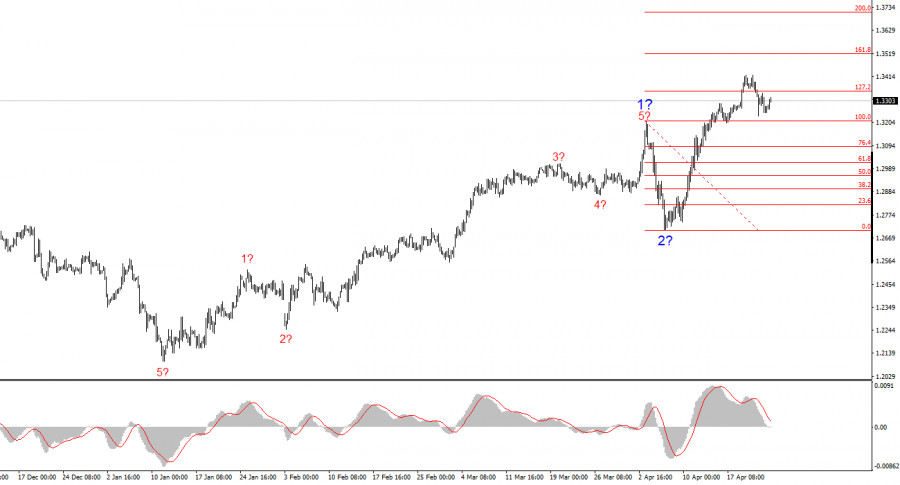

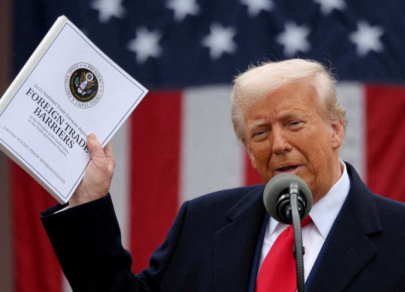

- The wave pattern for GBP/USD has also transformed into a bullish, impulsive structure—"thanks" to Donald Trump. The wave structure is nearly identical to that of EUR/USD. Until February

Autor: Chin Zhao

20:18 2025-04-24 UTC+2

40

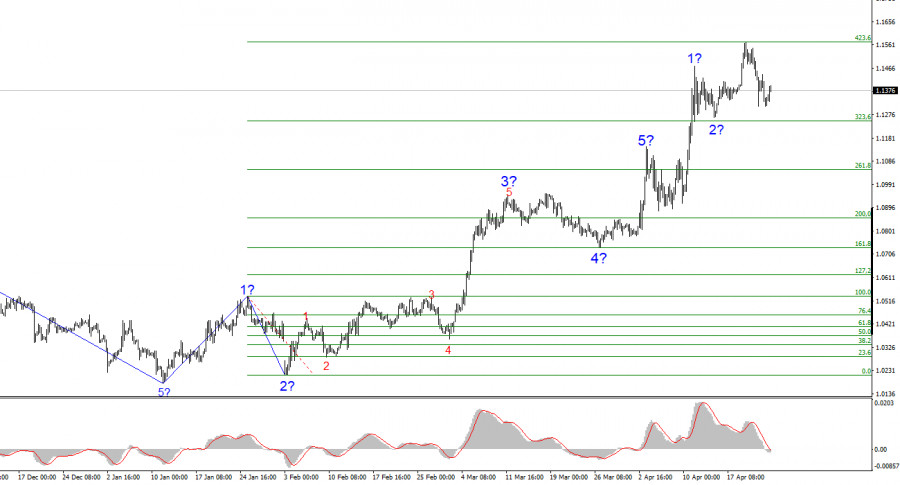

The wave pattern on the 4-hour chart of EUR/USD has transformed into an upward, impulsive structure. I believe there is little doubt that this transformation occurred solelyAutor: Chin Zhao

20:14 2025-04-24 UTC+2

34

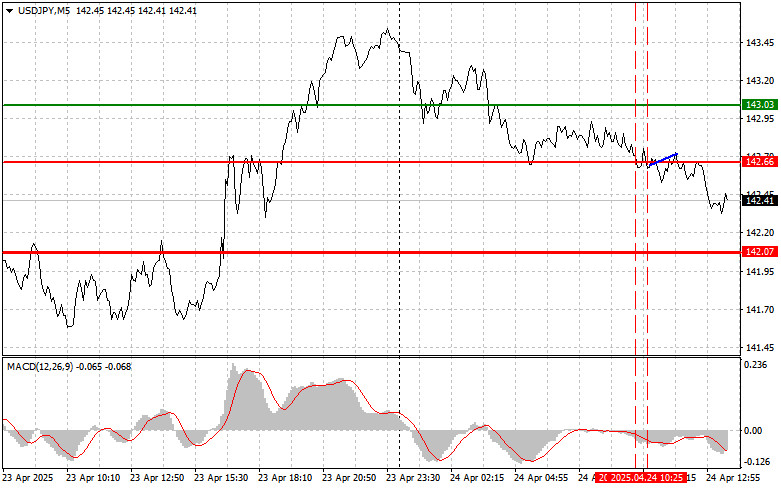

Trade Analysis and Strategy Tips for the Japanese Yen The first test of the 142.66 level occurred when the MACD indicator had already dropped significantly below the zero line, whichAutor: Jakub Novak

20:12 2025-04-24 UTC+2

27

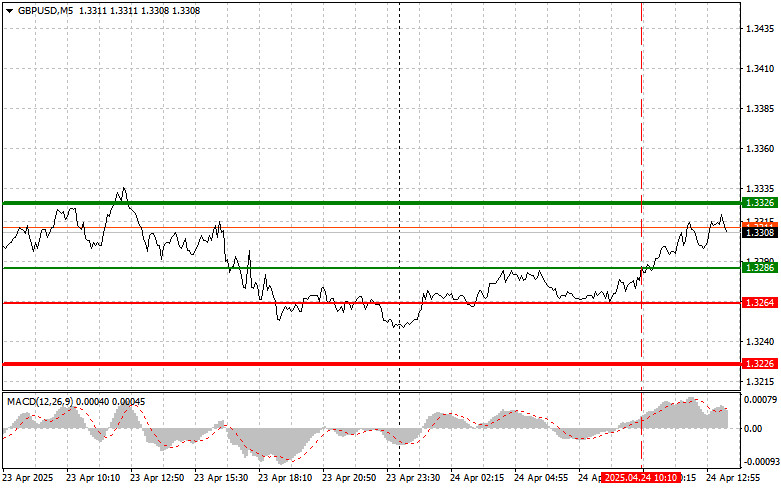

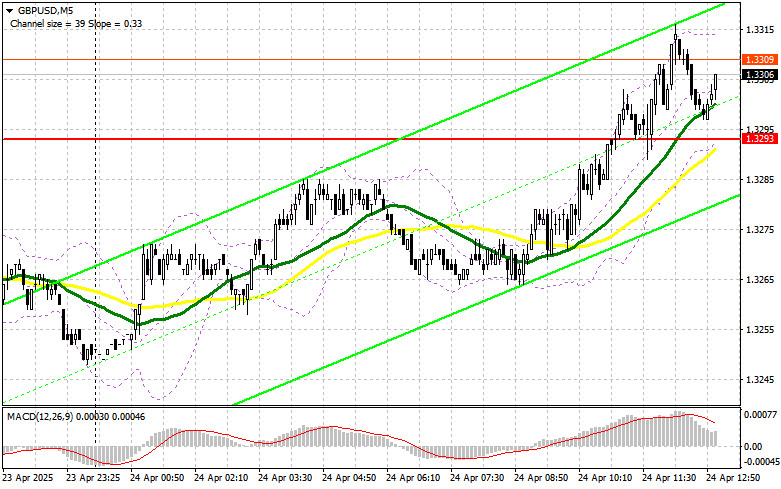

- Trade Analysis and Tips for Trading the British Pound The test of the 1.3286 level occurred when the MACD indicator had already moved significantly above the zero mark, which

Autor: Jakub Novak

20:08 2025-04-24 UTC+2

22

Trade Review and Tips for Trading the Euro The test of the 1.1361 level occurred at a time when the MACD indicator had already moved significantly above the zero markAutor: Jakub Novak

20:05 2025-04-24 UTC+2

16

In my morning forecast, I highlighted the 1.3293 level and planned to use it as a reference for entering the market. Let's look at the 5-minute chart and analyze whatAutor: Miroslaw Bawulski

20:01 2025-04-24 UTC+2

15

- Trading plan

EUR/USD: Trading Plan for the U.S. Session on April 24th (Review of the Morning Trades)

In my morning forecast, I focused on the 1.1358 level and planned to make trading decisions based on it. Let's take a look at the 5-minute chart to understand whatAutor: Miroslaw Bawulski

19:58 2025-04-24 UTC+2

21

Technical analysisTrading Signals for EUR/USD for April 24-26, 2025: sell below 1.1435 (21 SMA - 7/8 Murray)

Early in the American session, the EUR/USD pair is trading around 1.1358 within the downtrend channel formed on April 18. The pair is under bearish pressure. We believe the instrumentAutor: Dimitrios Zappas

17:06 2025-04-24 UTC+2

15

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAutor: Sebastian Seliga

13:25 2025-04-24 UTC+2

47