CHFNOK (Švajcarski franak vs Norveška kruna). Kurs i internetske karte.

Menjač valuta

21 Mar 2025 23:59

(0%)

Cena zatvaranja prethodnog dana.

Cena na otvaranju.

Najviša cena tokom poslednjeg dana trgovine.

Najniža cena tokom poslednjeg dana trgovine

Opseg najviših cena u poslednje 52 nedelje

Opseg najnižinih cena u poslednje 52 nedelje

CHF/NOK is not such a popular currency pair on Forex. CHF/NOK is the cross rate against the US dollar. Although the US dollar obviously does not present in this currency pair, it still has a significant influence on it. This can be seen, if you combine two charts: USDCHF and USDNOK. Thus, you can get an approximate CHF/NOK chart.

The US dollar has a significant influence on both currencies. That is why it is necessary to take into account the major US economic indicators to forecast correctly the course of this financial instrument. These indicators are as follows: the discount rate, GDP, unemployment rate, Non-Farm Payrolls, etc. It is necessary to note that discussed currencies could respond with different speed on changes in the US economy, therefore the CHF/NOK currency pair may be a specific indicator of these currencies changes.

The economic situation in Switzerland has been high for several centuries. For this reason, the Swiss franc has a reputation for one of the world’s most reliable and stable currencies. The Swiss franc, or Swissie, is also a kind of safe haven currency for capital investment during the crisis. Therefore, in times of crisis, when capital is urgently forwarded to Switzerland, the Swiss franc rises sharply against the other currencies. Trading this currency pair, you have to take into account this feature of the Swiss economy.

Norway is one of a highly developed, stable democracies with a modern economy. The country occupies the first positions on such economic indicators as quality of life and personal income level. Norway is the third largest producer and exporter of oil and gas. The main source of income of this Scandinavian country is the export of energy resources. In addition, Norway is the leading country in electrometallurgy, electrical engineering, mechanical engineering, etc. In addition, the Norwegian industry is a leading manufacturer of offshore drilling platforms for oil and gas. Also, Norway is a leader in mining and processing of a great variety of seafood, which are in high demand worldwide, especially in the European countries.

If you trade with CHF/NOK, you should focus on economic indicators of Norway, as well as the oil world price and other minerals needed to support the Norway economy.

This trading instrument is relatively illiquid if we compare it with major currency pairs, such as: EUR/USD, USD/CHF, GBP/USD, and USD/JPY. Therefore, when you make a forecast for the financial instrument, you should focus on those currency pairs that include the US dollar together with each of the considered currencies.

If you trade cross rates, it is necessary to remember that brokers usually set a higher spread than for more popular currency pairs, so before you start working with the cross rates, you should carefully read the conditions offered by the broker to trade with specified trade instrument.

Vidi takođe

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Autor: Irina Yanina

12:07 2025-03-21 UTC+2

2398

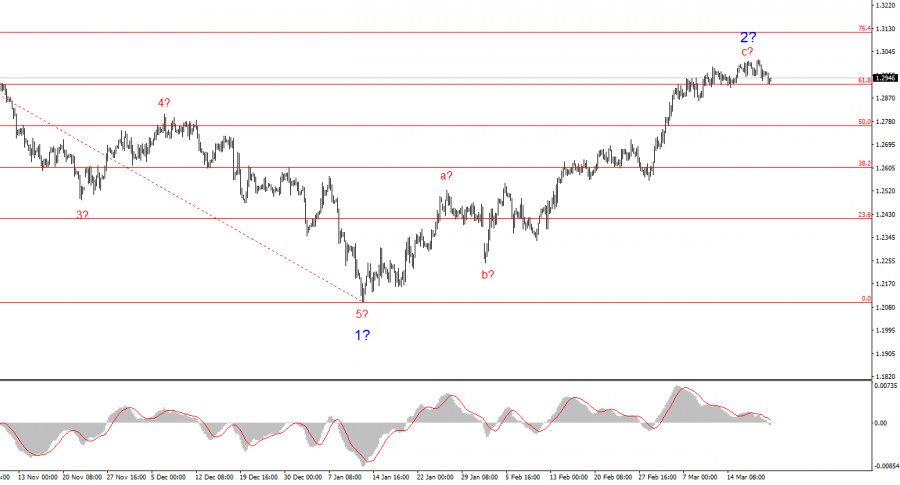

Bulls had the upper hand for two weeks, but it's time for a pauseAutor: Samir Klishi

12:02 2025-03-21 UTC+2

2368

The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.Autor: Chin Zhao

19:42 2025-03-21 UTC+2

2293

- Technical analysis

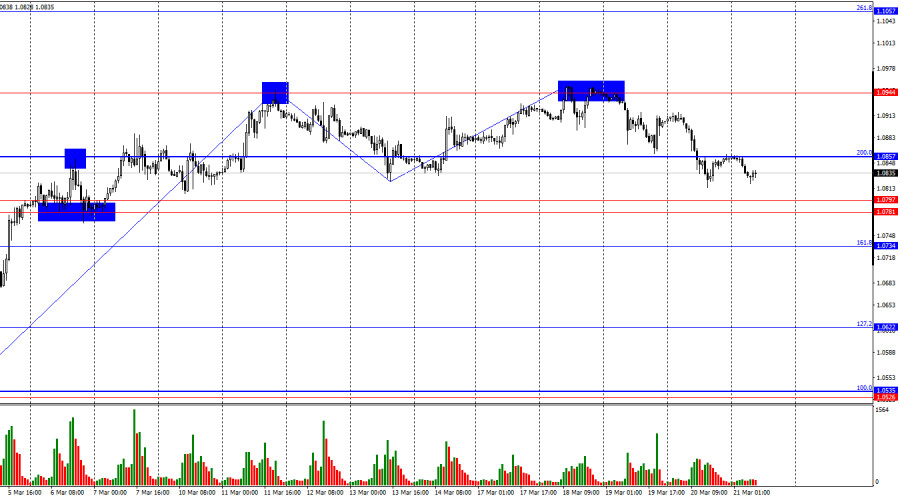

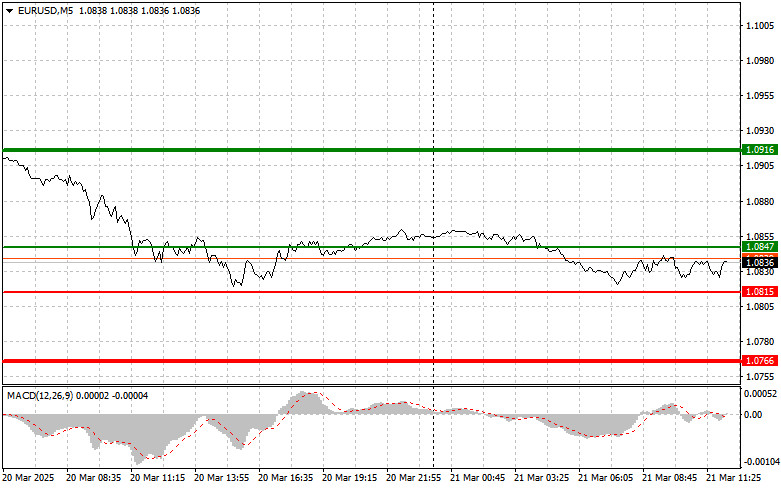

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Autor: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2233

Technical analysisTrading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Autor: Dimitrios Zappas

14:04 2025-03-21 UTC+2

2113

US stock market in limbo despite positive economic dataAutor: Andreeva Natalya

15:48 2025-03-21 UTC+2

2008

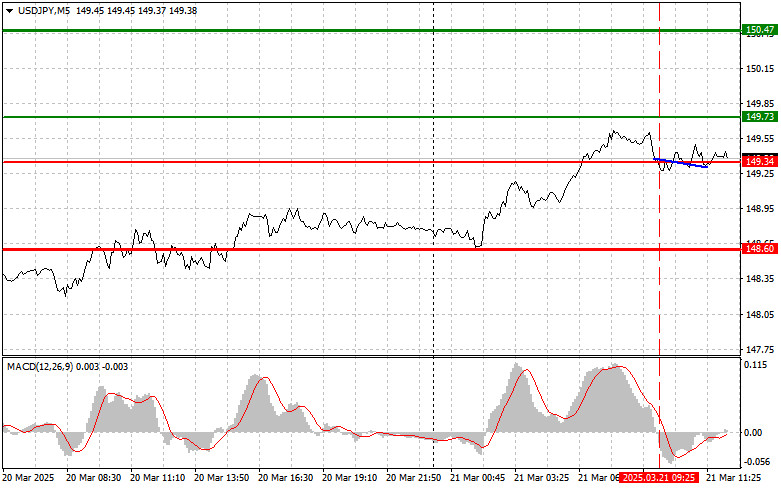

- USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Autor: Jakub Novak

19:30 2025-03-21 UTC+2

2008

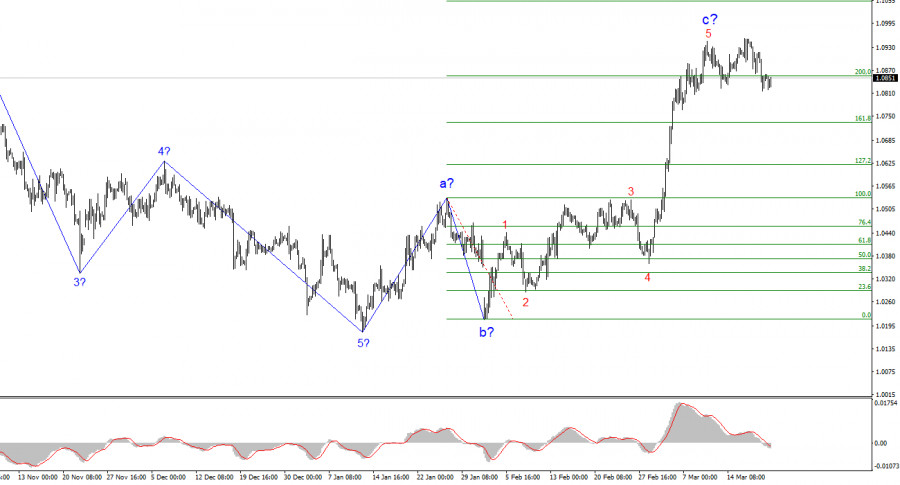

The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.Autor: Chin Zhao

19:39 2025-03-21 UTC+2

1993

EURUSD: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)Autor: Jakub Novak

19:09 2025-03-21 UTC+2

1903

- Today, following the release of data showing a February slowdown in the national Consumer Price Index (CPI), the Japanese yen continues to trade with a negative tone, creating uncertainty in the market.

Autor: Irina Yanina

12:07 2025-03-21 UTC+2

2398

- Bulls had the upper hand for two weeks, but it's time for a pause

Autor: Samir Klishi

12:02 2025-03-21 UTC+2

2368

- The GBP/USD pair declined by 25 basis points on Friday heading into the U.S. session.

Autor: Chin Zhao

19:42 2025-03-21 UTC+2

2293

- Technical analysis

Trading Signals for EUR/USD for March 21-24, 2025: buy above 1.0810 (+1/8Murray - rebound)

Our medium-term forecast remains bearish. So, any technical rebound will be seen as a signal to sell with a medium-term target at about 1.0361, the level where the instrument left a gap.Autor: Dimitrios Zappas

14:22 2025-03-21 UTC+2

2233

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 21-24, 2025: buy above $3,026 (7/8 Murray - 61.8%)

The Eagle indicator is reaching oversold levels. So, we believe that gold could resume its bullish cycle in the coming days. For this, we should expect consolidation above the psychological level of $3,000.Autor: Dimitrios Zappas

14:04 2025-03-21 UTC+2

2113

- US stock market in limbo despite positive economic data

Autor: Andreeva Natalya

15:48 2025-03-21 UTC+2

2008

- USDJPY: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Autor: Jakub Novak

19:30 2025-03-21 UTC+2

2008

- The EUR/USD pair saw no change on Friday. There was no news background in the direct sense of the word today, so the market had nothing to respond to, and trader activity remained minimal.

Autor: Chin Zhao

19:39 2025-03-21 UTC+2

1993

- EURUSD: Simple Trading Tips for Beginner Traders on March 21st (U.S. Session)

Autor: Jakub Novak

19:09 2025-03-21 UTC+2

1903