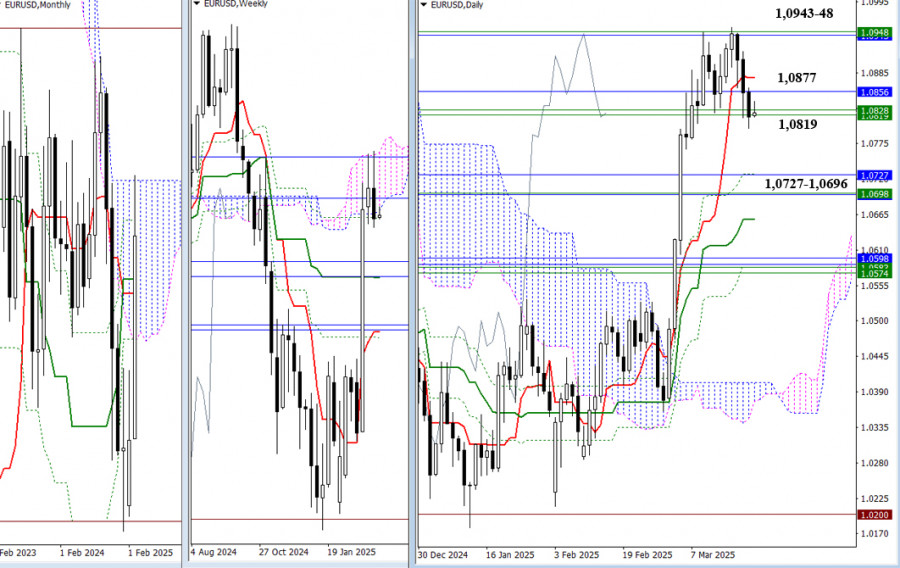

Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946�1.0825) and monthly levels (1.0943�1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend th.Autor: Evangelos Poulakis

08:55 2025-03-24 UTC+2

823

- Fundamental analysis

What to Pay Attention to on March 24? A Breakdown of Fundamental Events for Beginners

Eight macroeconomic events are scheduled for MondayAutor: Paolo Greco

07:08 2025-03-24 UTC+2

778

Technical analysisTechnical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAutor: Arief Makmur

08:09 2025-03-24 UTC+2

763

Technical analysisTechnical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAutor: Arief Makmur

08:09 2025-03-24 UTC+2

748

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Autor: Chin Zhao

19:42 2025-03-21 UTC+2

2773

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Autor: Chin Zhao

19:39 2025-03-21 UTC+2

2398

- The euro is eyeing the 1.1027 level.

Autor: Laurie Bailey

05:20 2025-03-24 UTC+2

1378

- The yen is significantly extending the correction � the target is 153.60�154.56

Autor: Laurie Bailey

05:20 2025-03-24 UTC+2

1243

- The pound resumes its rise.

Autor: Laurie Bailey

05:20 2025-03-24 UTC+2

1123

- Recently, the pair has been testing resistance levels from the weekly Ichimoku cloud (1.0946�1.0825) and monthly levels (1.0943�1.0856). Last week, sellers initiated a rejection and closed below these resistance zones. As a result, the main task for the bears now is to confirm and extend th.

Autor: Evangelos Poulakis

08:55 2025-03-24 UTC+2

823

- Fundamental analysis

What to Pay Attention to on March 24? A Breakdown of Fundamental Events for Beginners

Eight macroeconomic events are scheduled for MondayAutor: Paolo Greco

07:08 2025-03-24 UTC+2

778

- Technical analysis

Technical Analysis of Intraday Price Movement of Natural Gas Commodity Instrument, Monday March 24, 2025

From what is seen on the 4-hour chart, the Natural Gas commodity instrument appearsAutor: Arief Makmur

08:09 2025-03-24 UTC+2

763

- Technical analysis

Technical Analysis of Daily Price Movement of USD/IDR Exotic Currency Pairs, Monday March 24, 2025.

On the daily chart, the exotic currency pair USD/IDR appearsAutor: Arief Makmur

08:09 2025-03-24 UTC+2

748