- Gold continues to draw investor attention, particularly in times of heightened uncertainty in financial markets. Trade Uncertainty: Ongoing uncertainty in trade relations between the U.S. and China makes gold

Autor: Irina Yanina

11:50 2025-04-16 UTC+2

6

The USD/CHF pair is attracting new sellers today, showing signs of weakness under current economic conditions, driven by several key factors. Weak U.S. Dollar: The U.S. Dollar Index, which tracksAutor: Irina Yanina

11:41 2025-04-16 UTC+2

9

Fundamental analysisConfrontation Between the U.S. and China Will Negatively Impact Markets (Potential for Renewed Declines in #NDX and Litecoin)

Market optimism, fueled by Donald Trump's active manipulation of the tariff narrative, was short-lived. Traders remain focused on the escalating tensions between the U.S. and China following the U.S. DepartmentAutor: Pati Gani

11:34 2025-04-16 UTC+2

7

- Wall Street ended the session in the red. Shares of giants Boeing and Johnson & Johnson took the biggest hit as uncertainty around tariff policy continues to weigh on investor

Autor: Ekaterina Kiseleva

11:12 2025-04-16 UTC+2

7

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very carefulAutor: Sebastian Seliga

09:55 2025-04-16 UTC+2

15

Pressure on the cryptocurrency market returned yesterday after traders and investors triggered a sell-off in the U.S. stock market. As I've noted repeatedly, the correlation between these two marketsAutor: Miroslaw Bawulski

09:01 2025-04-16 UTC+2

17

- Forecast

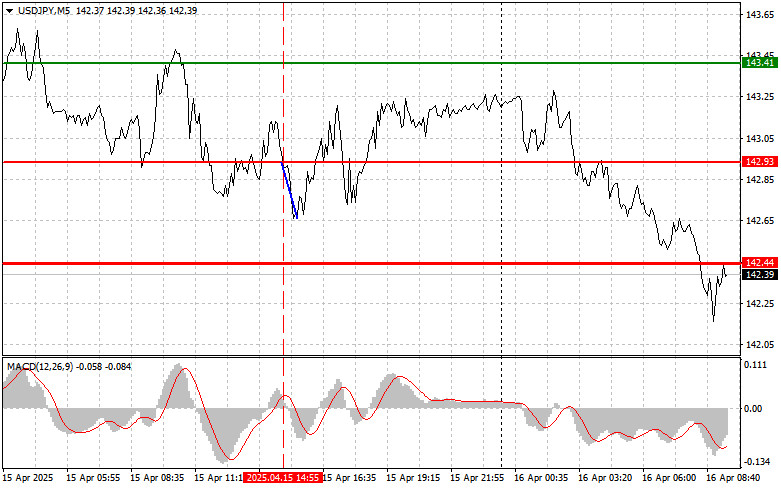

USD/JPY: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex Trades

The price test at 142.93 occurred when the MACD indicator had just started moving downward from the zero mark, confirming a valid entry point for selling the dollarAutor: Jakub Novak

08:46 2025-04-16 UTC+2

20

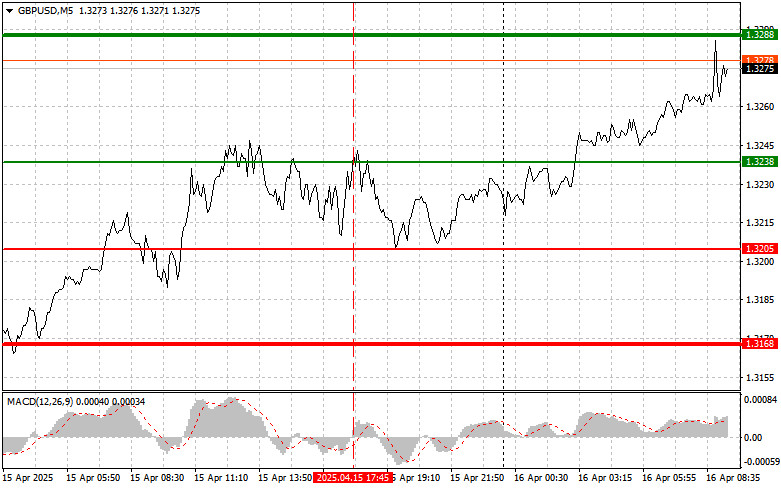

ForecastGBP/USD: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex Trades

The test of the 1.3238 price level occurred when the MACD indicator had just begun rising from the zero line, which confirmed a valid entry point for buying the poundAutor: Jakub Novak

08:46 2025-04-16 UTC+2

15

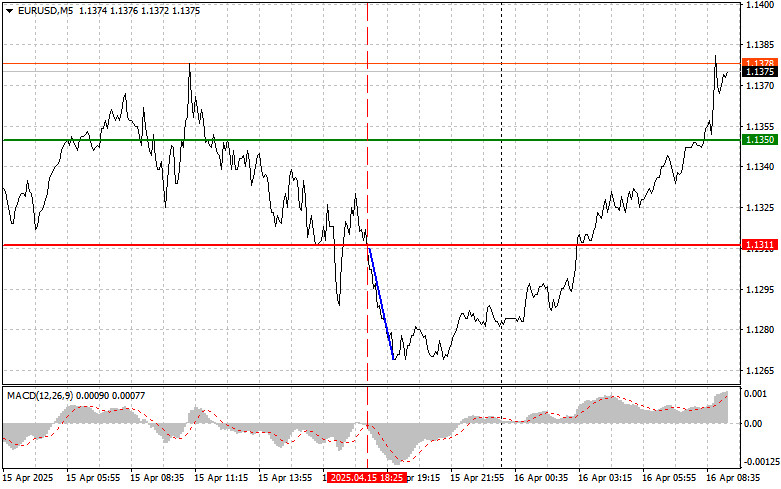

ForecastEUR/USD: Simple Trading Tips for Beginner Traders on April 16. Review of Yesterday's Forex Trades

The price test at 1.1311 occurred when the MACD indicator had just started to move downward from the zero level, confirming a valid entry point for selling the euroAutor: Jakub Novak

08:46 2025-04-16 UTC+2

15